snapVIEW Delta and Inflation Driving Markets in Specific Ways

- Clifford Bennett, Chief Economist at ACY Securities

- 17.08.2021 08:45 am trading

We're here to help.

snapVIEW

US manufacturing continues to slow, while capital inflows to the US remain strong. Stocks marched the course we have outlined, stretching from the significant Main Street slow-down due to foreign fear hedge buying. USD is firm as result.

The AUS200 markedly under-performed US indices yesterday. Expect further downside evolution.

The Australian dollar is at a significant precipice, and can fall sharply at any moment. We are getting gold and oil right. Going in opposite directions as forecast.

Both the gold up-trend and oil down-trend continue to be highlighted strategies for dealing with the delta surge and slowing US/global growth.

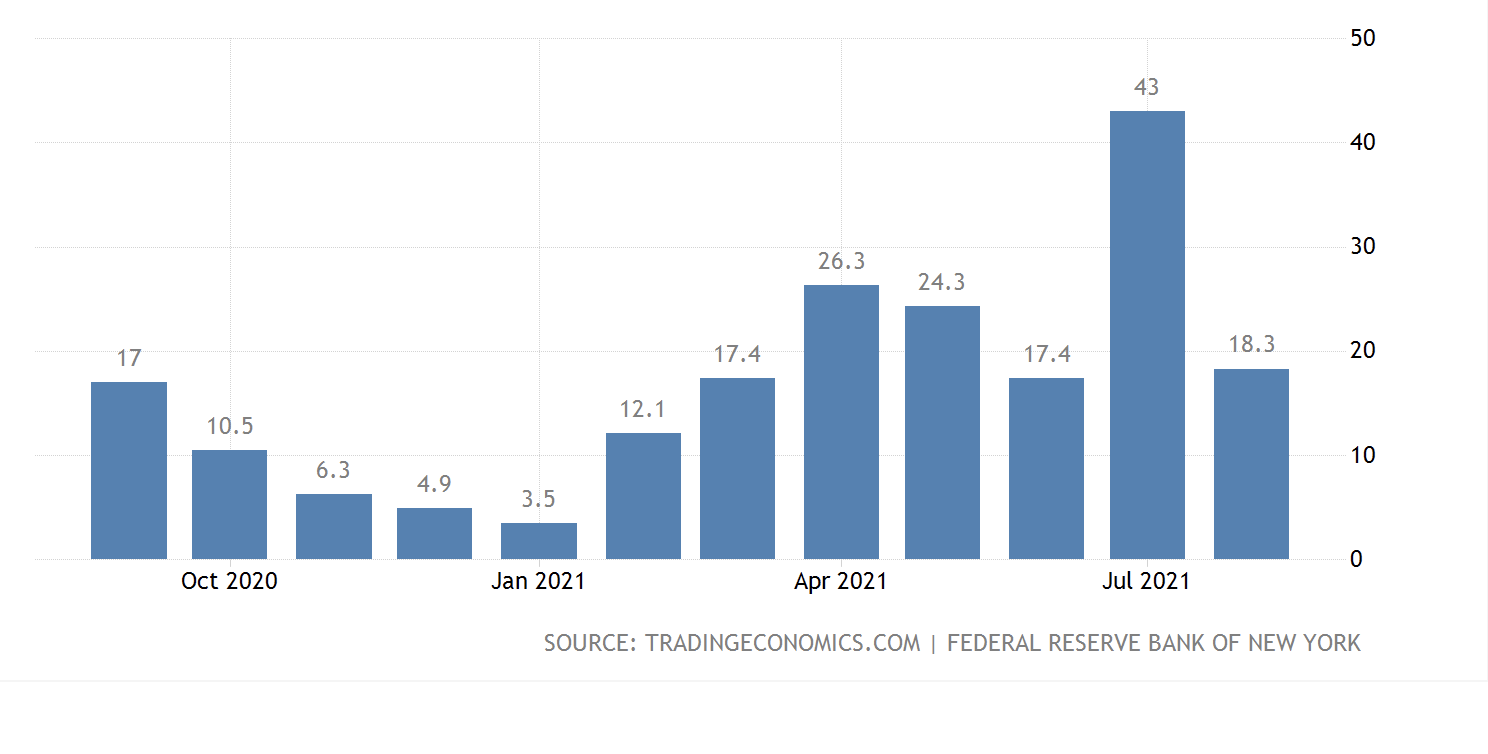

New York Empire Manufacturing Index

Falling back sharply from a momentary spike.

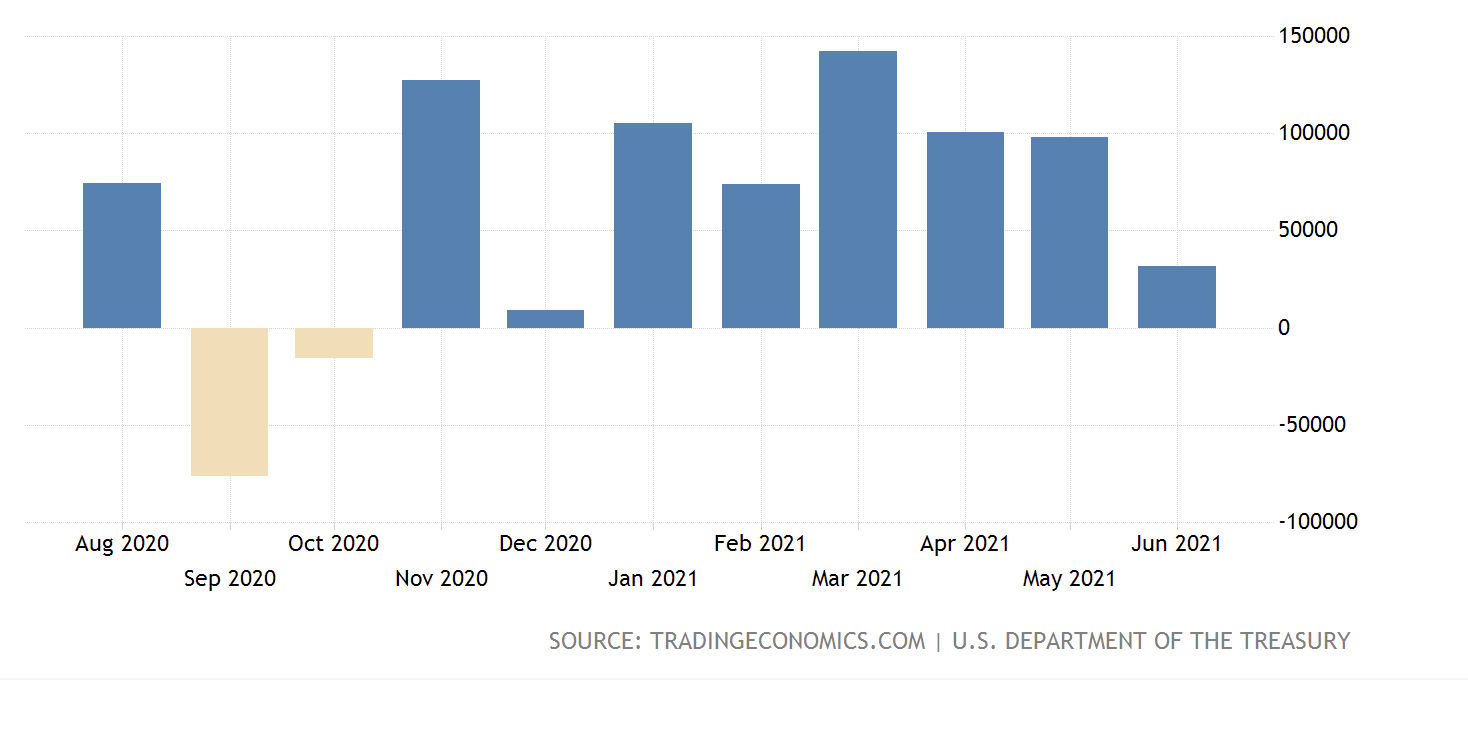

US Capital Inflow

Remaining strong, but also beginning to roll over a little.

This could point to my favoured eventual shift from US stocks to Gold as the fear hedge against the delta surge.

Australian dollar

Risk of immediate and significant further collapse.

US500

As it began to fall, suddenly, five hours of relentless buying. Most likely a very large buy order which day traders quickly fell in line on. Again immediate hesitation Pressure to upside only while very important pivot support now at 4465 holds.

Gold

Still see this as one massive correction/consolidation pattern that will trend higher to 2150 in the first instance. Then 2500.

Black Gold

Oil, I cannot emphasise enough, has extraordinary price correction power to the downside. At a time when the fundamental picture is also darkening. Think a 20% to 30% correction from the highs.

The story of a world confused by the rise of Delta, carrying the pain of inflation, and watching the US and China economies slow, will soon shift from panic buying of US stocks, to Gold. There will be no reason to be long Oil, and the Australian recession we built ourselves, will crunch stocks and the currency both.