Published

- 05:00 am

Moneyhub, the award-winning Open Data and payments platform, is partnering with leading global electronics manufacturer Samsung to facilitate the world’s first Open Banking payments on a retail self-service point-of-sale (POS) Kiosk.

Moneyhub’s award-winning Open Banking payment technology in conjunction with Samsung’s self-service ordering and payment solution, will support the digital transformation for many businesses. The sleek and compact Samsung Kiosk will be used by many sectors such as quick-service restaurants, retail stores, stadiums, and other hospitality venues.

Open Banking is a compelling payment option for these merchants, as customers pay by bank transfer, sending funds directly from their bank account to the merchant’s account. It is fast and secure without the need to share their credit or debit card details. As payments are initiated via the customer’s bank, it complies with the FCA’s Secondary Customer Authentication (SCA) which comes into force on 14 March 2022.

Payments are received instantly, at lower cost compared to cards. Merchants can pay up to 5% of their revenue to card providers to process payments, whilst Open Banking payment fees are less than 1% of the transaction value, helping merchants to improve their profit margins.

Moneyhub’s smart technology enables Samsung Kiosk users to manage their payments directly and safely by scanning the QR code with their mobile phone from the screen, making ordering and paying simple and quick for both the merchant and their customers.

Sam Seaton, Chief Executive Officer at Moneyhub said: “We are delighted to achieve a world-first with Samsung by bringing the speed, security and cost effectiveness of Open Banking payments to our increasingly fast-paced world. Payments is the new frontier for Open Banking and it is thrilling to see another necessary and impactful business case that brings together the quality of the Samsung Kiosk, with the benefits of this new and exciting way to pay.

Damon Crowhurst, Head of Display at Samsung said: “Through our partnership with Moneyhub, we are continuing to bring innovative solutions that help our customers navigate the complex landscape of a fast changing business environment. Implementing the open banking solution on our kiosk platform helps our customers drive increased profitability, through efficient, scalable and cost-effective solutions that are applicable for retail businesses of all sizes.”

Related News

- 08:00 am

Named a Leader for the 14th Consecutive Time in the 2022 Gartner® Magic Quadrant™ for Global Retail Core Banking

Infosys Finacle, part of EdgeVerve Systems, a wholly-owned product subsidiary of Infosys (NSE, BSE, NYSE: INFY), today announced that it has been recognized as a Leader in 2022 Gartner® Magic Quadrant™ report for Global Retail Core Banking for the 14th consecutive time, following the evaluation of its Finacle Core Banking Solution. Gartner comprehensively assessed five global core banking solution vendors on 65 variables and 321 data points spanning across ‘ability to execute’ and ‘completeness of vision’.

Finacle Core Banking is a cloud-native, componentized, and open APIs-driven solution. The solution is differentiated by its functionally rich modules, composable architecture, and an impeccable track record of powering innovations for financial institutions of all sizes. Banks gain a go-to-market advantage with Finacle’s flexible product factories that can help bring global innovations to life with simple configurations. Banks can also compose contemporary digital business models such as ‘Banking as a Service’ with ease, using Finacle’s open APIs, webhooks, and pre-integrated API management infrastructure. Today, financial institutions in more than 100 countries rely on the Finacle Core Banking solution to serve more than a billion people and millions of businesses.

Gartner analysts Vittorio D’Orazio and Don Free, mention in the report that, “Leaders in the global retail core banking market tend to possess a higher-level market understanding than peers that helps in lead generation and, ultimately, in achieving more sales. In addition, they make it their business to monitor market trends and funnel progressive innovation into their product roadmaps. Most of them possess software development quality certifications such as Capability Maturity Model Integration or are pursuing them. The Leaders are also, without exception, “thinking small” or targeting composable architecture as a gateway to providing increased accessibility to the granular functionality that banks need to drive the basis for differentiation. Leaders have high viability and great customer feedback. Leaders also focus on innovation — and the innovation trends that affect this particular market. For example, they can show visionary capabilities in managing new trends such as the ecosystem for open banking platforms by fostering the integration of their system with others’ products. They also respond to client demand for cloud deployment by gradually making their products more cloud-native with “APIfication” of the components and by introducing standards and the use of sandboxes.”*

Sanat Rao, Chief Business Officer & Global Head, Infosys Finacle said, “The digital divide between innovators with modern platforms and laggards struggling with legacy cores is widening rapidly. Thus, there is growing interest in embracing modern core platforms. Finacle delivers one of the most advanced digital banking foundations built on componentization, composability, and Open APIs. Our cloud-native solution and SaaS services help banks engage, innovate, operate, and transform better to scale digital transformation with confidence. We believe this leadership position is yet another testimony to our differentiated value proposition."

A complimentary copy of the Gartner Magic Quadrant for Global Retail Core Banking report can be accessed here.

Related News

- 03:00 am

Channel Partners Given Access to Enhanced Sales, Marketing, Product and Technical Tools to Maximize Online Security with Liveness Assurance™ and Genuine Presence Assurance®

iProov, the world leader in biometric face authentication technology, announced today the launch of its new Global Partner Program. New and existing iProov partners will be given access to enhanced resources for sales, marketing, product and technical support, enabling them to drive business growth by bringing world-leading security technology to their customers’ digital transformation programs.

iProov, which currently has an established partner ecosystem across the U.S., LATAM, Europe and APAC, has launched the new program to share industry expertise and market growth opportunities with organizations in a broad range of sectors. These include identity solution providers, system integrators and technology partners, all of whom will be equipped with the technology and resources they each need to create sizable revenue opportunities within the market.

“Organizations across the globe partner with iProov for our proven face verification technology and for the benefits we bring: excellent completion rates, the highest levels of security and usability, simple integration and fantastic working relationships,” said Rob Percy, Vice President, Global Partnership Strategy. “We are committing extensive resources to growing our global partner ecosystem, and participating partners will benefit from a greater competitive edge that will accelerate growth and maximize opportunities.”

The iProov Global Partner Program provides a framework that drives revenue, uncovers opportunities and fosters mutual success. The program benefits include:

· Access to the iProov Partner Enablement Platform and materials for sales, marketing and product information.

· Availability of market development funds and co-marketing opportunities.

· Enhanced onboarding, training and enablement.

· Unrivaled expertise in biometric face verification for deal support.

· Access to account teams to drive sales and ensure customer success.

For more information on how Jumio, Entrust, iiDENTIFii, Thirdfort and other leading identity solution providers are benefitting from partnerships with iProov, visit www.iproov.com/partners

Related News

- 04:00 am

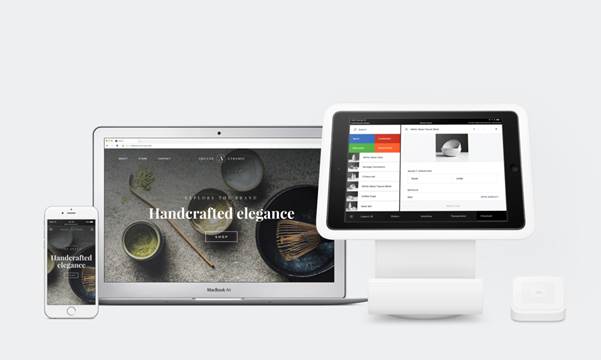

Today Square, the globally trusted software, payments, and hardware solution for businesses of all sizes, and CodeBase, one of the UK’s largest technology start-up incubators, announced a partnership to provide entrepreneurs with access to Square’s payment ecosystem and APIs (Application Programming Interfaces).

Through the partnership, Square will support CodeBase’s network of start-ups by offering a series of workshops that enable entrepreneurs to learn from leaders in the commerce and payments fields. Square will also offer these start-ups free or discounted hardware to accept payments as well as free payment processing to help kick-start their business. Finally, the start-ups will be able to connect directly with the Square platform team for questions and support as they build solutions on top of Square’s APIs.

Trusted by thousands of businesses around the world, Square offers all the tools sellers and developers need to start, run, grow, or adapt their businesses. Square tools enable business owners to set up eCommerce solutions, take card payments in person, access earnings faster, manage inventory or a busy kitchen, and much more. With a suite of products that fully integrate with each other, Square saves businesses time, offers solutions for a multitude of complex business needs all in one place, and makes it easier to adapt and grow as needs evolve in the future.

Speaking about the partnership, Ginevra Mambretti, Square Developer Product Marketing Manager, said: “We are thrilled to be partnering with CodeBase, Scotland’s biggest tech startup incubator, to provide entrepreneurs with preferential access to Square’s APIs and payment ecosystem. This is a first of its kind partnership in the UK and we are excited to see what’s born from the merging of Square’s tools and CodeBase’s network of innovation.”

"It's very exciting for us to be partnering with Square,” said Stephen Coleman, CEO of CodeBase. As the start-ups in our community grow and scale, it’s important for us to work with partners whose offerings can support companies on their business journey. Square’s rich set of APIs and SDKs will open up new opportunities for developers in our community, and we look forward to seeing the results.”

Developers across the UK can build innovative commerce applications that build upon Square offerings and publish them on the Square App Marketplace if they wish to do so. Popular APIs and SDKs include:

- Payments APIs: Square’s developer platform includes APIs and SDKs for taking in-person, online, and in-app payments.

- Terminal API enables developers to connect Square Terminal to their apps for in-person card and contactless payments. With Terminal API, payments sync automatically with sellers’ favorite point of sale software so they can focus on what matters most to their business.

- POS API enables developers to connect Square Reader for Contactless and chip payments with their point of sale application.

- Web Payments SDK is a JavaScript SDK that enables developers to integrate online payment processing into web applications to enhance the online buying experience.

- In-App Payments SDK helps developers easily integrate Square payments into mobile apps.

- Commerce APIs encompass the Subscriptions, Orders, Catalog, Gift Cards, and Loyalty APIs, which enable developers to build advanced commerce applications for Square sellers.

- Customers and Team APIs enable developers to manage customer and employee data within their app.

- Snippets API enables developers to insert Javascript, HTML, or CSS code inside the <head> tag of a website to create custom add-ons that sellers can add to their Square Online website.

Square’s suite of developer tools, including a developer dashboard, documentation, technical reference and API Explorer, are fully available to developers.

All of Square’s APIs & SDKs are free to use. Square offers fair, transparent, and merchant-friendly pricing for payment processing without requiring long-term contracts or extra fees. Square takes care of fraud prevention, dispute management, and security at no additional cost. Businesses can access their funds as soon as the next working day and only pay a transaction fee when they accept a card or mobile payment.

To learn more about Square Developers visit developer.squareup.com or to learn more about CodeBase visit thisiscodebase.com.

Related News

- 02:00 am

Leading end-to-end technology consulting service, AISROFT Technology concluded their successful participation at the iFX EXPO Dubai held from 22 to 24 February, 2022. The company’s representatives networked with dozens of business owners, forging lucrative relationships. They consulted with numerous FX/CFD/Crypto brokers interested in the AIRSOFT 360-degree solution and met with PSPs and affiliates to help the company grow its network and enhance the client experience.

iFX EXPO is the largest B2B fintech expo in the world, attracting thousands of attendees, exhibitors and sponsors. The participants include the top financial institutions, fintech firms, brokers, advisory firms, digital asset firms, blockchain companies, and other service providers. AIRSOFT has been a part of this high-profile event for many years. The company now looks forward to expanding brand awareness at the iFX EXPO International 2022, scheduled to be held in Limassol, Cyprus, in June.

A Great Start to the Year

AIRSOFT Technology has established itself as the leading technology and end-to-end services provider for financial firms. The company offers cutting-edge technology solutions for Crypto/CFD trading systems, including the Chrono trading platform that allows traders to leverage market volatility to make timed short-term trades. Brands using Chrono Trade can offer their clients high-frequency, exciting trading experiences, thereby increasing trader engagement and retention.

AIRSOFT has partnered with several newly launched brokerages in Europe in 2022. The company is also in talks with potential partners from the GCC region, LATAM, Eastern Europe, and more.

In the coming months, the company plans to participate in two major expos and networking events in Europe. The first is ICE London, which will be held from April 12 to 14. It is an exclusive event for the gaming industry. The event will be attended by global decision-makers, technology experts, and regulators. Though this year AIRSOFT will not have a booth at the event, the team will be setting up meetings during the three days. Interested parties should contact the team to schedule a meet.

Almost concurrently, AIRSOFT will also attend iGB Affiliate in London, due to high interest among clients and partners for its services. iGB Affiliate is the leading event for global affiliates and affiliate programs, to be held in London on April 13-14. Several sectors participate in the event, including gaming, casino, finance, crypto, sports betting, and more. The event will also host speaker sessions by industry pioneers, who will talk on topics such as localisation and digital marketing, branding for social media, mobile marketing, and more, in the iGaming industry. Members of the AIRSOFT team will be present for the three days of the event and may be contacted in advance to arrange meeting times.

After a long hiatus, live events have made a comeback, offering strategic opportunities to AIRSOFT Technology to forge collaborations and business deals. They also offer a large venue to increase brand visibility and discover the latest innovations in the sector.

AIRSOFT Technology Offers Strategic Solutions Enabling Business Growth

AIRSOFT has a team comprising industry veterans, who help design strategic solutions to enable brokers to expand globally. The company designs customised and compliant offerings, including CRM solutions, for intelligent and seamless onboarding of clients. This enables brokers to eliminate manual-intensive tasks and focus on branding, customer services, and business growth.

To enable this, AIRSOFT offers business consulting services, website development, and referrals to industry experts. Start-up brokerages can leverage these services to reduce costs and time to market. The company also offers integrated PSP solutions through its partnerships with leading service providers, exchanges, cashiers, and banks.

Brokers are further able to enhance the trading experience for their clients through access to over 5,000 tradable assets. Clients can also benefit from in-depth market analysis, charting tools, and ultra-fast execution speeds. Over 1,000 synthetic assets with customisable portfolios help them with asset diversification.

AIRSOFT aims to take its services to the next level in 2022. It will help brokers engage and retain clients effectively through cutting-edge technology tools. The company will also offer advanced risk management solutions, needed for retail traders in this volatile geopolitical environment.

Contact AIRSOFT Technology to learn more.

Related News

- 05:00 am

The Digital Euro Association (DEA) is delighted to announce its partnership with RTGS.global, which is building a financial market infrastructure (FMI) for the digital age. RTGS.global makes inter-bank liquidity visible, enabling wholesale cross-border payments to become faster and more efficient, while reducing settlement risk. The DEA’s partnership with RTGS.global will include, amongst others, joint educational efforts around digital currencies, knowledge exchange, and furthering the DEA’s mission of encouraging new ideas and forward-thinking in the field of digital money.

“Through our partnership with RTGS.global, we look forward to the exchange of insights regarding wholesale CBDCs gained from RTGS.global’s innovative developments in wholesale cross-border and interbank payments. This partnership further strengthens our portfolio of technology partners working on CBDC infrastructure solutions, and will positively contribute towards the discussion around a digital euro”, said Conrad Kraft, Executive Director of the Digital Euro Association.

“The trials and tribulations associated with cross-border transactions are well known. As demand increases, we need a way to speed up transaction processes while mitigating settlement risk. We should be aiming to match the speed of domestic payments, or any of the other digital services that we consume day-to-day. To make this a reality, cross-industry collaboration is essential. As such, we are delighted to become part of the DEA to help shape the future of digital money in Europe and further afield,” said Andrew Smith, CTO, RTGS.global.

Related News

- 04:00 am

Simpl, the market leader in 1-tap checkout, today announced the appointment of Robin as Principal Data Scientist. Robin has served as a Lead Scientist - Analytics Science in his previous role at FICO USA.

His new role at Simpl includes creating high-impact Data Science and anti-fraud projects in close coordination with other stakeholders. He will be working as a technical consultant to product managers from different departments.

Robin comes with over 14 years of robust experience in building AI solutions for a range of industries. During his time at FICO, he was instrumental in developing the FICO Cognitive Analytics toolkit using advanced machine learning algorithms. Robin’s areas of expertise include developing anti-fraud solutions for insurance claims, credit cards, and other applications. He has also worked on Clinical Decision Support and Identity Proofing projects.

Commenting on the key appointment, Nitya Sharma, CEO & Co-Founder – Simpl, said, “In the fintech payments industry it is imperative to continuously innovate by deploying new-age technologies. We believe that AI, ML, IoT, blockchain technology, data analytics and other technologies will help us in delivering powerful products and deliver better user experience to customers. And having seasoned technologists will help us to fast track our product development. In this regard, we are excited to on-board Robin as Principal Data Scientist. He will be instrumental in spearheading anti-fraud initiatives at Simpl.”

Robin, Principal Data Scientist– Simpl, stated, “I’m thrilled to be a part of Simpl’s journey in innovating the digital payments ecosystem and ensuring consumer data protection. I look forward to design and develop a suit of solutions utilizing advanced machine learning algorithms at Simpl and contribute towards Simpl’s commitment of making payment experience simple, safe, and secure for customers.”

Simpl will continue to seek out the best and brightest in the industry in hiring, promotion, and business practices. Simpl is committed to the simplification and democratization of digital transformation in the payments space in India.

Related News

Simone Maini

CEO at Elliptic

At Elliptic, we believe that cryptoassets will form the foundation of a financial system that is fairer, freer and safer for all to use. see more

- 06:00 am

Global leading cloud provider receives highest score in current offering

Alibaba Cloud, the digital technology and intelligence backbone of Alibaba Group, was named a “Leader” in The Forrester Wave™ Public Cloud Container Platforms Q1 2022, among the eight most significant players evaluated.

Recognised as a leader in the field by Forrester for the first time, Alibaba Cloud also obtained the highest score among all evaluated vendors in the current offering category assessing platform experience, cloud-native application development, container runtime and registries, platform operations and platform infrastructure.

“Container technology has become an integral part of the digital transformation process, and we are glad to be acknowledged as a ‘Leader’ in the public cloud container platform market by Forrester. As the demands around digitalisation grow and evolve, it is important for businesses of all industries to have flexible access to cloud-native technology that will allow them to position themselves efficiently in the market. We look forward to supporting our clients on their digital and innovation journeys as well as continuing to collaborate with ecosystem partners to develop new cloud-native applications,” said Jeff Zhang, President of Alibaba Cloud Intelligence.

The report highlighted that Alibaba Cloud now offers container services on six continents and contributes sustainably to the global open-source cloud-native community with seven Cloud Native Computing Foundation (CNCF) sandbox projects. The report also acknowledged that more than 90% of all Alibaba Group’s applications run on Alibaba Cloud’s container services, which enabled the company to excel in developing cloud-native services for clients looking to digitalise their businesses.

“Alibaba Cloud is a great fit for global enterprises targeting China and Asia Pacific markets or local firms going abroad that seek comprehensive cloud-native capabilities for digital transformation with proven experiences,” wrote Forrester in the report.

The Forrester Wave™ used a 29-criteria evaluation framework to identify public cloud container platform providers with track records of excellence in accelerating cloud-native application development via prebuilt services and automation, enabling automated platform operations in distributed environments and creating enterprise value through cloud-native marketplace and partner ecosystems.

As Alibaba Group’s own cloud provider, Alibaba Cloud supports the world’s biggest shopping festival 11.11 every year. During 11.11 2021, use of 100% cloud-native technologies reduced computing resources by 50% for every 10,000 transactions compared to the previous year.

In April last year, Alibaba Cloud was named a Function-as-a-Service (FaaS) leader in The Forrester Wave™: Function-As-A-Service Platforms, Q1 2021 report.

To view the Forrester report, please click here.

Related News

- 07:00 am

Glue42 Iress Connector automates and optimizes trading workflows to increase efficiency for business and technology users

Glue42, the company that delivers integrated desktop experiences to financial institutions globally, and Iress are teaming up to optimize the user experience of traders and wealth managers using the Iress Order System (IOS+) by automating the workflow between IOS+ and other prevalent applications on the financial desktop. With actionable information now readily available at their fingertips, users can gain a competitive edge and create a hyper-personalized experience for their own clients.

IOS+ is a complete trading and risk management software solution for global markets. Through the integration with Glue42, Iress users can seamlessly interact with applications such as Microsoft Excel, Microsoft Teams, Bloomberg and Virtu Analytics.

Russell Thornton, Head of Trading Strategy, Iress, said, “Our clients are inundated with information and as we evolve with their needs, it’s imperative that the Iress Order System operates in harmony with other apps on the financial desktop. In isolation there is a limit as to what can be achieved and therefore, enabling Iress to participate in cross-application workflows just made sense.”

“Glue42 helps us stay connected with other systems used by our clients,” he continued. “It’s all about enabling business and technology users to be more efficient and productive. Glue42’s desktop integration platform helps us execute on our vision at scale and in a cost-effective manner. It’s a win-win for everyone.”

As part of the partnership, Glue42 has developed an Iress Connector, a black box built on its enterprise solution that optimizes Iress IOS by speeding up trading workflows and enabling ‘click to sync’, a single-click data synchronization between the Iress platform and other applications.

Common use cases include integration with popular apps on the trading desktop to speed up time to market, allow for greater personalization and increased efficiency, placing critical information at the user’s fingertips.

On the technical side, the Iress Connector enables technology teams to eliminate lengthy point-to-point integration projects. As a result, our clients can implement solutions within a matter of days not months.

The connector follows continued client demand and is available through the Glue42 Appliance Store, a concept that brings pre-packaged business components that support the rapid integration of two or more applications, to the modern trading desktop. The store currently counts 30 connectors across the trading lifecycle that can be paired together to make a myriad of different appliances.

Reena Raichura, Director, Head of Product Solutions, Glue42, said, “Many vendors in the financial industry are going on a digital journey by modernizing and re-shaping their own platforms. Our purpose is to facilitate this process and help vendors connect with other third-party or inhouse applications in a speedy fashion. In doing so, we want to ensure that we eliminate all tech constraints, so our partners are better equipped throughout their digital transformation journey.

“More so, as financial institutions pick best-of-breed applications for their financial desktop platform, we want to ensure fintech vendors have a clear desktop integration strategy, so their applications maintain their relevance in the trading ecosystem,” she continued.

For more information, view this video: Click to Sync: sharing instrument data between Iress and Bloomberg.