Compelling US Story Australian 10 Year Bond Trend

- Clifford Bennett, Chief Economist at ACY Securities

- 09.09.2021 05:00 am trading

NY Banks Morgan Stanley and Citi join our Cautious US Equities view.

We say it first.

When I first made these forecasts on slowing US growth, continued supply chain disruption, tsunami of inflation and Delta, I said at the time it would take a couple of months for these forecasts to begin to be supported by data, and even longer for our competitors to come to the realisation that there is no Nirvana in sight just yet.

This is exactly what has unfolded.

My mantra has long been, 'look out the window' economics.

Applying economic commonsense to a fast evolving world.

We will then, by nature, often be the minority view, when all around are saying something completely different. It's a nice place to be from an over the horizon investment perspective.

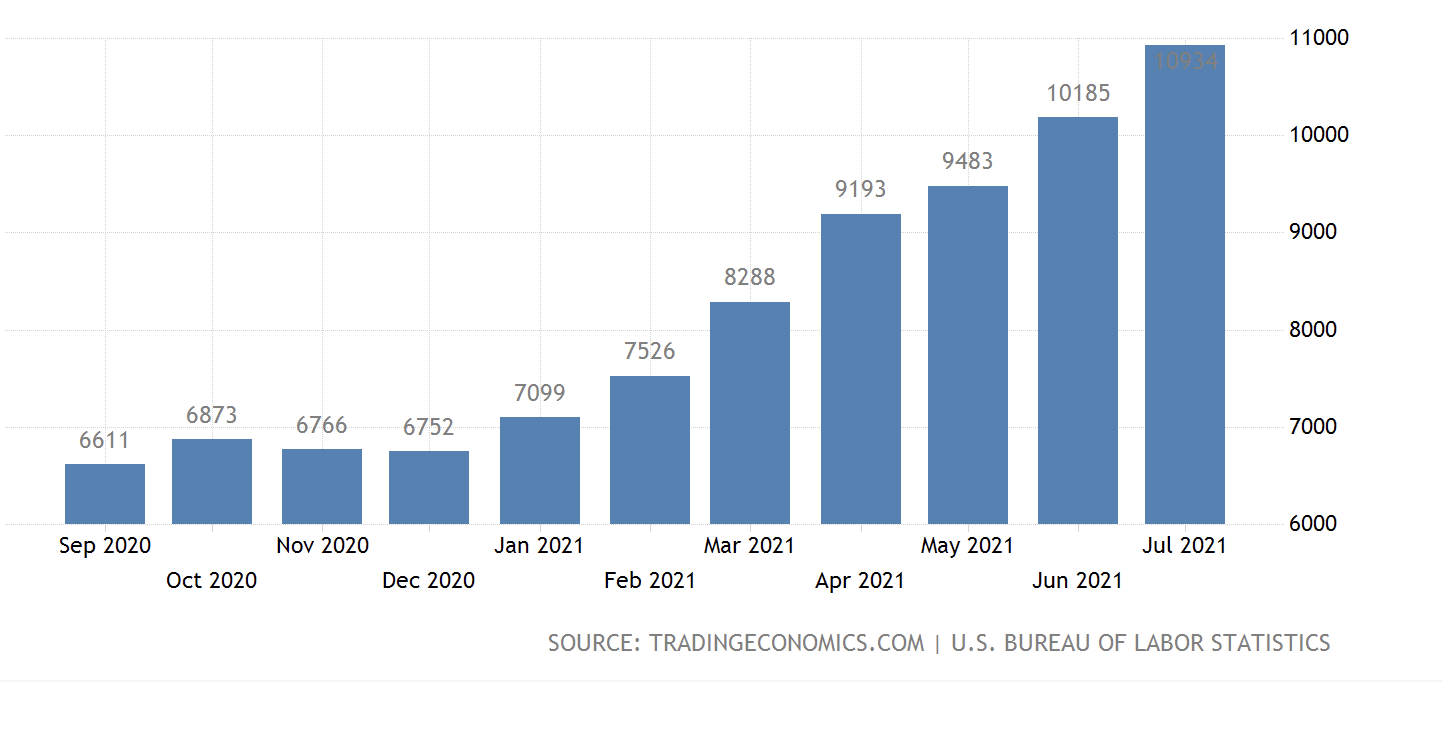

US Job Adds are through the roof.

This is probably the only positive looking economic data series in the US at the moment. This is because, it highlights the severe dislocation still on-going and likely semi-permanent for the domestic economy. All other data is falling, and the slow-down is due to the noxious mix of stimulus disruption, increasing inflation and the resurgence of the Delta variant.

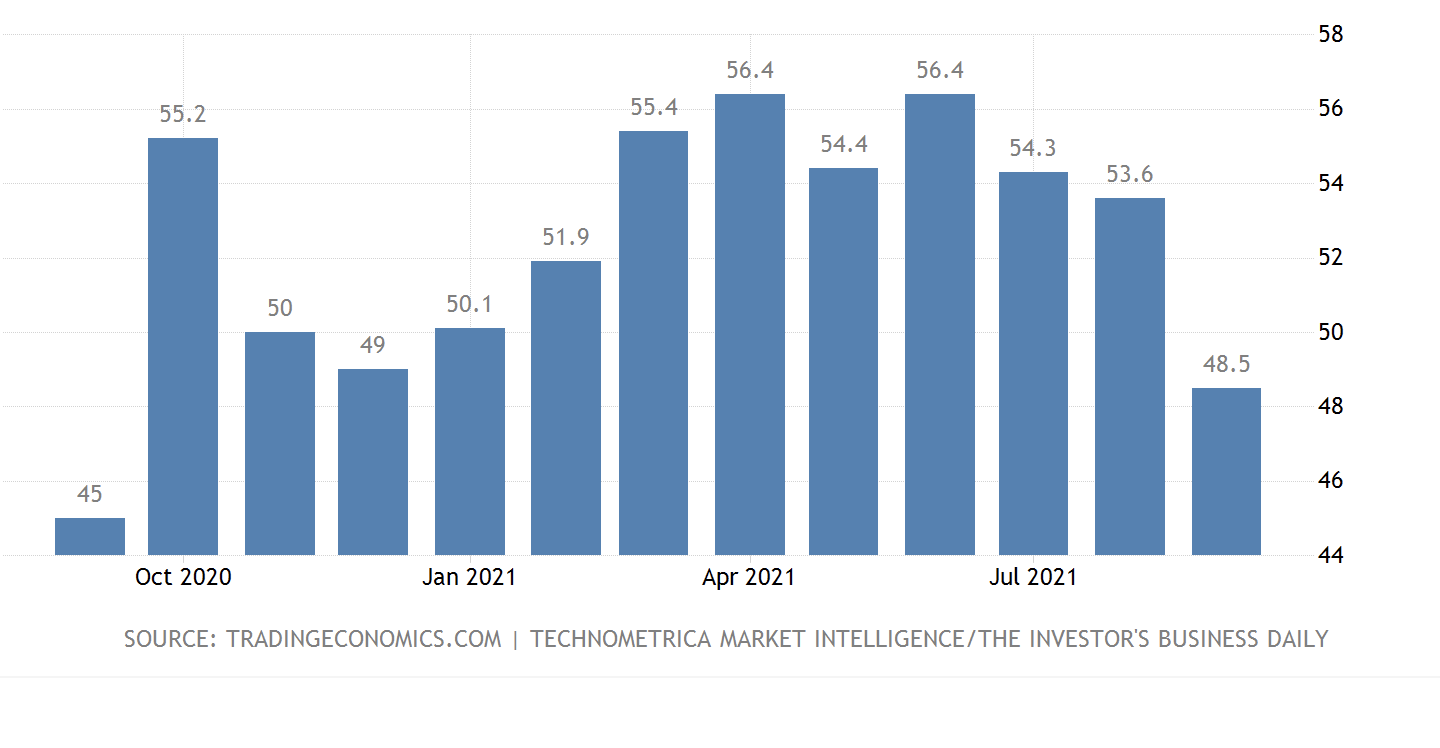

US Economic Optimism Index falls to one year low.

Saying more about where the US economy is really headed.

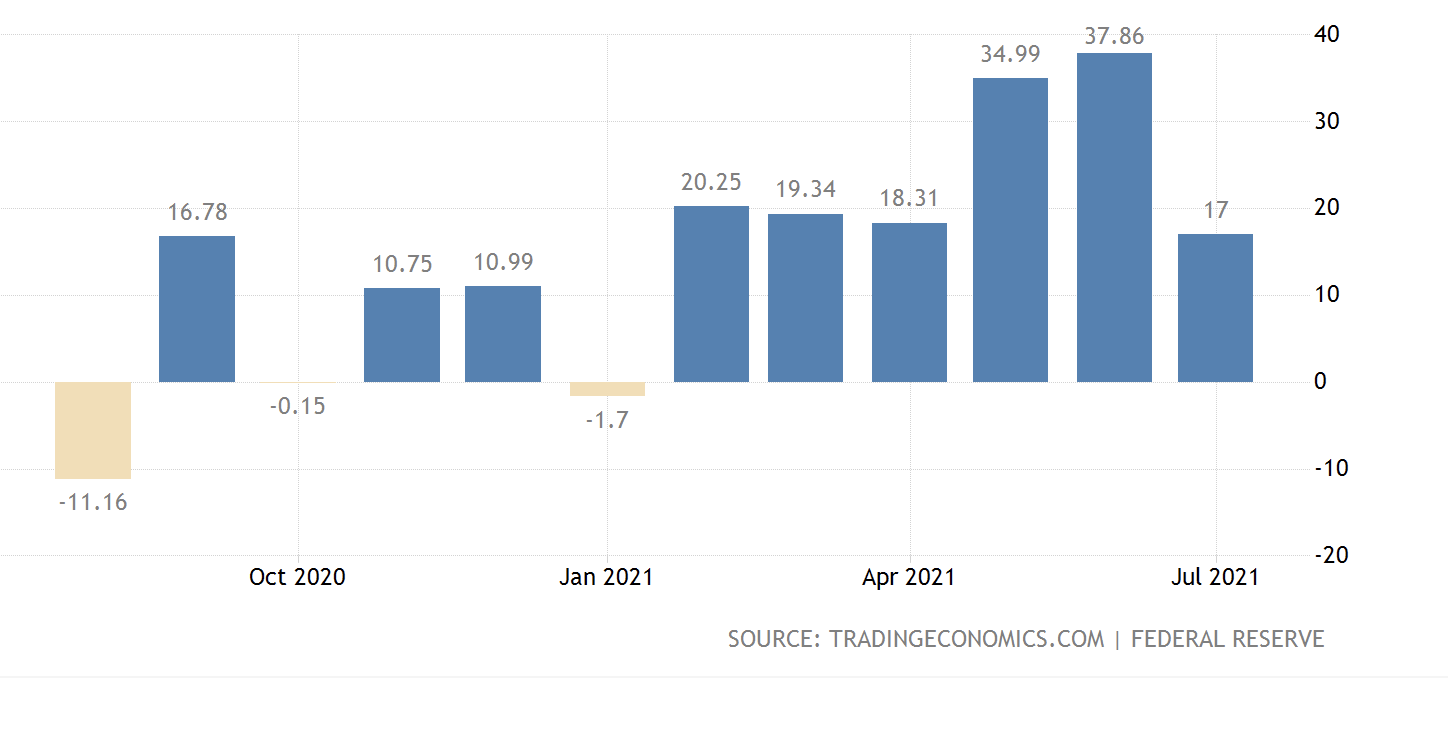

US Consumer Credit Growth declines significantly.

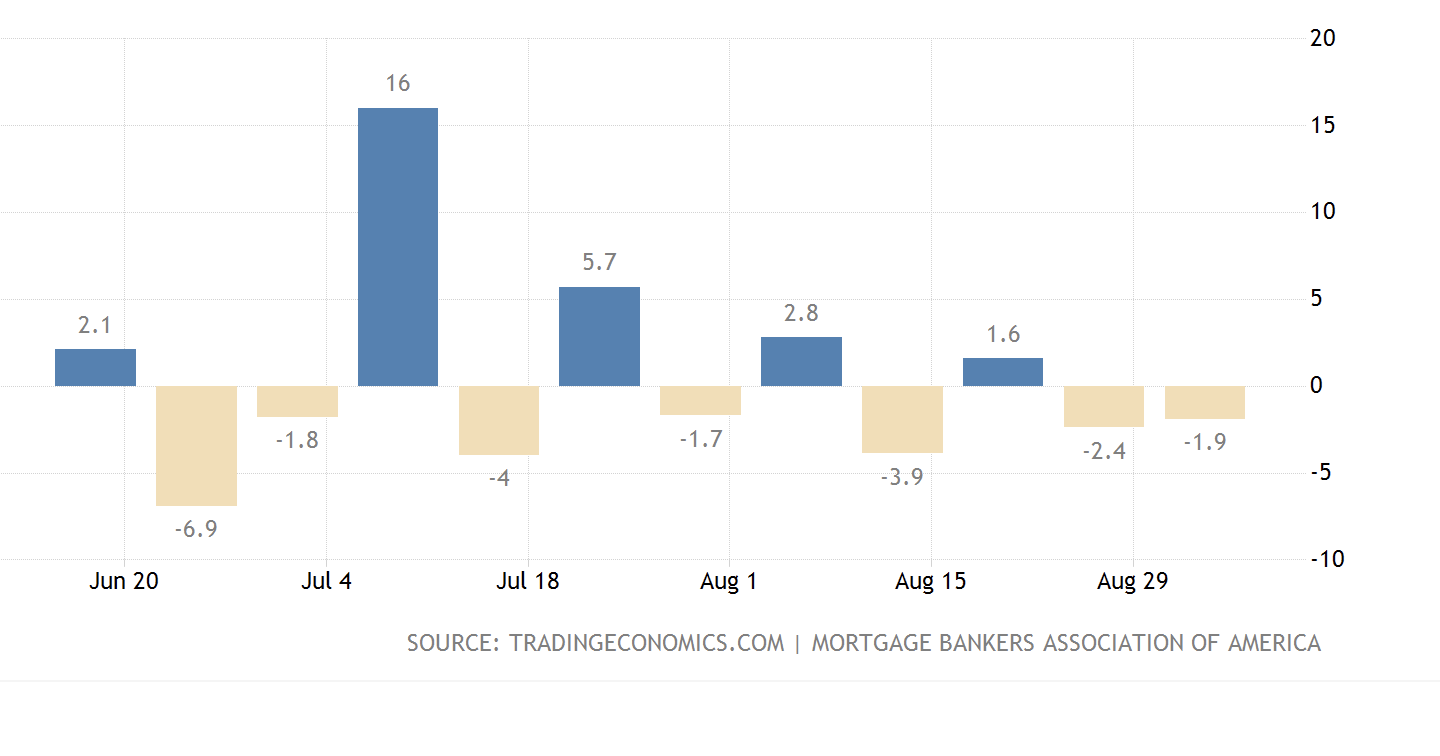

US Mortgage Applications point to a property price bubble about to burst.

Russian Inflation continues to climb.

The wild beast of inflation, freedom of pricing for businesses, is everywhere.

Australian 10 Year Bond Yields trending higher.

As governments like Australia scramble to pay for their stimulus indulgences, there will be somewhere with reasonable yield for investors to safely put their money. An equity negative, once a magical tipping point is reached. Where caution over equities becomes so profound, and safe bond yields so attractive, that everyone rushes for the exit.

What I have got wrong in the short term is Gold, This is a significant pullback. I am, and remain, bullish Gold for the long term. The initial process is a global unwinding of risk pressuring the commodity with others. Where Gold will shine, is as a safe haven, if things continue to deteriorate further.

The view on Australia remains Recession, an economy that will have a protracted and struggling recovery to get back to anywhere near trend growth. Alongside equities and currency that are far too highly valued by recent market sentiment.