NEW Snappier More Helpful Format. Australia drops. US Global trouble

- Clifford Bennett, Chief Economist at ACY Securities

- 18.08.2021 09:45 am trading

Good morning, We're looking at the unfolding collapse of Australia's economy, currency and stock market. A global return to more traditional investment patterns. Gold, and even cash may take centre stage.

Click on image or use this link to watch now: https://youtu.be/2noUhOgdNIY

snapVIEW

Australia is in trouble.

Commodity exports have likely peaked. The domestic economy is largely shut down with no quick escape tunnel available.

Getting to even 60% vaccination may be more of a struggle than authorities anticipate.

The back of the false rally in stocks is breaking. AUS200 likely to follow the Australian dollar lead.

Significant downside risk will continue to dominate over the medium term. Could become entrenched. There are plenty of hedging tools available and everyone should have their defence strategies in place by now.

US and global economy/stocks again turn south.

Retail sales were soft and are of course no surprise to us, as we have been forecasting this very rolling over of the US economy for many months.

The market alert is really much wider than this.

The US slow-down, where they are now again discussing the possibility of shutdowns, may just be the beginning of a mood that will sweep across the world and even to Europe again. This is not a buy stocks environment.

Add already over-valued, over-heated markets, and this could well be that downturn that pressures global investment flows to shift away from US stocks and to the more traditional haven of Gold. Crypto could enjoy a brief further rally out of this, but that would be likely to fade should the Delta surge truly begin to bite in a way the second wave of the Spanish flu did.

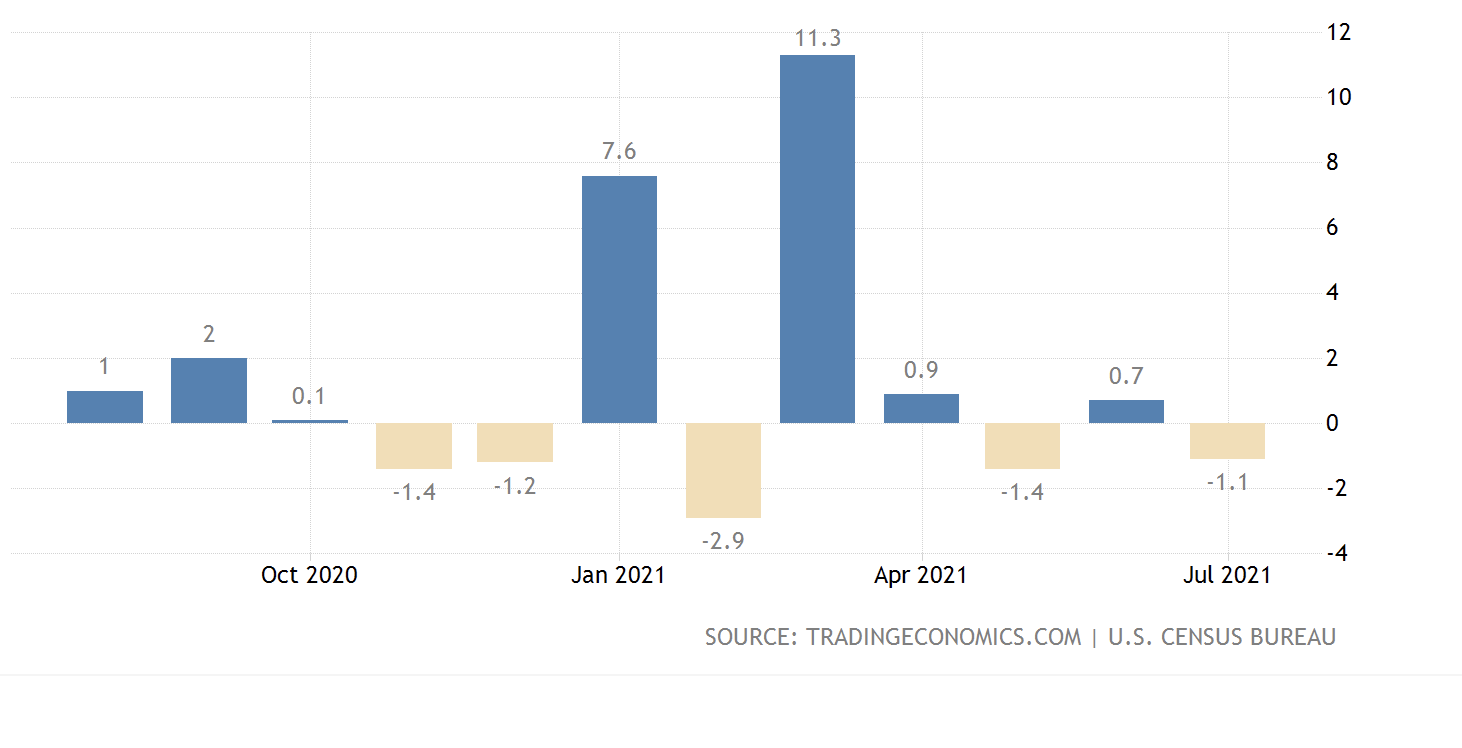

US Retail Sales

Fell 1.1% in July.

The US economy is an extremely fragile state at the moment. Note, Consumer sentiment indicators are currently hitting fresh lows since covid-19 started.

After massive stimulus, the US economy is again falling, just as it suffers geo-political failure on a historic level in regard to Afghanistan. All such factors do feed into the state of mind of Americans, and their resulting consumer behaviour.

The USA and Australia economies peaking simultaneously.

It cannot be highlighted enough, that this is an extremely combustable mix for the Australian equity market.

Particularly, as Australia has a now long term weakened relationship with China. Our biggest export destination.

The Australian economy will be increasingly squeezed from various directions, on top of the already zeroed immigration and foreign student situations.

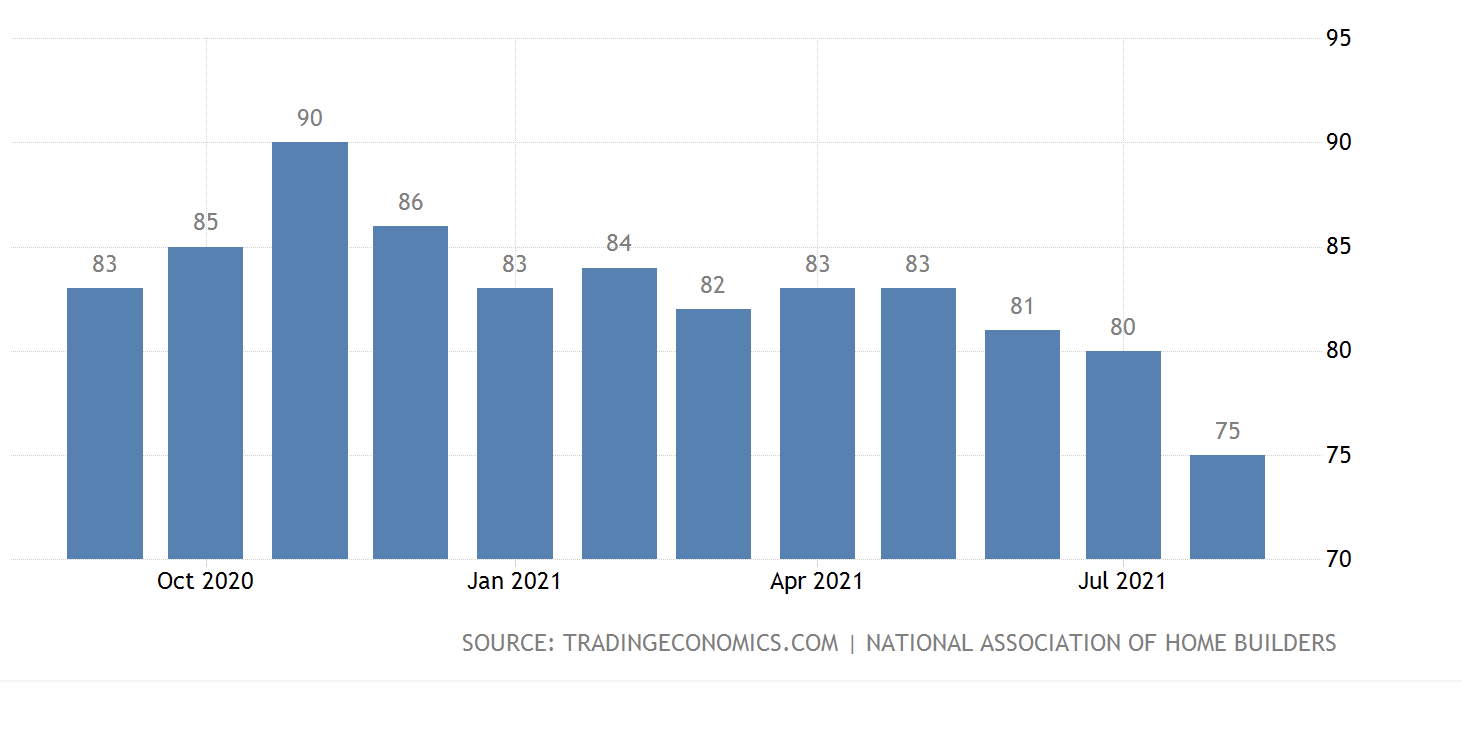

US Home Builder Sentiment

As forecast, the second housing bubble of this century, something no one else has wanted to acknowledge, is already beginning to burst.

The NAHB housing index fell to 75 in August.

US Federal Reserve Chairman, Jerome Powell,

said the Delta variant surge is making the outlook

for the US economy uncertain.

Understatement of the day award.

Oil / Black Gold will certainly not shine.

Correct chart today. Oil is targeting as low as $55, perhaps $52 over the medium term. Reflecting its status as the best hedging tool against a renewed global slow-down.

US500

The immediate twists and turns here, will be giving the bulls pause for thought.

EURUSD

My target remains 1.1100.

Further sharp downward acceleration is a real risk at the moment. As the global investment community belatedly shifts gears to a safe-haven mentality.

Australian dollar

From .7745,

I have been adamant that the Australian dollar was targeting 70 cents/risk .6850.

Nothing has changed. A couple of times, I have mentioned there may be some support in the .7220 area, but this should be viewed as merely a bus stop on a much longer journey.

First to Call Australia in Recession

We were the first to call Australia to already be in a recession. The data that will show us to be correct, will not be available until early next year, but one has only to 'look out the window'.

This fundamental reality, just beginning to dawn on other market participants, will increasingly have a profound impact upon the Australian dollar and stock market valuations.

A lot of scary room to the downside.

This Australian and global outlook is objective.

Not negative in approach. Just in the very real observations that strongly suggest hyper-active management of all investment portfolios is appropriate at this time.

There are plenty of ways to hedge this kind of scenario and outlook.

This is the true beauty of our modern financial markets. Where the individual has the advantage over large institutions. No committee decision making delays. Which sometimes run into the weeks for large funds and investment banks.

Real world, look out the window, insights and action will support your success.

Whatever we can imagine, we can do way more.