Delta, Taper Fears Boost US Dollar, Risk-Off Extends

- Michael Moran , Senior Currency Strategist at ACY Securities

- 20.08.2021 08:00 am trading

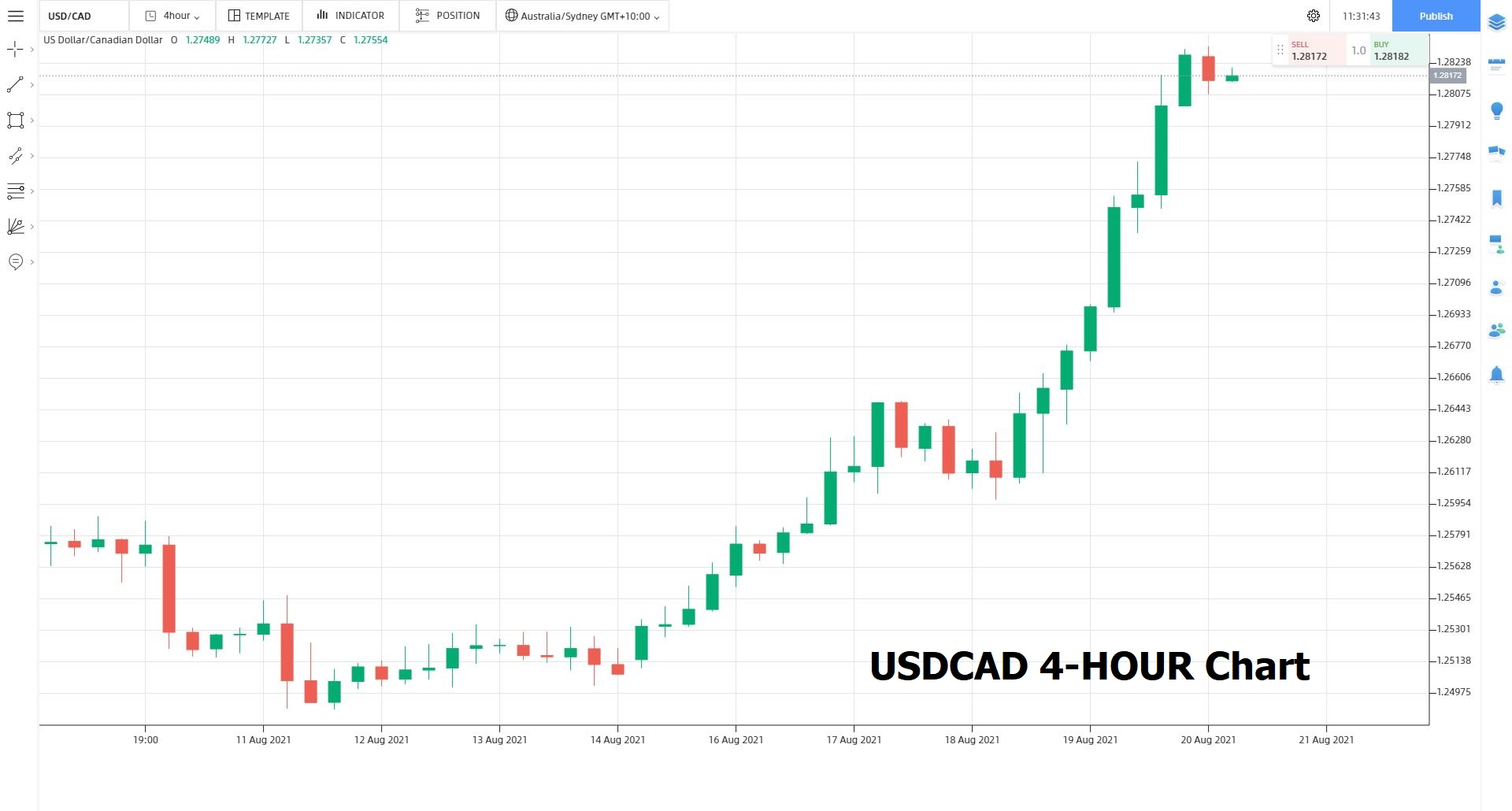

Oil Slide Quickens, CAD, AUD, Resource FX Slump

Summary: The Dollar Index (USD/DXY) soared 0.45% to a 9-month high at 93.55 (93.15) boosted by safe-haven flows as the market’s risk-off stance extended. Rising global cases of the Delta variant of Covid-19 and growing expectations of a Fed taper hammered commodities and resource FX lower. WTI Oil plunged 2.75% lower on fears of weaker demand from restrictions due to the virus spread. Against the oil sensitive Canadian Loonie, the Greenback surged to 1.2830 (1.2655), near 6-month high, a gain of 1.28%. The Australian Dollar plummeted 1.15% to 0.7148 (0.7235), fresh 2021 lows. New South Wales, Australia’s largest State, recorded a new daily high of 681 Covid-19 infections which prompted a lockdown extension in the region. Sterling was pounded lower to 1.3635, (1.3755 yesterday) near one-month lows. The Euro eased to 1.1675 from 1.1708 yesterday, a 9-month low, just another victim of the broadly stronger Greenback. Against the Yen, the Dollar finished little-changed at 109.78 (109.75). The Japanese currency also benefitted from haven support. Against the Asian and Emerging Market currencies, the Greenback rose moderately. The USD/SGD pair rallied 0.26% to 1.3640 (1.3610). Against the Chinese Offshore Yuan, the Dollar (USD/CNH) finished at a 3-week high at 6.5020 (6.4840 yesterday).

Global bond yields were mostly flat. The US 10-year Treasury yield settled at 1.24% (1.26%). Germany’s 10-year Bund rate was last at -0.49% from -0.48% yesterday.

Wall Street stocks finished mixed. The DOW was last at 34,910 (34,930) while the S&P 500 settled at 4,410 (4,395).

Data released yesterday saw Australia’s Employment Change rise to 2,200, beating forecasts at -42,500 but lower than June’s 29,100. The Unemployment Rate improved to 4.6% in July from 4.9% previously. Switzerland’s Industrial Production rose 15.7% in Q2 from 4.8% in Q1. The Eurozone Current Account in June climbed to +EUR 21.8 billion from a previously revised upward +EUR 13.9 billion. The US Philly Fed Manufacturing Index in August slipped to 19.4 from 21.9, missing forecasts at 23.0. Weekly Claims for Unemployment Benefits in the US eased to 348,000 from 375,000 the previous week, bettering forecasts at 363,000. US Conference Board’s Leading Index in July rose to 0.9% from 0.5%, beating estimates at 0.8%.

Earlier this morning, the UK reported it’s GFK Consumer Confidence Index which dipped to -8 from -7, and forecasts at -7.

- AUD/USD – The Aussie Battler plummeted to finish 1.15% lower at 0.7148 from 0.7235 yesterday. Australia’s struggle to contain rising coronavirus infections as well as the overall stronger Greenback and risk-off sentiment weighed on the Aussie.

- USD/CAD – surged on the back of weaker Oil prices which were down for the sixth day in a row. The Greenback finished 1.28% higher at 1.2825 from yesterday’s 1.2655 open. Overnight peak traded was at 1.2831.

- GBP/USD – Traders pounded Sterling to a new one-month low at 1.3635 from 1.3755 yesterday. Broad-based US Dollar strength and weaker CPI data continued to weigh on the British currency.

- EUR/USD – The Euro eased 0.22% too finish at 1.1675 from yesterday’s 1.1705 opening. The shared currency was also a victim of overall US Dollar strength. Against the other major currencies, the Euro has fared better.

On the Lookout: Markets will continue to monitor developments on the Federal Reserve’s ongoing taper discussion. There are no major US data released today. A key event is a speech which is currently going on from RBA Assistant Governor Kent on the FX markets online. Japan follows with its National Headline and Core CPI report (National no forecasts, previous was 0.2%, Core f/c -0.4% from 0.2%). China’s People’s Bank of China has its interest rate setting (11.30 am Sydney), which is currently at 3.85%. There are no predictions for this event. Watch for the report, it could be a mover for the Aussie and regional Asian FX. Germany releases its July PPI report (m/m f/c 0.8% from previous 1.3% - ACY Finlogix). The UK follows with its July Public Sector Net Borrowing report (f/c -GBP 11.8 billion from previous -GBP 22.8 billion – ACY Finlogix); UK June Retail Sales (m/m f/c 0.4% from 0.5%, y/y f/c 6% from 9.7% - Finlogix). Canada releases its June Headline Retail Sales (m/m f/c +4.4% from previous -2.0%; y/y no forecasts, previous was 24.6%).

Trading Perspective: Its Friday today, thank God. Expect consolidation with profit taking and position adjustments dominating trade. The US Dollar has had a good run north and Friday may be a time for profit-taking. The benchmark US 10-year bond yield eased to 1.24% from 1.26% yesterday. Which highlight that taper fears are overblown and should keep the topside of the Greenback limited. While some US Fed officials have begun discussing an easing of economic stimulus, they agreed that “substantial progress” needed to be made in the economy. Upcoming data releases in the days ahead will matter.

- AUD/USD – Traders have been ultra-bearish on the Aussie Battler all week and have been rewarded. A week ago, the Aussie was trading at 0.7370. This morning, the AUD/USD pair opened at 0.7148. Overnight low for the Aussie was at 0.7142, which is where the immediate support lies (0.7140). The next support level comes in at 0.7100. Immediate resistance can be found at 0.7185 followed by 0.7215. Look for consolidation in a likely 0.7140-0.7210 range today. Prefer to buy near current levels.

- GBP/USD – Sterling was pounded lower by the FX markets on the overall USD strength. GBP/USD has immediate support at 1.3630 which is near the overnight low (1.3632). The next support level can be found at 1.3610 followed by 1.3580. Immediate resistance lies at 1.3680 followed by 1.3710. Look to trade a likely 1.3620-1.3720 range today. Prefer to buy dips.

- EUR/USD – The shared currency eased against the Greenback to 1.1675 at the New York close from its 1.1708 open yesterday. Overnight low traded was 1.1666. Immediate support can be found at 1.1655 followed by 1.1620. Immediate resistance can be found at 1.1700 and 1.1740. Look for the Euro to consolidate in a likely range today between 1.1660-1.1720. Prefer to buy dips on the shared currency today.

- USD/CAD – skyrocketed to finish at 1.2825 from yesterday’s open at 1.2655. The Canadian Loonie was a victim of weaker Oil prices, which finished lower for the sixth day running and the broad-based stronger Greenback. USD/CAD has immediate resistance at 1.2830 (overnight high 1.2831) followed by 1.2860. Immediate support can be found at 1.2775 followed by 1.2730. Looking to sell USD rallies in a likely range today of 1.2735-1.2835.

(Source: Finlogix.com)

It’s been a long week folks, take it easy, stay safe. Happy trading, happy Friday!