FREE PROFIT BIG TROUBLE

- Clifford Bennett, Chief Economist at ACY Securities

- 24.08.2021 09:00 am trading

Troubled world in a very good looking nutshell.

It's free profit for every business on earth now. For the tech sector this represents a massive boost.

We have been saying way before anyone else, in fact, I still don't hear anyone else catching on, that this inflation wildfire is due to the freedom of pricing that has suddenly come in to play, post Covid.

In case you haven't heard me say it before, from the corner store to the global corporation you can now raise prices as you wish, blaming those price rises on covid, and not lose any market share at all.

Usually, there is a price to pay for increased profit. In the form of higher research and long term investment, or, in a willingness to give up some market share to your competitors.

Today, there is no price to pay.

You can just raise prices, as you wish arbitrarily.

Profit is free.

Microsoft just announced it is raising its prices.

Apple has already established you can raise prices without losing market share.

This is a bonanza period for Tech companies.

Companies everywhere are raising prices with haste. The mind boggles at the profit growth potential of the global brands that have locked in our every day behaviour to their applications, streaming and data services. Where they can charge whatever price they want, without fear of losing market share.

This doesn't mean they can do so without retribution. Consumer uproar is highly likely at some price point, but the time point is only just on the horizon. The Tech companies know this, as do all major corporations, and so they are literally making hay while the sun shines. And without even having to do the usual heavy lifting farm work.

Free profit. What a great time to be a Director of a corporation. You can only look good, as earnings and profits climb.

For a time.

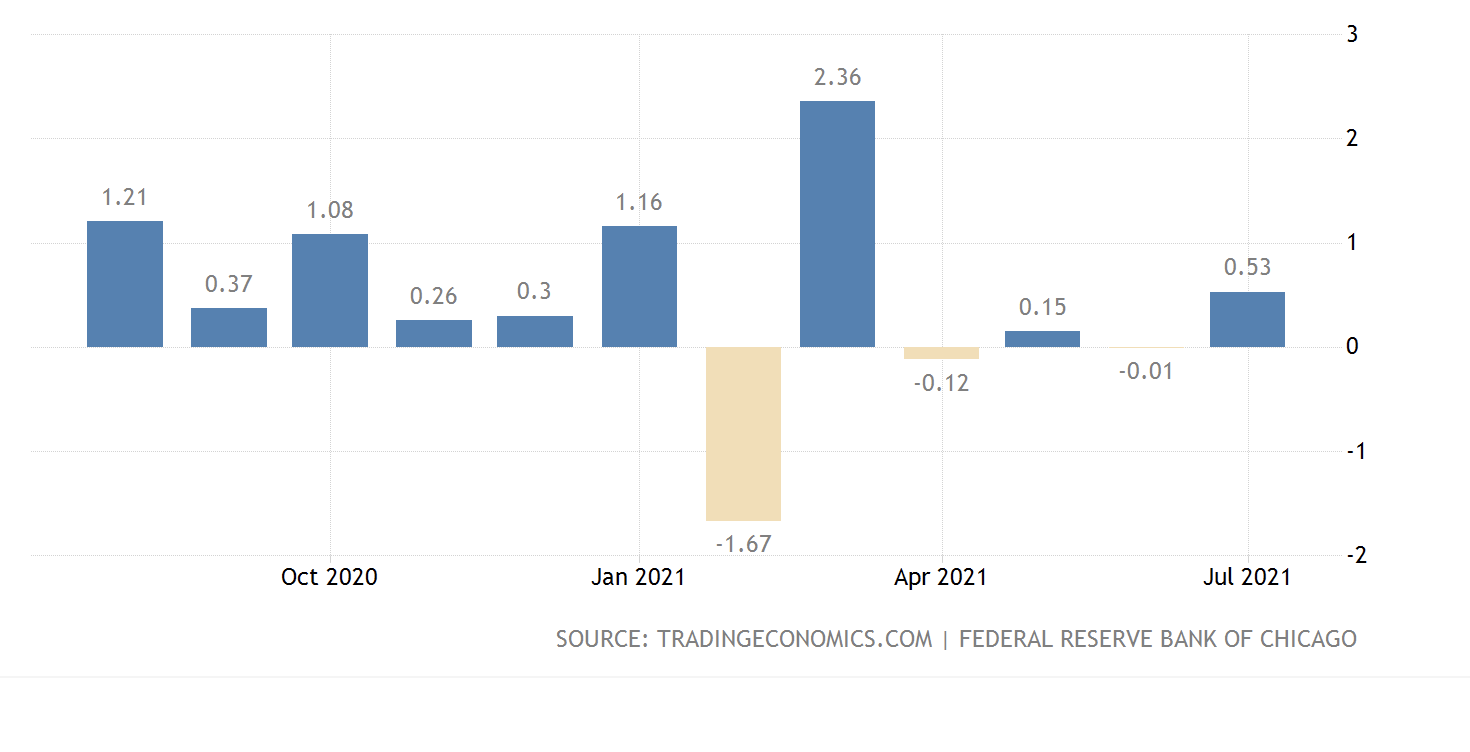

US Chicago Fed Activity Index

Achieved a modest positive, but personal consumption and housing were negative. Recent data across the board is showing a clear softening trend, especially among consumers. This is where the trouble is. With the real economy.

The US economy is already getting all the help it is going to get, and that has been substantial, but remains only at pre-covid levels with a softening trend now well established. And over five million less jobs than it had before.

Inflation, completely mis-understood by the major banks and the Federal Reserve, is totally out of control and will continue to build.

Yes, on top of the free profit price gouging going on unabated, not even called out, there is also the very real supply chain disruption issues. These are the cover story exciuse for all other price rises, but the excuse is also very real at the same time.

We are seeing this in producer price rises the world over. The inflation wave is building, not peaking.

The fall away in many commodity markets and oil, will take a touch of the sting out of the forth coming inflation numbers, but they will, nevertheless, remain uncomfortably strong.

Inflation will remain higher, for longer, than any central bank expects. Let alone the market.

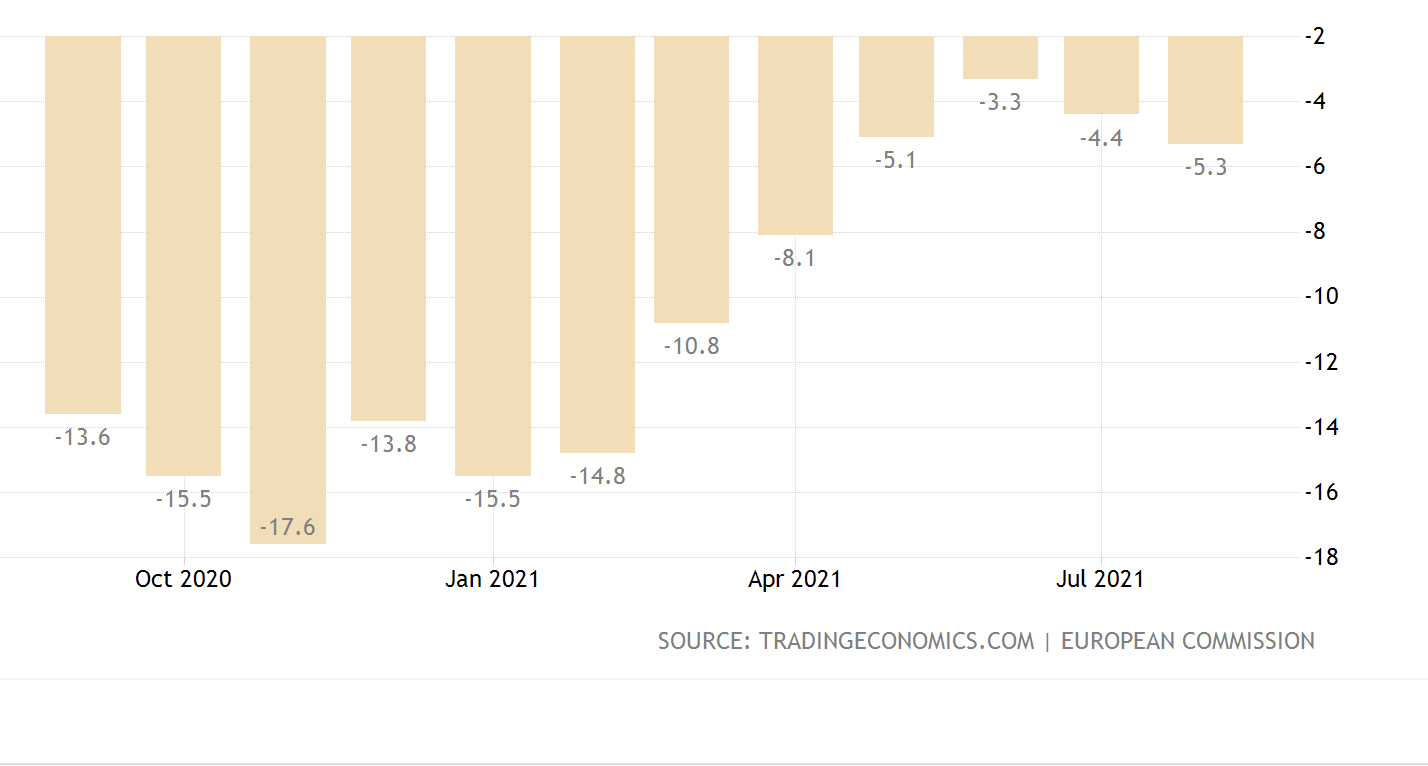

European Consumer Morale

Again rolling over to the downside rather significantly. This is a global phenomenon now.

NASDAQ

After looking like a top, has shot to new highs.

Much of the commentary on the day is around the official approval by the FDA of Pfizer. But this is ridiculous. Of course no one was waiting for this. Or very few. The US military had even mandated Pfizer previously. So the idea that this is breakthrough news is absurd.

Absurd though, markets can be.

The real reasons for the strong gains on the day were the growing recognition of fattening profit margins generally, but especially in the Tech sector. There was also the reluctance of any trader to be short US stocks this week, as the Fed Chair Jerome Powell will be speaking at Jackson Hole at the end of the week. Likely cautiously, given Delta.

Powell, will likely walk the middle ground by saying that there is heightened uncertainty over Delta, and while there should be discussion over tapering just the same, this will proceed cautiously. This is short term stock bullish, but he may also confirm tapering will occur this year.

The US dollar is moderating this week for exactly the same reasons. This dollar pullback, I view as a short term correction, and I expect further strength in the weeks ahead.

Our favoured Gold took off, and this strength will be persistent going forward. Oil had a good bounce. Do not expect it to last.

Of interest, is how the Australian futures market index under-performed during New York. I remain very bearish Australian stocks, and any rally should be considered as a hedging of investments opportunity.

The Australian dollar remains a sell story, every way you look. Domestically we are in a protracted recession. On trade, well, we have already seen our best days.

This week, stocks and currencies will try to rally. That strength may not even last until Friday. Mid to late the following week, they could all be headed south again.