Published

- 02:00 am

emerchantpay, a leading payment service provider, and Propel, a pioneering asset finance specialist, have announced a new strategic partnership. This will enable emerchantpay’s partners to offer top-of-the-range card terminals to merchants in the UK, with flexible financing options.

The strategic alliance enables emerchantpay to provide financing solutions to companies across an array of business structures for card payment terminals. Propel’s award-winning platform, Propeller, ensures an optimised sales process for emerchantpay sales teams and partners. emerchantpay is also launching a ground-breaking customer onboarding platform that will seamlessly integrate with the Propeller platform to give an industry-leading digital onboarding experience.

As the UK economy bounces back from the pandemic, small and agile businesses look particularly set to prosper in the months to come. SME retailers who service local clients were hit hard in the last 20 months, and potentially have increased debt burden and tax deferrals as a result. emerchantpay’s solutions are more relevant than ever for retailers; enabling increased cashflow, rapid payment and contactless solutions to the end customer.

emerchantpay, with 17 regional and representative offices across the globe and 20 years in payment processing, will be the first payment service provider to partner with Propel, offering card terminal financing solutions to a range of business customers. Propel has helped more than 40,000 businesses access financing to acquire the use of critical equipment quickly and easily. This agreement is one of a series of important strategic partnerships between Propel and leading organisations, such as Barclays Business Banking and Azets.

Jon Horddal, Chief Product Officer at emerchantpay, said: “We are delighted to be partnering with Propel, a leading digital-first, asset finance company that place the customer at the centre of their thinking. The partnership will enable emerchantpay to offer flexible finance solutions in a digital framework, delivering rapid decisions for our customers. The partnership will enhance the services we provide for our customers and enable our partners to accelerate their growth in an ever-changing payments landscape”.

Jon Maycock, Commercial Director at Propel, said: “Post pandemic, SME merchants will add real value to the economy. We are excited to be partnering with emerchantpay. The significant value that their payment services provide to the SME community underpins the liquidity of the retail industry. We are delighted to support them with transparent finance solutions that protect the merchants and allow them to access funding that is quick, simple and easy to understand”.

In March 2021, there were 1.5 billion card transactions in the UK; with contactless payments today accounting for more than a quarter of all payments in the country. Accepting card payments has never been more integral to core business activities and the long-term growth of UK businesses. emerchantpay and Propel believe this new financing solution is a significant development for UK businesses as they bounce back from the pandemic.

Related News

- 05:00 am

- The latest raise values ConsenSys at over $7 billion USD, more than doubling its valuation since its $200 million Series C raise in November 2021.

- In January MetaMask exceeded 30M monthly active users accessing Web3 applications, a 42% increase in 4 months.

- Infura is the leading Ethereum development platform, with 430,000 developers and in excess of $1 trillion in annualized on-chain ETH transaction volume supported through Infura’s Ethereum API.

- Funding will support the hiring of over 600 new employees globally, and continued reinvestment in development and tooling for the extended Ethereum ecosystem.

Today, ConsenSys announced the close of a $450 million USD financing round, bringing its valuation to over $7 billion USD. ParaFi Capital led this raise after participating in ConsenSys’ Series C round in November 2021. They were joined by new investors, including Temasek, SoftBank Vision Fund 2, Microsoft, Anthos Capital, Sound Ventures, and C Ventures. Series C investors — Third Point, Marshall Wace, TRUE Capital Management, and UTA VC, United Talent Agency’s venture fund — also participated in this round. Sullivan & Cromwell LLP acted as ConsenSys’ legal advisor in this transaction.

ConsenSys has been a pioneer in creating the foundational software for the next wave of the internet, Web3. Our mission is to unlock the collaborative power of communities by making DAOs, NFTs, and DeFi universally easy to use, access, and build on.

The acceleration of Web3 adoption globally is also illustrated by the rise of leading self-custodial wallet, MetaMask, which now supports more than 30 million Monthly Active Users (MAUs), growing by 42% in only four months. A global user base relies on MetaMask to mint and collect NFTs, join DAOs, and participate in DeFi protocols. The United States, the Philippines, Brazil, Germany and Nigeria represent some of MetaMask’s most active markets.

The proceeds from the round will be converted to ETH to rebalance the ratio of ETH to USD-equivalents in line with ConsenSys’ treasury strategy. This further builds ConsenSys’ “ultra sound money” position in advance of Ethereum’s upcoming merge to Proof of Stake.

ConsenSys has long maintained a significant treasury of ETH, stablecoins and other crypto tokens, and is actively using its own financial infrastructure, such as MetaMask Institutional and Codefi Staking, to put these assets to work in DeFi protocols and via staking.

Joseph Lubin, Founder and CEO of ConsenSys said, “I think of ConsenSys as a broad and deep capabilities machine for the decentralized protocols ecosystem, able to rapidly capitalize at scale on fundamental new constructs that emerge, such as developer tooling, tokenization, token launches, wallets, security audits, DeFi (1.0, 2.0 and beyond), NFTs, bridges, Layer-2 scaling, DAOs, and more. This view has resonated with our crypto native and growth investors in a Series D that will enable us to execute powerful growth strategies. This round takes in digital assets as well as fiat and converts immediately to ETH. Next round will be our ‘Series ETH’ where we will assist investors in getting fully crypto native and contributing ETH as a symbol of and commitment to the ongoing paradigm shift.”

Funding will also support the rapid expansion of MetaMask with a major redesign scheduled for release later in 2022, as well as the roll out of a plug-in extensibility system that will allow integration with a wide variety of blockchain protocols and account security schemes. This roadmap expansion also builds on ConsenSys’s recent acquisition of MyCrypto, which will enable MetaMask to bolster its industry-leading security infrastructure and create a cohesive user experience across desktop, mobile, extension, and browser wallets.

ConsenSys will also accelerate the global adoption of Infura’s development tool suite as well as ConsenSys’s efforts to drive NFT adoption for artists, content creators, brands, intellectual property owners, game publishers, and sports leagues.

With nearly 700 full time employees at present, ConsenSys’ hiring will surge this year as it is on track to scale to over 1,000 employees by the end of 2022. ConsenSys maintains a core objective to be an industry leader when it comes to diversity, equity and inclusion, partnering with organizations like Work180, CryptoChicks and the Black Women Blockchain Council. Since September 2020 ConsenSys has increased gender balance in the workforce from 19% to 25% as of December 2021. Its belonging scores also continue to trend up, reaching 91% in the latest survey. ConsenSys is proud to be a major driver of the transformation to the “age of community.”

“ConsenSys has emerged as one of the most important companies in the blockchain space,”said ParaFi Capital Founder and Managing Partner, Ben Forman. “In particular, MetaMask is the gateway for over 30 million users to access web3 and DeFi applications every month, making it one of the most widely used blockchain products in the world for consumers and businesses. As a long-time power user of ConsenSys’ products and services, ParaFi is thrilled to be an investor and thought partner as the company continues to operate at the forefront of decentralized infrastructure.”

Neil Cunha-Gomes, investor for SoftBank Investment Advisers said, “We’re delighted to partner with Joe and the team in their mission to power access to the decentralized web. We believe ConsenSys’ ecosystem of simple to use, neutral, and secure Web3 products continues to foster unprecedented levels of engagement and we’re excited to help them take Web3 adoption to the next level.”

Related News

- 07:00 am

Customer experience will be a major concern for organizations, and the rationale is simple: firms that prioritize customer experience minimize attrition while increasing sales - resulting in better profitability. Customer service and customer experience are two terms that are frequently used interchangeably. While one is a single point of contact with a brand, the other has an influence on sentiments and emotions, as well as covering the full consumer journey, and is, therefore, more comprehensive.

What is the significance of the customer experience for your business?

Companies recognize they cannot survive without the support of their consumers, which is why they are concentrating on how to gain new business and, probably more crucially, how to maintain existing clients.

According to a poll, "delivering an excellent customer experience" has risen to the top of the list of strategic objectives. On a scale from 1 to 5, 75 percent of executives and professionals in customer experience management gave the customer experience a '5' rating (5 being of the highest importance).

In contrast to a positive customer experience, which is focused on making all interactions and touchpoints with your organization simple, engaging, and smooth, a negative customer experience is focused on the exact opposite of this for delivering a negative customer experience.

A few of the most prominent reasons for poor client experiences include:

- Difficult purchase procedures and poor communication.

- Customers have had negative encounters with customer service.

- The personal security of a consumer has been compromised.

- Waiting on hold for much too long.

- Ignoring consumer input is unacceptable.

Increasing the Payment Experience Quality for CX:

The acceptance of digital payments began slowly with micropayments some years ago, but it has lately expanded to allow much larger transactions as the public has come to appreciate the convenience and ease of using digital payment services.

User adoption is critical to gaining traction in the digital payment industry and developing a sustainable business model. Adoption is driven mostly by user experience, which is crucial. What a user sees is simply one aspect of the user's experience; other aspects include interactions with other people, services that are provided to them, and, eventually, habits that the user acquires.

Creating an efficient payment experience may be a difficult task that necessitates the development of more than simply a software program. Platform modernization, employee experience, and the use of a service design methodology are all important factors. You must match your digital payments strategy and vision with essential upgrades to provide distinct user and staff experiences.

#1: Balance between security, ease of use, and agility:

A great digital payment experience is achieved through a careful mix of security, ease of use, and responsiveness. Payments have changed throughout time to give users richer and more personalized experiences. These digital developments will continue in the foreseeable future. The use of futuristic payment capabilities such as voice-activated payments, payments on smart appliances through the Internet of Things, security powered by artificial intelligence and machine learning, biometric authentication, and the use of temporary codes for transactions instead of cards is already gaining popularity among consumers.

Those financial institutions that have successfully won the payments industry should invest in cloud-based infrastructure that allows users to make real-time payments while maintaining the highest level of security. Additionally, by harnessing real-time data with the assistance of artificial intelligence (AI) and machine learning (ML), the payments experience will be personalized, and security will be enhanced through digital authentication, fraud detection, and prevention.

Customers Should Have a Variety of Payment Alternatives:

We are suggesting that you should operate a store that offers a variety of payment options. Consider taking every form of payment method that consumers may be utilizing these days, including cash, credit card, mobile payments, check, gift cards, and other creative payment methods.

As you investigate this more, you will discover that different types of payment have varying payment processing fees to consider. Using American Express as an example, the business owner often pays more in credit card processing fees than he would with Visa. You might also provide a 10 percent discount to your customers to encourage them to pay with cash, which would allow you to receive the funds in your account more quickly.

People want to be able to pay in a way that is convenient for them. Allowing mobile device payments because you don't understand them or rejecting checks because it requires a trip to the bank is not a good idea. Offering methods of payment for your site and business in the manner in which your consumers choose to contribute to you. Then devise a strategy for ensuring that those payments are accommodated inside your payment processing. You will also need to figure out the most efficient approach to set up a merchant account to take advantage of the flexibility that they provide.

A large number of payment alternatives may even be a fun way to showcase your business or provide you a competitive advantage over other individuals in your town who only have a few payment options.

Consider your product as if it were a global product right out of the box:

If you want to take advantage of the worldwide nature of payments today, your digital payments solution must have fundamental global features like:

- Handling foreign currencies and currency conversions outside of your home country or region is a difficult task.

- As a result, your application design or design system may need to be modified to accommodate longer text strings, global character sets, and content layout from the right to the left in the user's target language.

- Making use of and giving priority to local digital payment mechanisms that are prominent in a user's geographic and economic environment.

The operational operations that support your digital payments service must also be adapted to meet the needs of a worldwide customer base as well. When your customers make foreign transactions, your risk management system should be able to spot potential risks.

Concluding Remarks

If you want to develop a successful small business, you must discover how to be paid quickly by your clients. This can help you avoid cash flow problems, decrease stress, and gain the confidence to expand your business as you see appropriate.

Related News

- 03:00 am

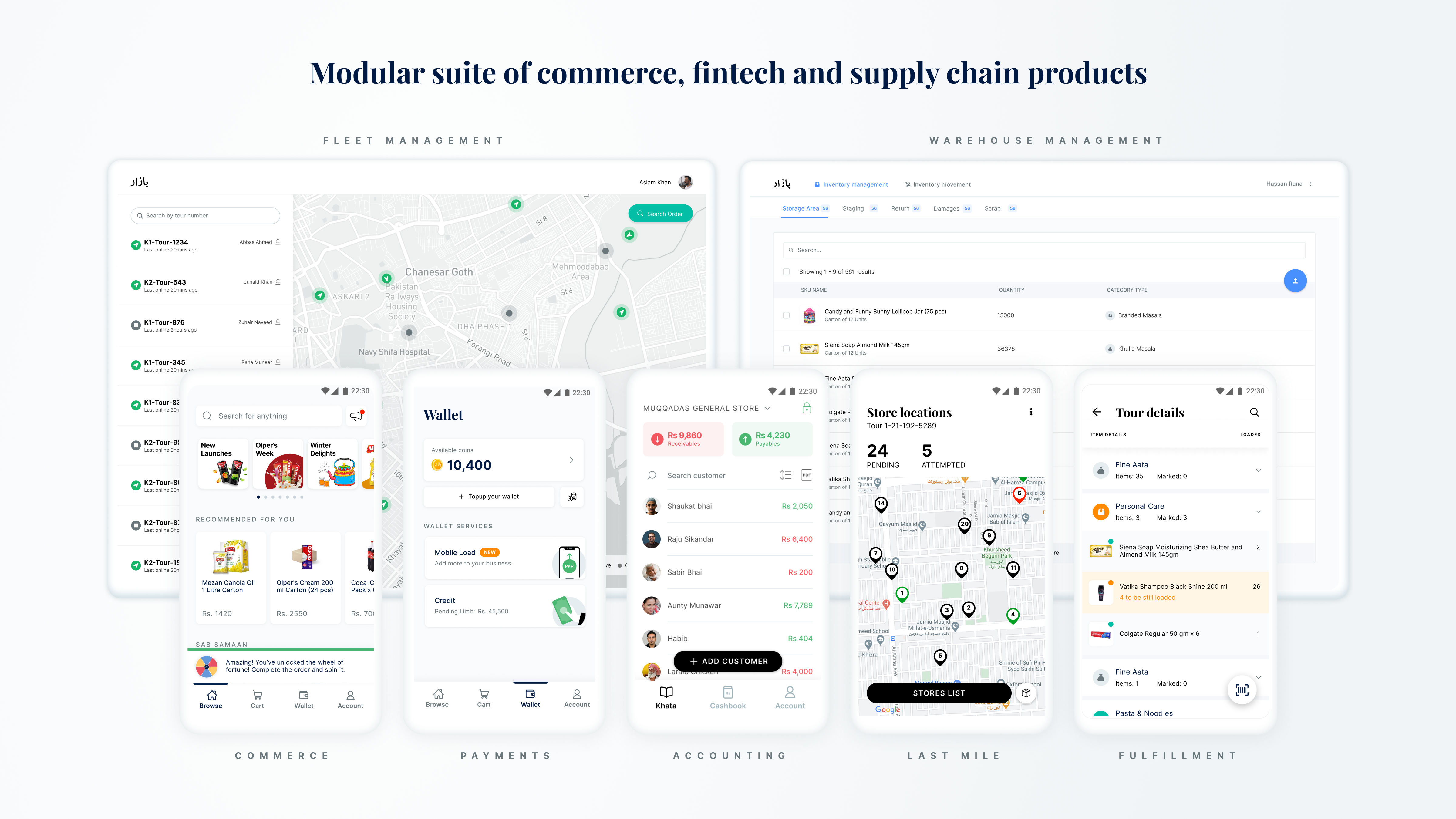

Bazaar, Pakistan’s leading B2B e-commerce and fintech platform has raised $70M in a Series B financing led by Dragoneer Investment Group and Tiger Global Management. Through its expanding footprint of digital products and last-mile infrastructure, Bazaar provides procurement, fulfilment, operating software, digital lending, and supply chain products to merchants and suppliers in Pakistan. This investment, which comes just 6 months after its historic Series A, takes Bazaar’s total institutional funding to over $100M, establishing it as one of the most well-capitalized startups in the country’s rapidly growing tech ecosystem.

Existing investors, including Indus Valley Capital, Defy Partners, Acrew Capital, Wavemaker Partners, B&Y Venture Partners and Zayn Capital also participated in the round.

“We are thrilled to support Bazaar’s vision of building an end-to-end commerce and fintech platform for millions of unbanked and offline merchants in Pakistan”, said Christian Jensen, Partner at Dragoneer Investment Group. “Bazaar’s pace of geographic expansion and new product development is a testament to the rare talent and culture Hamza and Saad have cultivated at Bazaar.”

Bazaar’s mission is to build an operating system for traditional retail in Pakistan. This retail economy, worth over $170B, is primarily offline and mostly served through 5 million SMEs across the country. This merchant base, which is the lifeline of Pakistan’s economy, also lacks access to formal financial services in a country that hosts the world’s third largest unbanked population. At the same time, Pakistan is undergoing a massive digital penetration wave driven by widespread availability of affordable smartphones and some of the lowest mobile broadband costs in the world. Bazaar aims to capitalize on these fundamentals by building an integrated platform of B2B offerings that can aggregate, digitize, and finance the country’s fragmented retail landscape.

Bazaar has been growing at an incredible pace since starting out less than two years ago. Its B2B e-commerce marketplace is now servicing 21 towns and cities across Pakistan, covering 30% of Pakistan’s population through more than a dozen functional fulfillment facilities. Bazaar is adding 3-4 new cities and towns to its last mile network every month, putting it on course to establish the country's largest tech-enabled last mile footprint by the end of the year. Through this last mile network, Bazaar provides hundreds of top brands and manufacturers direct access to underserved merchants and geographies across retail categories powered by real time analytics and intel on brand performance significantly improving their distribution capability.

Easy Khata, Bazaar’s merchant software product, has brought a new dimension to B2B e-commerce in emerging markets. Easy Khata serves as the core system of record for merchants, helping them digitize procurement, inventory management, customer engagement, accounting, and lending. The app has on boarded over 2.4 million businesses across 500 cities and towns in the country, recording over $10B in annualized bookkeeping transaction value.

Bazaar Credit, the recently launched short-term working capital financing product, provides much-needed liquidity to its largely unbanked merchant base. To date, Bazaar has provided thousands of digital loans, with 100% repayment and significant uplift in merchant buying volumes. Bazaar’s proprietary credit model incorporates customer data from both its marketplace and merchant software products, giving it a differentiated ability to lend to this underserved segment.

“We believe that Pakistan is at an inflection point in its tech ecosystem development. Bazaar is tapping into the massive merchant opportunity and is leading the charge in the country. We are excited to back their incredible team and phenomenal growth in such a short span of time.” said John Curtius, partner at Tiger Global Management.

Bazaar was founded in June 2020 by Hamza Jawaid and Saad Jangda, two high school best friends who moved back to Pakistan with a mission to create an incredible institution for and from Pakistan. Their strong focus on team, culture, and product has helped them attract talent from some of the best companies and investors around the world, creating a unique and unprecedented talent flywheel in the country. Prior to Bazaar, Hamza was a management consultant at McKinsey & Company, while Saad was a product manager for ride-hailing and food delivery at Careem and for ad products at Snapchat.

“We are humbled and excited to continue on the path to create a generation defining story for Pakistan. With significant backing of two of the largest venture growth funds in the world, we believe this will continue to change the narrative on the country and inspire countless more and bigger stories in near future. This is a result of the trust and partnership of our colleagues, suppliers and most importantly our customers – the small merchants who are the backbone of our economy.” said the founders, Hamza and Saad.

With the fresh round of funding, Bazaar plans to expand into more cities across Pakistan, launch new marketplace categories, scale its lending offerings, and accelerate new product development.

Related News

- 08:00 am

Michelle Stevens, banking specialist at finder.com, a personal finance comparison site

Innovation in banking isn’t limited to personal accounts or consumer finance; business banking has seen its fair share of transformation in recent years, too.

Digital challenger banks and fintechs entered the sector around 5 years ago, taking on the high street banks. Analysis conducted by the FCA found that the market share for business accounts among the “big 4” banks dipped from 74% in 2019 to 67% in 2021, while the market share for digital challengers climbed from 1% to 10% over the same period.

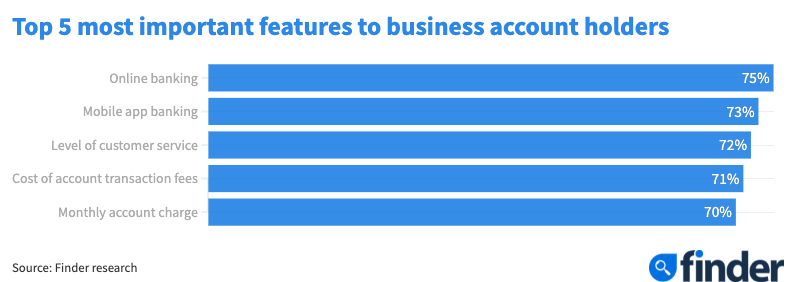

This may be partly because the sophisticated digital banking features typically associated with this new wave of challengers are important to businesses. From advanced mobile app banking and invoicing services, to expenses management and integrations with external accounting software, business accounts have come a long way over the past decade.

In a recent survey of business account holders by Finder, 75% cited online banking as the most important feature to them, closely followed by mobile app banking (73%), the level of customer service (72%), the cost of account transaction fees (71%) and the monthly account charge (70%). Our poll also uncovered that challenger business banking brands enjoy a higher customer satisfaction rating - an average of 88%, versus 76% for traditional banks.

But as high street banks continue to close branches and develop their digital offerings, there could be scope for them to curb the growth of the challengers. Finder’s research found that 60% of business account holders have their business account with the same provider as their personal current account, giving these banks a loyalty head-start. Some 72% of those polled had also never switched their business banking provider, showing that the majority of business account holders are loyal to the bank they initially set up their account with.

Business account holders who are tempted to switch providers - and 36% told Finder that they’re considering doing so over the next year - can use the Current Account Switch Service (CASS). As well as the pull of potentially better account features and tools, fees have also been a battleground recently, with some providers not charging any monthly account fees, or offering long introductory periods of fee-free banking to new account holders and switchers.

So business account holders who are looking to switch should check several aspects of their potential new account: whether the banking tools meet all the requirements of running their business; if there are any new features that would be of additional benefit; and what the account charges are, including transaction, monthly and overseas fees, as well as how long any offer of free banking lasts.

Only time will tell if business account holders decide to get into the switching habit, or if the “big 4” high street banks can stop the slide in their market share. But one certainty is that innovation in business banking is only set to continue.

Related News

- 05:00 am

Sift’s Q1 Digital Trust & Safety Index reveals rising fraud across fintech, company releases Trust Intelligence Center for Trust and Safety Professionals

Sift, the leader in Digital Trust & Safety, today released its Q1 2022 Digital Trust & Safety Index, detailing the increasingly sophisticated—and often automated—tactics cybercriminals leverage to commit payment fraud. Derived from Sift’s global network of over 34,000 sites and apps and a survey of over 1,000 consumers, the index reveals that the payment fraud attack rate (the rate of fraudulent transactions blocked by Sift out of total transactions) across fintech ballooned 70% in 2021—making it the highest increase across any vertical in Sift’s network. The increase in payment fraud also correlated with massive 121% growth in fintech transaction volumes on Sift’s network year-over-year, making this sector an attractive target for cybercriminals.

According to Sift’s analysis, these rising attacks, blocked by Sift, were aimed primarily at alternative payments like digital wallets, which saw a 200% uptick in payment fraud, along with payments service providers (+169%), and cryptocurrency exchanges (+140%).

Sift has specifically seen these abuse tactics aimed at buy now/pay later (BNPL) services, which saw a 54% year-over-year uptick in fraud attack rates. In late 2021, Sift’s Trust and Safety Architects discovered a growing number of fraud schemes on Telegram offering unlimited access to BNPL accounts through fake credit card numbers and compromised email addresses—showcasing the array of methods actors in the Fraud Economy are using to target the entire fintech sector.

The Hidden Brand Impact of Payment Fraud

Along with network-wide growth in average daily transaction volumes across every industry, Sift saw an overall 23% surge in blocked payment fraud attacks in 2021. Concurrently, nearly half of survey respondents (49%) report that they’ve fallen victim to payment abuse over the past one to three years—and 41% of the victims experienced it in the last year alone. Of those victims, nearly one-third (33%) identified financial service sites as the ones that pose the highest risk, which could negatively affect customer trust in the industry.

“Many brands fail to realize that the damage of payment fraud goes beyond the initial financial impact,” said Jane Lee, Trust and Safety Architect at Sift. “The vast majority of consumers report abandoning brands after they experience fraud on a business’s website or app, diminishing customer lifetime value and driving up acquisition costs. Further, potential customers who see unauthorized charges from a particular company on their bank statements will forever associate that brand with fraud. In order to combat these attacks and grow revenue, businesses should look to adopt a Digital Trust & Safety strategy—one that focuses on preventing fraud while streamlining the experience for their customers.”

Tackling the Fraud Economy with Sift’s Fraud Intelligence Center

To help trust and safety teams better understand the intricacies of the Fraud Economy, Sift has launched its new Fraud Intelligence Center. Leveraging data from Sift's global network of 70 billion events per month, the Fraud Intelligence Center will provide trust and safety professionals with the latest data, trends, and expert analysis they need to fight back against the Fraud Economy.

Sift’s Fraud Intelligence Center can be found at sift.com/fraud-center and Sift’s Q1 Digital Trust & Safety Index can be found here.

Related News

Duncan Cooper

Senior Market Strategist & Trading Mentor at ACY

Watch the video for a summary of this week’s news releases and a complete top down analysis of the GBPJPY. see more

Duncan Cooper

Senior Market Strategist & Trading Mentor at ACY

- 06:00 am

Related News

- 08:00 am

Praxent develops prototype to help investtech startup raise capital and accelerate launch

Praxent, a fintech design and engineering partner to financial companies, today announced that it has supported Endex by accelerating the product development and path to fulfillment for the Gen Z-founded startup.

Endex is a social investment platform that facilitates the convenient creation, publication and investment in custom peer-managed portfolios. It has a social component that allows retail investors to learn from and emulate investment strategies. Working with Praxent, Endex founders were able to quickly bring their concept to a workable prototype, which served as a proof of concept for early investors and allowed for a smoother product development cycle, expediting the company’s path to market.

Endex founders first approached Praxent when they needed to raise capital pre-launch but lacked a way to demonstrate their concept. iPhone mockups were not enough for today’s competitive fintech investors. They considered using an offshore company to create a functional demo but didn’t want to wait the months that would require. Praxent was able to design and develop a clickable prototype in just four weeks – and included an app map, wireframes and style guide to help tell their story.

“We were impressed with Praxent’s deep fintech experience and understanding of what we were trying to accomplish from day one,” said Brittany Wright, CEO and co-founder of Endex. “Praxent helped us work through and optimize the design and user journey, translating our idea into something tangible. The prototype allowed us to jumpstart our fundraising, which is critical to any launch. Plus, their frontend design work streamlined the development of the app, getting us to market faster than expected.”

Praxent’s team worked closely with Endex’s founders, helping them create an intuitive user experience from the first stage and create a strong, compelling brand identity. Feedback from investors and prospective users has been overwhelmingly positive. Plus, the prototype paved the way for Endex to be accepted into an accelerator, secure additional funding, pursue influencer collaborations, and strengthen brand awareness.

“People are taking their finances into their own hands, making the Endex vision for connection and collaboration timely and in demand. I’m glad we could help them with the early steps they needed to make this goal a reality,” said Tim Hamilton, CEO of Praxent. “By working with us to design and develop a seamless, modern experience, Endex has been able to take a significant step forward in preparation to launch. Since the development of the prototype, the company has been able to raise money, grow their social media presence and even explore integrations with larger brokers.”

Endex public beta launched on the Google Play Store and the App Store on March 1st and is already seeing the creation of over 30 custom indexes with various themes, ranging from tech to ESG to women-led companies and more. Endex plans to expand upon their initial offering and roll out additional features in the coming weeks such as premium features, monetization and additional brokerage integrations with Robinhood, Webull and more, before launching the full release in May. In the meantime, users can connect with like-minded investors, create and copy custom indexes, and earn rewards exclusively for beta users.