Published

- 03:00 am

Console Connect, an easy-to-use platform for the Software Defined Interconnection® of applications and infrastructures, and Colt Technology Services, a leading provider of agile, high bandwidth connectivity solutions, have today completed the first stage of major API-led interoperability between their global on-demand SDN platforms.

The APIs between the Console Connect Software Defined Interconnection® platform and the Colt On Demand platform enable enterprises to benefit from on-demand, agile networking and interconnect directly to clouds, data centers, and business partners across both private networks. The APIs will also enable seamless quoting, ordering and provisioning on-demand services between two high-performance networks in real-time.

As part of the initial integration of the two SDN-enabled platforms, Console Connect will be able to extend its automated platform reach into new data center locations across the UK, with plans to expand to more enterprise locations and metro areas throughout Europe, leveraging the speed and performance of the Colt IQ Network. This enables Console Connect users to instantly provision and pay for dedicated Layer 2 services between two networks using a single portal.

The collaboration demonstrates Console Connect and Colt’s mutual commitment to end- to-end automation, and recognizes the need for increased interoperability and collaboration to orchestrate connectivity among networks.

Mr. Marc Halbfinger, CEO of Console Connect, said, “APIs are crucial for the advancement and settlement of automated network services and enable carriers to work together in new and innovative ways. We are honored to work closely with Colt – a partner with whom we share a vision of a fully automated and on-demand future.”

Ms. Keri Gilder, CEO of Colt Technology Services, said, “Working with Console Connect, we’re pioneering the use of APIs within intelligent networking and to provide agile, on- demand, high bandwidth connectivity solutions to more enterprises across the world. APIs continue to be a major focus area in our industry, and our collaboration will help us to continue to transform the way businesses interact with each other and how they provide value to their customers by optimising automation, improving collaboration, simplifying innovation and enhancing security.”

In 2021, Console Connect extended its automated network coverage to over 650 data centers across more than 55 countries worldwide. Console Connect is home to a growing ecosystem of cloud, SaaS, IX, IoT, carrier and enterprise partners, which are directly interconnected by the platform’s private high-performance network. Through the platform’s MeetingPlace feature, users can also directly order and provision partner services, such as remote peering, colocation and business applications, as well as access native services from Console Connect.

Colt provides a range of On Demand services for its enterprise and wholesale customers, delivering fully flexible connectivity solutions between data centers, cloud service providers and enterprise buildings.

The Colt IQ Network is a 100Gbps optimized intelligent network distributed to more than 900 data centers and over 29,000 on-net buildings across Europe, Asia and North America’s largest business hubs, enabling customers to expand their businesses globally with Colt.

Further stages of the API integration will include extending the automated reach of Colt’s On Demand platform to more global markets using Console Connect’s extensive, high-performance network.

Related News

- 02:00 am

Specialist lender Cambridge & Counties Bank has selected nCino, a pioneer in cloud banking and digital transformation solutions for the global financial services industry, to further transform the bank’s back-office lending infrastructure. The partnership will deliver an enhanced customer-centric market proposition as the bank looks to capitalise on the strong momentum and reputation it has in the UK real estate market.

The nCino system is an end-to-end, scalable digital platform focused on enriching customer service and optimising back-office processes and administration. The company has relationships with more than 1,200 financial institutions worldwide, including several lenders in the UK.

Commercial brokers and the bank’s customers will benefit in a number of ways from the new partnership. An increased level of automation and data analytics will expand the bank’s front-office service proposition, building on Cambridge & Counties Bank’s established one-to-one service model which sees dedicated relationship managers work with brokers and customers over the lifetime of their relationship.

In addition, new capabilities and services include being able to sign documentation on a mobile device, among others, all leading to a quicker loan drawdown. Plus, it will give brokers the option to directly apply and upload documents through a highly intuitive web-based application.

David Holton, Chief Transformation Officer at Cambridge & Counties Bank, said:

\“Cambridge and Counties was established as a relationship bank to support brokers and customers with skilled, experienced colleagues who take the time to understand each opportunity. It is vital that the evolution of our systems further enables this successful relationship-based approach. I am confident that the partnership with nCino will allow us to achieve this unique blend of modern technology whilst retaining our traditional relationship banking and underwriting strengths.”

Jonathan Annis, Area Vice President UKI at nCino, said:

“We’re delighted to be working with Cambridge & Counties Bank as it looks to enhance employee, broker and customer experiences. Forward thinking and customer-centric financial institutions are embracing cloud technologies as part of their transformation and growth strategies. We’re proud that Cambridge & Counties saw a partner in nCino for this journey.”

Related News

- 02:00 am

A decentralized ecosystem surrounding blockchain technology is needed for full-solutions operations. The blockchain represents a decentralized transaction ledger that forms a part of a larger computing infrastructure, which must consist of several other functions, including communication, storage, archiving, and file serving. Storj represents one of the projects that are developing solutions for the distributed blockchain ecosystem, as well as IPFS for file serving, storage, and link maintenance. When it comes to storage, the most obvious need might be a secure, off-chain, decentralized storage for files like Electronic Medical Records, or even something as simple as a Microsoft word document.

It is worth pointing out that file storage can either be decentralized - as in the blockchain - or centralized, like Google Drive. The assets can be registered by blockchain transactions, including a pointer and access method and privileges. When it comes to file serving, the InterPlanetary File System (IPFS) project has suggested an engaging technique, which can be tailored for decentralized file serving. The IPFS represents the need for a worldwide accessible file system, which can provide a form of resolution to the issue of broken website links to files, beyond the idea of blockchain technology.

One of the major causes of concern today is cyber security. Over the past few years, the rate of cyberattacks has risen dramatically. The safety of using blockchain is a major question in the minds of many people across the globe. Blockchain technology was initially introduced to support Bitcoin. However, since then, it has gathered so much popularity across several industries. It is no strange fact that the influence of this blockchain is beyond cryptocurrencies. The dramatic rise in blockchain recognition has brought up questions about its security and integrity.

The revolution in digital money is now moving into banking. If you did not know this then you need to visit Bitcoin Prime because they offer current updates in the crypto world.

You will find several top-rated companies across the globe adopting this technology. For this reason, it is only natural to be sure that this technology is up to the task. The data structure that blockchain produces is worth mentioning, as well as its security features. This is based on cryptography and decentralization. This encourages trust during any given transaction. The blockchain consists of blocks, which contain transactions. The blocks are cryptographically connected in such a way that they are extremely hard to alter. Besides validating transactions, which are contained in the blocks, a consensus mechanism can also ensure that all transactions are correct. Decentralization is possible since every member of the network contributes over a distributed network. No single point of failure can exist in such a network. As a result, no single user can change transaction records. The popularity of blockchain has ensured that a wide variety of tasks can be solved. In recent times, blockchains have become a key component that helps in setting up business processes.

Besides cryptocurrencies, Blockchain technology can be applied in workflow management, Internet-Of-Things networks, and more. A number of businesses have found this technology a crucial component. Its high level of security can expose this technology to a great level of risk. Besides, there is sensitive information about the assets of various users. This makes it important to have strong protection.

Furthermore, different blockchain networks vary in who can gain access to the data. The most common types of blockchain are either private or public. The security measures vary with each type. While everyone is allowed to join a public blockchain network, only selected participants can engage in private blockchain networks. However, regardless of the type of blockchain network, the anonymity of users' identities can be maintained.

Conclusion

Even though blockchain technology was launched to support Bitcoin, its high level of security and decentralization have made it a popular choice across several fields.

Related News

- 03:00 am

CryptoUK, the trusted voice of the UK crypto industry, has today announced the appointment of Teana Baker-Taylor as its new non-executive director (NED).

The appointment comes at a time when growing adoption is intensifying debate about possible regulatory frameworks for the UK’s digital assets industry.

Teana joins CryptoUK having held a number of critical leadership roles in traditional finance and the digital assets industry, working directly with regulators and Capitol Hill policy makers. She is currently the Chief Policy Officer for the Digital Chamber of Commerce, a leading US trade association representing the digital asset and blockchain industry, and leads the Chamber's Policy and Government Affairs activities.

Formerly at Crypto.com and Binance, Teana was responsible for the UK and European market strategy, operations and business development, as well as government relations and regulatory affairs across the region.

Teana Baker-Taylor, who will take up the role of NED immediately, said:

“The UK digital asset industry is at a turning point and maturing fast as adoption grows. Having been on both sides of the fence as a policy advocate and commercial market operator, I am excited to support CryptoUK in building the bridges between policymakers and market participants. CryptoUK is moving the needle on policy and regulatory framework development to ultimately build trust and protect all participants, from retail investors to the crypto industry players.

”In my role as NED, my goal is to leverage my board experience to put in place and support a robust governance model for CryptoUK so it can scale as the industry grows.”

Ian Taylor, executive director of CryptoUK, said:

“We are delighted to be joined by Teana in an advisory capacity. She brings tremendous expertise and experience leading policy maker and regulator outreach and advocacy initiatives to build a shared understanding of the risks and opportunities presented by digital assets. She joins us at the perfect time to build our governance model and support our engagement strategy to inform a runway of policy initiatives that are top of mind for policy makers.”

CryptoUK is an independent industry body that exists as a cohesive, credible voice for the evolving UK crypto industry, working directly with policymakers and market players to advocate for better education, mutual understanding, and fair and balanced policy.

Related News

- 04:00 am

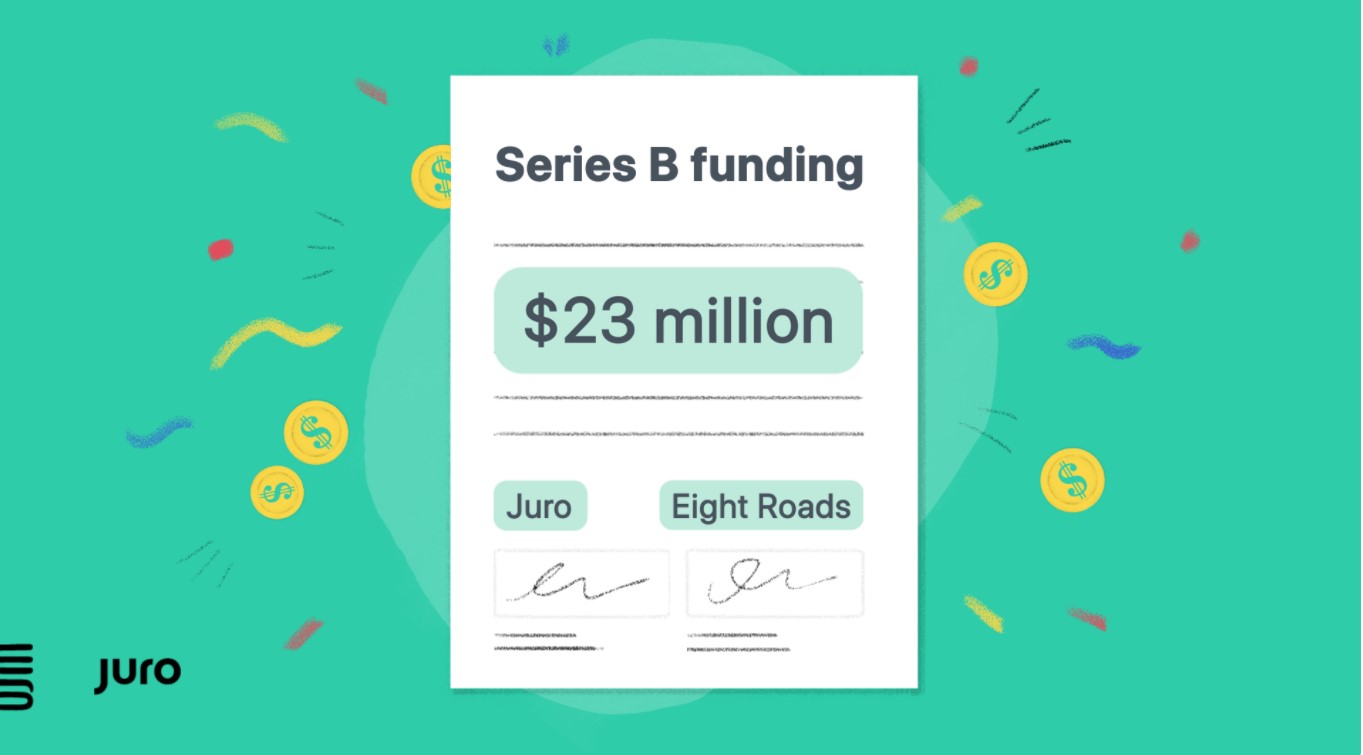

Juro raises $23 million in a Series B round, led by Eight Roads - so what does this mean for Juro, and how will this investment help us deliver even more value to in-house legal and the teams they enable?

Today I’m super happy to share that we’ve raised $23 million in a Series B round, led by Eight Roads: the Fidelity-backed investors with an outstanding portfolio that includes Alibaba, Cazoo, Spendesk and Made.com.

Alston Zecha has joined our board as part of their investment - I’ll let Alston explain why they decided to invest:

“Until Juro, there hasn’t been an all-in-one platform which automates contracts and provides frictionless integrations with clients’ workflows ... It has market-leading customer satisfaction scores plus the highest employee satisfaction score we’ve seen at a scaleup.”

-- Alston Zecha, partner at Eight Roads and now director at Juro

When Pavel and I founded Juro back in 2016, we saw that documentation was away from offline file types and into the browser. Whether that was designers moving to Figma, whole teams moving to Notion or developers being firmly rooted in Github, a more collaborative way of working was emerging in multiple business functions.

But legal paperwork was still stuck in manual Word + email workflows that caused and continue to cause pain for millions of people every day. We set out on a mission to make contracts frictionless and accessible to everyone. If we could do that, we could help the world agree just a little bit more.

Fast forward five years and Juro is pioneering browser-native contracting through our all-in-one contract automation platform.

Our big bet was that contracts would follow other key business touchpoints and move natively to the browser. Some were sceptical that we would ever see the end of Word, but last year our customers agreed 250,000 contracts this way, in the Juro platform, without ever needing to switch between email and Word.

This is a step change in the way in which contracts are agreed.

Thanks to our visionary backers ⭐

Since Juro’s early days, we’ve been lucky enough to work with some of the fastest-growing tech companies in the world as customers - visionary legal teams at companies like Deliveroo, Cazoo, PayFit and Trustpilot, who are challenging ways of thinking in their industries, while we aim to do the same.

We now work with more than 25 ‘unicorn’ valuation tech companies, amongst our 6000+ customers - and we wouldn't be where we are today without all our customers’ support and invaluable product insights.

It takes belief to work with an early-stage startup, and the early customers of Juro’s were true visionaries. I want to take a moment to thank each and every one of them for their feedback, support, and for believing in Juro’s mission, as we work to change the way legal and business teams agree and manage contracts.

We’re also grateful to be backed by some of the best investors in the world, and we’re proud that Union Square Ventures, Point Nine Capital and Seedcamp all chose to participate in this round with Eight Roads.

What you will see in the Juro product

This new investment enables us, in turn, to invest in developing even more of the features and upgrades that really matter to in-house legal and the teams they enable.

Visual version history, threaded comments, and upgraded safety features - all in our new negotiation flow

You will see more upgrades to our editor workflows, like our recent negotiation upgrade. We now have what we believe is the most advanced editor specifically designed for legal contracts. You can now in Juro collaborate synchronously internally and asynchronously externally -- combining the best of Google Docs and Word in a beautiful browser-native experience.

You’ll also see more integrations, like our recent Zapier integration, to ensure that business users can initiate contracts from the tools they live in every day. Our template editor makes document generation from integrated tools 10x easier than was previously possible and we’ll ship lots more in this area.

Aside from this, you’ll also see hundreds of improvements to our interface driven by the feedback we receive from our customer community. Stay tuned for our public roadmap to find out in detail what we’ll be shipping for you in 2022.

As the Juro platform has gone from strength to strength, our public reviews have done the same, and we now lead our category in G2 for ease of setup and quality of support. We’re now the #1 rated contract platform globally for ease of use.

If your business could benefit from the only platform that truly enables you to process contracts end-to-end with one solution, get in touch here. We’re excited to show you what comes next.

Join our mission

With all this in mind, there’s never been a better time to join Juro - and we have big plans to scale our leadership and team. Thanks to our incredible team of Jurors, and in particular the tireless work of our people and talent team, we're currently rated the #1 startup to work for with a presence in London, with an employee NPS score of 91/100.

We plan more than 80 new hires for 2022, including executive leadership. If you're looking for a new challenge in a human-centric company, you're in luck - we have 15 roles on our careers page right now! Check it out for our open roles, as well as a wealth of info on the culture we are building.

Thank you for your support and for being part of the Juro community.

Related News

- 04:00 am

Worldline to deliver support programme for Broderick’s rapid transformation from cash to card payment solutions throughout its vending portfolio

Worldline, the European leader in the payments and transactional services industry, is to deliver a three-year support programme for Broderick’s, the Manchester-based, fast-growing, family-owned operator of more than 1,000 vending machines across the UK.

Worldline will provide Broderick’s with all the necessary acquiring services to manage payments and complete transactions for credit and debit cards across all payment channels in any currency, particularly the UK Pound. In addition, its high-capacity network has an excellent switching speed to reduce transaction times. The commercial model for the volume of transactions fits the needs of the business and payment mix of Broderick’s growing vending installation network.

Looking for the optimal partner to support its rapid transformation from cash to card processing within its vending business, the major challenges for Broderick’s included the need for a technical solution fast enough to integrate into its innovative portfolio of vending solutions, while also offering a telemetry solution to support the need for an effective tour planning and operation business.

Similarly, for financial controlling purposes, sophisticated reporting capabilities are expected to support Broderick’s sales and payment reporting as well as inventory management. Machine health monitoring is an additional core requirement to be delivered within the Worldline solution.

The mix of high and low value transactions means the solution also needed to be economic across more than 3.5 million transactions processed per year and capable of supporting Broderick’s growth plans across the UK.

To deliver the solution, Worldline partnered with PMTsolutions AG, the turn-key solution specialist for open and closed loop cashless services and integrated its VendingPay platform to provide electronic payment services for contactless credit and debit cards, both physical and virtual. Card readers have been reduced in size, to be more easily integrated on any vending machines and behind glass. The connection from the card reader to VendingPay host is managed by Nebular, the vending management platform from Coges. The Nebular portal permits an integrated control of all sales transactions in real time as well as vending management services, to keep all vending locations under control.

Nicolas Dejonghe, Head of Vending at Worldline, said:

“We are very excited to be working with Broderick’s and this agreement demonstrates the full value of the Worldline and PMTsolutions partnership, enabling us to combine our skills and expertise and work together to build a full solution that will underpin Broderick’s growth plans and operational needs.”

Simon Davies, Business Intelligence Manager at Broderick’s, continued:

“Broderick’s is delighted to be entering this significant three-year association with Worldline. We are very confident that the partnership will enable us to concentrate on what we do best, while allowing Worldline to handle our payment services efficiently and seamlessly, all in the best interests of our customers and business overall.”

Manfred Sokat, CEO at PMTsolutions, added:

“By integrating our VendingPay platform with contactless card reader, together with Worldline acquiring and the vending management system from COGES, we are delighted to be able to provide the optimal and multifaceted cashless services required for Broderick’s vending machine infrastructure."

Ends

Related News

- 08:00 am

Napier, provider of leading anti-financial crime compliance solutions, has announced Kevin O’Neill has joined the fast-growing RegTech as Chief Revenue Officer (CRO) to help drive further growth across its global operations.

With more than 25 years’ experience in technology and financial services, O’Neill comes to Napier having served as Global Head, Asset Management and Asset Servicing, and Head of EMEA Sales for Fenergo. He has also held senior positions at BNY Mellon and Royal Bank of Canada.

As CRO, O’Neill will be responsible for leading Napier’s new business growth plans, bringing its next generation SaaS financial crime solutions to the world’s leading financial services businesses, delivering superior customer experiences, and building the momentum that will allow Napier to achieve its ambitious growth objectives over the coming years.

Julian Dixon, founder and CEO at Napier, said:

“We are thrilled to see Kevin take up the position of CRO. His deep knowledge of the financial services industry combined with his enormous experience in driving revenue growth will help us in achieving our ambitious plans for further expansion across all markets this year.”

Napier’s AI-enhanced platform for intelligent AML and financial crime compliance is the tool of choice for over 200 clients, including tier one banks, payment providers, FX, crypto and other financial institutions. The platform’s dynamic, modern operating environment helps drive efficiencies by transforming financial crime compliance from manually intense tasks to a fully automated operation in a highly intuitive and unified workspace.

The news follows the recent appointment of former HSBC COO Andy Maguire as Board Chair. Napier was also named a Rising Star by the RiskTech 100 and has appeared in both the 2022 Deloitte Fast 50 tech list and RegTech100.

O’Neill commented:

“I am delighted to join the Napier team at this exciting stage in our growth trajectory. The financial services industry is realising the enormous benefits of next-generation AI & SaaS solutions to upgrade their financial crime operations. Napier's solid foundations, with its extensive client base and technology that is leading transformation of the industry, makes it solution of choice for many of the world's leading financial organisations. We can expect to see continued global growth as the power of our intelligent compliance solutions, including Transaction Monitoring, Transaction Screening, Client Screening, Risk-based Scorecard and Client Activity Review plays an even greater role in combatting financial crime.”

Related News

Lydia Iseh

at Freelance Writer

People are always looking for ways to make some extra cash. Even if you are wealthy, you can always use some more money, right? see more

- 05:00 am

- Luxembourg, Ireland and France top the table of the highest individual fines issued (EUR746m, EUR225m and EUR50m respectively). Luxembourg, Ireland and Italy top the table of the highest aggregate fines issued

- There was an 8% growth for breach notifications compared to last year with more than 130,000 breaches notified since 28 January 2021

- Per capita the Netherlands tops the rankings for data breach notifications

- The increase in fines is significant but the Schrems II judgment of Europe’s highest court and its profound implications restricting international data transfers continues to be the top data protection compliance challenge for many organisations caught by GDPR

Nearly EUR1.1bn (USD1.2bn/GBP0.9gbn) of fines have been imposed for a wide range of infringements of Europe’s General Data Protection Regulation. This represents a 585% year on year increase in fines imposed since 28 January 2021 compared to EUR158.5m during the same period last year, according to international law firm DLA Piper. The figure is taken from the law firm’s latest annual General Data Protection Regulation (GDPR) fines and data breach survey of the 27 European Union Member States plus the UK, Norway, Iceland and Liechtenstein.

Luxembourg, Ireland and France top the rankings for the highest individual fines (EUR746m; EUR225m and EUR50m respectively). Luxembourg and Ireland have each imposed record breaking fines moving them from the bottom to the top of the league tables.

The growth of breach notifications has continued with an 8% increase from last year’s average of 331 notifications per day to 356 this year and more than 130,000 personal data breaches notified in aggregate since 28 January 2021.

Weighting the results against country populations, the Netherlands takes pole position this year ahead of Liechtenstein and Denmark with 151, 136 and 131 breach notifications per 100,000 people respectively. Croatia, the Czech Republic and Greece reported the fewest number of breach notifications per capita since 28 January 2021.

While the increase in fines may be significant, the judgment of Europe’s highest court in Data Protection Commissioner v Facebook Ireland Limited, Maximillian Schrems in July 2020 known as “Schrems II” continues to be the top data protection compliance challenge for many organisations caught by GDPR. The judgment and Chapter V of GDPR impose strict limitations on the transfer of personal data from Europe and the UK to “third countries” with data exporters risking suspension orders, fines and claims for compensation for failing to meet these new requirements. The judgment requires organisations exporting personal data from Europe and the UK to third countries to carry out comprehensive mapping of those transfers and detailed assessments of the legal and practical risks of interception by public authorities in the countries where importers are located, greatly increasing the compliance burden on data exporters and importers.

Commenting on the survey findings, Ross McKean, Chair of the UK Data Protection and Security Group said: “The nearly sevenfold increase in fines may grab the headlines but the Schrems II judgment and its profound implications for data transfers has established itself as the top data protection compliance challenge for many organisations caught by GDPR.”

According to the survey findings the Schrems II judgment doesn’t just create a risk of fines and claims for compensation, it also threatens service interruption in the event data transfers are suspended, with serious implications for business continuity.

“The threat of suspension of data transfers is potentially much more damaging and costly than the threat of fines and compensation claims. The focus on transfers and the significant work required to achieve compliance inevitably means that organisations have less time, money and resource to focus on other privacy risks” continued Ross McKean.

Ewa Kurowska-Tober, Global Co-Chair of DLA Piper's Data Protection & Security Group, said "The Schrems II judgment has effectively shifted the problem and burden of a fundamental conflict of laws from the politicians and lawmakers to individual data exporters and importers. Meeting the requirements of Schrems II is a challenge even for the most sophisticated and well-resourced organisations and is beyond the means of many small and medium sized enterprises. What is really needed is a resolution of the underlying conflict of laws rather than imposing an unrealistic compliance burden onto business and another headwind to international trade as we emerge from the global pandemic."

Related News

- 05:00 am

Wikisoft Corp, a big data and business analytics company, today announced plans to digitize startup funding and accelerate matching startups with investors.

Once a startup's seed investment round is secured then the fledgling company powers ahead to create a minimal viable product (MVP). Once the MVP is proven, the founders of the startup will soon require further investment to accelerate growth. They participate in a series of investment rounds - series A, B or C, depending on the maturity of the business.

This is a stressful period and an arduous process involving introductions, pitches, negotiations, term sheets, and all the intricacies that go with each stage and every round. The time is ripe to change from manual processes to digital, creating a trusted and authenticated system to bring together high-potential, dynamic, young, fully-operational startups with groups of wily discerning tech investors looking for capital appreciation.

Deloitte recently wrote that 23% of the fund order process is still being handled manually, mainly though fax orders which have a significant impact on distribution costs. PwC surveyed 100 Private Equity houses with a minimum EUR250m assets under management. The PE houses named digitization as the most important megatrend influencing new investment.

Wikisoft, listed on OTCQB, is a fast growing, international, agile, big-data-powered, company which in today's fast-moving business world of increasing globalization leverages big data and associated insights from global business datasets to improve performance.

In line with this new phase of digitization and globalization, Wikisoft sees a growing demand for access to credible and reliable business data about startups and investors and has an ambition to digitalize the process of matching the right startup with the right investor and accelerate the investment process.

Carsten Kjems Falk, Wikisoft's CEO, spoke about the company's vision, "Our advancement will accelerate matching investor to startup, and vice versa, at a lower risk through credible and reliable business data. Series A, B and C investment rounds will be more efficient for all parties via digitization. It will enable startups to concentrate on scaling-up their business, becoming highly valued, and eventually opening the possibilities for even further expansion. Investors will have an efficient way of finding prospects and make the right investments."