GBP, CAD, NZD Outperform on Interest Rate Divergence

- Michael Moran , Senior Currency Strategist at ACY Securities

- 28.05.2021 10:15 am trading

JPY Slumps, AUD, DXY Flat, USD/CNH Breaks Lower

Summary: The Dollar Index (USD/DXY) finished little-changed at 89.97 (90.00) after trading in a tight range overnight. Sterling outperformed, soaring 0.61% to 1.4200 (1.4125) after Bank of England policymaker Gertjan Vlieghe said the central bank may raise interest rates earlier than originally indicated. Currency divergence widened following changes in the economic outlooks from their respective central banks and their plans to reign in easy money policies. USD/CAD slipped 0.5% to 1.2065 (1.2122) after analysts from the country’s major banks saw the Bank of Canada likely trimming back bond purchases in July. Higher oil prices also aided the Canadian Loonie. The Kiwi (NZD/USD) maintained its bid, ending modestly higher, at 0.7297 (0.7287 yesterday). Earlier this week the Reserve Bank of New Zealand (RBNZ) surprised markets with a hawkish outcome. Elsewhere in Asia, the USD/CNH pair (US Dollar vs Offshore Chinese Yuan) slumped to fresh 3-year lows to 6.3673, settling at 6.3720 at the New York close. After the clean break of the USD 6.4000 level, traders were confident that Chinese authorities were not uncomfortable with the stronger Yuan and pushed the US Dollar lower. On the other side of the spectrum, the USD/JPY pair soared 0.58% to close at 109.80 (109.15). The benchmark US 10-year bond yield ended up 2 basis points at 1.60%. Japan’s 10-year JGB rate was unchanged at 0.07%. The Australian Dollar ended at 0.7742 in late New York from 0.7744 yesterday after trading in a narrow range. EUR/USD was little changed at 1.2197 (1.2195 yesterday). Wall Street stocks finished with moderate gains. The DOW was up 0.33% to 34,573 (34,347). The S&P 500 rose to 4,212 from 4,198. Other global bond yields were higher. Germany’s 10-year Bund yield was last at -0.17% (-0.21%). The UK’s 10-year Gilt rate rose to 0.81% from 0.75%. The Australian 10-year bond yield was lower, settling at 1.62%, from 1.66% yesterday.

Economic data released yesterday saw Australia’s Q1 Private Capital Expenditure rise to 6.3% from the previous 3.0%. Switzerland’s Trade Surplus missed forecasts at +CHF 3.84 billion vs +CHF 4.85 billion. Germany’s GFK Consumer Climate Index underwhelmed at -7.0 against estimates of -5.3.

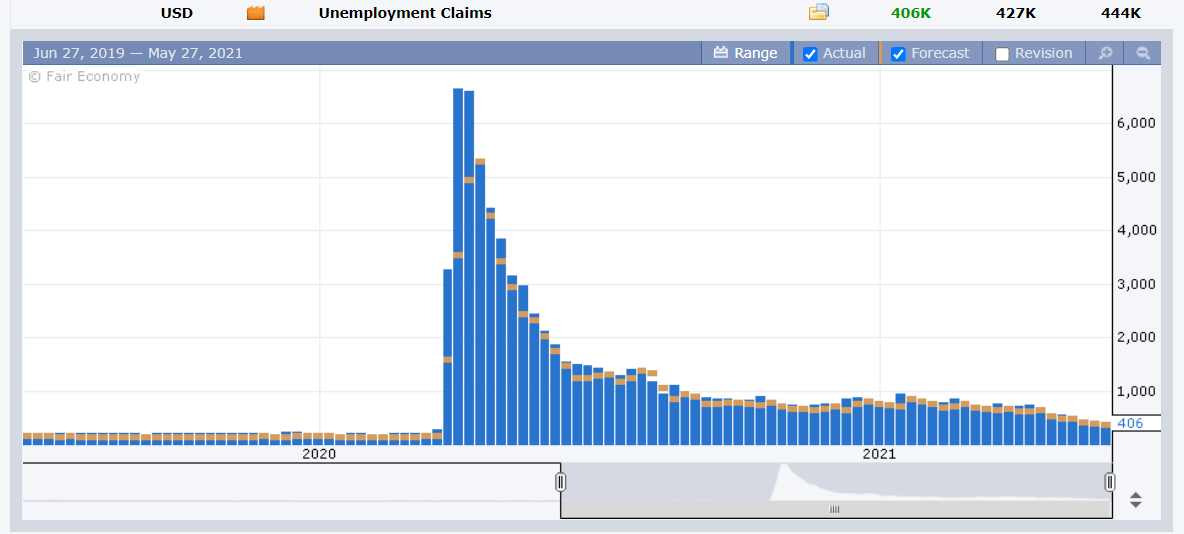

US Weekly Unemployment Claims fell to 406,000, bettering median forecasts at 427,000 and the previous week’s 444,000. It was a 14-month low. The US Preliminary Q1 GDP printed at 6.4% against expectations of 6.5%.

US April Core Durable Goods Orders rose 1.0% beating forecasts of 0.8%. Headline DGO was -1.3%, from an upwardly revised March print at 0.8%. US Pending Home Sales fell -4.4% missing forecasts at +0.8%.

- GBP/USD – Sterling soared following hawkish comments from Bank of England policy maker Gertjan Vlieghe. The British currency hit an overnight high at 1.42188 from its 1.4125 opening yesterday, settling to 1.4200 in late New York. Markets ignored the fact that Vlieghe’s term is due to expire on August 31 this year.

- USD/CAD – The Canadian Loonie was next best performing currency after analysts from Canada’s major banks saw the BOC further dialling back bond purchases in the next policy assessment (July). USD/CAD slipped to 1.2065 (overnight low 1.2056) from 1.2122 yesterday.

- NZD/USD – The Kiwi maintained its overall bid, climbing back 0.27% to finish at 0.7296 (0.7290 yesterday). A hawkish outcome from the RBNZ meeting earlier this week saw the “Flightless Bird” soar to 0.7316 yesterday morning.

- EUR/USD – The Euro traded in a relatively tight range between 1.2175 and 1.2215, settling at 1.2197, little changed from its open at 1.2195 yesterday. A fall in Germany’s GFK Consumer Confidence Climate failed to excite traders of the single currency.

On the Lookout: Divergence will continue to impact the currencies in early trade today. Economic reports due later tonight feature key US inflation data. The Federal Reserve’s favoured inflation measure, the Core PCE Price Index (April) is expected to rise to 0.6% from a previous 0.4% (month-on-month) and to 2.9% (year-on-year) from a previous 1.8%. Other data released earlier today (Finlogix Economic Calendar) see Japan’s Tokyo Core CPI (Annual) (f/c flat at -0.2%) and Japanese Unemployment Rate (f/c 2.7% from 2.6%). Primary European data start with May French Annual Inflation Rate (f/c 1.4% from 1.2%). Eurozone May Consumer Confidence Index follows (f/c -5.1 from -8.1) as well as Eurozone Economic Sentiment Index for May (f/c 112.1 from 110.3). The US reports its April Goods Trade Balance (f/c Deficit of -USD 92.0 billion from -USD 90.6 billion). US April Personal Income follows (f/c -14.1% from +21.1%). US Personal Spending (April) is f/c to dip to 0.5% from 4.2%. Finally, Chicago PMI is forecast to dip to 68.0 from 72.1.

Trading Perspective: While the Dollar Index finished flat, currency divergence dictated FX moves. Expect this theme to continue today in Asia and early Europe until the release of a key US inflation report tonight. Global rival bond yields were mostly higher than the US counterpart despite its rise.

The US Core PCE Price Index is forecast to climb to 0.6% from 0.4%, monthly. The rise is already built into the US Dollar at current levels and would need to be higher for the Dollar Index to rally off its base near 90.00. Robert Kaplan (Dallas Fed President) said that improved labour conditions call for taper talks. Last night US Weekly Jobless Claims slid to a 14-month low. This enabled the benchmark US 10-Year bond yield to climb 2 basis points to 1.60%. However, this was offset by higher rises in rival global bond rates. All eyes on the data releases tonight.

- GBP/USD – Sterling took the limelight follow the hawkish remarks from BOE policymaker Vlieghe. Which was backed up by a rise in UK 10-year yields by 6 basis points (0.81% from 0.75% yesterday). GBP/USD rose to 1.42188 overnight before easing to 1.4200 at the close. Yesterday, Dominic Cummings, a former aide to the British PM, said the Boris Johnson is unfit to be the Prime Minister. Political conflict surrounding the handling of the Coronavirus pandemic is a threat to the British Pound. Immediate resistance lies at 1.4220 and 1.4250. Support can be found at 1.4170 followed by 1.4140. Any USD strength could see Sterling stumble. Likely range today 1.4130-1.4230.

- EUR/USD – The Euro stayed within its recent tight range between 1.2170 and 1.2270. The Single currency finished little changed at 1.2197 after hitting an overnight high at 1.22149. The highs are coming down, and immediate resistance today lies at 1.2220. The next resistance level is found at 1.2250. Immediate support can be found at 1.2170 (overnight low 1.2175) and then 1.2140. Look for a likely range today of 1.2170-1.2220 with a heavy feel dominating this currency pair.

- USD/JPY – The Greenback broke higher against the Japanese Yen, hitting an overnight peak at 109.923 before easing to settle at 109.80. Earlier this week Japan slashed its economic outlook for the first time in 3 months. The country struggles to battle the virus amidst its commitment to host the Olympic Games which is causing a lot of internal conflict. This will continue to weigh on the Japanese currency. That said the 110.15 resistance level is strong and should hold. We could see Japanese exporter interest coming in soon. The next resistance level is found at 110.40 and 110.80. Immediate support lies at 109.60 and 109.30. Look for consolidation in a likely range between 109.30-110.10. Just trade the range shag on this one.

- NZD/USD – The Kiwi settled at 0.7297, not far from its peak on Wednesday following the RBNZ interest rate meeting outcome. NZD/USD traded an overnight range of 0.7265 to 0.7311. Despite the bullish bent from the RBNZ, one thing traders tend to forget is that current RBNZ Governor Orr does not favour a strong currency, both against the USD and on a Trade Weighted Basis. Expect immediate resistance at 0.7310 to hold. The next resistance level lies at 0.7330. Immediate support can be found at 0.7260 and 0.7230. Look for a likely range today of 0.7230-0.7320. Prefer to sell rallies. The Flightless Bird can’t fly forever in the current environment.

Happy Friday and trading all.