Surging Inflation, Fed Vigilance Lifts US Bond Yields, Dollar

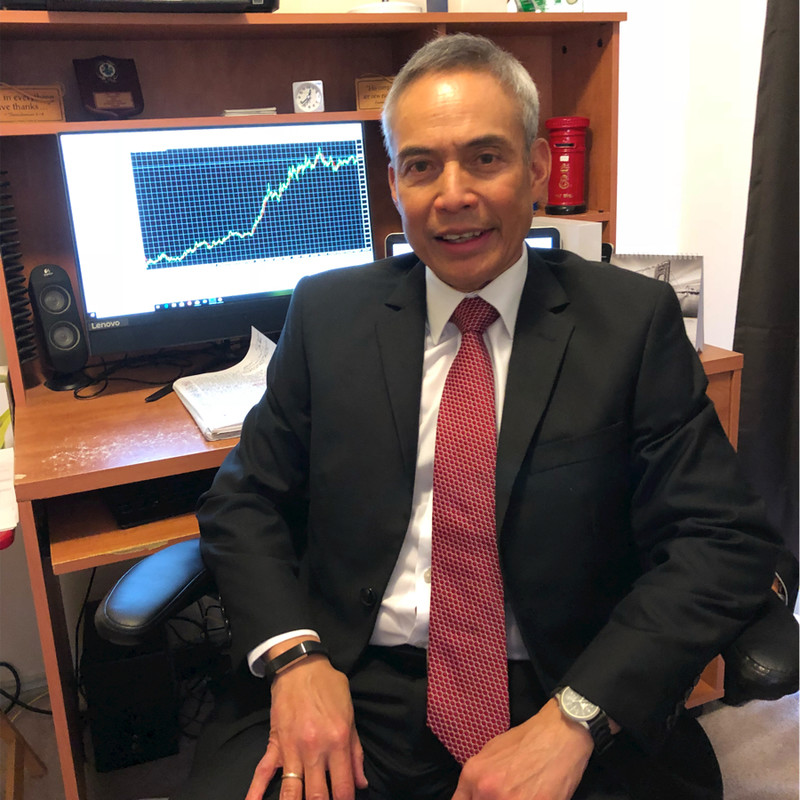

- Michael Moran , Senior Currency Strategist at ACY Securities

- 14.07.2021 07:15 am trading

NZD Slides into RBNZ Decision; EUR, GBP, AUD Extend Falls

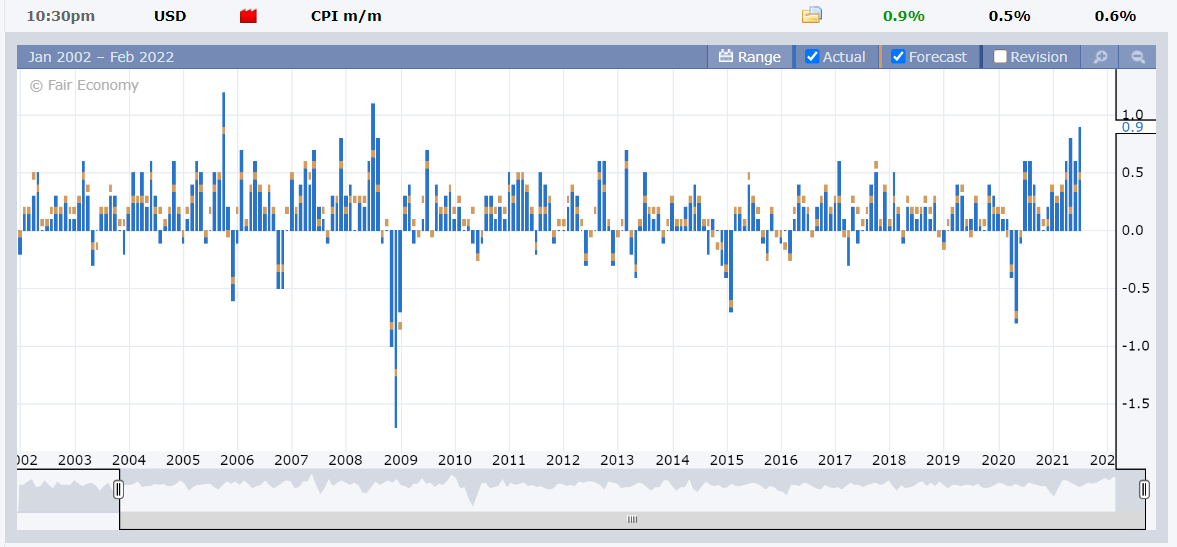

Summary: Surging US inflation saw consumer prices increase 0.9% in June, against forecasts at 0.4%, and a previous 0.6% (May). This was the largest increase since July 2008. The benchmark US 10-year bond yield climbed 6 basis points to 1.42% (1.36%). Federal Reserve Presidents Bostic (Atlanta) and Bullard (St Louis) alluded that the US central bank is in an ideal position to start reducing the pace of its bond buying program. The Dollar Index (USD/DXY), a favourite gauge of the Greenback’s value against a basket of 6 major currencies, surged 0.58% to 92.77 from 92.22 yesterday. Ahead of today’s Reserve Bank of New Zealand interest rate decision and statement (12 noon Sydney), the Kiwi (NZD/USD) slid 0.6% to 0.6943 (0.6990). While no changes are expected, the RBNZ is considered as one of the world’s most hawkish central banks. The Bank of Canada is the other. The BOC also meets on policy later this evening (12 midnight Sydney). The BOC started the global taper in April and Canada’s economic data has improved since. Against the Canadian Loonie, the Greenback closed at 1.2515 from 1.2455 on overall USD strength. Elsewhere, broad-based USD strength saw the Euro tumble 0.7% to finish at 1.1780 (1.1860) while Sterling was sold off to 1.3815 from 1.3882. The Australian Dollar fell 0.43% to 0.7445 from 0.7477 despite an easing of total coronavirus infections to 100 from 120 yesterday. The Greenback settled higher against most Asian and Emerging Market currencies. USD/SGD was up 0.30% to 1.3560 (1.3518) while USD/CNH rallied to 6.4810 from 6.4765 yesterday. The USD/THB pair was little changed, settling at 32.67.

Wall Street stocks slipped. The DOW finished 0.32% lower to 34,907 (35,017) while the S&P 500 lost 0.38% to 4,369 (4,385). US two-year treasury bond rates were up 2 basis points to 0.25% from 0.23%. Other global bond yields were mixed. Germany’s 10-year Bund yield settled flat at -0.30%. The UK 10-year Gilt yield was at 0.63% from 0.65%. Australia’s 10-year bond yield was at 1.32% (1.31%). Japan’s 10-year JGB yield settled at 0.01% from 0.02% yesterday.

Other data released yesterday saw Australia’s National Australia Bank Business Confidence Index dip to 11.0 from a previous 20.0. China’s Trade Surplus in June (USD terms) rose to USD 57.5 billion from USD 45.53 billion. The breakdown though in Yuan terms saw China’s Exports dip 20.2% (against f/c of 29.6%) and Imports ease by 24.2% (against f/c of 32.3%). Germany’s June CPI (m/m) matched forecasts at 0.4%. France’s CPI (m/m) also matched expectations at 0.2%. US June Core CPI (m/m) rose to 0.9% beating forecasts at 0.4%. US June Annual Core CPI rose to 5.4%, from 5%, beating median expectations of 5.0%.

- AUD/USD – extended its fall against the overall stronger US Dollar to finish at 0.7445 from its opening at 0.7477 yesterday. Australia’s total coronavirus infections eased to 100 from 120 yesterday. Overnight high traded for the Aussie was 0.7503. Overnight low was 0.7426.

- NZD/USD – The Kiwi tumbled to an overnight low at 0.69173 from its 0.6982 opening yesterday. NZD/USD hit an overnight peak at 0.7009 before sliding under the weight of broad-based US Dollar strength. The RBNZ meets on policy today (12 noon Sydney).

- GBP/USD – the surge in US inflation weighed heavily on the British currency which slumped to an overnight low at 1.3800 before stabilising to settle at 1.3815. Yesterday, Sterling was opened in Sydney at 1.3880. The UK releases its inflation numbers later today.

- EUR/USD – the shared currency fell under the weight of broad-based US Dollar strength. The Euro finished at 1.1780 after hitting an overnight and early April low of 1.1772. Yesterday the EUR/USD pair was trading at 1.1860. With no major European data releases later, the shared currency’s fate lies with the Greenback.

On the Lookout: Data releases kicked off today with New Zealand’s May Visitor Arrivals, rising 80.4% (m/m), down from its 588.3% rise in April. The Kiwi did not budge on the data as it is not considered first-tier. Australia’s July Westpac Consumer Confidence Index Change follows (no f/c, previous was -5.2%) Japan releases its May Industrial Production (m/m f/c -5.9% from previous 2.9%; y/y no forecast given, previous was 15.8% - ACY Finlogix). The UK kicks off European reports with UK June CPI (y/y f/c 2.2% from 2.1%), June Core CPI (y/y f/c 2.0% from 2.0%); UK PPI Input (m/m f/c 1.2% from 1.1%; y/y f/c 10.8% from 10.7%), UK PPI Output (m/m f/c 0.6% from 0.5%; y/y f/c 4.8% from 4.6%). Eurozone May Industrial Production follows (m/m f/c 0.6% from 0.8%; y/y f/c 22.2% from 39.3%). Finally, the US releases its June PPI data (m/m f/c 0.5% from 0.8%; y/y 6.8% from 6.6%) and Core June PPI (m/m f/c 0.5% from 0.7%; y/y f/c 5.1% from 4.8%).

The PPI reports are a leading indicator of consumer inflation and could set the tone for the US Dollar in the days ahead, if they follow the lead of the CPI numbers.

Trading Perspective: With two major central banks meeting to determine their next policy adjustments as well as possible further evidence of US price pressures, we could be in for a choppy session. Federal Reserve Chair Jerome Powell delivers his semi-annual testimony on monetary policy before the House Financial Services Committee in Washington DC. (Sydney, July 15, 2 am).

Should Powell downplay the CPI report, the Dollar will surrender its gains versus its Rivals. However, if he alludes to a near-term taper, the Greenback could rocket higher. Both the RBNZ and BOC policy meetings occur before Powell’s testimony.

- USD/CAD – Overnight, the USD/CAD pair traded in a choppy range between 1.2442 to 1.2540. The Greenback finished at 1.2515, up 0.48%. The Bank of Canada meets on policy tonight (1 am Sydney, July 15). While the BOC is expected to keep its Overnight Rate at 0.25%, the Canadian Central bank could reduce asset purchases. With an improving economy and successful Covid-19 vaccination take-up (almost 70% of the population have received a first jab), the BOC could deliver. USD/CAD has immediate resistance at 1.2540 (overnight high) and 1.2570. Immediate support can be found at 1.2485 and 1.2450. Look for a likely trade today between 1.2440 and 1.2530. Prefer to sell into USD strength. The CAD could go Loonie tonight! Happy days…

- AUD/USD – The Aussie settled 0.43% lower at 0.7445 from its open at 0.7477 yesterday. The Battler fell under the weight of the broadly based stronger US Dollar despite a slowing of Covid-19 infections from its latest 3rd wave rise of the Delta variant. AUD/USD has immediate support at 0.7425 (overnight low 0.74236) and 0.7400. The next support level is at 0.7380 (strong). Immediate resistance can be found at 0.7480 followed by 0.7510. Look for a likely range trade between 0.7420-0.7520. We could be in for a wild one today. Watch the Kiwi’s moves as well.

- NZD/USD – The Kiwi finished at 0.6943 at the close of New York trade after it hit an overnight peak at 0.7009. Ahead of today’s RBNZ Interest rate decision and statement (Sydney 12 noon) expect the Kiwi to trade in a likely 0.6915-0.6985 range. Should the RBNZ, considered one of the world’s top hawkish central banks, signal an intention to hike interest rates before the end of this year (some NZ banks are predicting a November hike) we will see the Kiwi soar through 0.70 cents. If, however, they fail to deliver a hawkish intent, disappointed bulls could see a sell off under 0.69 cents. The Kiwi may be in for a choppy session, like the days of old. Happy days indeed!

(Source: Finlogix.com)

- EUR/USD- The Euro wilted under the pressure of the broadly based stronger US Dollar. The shared currency hit an overnight low at 1.1772 before settling at 1.1780. Overnight high traded was 1.1876. Yesterday the EUR/USD pair was trading at 1.1860. EUR/USD has immediate support at 1.1770 followed by 1.1740. The 1.1700-40 level provides strong support. Immediate resistance is found at 1.1810 followed by 1.1840. Look for a likely trade between 1.1760-1.1860 today. Just trade the range shag on this one today, watch the USD moves.

Happy Wednesday and trading all.