Fintech’s Resurgence: A Conversation with Markus Fehn

- 05.11.2025 -- 06:08 am

- Markus Fehn,, Head of Strategy and Innovation, Chartered Investment

By Financial IT Magazine As fintech enters a new phase of maturity, the lines between traditional finance and digital innovation are blurring fast. Markus Fehn, Head of Strategy and Innovation at Chartered Investment, shares how the company is bridging that divide — from early blockchain experiments to BaFin-regulated tokenization — and why the...

Scaling FP&A With AI, Customer Obsession, And Global Ambition

- 02.10.2025 -- 03:14 pm

- Jorge Lluch , COO, Abacum

Financial IT’s Tawney Kruger sat down with Abacum COO Jorge Lluch to discuss the company’s recent $60 million Series B raise, its journey from inception to today, and the evolving role of financial planning in the age of AI. Tawney Kruger (Financial IT): Jorge, welcome. It’s great to finally have you with us. Congratulations on...

Simplifying European Currency Clearing

- 11.07.2025 -- 09:43 am

- Morten Juhl Lilleøre, COO, Banking Circle

Financial IT: Recently, Banking Circle announced the launch of Swiss franc payment capabilities. Could you share what motivated this initiative and how it fits into your broader strategy for European and global coverage? Morten Juhl Lilleøre: This past week, we were pleased to announce the launch of our Swiss franc offering—a project we’ve been...

Modular Payments, Global Reach

- 17.06.2025 -- 10:19 am

- Adam Vissing, VP, IXOPAY

Financial IT: Adam, to begin, can you introduce IXOPAY and share what sets your platform apart in the payments industry? Adam Vissing: IXOPAY is the leading enterprise payments orchestrator. Since our founding in 2016, we’ve supported global merchants in managing payment processes across geographies, methods, and providers. Our recent merger with U....

Securing Identity with Innovation

- 13.06.2025 -- 02:11 pm

- Eduardo Azanza , CEO , Veridas

Financial IT: Eduardo, thank you for joining us. To begin, can you give us an overview of Veridas and the core mission behind the company? Eduardo Azanza: Thank you. Veridas was founded 10 years ago with a very clear mission: to determine whether a digital identity is real or fake. In a world where it’s easier than ever to fabricate identities, that...

Navigating Regulatory Complexity in Payments

- 28.05.2025 -- 11:11 am

- Dean Francis, VP and Sector Lead, Fintech, Payments & Insurance, Corlytics

An Interview with Dean Francis, VP and Sector Lead, Fintech, Payments & Insurance, Corlytics Financial IT: What kind of regulatory changes are we seeing in the payments space right now? How are recent regulatory shifts affecting the sector, and what trends are you keeping an eye on? Dean Francis: We’re seeing three key areas dominating the...

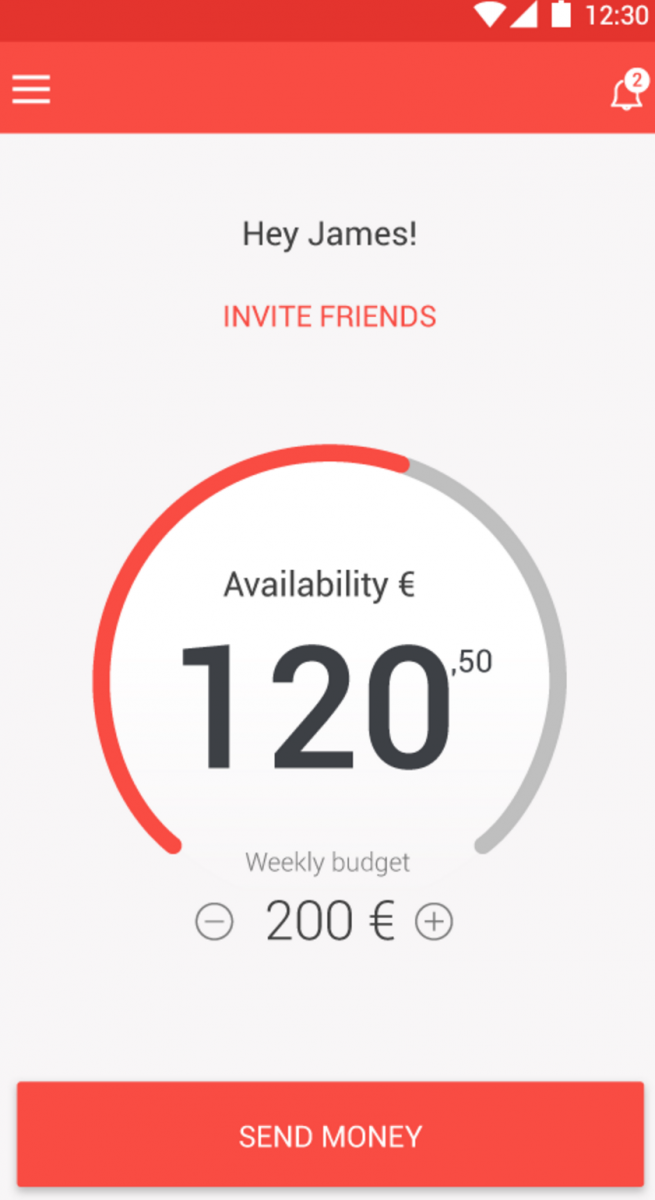

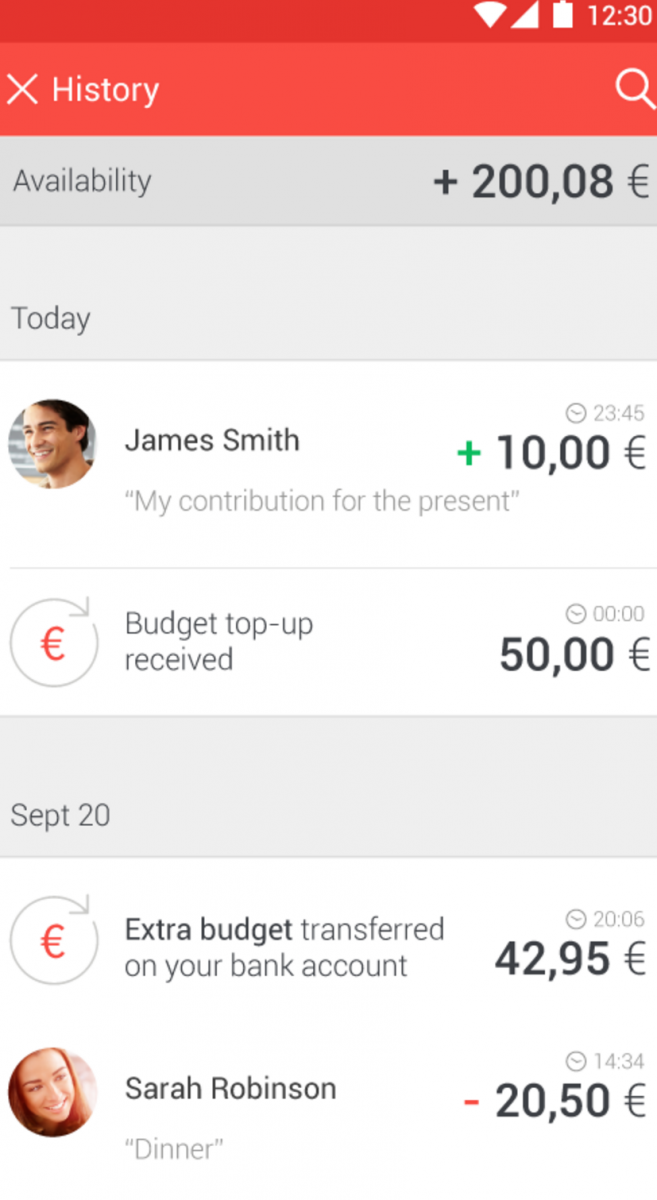

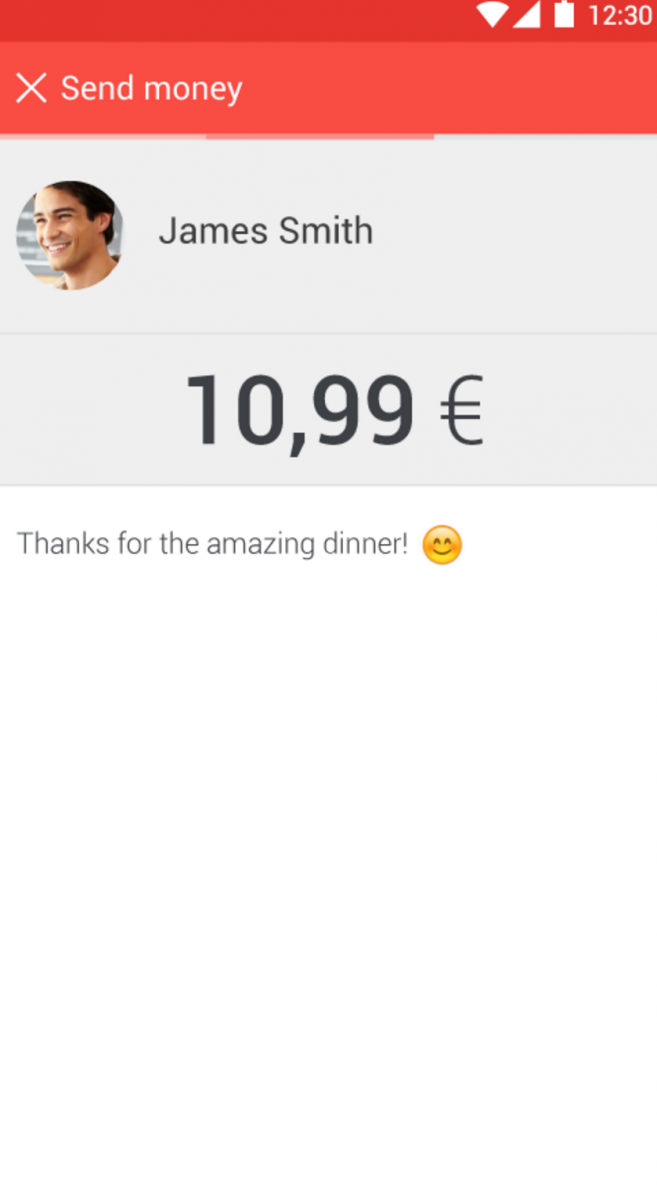

Embedded Finance: The Key to Business Growth and Consumer Loyalty in a Changing Market

- 04.02.2025 -- 02:17 pm

- James Butland, Managing Director UK, Mangopay

Why has embedded finance become a must-have for businesses? A high inflationary market and financial instability continue to challenge traditional businesses, but platforms are adapting. In the last decade, platforms have diversified, branching out beyond e-commerce to include travel, on-demand services, fintech services and are now an important way...

Riding the Fintech Wave: An Interview with Zak Westphal

- 10.01.2025 -- 04:40 pm

- Zak Westphal, CEO and Co-Founder, StocksToTrade

The financial technology (fintech) revolution is transforming the finance sector, opening up significant opportunities and challenges for entrepreneurs. As a global fintech leader, the UK has a front-row view of these rapid changes. To help UK founders take advantage of this disruption, we spoke with Zak Westphal, CEO and Co-Founder of StocksToTrade...