Exporters and the AUD story. Stocks and Data.

- Clifford Bennett, Chief Economist at ACY Securities

- 20.08.2021 08:00 am trading

Good morning,

Stocks rallied on US New Jobless Claims being lowest since the crisis began, but of course they should be. There are still 5 million less jobs, and workers have never been more actively looking to change jobs, along with all the supply chain disruptions still in place.

Australian Un-employment

No Chart. Anyone talking about yesterday's un-employment number as being at all relevant to the Q3, Q4, Q1 economic outlook, does not have all their marbles.

snapVIEW

US New Jobless Claims were running in a range of 200,000 to 250,000 before Covid. The current improvement is to be applauded, but with new job losses still significantly elevated, this is not necessarily a reason to buy stocks at already high prices.

The market is likely to give up the New York session gains, rather quickly.

Europe is in free fall.

The Australian market has not a leg to stand on.

The Delta surge continues globally, and every one is trying to look the other way. It will have increasing economic impact however, and this will continue to weigh on stock prices that represent that bizarre Nirvana belief of many economists and fund managers.

I declare the stretch of Wall Street ivory tower stock prices away from Main Street reality to be over.

Click on image or use this link to watch now: https://youtu.be/phCsE33BKs8

US New Jobless Claims

Despite massive stimulus measures and relative emergence from shut downs, lay offs continue at a concerning pace. Nevertheless, progress is most certainly being made. How long that will last, given the now apparent to everyone slowing of the US economy however, remains to be seen.

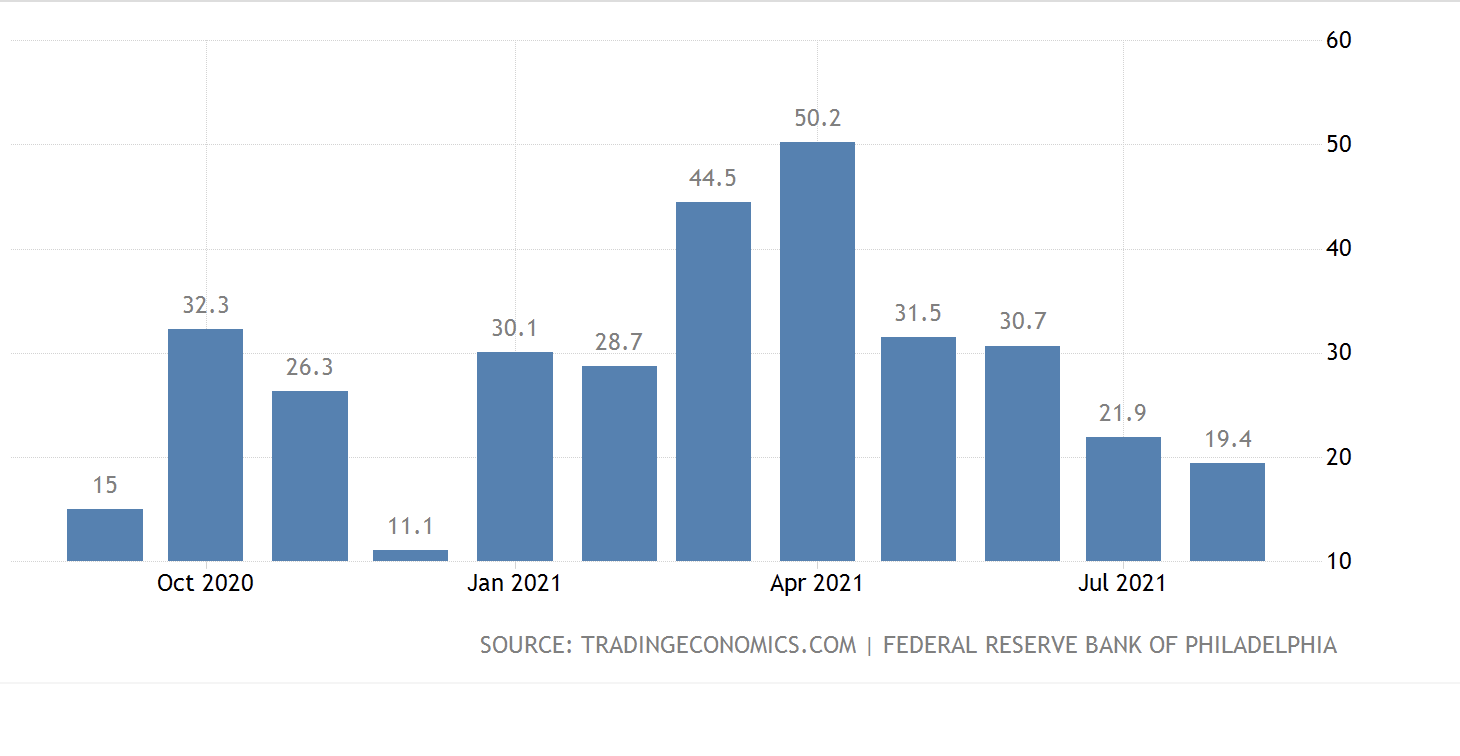

US Philadelphia Fed Manufacturing Index

Manufacturing is now at, and even below pre Covid levels. This should be totally alarming to everyone. Employment is the slowest of all indicators, but this manufacturing index is relatively real time, and it is certainly pointing south.

We have constantly warned the US economy was still fractured and in serious trouble.

US500

The Jobless Claims rally ignored the manufacturing data, and to be honest, if that is the best the buy the dip side can muster, this market is in serious trouble.

Dow Jones

Remained more subdued. There is a short term reversal point, which could muster some momentary further buying if it can manage that. Overall, very much a bear trend continuation I believe.

Trying to rally. Why? Who knows. It looks already tired and ready to fall again. Perhaps, a short term rally to 7550 is possible, but that would probably be the best we would see for the rest of the year. The dominate risk is at all times to the downside, as the reality of recession crunch increasingly comes to bear. Good name for a song.

EURUSD

The target area remains 1.12 1.11. Despite the European recovery, the fresh wave of Delta is driving some safe haven features of the currency market toward the US dollar. And the Fed will be tapering/hiking first.

Meanwhile, the Australian dollar maintains an independent story of it's own. I think you know we have been targeting 70 cents, risk .6850, since .7745.

As market sentiment catches up to us, eventually, for a moment anyway, everyone who wants to sell will have done so. There will be a bounce at some point.

Hopefully, our exporters were not fully hedged up there. Though their banker advisers were most probably telling them to do so. Such was the ludicrous 'Australia is invincible' sentiment of previous months.

If, our exporters were fully hedged up at 77 cents, then they just transferred 10% of their potential export earnings to offshore counter parties. No wonder US hedge funds love trading our currency. Such has been the sad story of exporter hedging strategies over several decades. It is an aspect of our commodity exports and currency movement matrix, very few take the time to consider.

Australia, as a whole, while wealthy from our fortunate geographical location in Asia and natural riches, again due to the geography of our continent, we nonetheless, could have been richer.

Who said it isn't all about geography. Well, our miners too, it must be said, are world class.

Whatever we can imagine, we can do way more.