Published

- 06:00 am

Research from bank challenger, Tally, reveals many UK travellers are confused about how foreign exchange works, with a quarter believing banks are deliberately misleading

● Four in ten of those polled were not aware that banks charge fees for withdrawing cash when abroad, whilst 50% were unaware that choosing the local currency for card payments saves them money

● With international travel opening up again, many holidaymakers want a change in the law to stop banks from charging unfair transaction fees when they're abroad

As the travel industry slowly begins to recover from the implications of COVID-19, many Brits are booking a much-needed holiday. And some are planning big-budget trips thanks to increased savings during the height of the pandemic.

But these holidays will cost many Brits far more than necessary given the lack of knowledge around foreign exchange (FX) charges and international transaction costs, according to research by Opinium*, commissioned by bank challenger Tally.

Nearly six in ten (57%) people don’t know banks add a margin to the official FX rate in addition to charging a transaction fee for using your card abroad, while four in ten (39%) are unaware that many banks charge fees for withdrawing money from cashpoints when abroad as well as additional interest on the withdrawal.

Half (51%) are unaware that choosing to pay in the local currency rather than in pounds when using your card abroad gives you a more favourable exchange rate. A similar proportion (55%) are unaware that if you don’t pay in the local currency on your card when abroad, the retailer will set the exchange rate and have the option to add conversion fees on top.

A further 24% say banks are deliberately unclear on FX rates.

According to the research, many travellers are now demanding change to reduce FX costs. A third - 32% - believe a law should be introduced to stop banks from charging customers transaction fees simply because they’re abroad.

Business looks set to be brisk for the sector, with the UK government recently announcing an end to pre-departure testing for holidaymakers returning to England and Wales, along with abolishing mandatory isolation until a negative PCR test has been obtained by those visiting the UK.

This development provides a huge boost to the travel industry, with travel company Kuoni’s CEO claiming that the industry will be “90% back before the end of spring.”

Cameron Parry, Founder and CEO of Tally, said: “A lack of clarity around foreign currency exchange and payments abroad generates revenues for banks, via unnecessary fees for bank customers.

“We want to demystify costs for bank customers. It is important that charges are simple and transparent so people can make the best choice when it comes to spending their hard-earned cash when overseas. People can accept a cost for convenience but no one likes having the wool pulled over their eyes.”

“The research tells us that consumers are not satisfied with the current system and are looking for change.”

Many savers are likely to have built up a lot of annual leave during the pandemic. This, combined with parts of the world opening up, means thousands are planning foreign holidays for 2022.

Cameron Parry added: “Our advice is to pay attention to the options presented at time of payment when abroad. And consumers should get themselves an account designed with international use in mind, such as a Tally account, which doesn’t charge foreign transaction fees, foreign withdrawal fees, or markup the official FX rate.”

Related News

- 06:00 am

Changes come as part of global leave shake up with enhanced time off for 'me days' alongside the company's long running sabbatical policy

Wise, the global technology company building the best way to move money around the world, today announces a new leave policy, rolled out worldwide.

Wise has decided to apply its minimum holiday, parental leave, and general leave policy to all 3,000 Wisers helping to deliver the mission of money without borders. The move is designed to create a better, more fair, global standard, where Wisers can have flexibility and space to do their best work, regardless of where they are.

As of January 2022 all Wisers have access to the below as a minimum paid time off (PTO).

Parental leave:

18 fully paid weeks of parental leave for birth or adoption, if the person has been at Wise for 1+ year at the due date or adoption date. This applies regardless of the parent’s gender.

10 days leave on full pay for any Wisers affected by pregnancy loss

This is applicable whether it happens to a Wiser, their partner or their baby’s surrogate mother.

Additional leave:

33 days annual leave (holiday, PTO) per year, including local public holidays.

3 me days per year to help people manage their life - Wisers can use this for ‘life admin’, general relaxing, or errands like vet visits.

6 weeks paid sabbatical - available every four years of service at Wise.

The minimum standard will be applied in every location, even if this is more than local market practice. In markets where the existing offer exceeds Wise’s new policy, this will continue to be the case. The new minimums will only be applied where they offer an improvement on what’s already in place.

Example changes:

Maternity and paternity leave in the USA will increase from 16 weeks at full pay, to 18 weeks at full pay

Maternity leave in Malaysia will increase from 9 weeks to 18 weeks at full pay

Australia and the UK will receive an extra 5 days of fully paid sick leave

Kristo Käärmann, co-founder and CEO of Wise, stated:

At Wise, we’re an international team and operate without borders. By applying a global leave minimum to everyone on our team, we’re setting the standard of balancing work and personal time. We’re no strangers to challenging the status quo, and making things work better regardless of where people live.

Hayley Bucur, Senior People Leader at Wise, added:

Time and again we see people wanting real workplace benefits that truly enhance their work life balance. It’s not about office gimmicks any more, but creating a genuinely better place to work. We hope that standardising our global minimums will create a better, and fairer, balance for our Wisers regardless of where they are. Changes come as part of global leave shake up with enhanced time off for 'me days' alongside the company's long running sabbatical policy

Related News

- 05:00 am

- Women’s Pioneer Housing Association improves budgetary control and saves time on processing invoices using Invu’s Purchase Order Processing software -

Women’s Pioneer Housing, a provider of homes and services that offer a springboard to independent women, has reimagined its purchase order and invoice processing system and gained renewed control over their spending.

Using Invu Purchasing, a purchase ordering software from Invu, Women’s Pioneer Housing has significantly improved the level of control exercised over business expenditure and the ability to process supplier invoices on time.

In addition to improving their budgetary control, Women’s Pioneer Housing has also reduced duplication of work and has seen increased employee productivity. Due to this enhanced visibility, they are now reaping the rewards they can achieve with the efficiency savings.

Before implementing Invu Purchasing, Women’s Pioneer Housing’s original process for raising and managing purchase orders was extremely time-consuming and inefficient for the finance staff, who would manually process over 6,000 invoices a year.

Women’s Pioneer Housing recognised the importance of exercising control at the point of making a purchase commitment rather than at the point that a supplier invoice is received. This made it vital to find a solution that streamlined their requisition process and freed the finance team to focus on other areas of the business.

Atrik Gadoya, Finance Manager at Women’s Pioneer Housing, explained,

“In the time it used to take to register 10 invoices, the new system can cope with registering 100! The system reads the level of budget available and informs the officers how much they’ve committed, how much spend they have left and allows managers to make more informed judgements.”

Mark Cole, Director of Resources at Women’s Pioneer Housing, highlighted,

“The Chief Executive and Senior Staff were supportive of the system because of the enhanced budgetary control. We also saw the benefits they could achieve with the cost savings.”

Women’s Pioneer Housing aren’t alone in using manual and slow invoice processes. This has proven to be the case for many businesses, as shown in an independent research project with the majority (85%) of businesses still printing out their invoices even if they have been received digitally.

Ian Smith, GM and Finance Director at Invu, said:

“Women’s Pioneer Housing, along with many other businesses, need improved visibility of where the invoice sits in the process, better control over approval processes to ensure invoices are consistently sent to the right people for approval, and identity management, to make certain that the person signing it off is authorised to do so. Particularly as more and more finance teams are working remotely from home, increasing the risk of fraud and error. ”

Finance departments across the UK are ready to embrace automated accounting processes. Research has shown that 44% of finance workers think that automating processes would make them more productive, with one in five (22%) claiming they would welcome automation in their business.

Smith concludes, “With Invu, those responsible for expenditure budgets can be certain that they have control over what is charged to their budgets as it is approved only by themselves or their chosen delegates.”

Related News

- 04:00 am

A survey of leading global banks by Icon Solutions has revealed that Request to Pay is widely expected to challenge established payment methods, with 87% of respondents viewing it as a good alternative to direct debits and 71% expecting it will reduce merchant’s dependency on payment cards. Yet 67% also identify bank readiness as the main barrier impacting adoption of Request to Pay services, with the limitations of existing technology and a lack of clear strategy seen as the key inhibiting factors.

In allowing payees to initiate requests for payments within a secure messaging channel, Request to Pay enables new flexible ways for money to move between people, organisations and businesses. ‘Demystifying Request to Pay: An Industry Perspective’ surveys over 50 industry stakeholders, including global retail and corporate banks, to understand customer demand, key use-cases and the path to widespread adoption. In-depth interviews were also conducted with senior executives at several leading banks.

Despite early momentum from retail customers for bill payment services, 73% of respondents see most demand for Request to Pay services from large corporates. To reflect this increasing demand, respondents are planning to leverage Request to Pay to diversify product roadmaps, with invoicing, payments reconciliation, and the digitalisation and integration of processes and systems identified as the leading emerging use-cases.

Louise Shorthouse, Senior Payments Consultant at Icon, comments

: “Make no mistake, the industry expects Request to Pay to have a lasting impact on the future of banking and payments. The potential to deliver more flexibility, choice and control to corporates, merchants and consumers – while reducing costs – offers a real alternative. For example, Request to Pay opens the ability to circumvent traditional card rails and drive consumers towards cheaper account-to-account (A2A) based payment options at the point-of-sale, and provides an alternative to direct debits that gives customers more flexibility in how they pay bills and manage their finances. If we consider the massive transaction volumes involved, it seems inevitable that Request to Pay will change the way we pay.”

Yet despite increasing customer demand and growing uptake of instant payments presenting a compelling business case, a gap persists between industry attitude and actions. Few survey respondents had launched Request to Pay services to date and Request to Pay does not feature on the short-term roadmaps for many. While countering the risk of fraud and standardising message content and exchange are seen as key challenges, bank readiness is overwhelmingly seen as the main barrier to adoption.

Toine van Beusekom, Strategy Director at Icon explains:

“Despite the undoubted potential of Request to Pay, technology transformation programmes remain notoriously difficult. Identifying a pragmatic path to upgrade existing technology estates, in tandem with a clear strategy that is aligned with broader business objectives, will be critical to accelerating bank support for Request to Pay services and remaining competitive in the long-term. But with banks already at the limits of their technological and strategic capacity, trusted third-parties promise to play an important role in filling the resource gap to help banks realise the huge opportunities presented by Request to Pay.”

To learn more, download the full report.

Related News

- 07:00 am

Business-to-business open banking payments provider Crezco has appointed Ivelina Delcheva as its first Chief Financial Officer and Chief Operations Officer.

A finance expert with extensive fintech experience, Delcheva will lead the London-based startup’s growth agenda.

Delcheva joins Crezco from Chip Financial, where she was interim CFO when the company closed the biggest ever equity crowdfund on Crowdcube, with a £11.5 million raise in October 2021. Prior to that, Delcheva was COO at Auto1 Fintech, a German fintech company providing financing for cars through dealerships across Europe. She has also held roles at BNP Paribas and worked for a number of emerging financial services companies in Central and Eastern Europe.

In her new role, Delcheva will be responsible for Crezco’s growth agenda and establish KPIs and processes that reflect Crezco’s values and goals.

Ralph Rogge, co-founder and CEO of Crezco, said

“We have had a strong period of growth since launching in 2020, culminating in our successful seed fundraise. To take the next step we need a strong leadership team in place, and one that brings outside experience to the table. Ivelina’s experience of both startups and the fintech space, her passion for helping businesses grow and her understanding of the opportunities and challenges of early-years companies is exactly what we need to help our finance and operations functions develop and support our growth objectives.”

Delcheva said “Having worked at a number of small businesses I know how inefficient and expensive payments processing can be, and how it hampers efforts to scale effectively. Card payments are expensive for B2Bs and are subject to delays, human error and inertia. Despite all the technological advancements, today, 90% of invoices are still processed manually. With over $120 trillion in B2B payments transacted annually, I know that even the smallest improvements can have a huge impact on businesses.”

“Crezco has built a one-of-a-kind B2B payment solution, at a time when open banking is gaining traction around the world. It is exciting to join a company that is in such a strong position to capitalise on the immense opportunity to innovate in theB2B payment space, one that is hyper-focused on the customer, technology and a great team,” Delcheva continued.

Crezco is integrated with more than 300 banks and 400m bank accounts across the EU and UK, more than any other open banking payment API provider.

Crezco makes B2B invoice payments as frictionless as card payments but without the associated costs. The company is integrated with more than 300 banks and 400m bank accounts across the EU and UK, more than any other open banking payment API provider.

Crezco recently raised £3 million in a seed funding round, which is being used to continue the company’s international expansion and add to its product range.

Related News

- 09:00 am

SteelEye, the compliance technology and data analytics firm, has announced a record year of growth. Revenues increased 88 percent year-on-year in 2021 and the company now has over 120 institutional clients worldwide, with new clients including Oppenheimer Europe Ltd and JonesTrading.

SteelEye – which is headquartered in the UK and has offices in London, New York, Paris, Bengaluru, and Braga – has seen increasing demand for its services as financial firms’ regulatory compliance needs have grown across the globe. In response, the business expanded to the United States last year, backed by $17 million funding rounds in 2020, and appointed RegTech veteran Brian Lynch to lead its US operations.

Pressure from regulators and the increasing need to improve operational efficiency across the industry have encouraged more firms to replace legacy technologies through platforms like SteelEye. This demand is growing exponentially as remote and hybrid work patterns become the norm – requiring firms to have secure cloud-based SaaS solutions.

SteelEye expects another year of strong growth in 2022 as continued regulatory pressure and more pervasive adoption of cloud drives an increasing number of firms to upgrade their compliance capabilities. A particular area of focus, directly related to the new ‘normal’ is communications archiving and monitoring, as evidenced by the scale of penalties handed out recently for record keeping failures in relation to WhatsApp.

Matt Smith, Chief Executive Officer at SteelEye, said:

“The regulatory pressures facing the industry continue to intensify. There is increasing recognition that legacy compliance systems are no longer fit-for-purpose and expose firms to unnecessary regulatory risk and high costs due to inefficiencies.”

“We are extremely proud of what our team achieved during 2021, a year marked by uncertainty, market turbulence and economic volatility. The RegTech landscape evolved dramatically in the last 12 months and SteelEye’s compelling proposition is agile and ideal for firms seeking a holistic platform to support their long-term compliance needs.”

2021 saw SteelEye launch two new products: a Three-Way Reconciliation solution to help firms improve their data quality, and an AI-driven lexicon to reduce false positives in communication surveillance. The firm increased its headcount by 60 percent last year and plans to expand by a further 70 percent by the end of 2022, with a large focus on North America to keep pace with demand.

Related News

- 06:00 am

Putting customer experience and flexibility first for ENTRIS BANKING customers

Bottomline, a leading provider of financial technology that makes complex business payments and financial messaging simple, smart and secure, today announced that ENTRIS BANKING AG, a new Swiss customer, has selected Bottomline’s SaaS-based payment connectivity platform to provide customers with an enhanced, more flexible domestic and international payment experience.

ENTRIS BANKING is a business process and technology outsourcing provider acting as a transaction bank and payment hub to a group of more than 40 small and mid-sized banks in Switzerland. To support and navigate its digital transformation journey, ENTRIS BANKING required a collaborative technology partner with a sophisticated understanding of the disruptive changes set to shape Swiss and International payments schemes.

Beyond domestic SIC/SECOM and cross-border SWIFT connectivity, the new SaaS-based platform will enrich the onboarding and user experience for ENTRIS BANKING’s customers, and improve its back-office operations. By updating its technology stack, ENTRIS BANKING will benefit from the centralised data intelligence and control, increased efficiency, and improved risk management that the solution offers.

“In light of the evolving payments industry in Switzerland, the switch to Bottomline’s SaaS-based payment connectivity platform will be an important step ahead,” said Juerg Gutzwiller, CEO, ENTRIS BANKING. “bWe selected Bottomline because of its modular technology, the comprehensive support and its international payment experience. This will allow ENTRIS BANKING to offer its customers an efficient and future-proof payment hub, which will be ready for the challenges ahead, such as the introduction of instant payments in Switzerland.”

“For us, it’s not only about collaborating with financial institutions to deliver technology and innovation that will meet their payment needs,” comments Daniel Bardini, Bottomline’s Managing

Related News

- 06:00 am

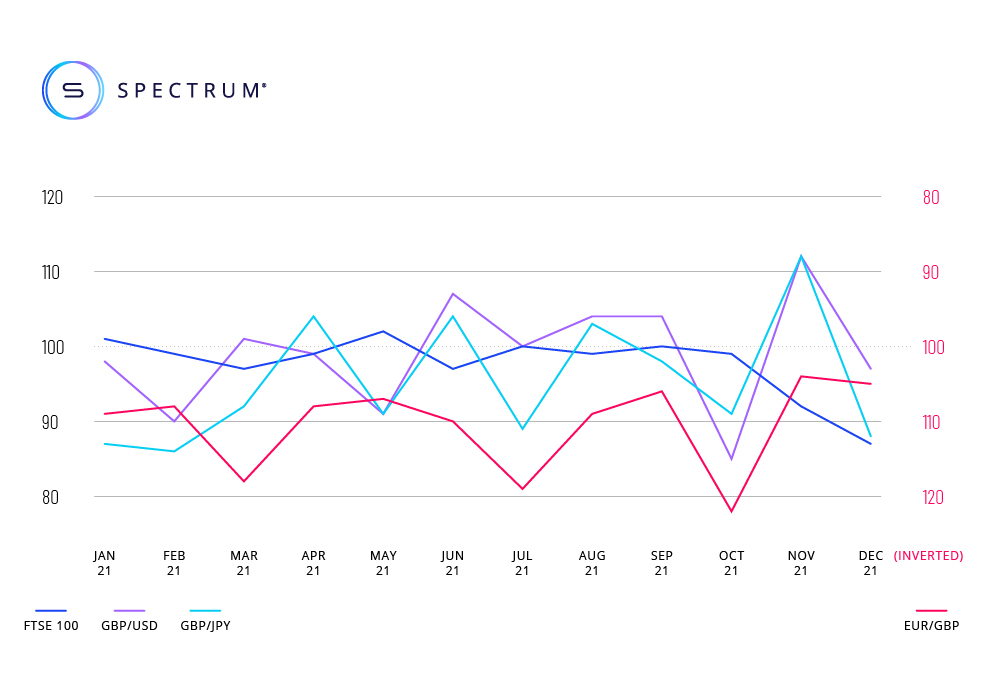

- SERIX for FTSE 100 reaches record bearish territory of 87

- British pound also loses investor confidence

- Retail investor sentiment positive on IBEX, MIB and NASDAQ

Spectrum Markets, the pan-European trading venue for securitised derivatives, has published its SERIX sentiment data for European retail investors for December (see below for more information on the methodology), revealing that of all investible equity indices the UK’s FTSE 100 experienced the most long-selling and short-buying activity.

Since the SERIX value on the FTSE 100 stood at 100 in September 2021, representing an equal balance of buying and selling, the curve sloped sharply into bearish territory in the months thereafter, finally reaching a value of 87 in December, the lowest monthly value for the index since the SERIX was introduced as a benchmark. In contrast, positive investor sentiment can be observed in the Italian MIB 40 index (101), the Spanish IBEX 35 (104) or America’s NASDAQ 100 (103).

At the same time, the British pound also lost investor confidence. Here, the SERIX value for the GBP/USD currency pair fell from 112 in November to 97 in December, which also indicates a bearish investor sentiment. A similar trend can be seen for sentiment around the currency pairs GBP/JPY and GBP/EUR.

Looking at the SERIX data for the top three underlying markets, the NASDAQ 100 and DAX 40 were relatively unchanged at 103 and 99 respectively. Meanwhile the S&P 500 rose slightly, from 97 to 98, while remaining in the bearish zone overall.

A lot of things have come together in the UK: Brexit, which took effect in 2021, increased trade costs, leading to a decline in trade volume and relocation of company headquarters. The loss of EU freedom of movement drew workers away, further increasing production and distribution costs. There is a national shortage of lorry drivers, but also of care workers and of workers in the food processing industry, leading to supply bottlenecks. In addition, the UK has also been hit hard by the global supply chain crisis and the associated price rises and, finally, Omicron dampened hopes of recovery.

“Overall, it seems retail investors simply did not see much in the way of encouraging signs in the UK market at the end of the year and - on the contrary - even see it as overvalued, which is illustrated by the numerous bearish positions on the FTSE 100 index. Investors also do not seem to consider the slight recovery of the FTSE to be sustainable in the long-term or sufficient cause for optimism. Alternatives such as the Spanish IBEX or the Italian MIB currently seem to be more convincing to Index investors." explains Michael Hall, Head of Distribution at Spectrum Markets.

During December, 72.5 million securitised derivatives were traded on Spectrum Markets, with 37.2% of trades taking place outside of traditional hours (i.e. between 17:30 and 9:00 CET). 83.2% of the traded derivatives were on indices, 9.8% on currency pairs, 5.4% on commodities, and 1.6% on equities, with the top three traded underlying markets being DAX 40 (24.1%), NASDAQ 100 (17.8%), and S&P 500 (14.6%).

Related News

- 03:00 am

The Chartered Institute for Securities & Investment (CISI) is delighted to announce the re-launch of its National Advisory Council (NAC) for Switzerland.

The new CISI Switzerland NAC President is Paul Heber FCSI (left), Director & Member Investment Committee at Valère Consulting SA. The CISI NAC Committee members are:

Asma Ali, Director of Marketing and Administration at Altaira Wealth Management

Anthony Acampora, CEO at Altaira Wealth Management

Stuart Clarvis ACSI, COO at Altaira Wealth Management

The NAC will support CISI membership in Switzerland and steer CISI’s activities in developing professional standards across the finance profession.

The CISI has been present in Switzerland for over a decade with a vibrant community of over 80 CISI members. Candidates can book CISI exams online and sit exams at its local computer-based testing (CBT) centre in Zurich.

The Swiss Association for Quality (SAQ) recognises 25 of CISI’s e-learning Professional Refresher modules as official recertification measures for the Certified Wealth Management Advisor CWMA Programme. Each module is given a special code. Completing all 25 modules allows individuals to meet the 24 hours required by the SAQ.

The CISI is also delighted to partner with the International Management School Geneva (IMSG) which offers the CISI’s International Introduction to Securities and Investment as part of its curriculum.

Kevin Moore Chartered FCSI, Director of Global Business Development at CISI said:

“We are delighted to re-launch our Swiss National Advisory Council. Their support is instrumental in helping to grow our membership to ensure that the Swiss financial services sector has practitioners qualified above and beyond the standard competence requirements, supporting consumer confidence in the financial services market.”

Paul Heber FCSI, CISI NAC President said:

“I am most privileged to have been given the opportunity to lead the new Swiss NAC and very much look forward to driving wider awareness of our presence and role across Switzerland.”

For further information on the CISI programme in Switzerland contact Brigid.Taylor@cisi.org

Related News

- 07:00 am

Formerly OKEx, OKX’s new brand highlights the platform’s robust suite of crypto, NFT and DeFi investing products

OKX, which recently became the second largest cryptocurrency exchange in the world by spot trading volume, today announced a company-wide rebrand that reflects the dynamism and accelerating adoption of cryptocurrency. Founded in 2017 as a cryptocurrency trading service, OKX has since amassed over 20 million users and expanded its suite of digital asset investing products to include OKX Earn, a tool for earning passive crypto income; an NFT marketplace and decentralized application discovery hub; and most recently, MetaX, OKX's new decentralized mode that features a cross-chain dashboard and self-custody Web 3.0 wallet for storing digital assets, including NFTs.

This shift, as highlighted by the company’s name change from OKEx to OKX, reflects the platform’s growing number of wealth creation opportunities beyond the exchange, which investors use to trade hundreds of digital assets on spot, margin and derivatives markets.

As part of the move, OKX has declared its mission to be “to remove barriers to wealth creation by giving you access to everything our decentralized future holds.” This underscores the platform’s ongoing evolution towards decentralization, which includes giving investors the option to self-custody their digital assets. Distinct from other centralized cryptocurrency exchanges, OKX is committed to gradually decreasing the company’s level of involvement in user activity, with the ultimate goal of shedding intermediation entirely.

“OKX is moving beyond the standard centralized exchange model to give our customers an end-to-end cryptocurrency experience,” said Jay Hao, CEO of OKX. “Most importantly, we’re doing this while upholding the core principles of crypto — decentralization and autonomy. Our goal is to give customers the tools they need to easily and securely earn, transfer, and spend their wealth as they see fit, without intermediation from us. We’ve dropped the ‘E’ from our name because we’re so much more than an exchange, just like crypto is so much more than a speculative asset.”

OKX, which lists over 250 digital assets and has long held the #1 rank for cryptocurrency futures trading volumes, recently became the second largest cryptocurrency spot trading platform in the world. In 2021, total trading volume on the platform, including spot and derivatives instruments, grew over 700%, while the number of trades executed on the platform increased over 480%. Staking, savings and DeFi offerings via OKX Earn saw over $5.1 billion deposited by users, and paid out over $314 million in passive income this past year.

To learn more, please visit OKX.com and follow @OKX on Twitter.