Statement from Davidson Kempner Regarding the Deutsche Wohnen Takeover Offer by Vonovia

- 4 years 5 months ago

- Management

Davidson Kempner currently owns an aggregate 11.4 million shares (3.2% of the share capital), has been a substantial long-term investor in Deutsche Wohnen SE, one of Europe's largest property companies over many years and has engaged in an extensive dialogue with the Management during this period. Davidson Kempner has also been an investor in Vonovia. Vonovia and Deutsche Wohnen Have Circumvented Shareholder Rights

TISA Exploits TISAtech Platform to Select Contengo to Support Technology modernisation Programme and new Service Development Initiatives for the Wealth Management Industry

- 4 years 5 months ago

- Wealth Management

Demonstrates TISAtech’s ability to accelerate the adoption of validated, new technology providers Contengo joined the TISAtech community in December 2020 Further showcasing TISAtech’s commitment to driving innovation and positive change across the financial services arena

NeoXam’s Datahub Platform Selected by Tikehau Capital to Support Transformation Program

- 4 years 5 months ago

- Asset Management, Alternative Finance

NeoXam’s DataHub platform has been selected by Tikehau Capital, the global alternative asset management group to support a broader IT and operational transformation program across their global multi-fund business.

Press Release - Metzler Asset Management and Hanover Stock Exchange Team Up With Solactive to Issue New Metzler Global Ethical Values Mutual Fund Focusing on Institutional Investors

- 4 years 5 months ago

- Trading Systems, Investment, Management

ESG stays in favor of institutional investors, and while aiming to achieve adequate returns, investors increasingly commit themselves to create a positive societal impact with their investments, too. Now, Metzler Asset Management GmbH, one of Germany’s asset managers with the longest time-honored traditions, in cooperation with Solactive, is launching the index-linked fund Metzler Global Ethical Values (ISIN: DE000A2QGBH0).

Arabesque Introduces Autonomous Asset Management

- 4 years 5 months ago

- Artificial Intelligence, Asset Management, Investment Management

‘AutoCIO’ is the world’s first fully AI-powered portfolio manager that emulates the human decision-making process in asset management

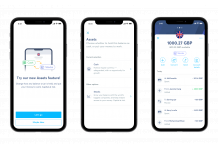

Wise Launches Assets, Your Wise Account Invested in the World’s Largest Companies

- 4 years 5 months ago

- Investment, Asset Management

Assets offers current account flexibility, with the potential for investment returns

ACI Fraud Management Incremental Learning Technology Receives Full Patent Approval

- 4 years 5 months ago

- Management, Payments, e-Payments

Innovative industry-first approach to machine learning considerably enhances fraud protection for merchants and financial institutions

r10 Consulting, the Management Consultancy for the Insurance Industry, Today Announces the Launch of the r10 Partner Ecosystem.

- 4 years 5 months ago

- Management, Insurance, Consultancy

The Ecosystem combines r10’s insurance industry knowledge and implementation expertise with its partners’ leading technology solutions and services. Clients will have access to a one-stop-shop of products and services that bring together best practice expertise gained from current experience of the insurance sector, providing a flexible approach to change.

Nordigen Partners With Fineo to Enable UK Personal Finance Platform

- 4 years 5 months ago

- Open Banking, Personal Finance, Management, Data

UK-based personal finance management platform Fineo partnered with European open banking company Nordigen to leverage open banking technology. Fineo facilitates the integration of customer bank accounts using Nordigen's account information API to offer a clever way to manage finances.

Payhawk Announces Integration with Apple Pay

- 4 years 5 months ago

- Management, Payments

A safer, more secure and private way to pay with iPhone and Apple Watch

Kneip Appoints Cyril Molitor as Chief Operating Officer

- 4 years 5 months ago

- Fund Management, Data Management

Molitor joins Kneip to drive its technology and operational strategy and support the next phase of the company’s expansion

EFA Selects NeoXam for Regulatory Reporting

- 4 years 5 months ago

- Investment, Fund Management, Financial

The regulatory environment around funds has drastically increased in recent years and this trend is expected to continue. As a leading provider of the fund industry in Luxembourg, EFA is committed to providing its clients with the best service and the most up-to-date tools to respond to their existing and future regulatory requirements. To this end, the EFA wanted to adopt a dedicated platform to industrialise the operations of its teams... more

Avaloq Ventures Goes Independent and Is Renamed Fivet Fintech. The Venture Capital Specialist Remains a Key Part of Avaloq’s Ecosystem Strategy

- 4 years 5 months ago

- Investment, Management

Avaloq today announced that the investment advisor of its fintech investment fund is being spun off from the group by means of a management buyout. This change of ownership will not impact the fund’s strategic focus and Avaloq will maintain its long-term interests and involvement in Avaloq Ventures.

Centtrip Expands Into the United States to Revolutionize Expense Management

- 4 years 5 months ago

- Management, Payments, Credit Cards

Centtrip, the global fintech providing expense management and card payment technology, has launched its platform, app, and card in the United States. The fintech has partnered with Adyen to provide its U.S. offering. Designed for the demands of highly mobile businesses, the Centtrip card offers some of the highest spend limits on the market.

Form3 Announces a $160 Million Series C Funding Round Led by Goldman Sachs Asset Management

- 4 years 5 months ago

- Fundraising News, Asset Management, Payments

Form3, the leading platform payment technology provider, has today announced its Series C investment funding of $160 million. The fundraising was led by the Growth Equity business within Goldman Sachs Asset Management (Goldman Sachs) and included participation from existing investors. This brings the company’s total fundraising to $220million. Form3 welcomes new shareholder Goldman Sachs alongside existing investors Lloyds Banking Group,... more