BUY GOLD SELL AUS

- Clifford Bennett, Chief Economist at ACY Securities

- 23.08.2021 07:45 am trading

Market Trading Alert

It is not possible to trade and invest in markets at the moment, without taking into account the rise of Delta around the world.

For Australia, the economic shutdown is intensifying.

What is happening in Australia, may be a pattern that will be repeated elsewhere.

This is all happening just when governments and investors were expecting the world to be emerging from the health risk, as well as enjoying a re-opening of the global economy.

There is no doubting the gathering storm clouds.

Australia

All of NSW, Victoria and the ACT are in lockdown.

Queensland will be brought to its knees, with the loss of both international and southern state travellers now total.

South Australia, Western Australia doing well to stay out of the shutdown list for now. Northern Territory as well.

However, the bulk of the Australian economy is at a standstill. Stimulus measures are appropriately targeted and more minimalist than previously. The great shopping splurge will not be seen this time around.

While we have been forecasting a recession from two weeks ago, the rest of the market has been operating on a cloud somewhere. Thinking everything we would be OK. We would bounce back quickly. It is just not happening, and to be honest never was.

This is important, because despite all the forewarning of this recession, the market is not positioned at all for the economic calamity un-folding.

The economic pain and tragedy in the community is real and growing fast. Forget sharp recovery ideas Australia is in a recession and possibly a protracted one.

On the positive side, we have the tools and strategies to hedge our portfolios succesfully.

GOLD

It does have a slight look of wanting to roll over back toward the 1750 area. Such movement, I would feel, was still part of an overall bullish construct.

The potential for Gold is enormous. Perhaps $2,500.

The big picture outlook remains that large quantum consolidation pattern we spoke of last week.

In this nearer term picture above, we have already seen what I believe to be only the first wave of a significantly bullish phase. In Elliot terms, this is the wave two consolidation phase. Will it be shallow, or see that pullback potential mentioned.

This as an excellent market to develop a footing as a hedge against a slower global economy and greater supply chain disruption. The Delta strain surge continues apace.

A very muted attempt at recovery so far. The US market did have a good bounce, but also showed signs of that perhaps not lasting very long at all. The Australian market continued to languish.

The mood seems to be, stay away from that dangerous medium term pivot point around 7400. At this point, it looks like a far too powerful magnet however.

With case numbers rising in all the lockdown states, and a problematic focus on vaccinations as a solve all solution, the Australian market seems very over-valued here.

Coming on top of rolling over commodity prices and China moving more stridently to reduce drastically its reliance on Australian iron ore, it is difficult to see any early Monday rally lasting very long at all.

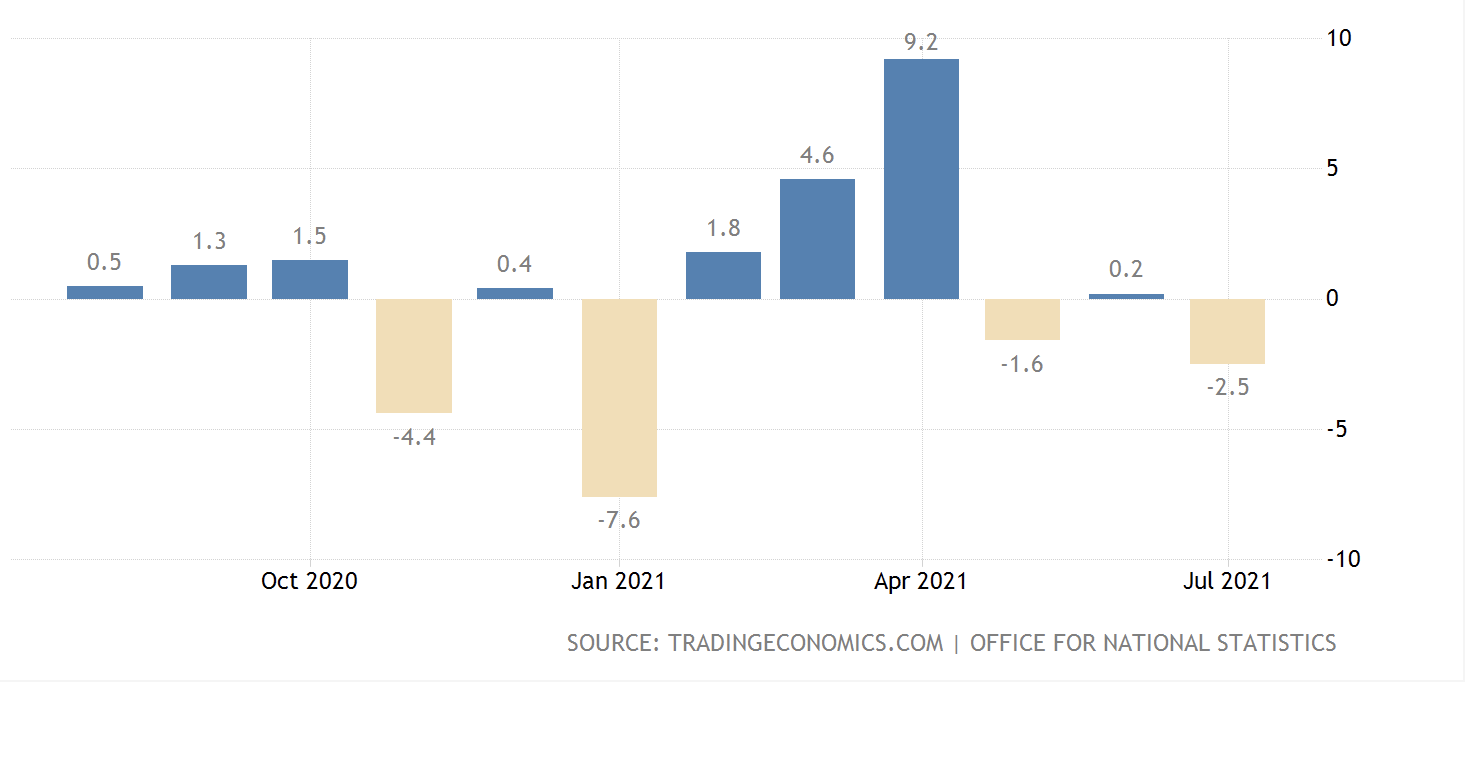

UK Retail Sales

Back into a serious weakening phas. Despite the momentary relief seen as the economy re-opened.

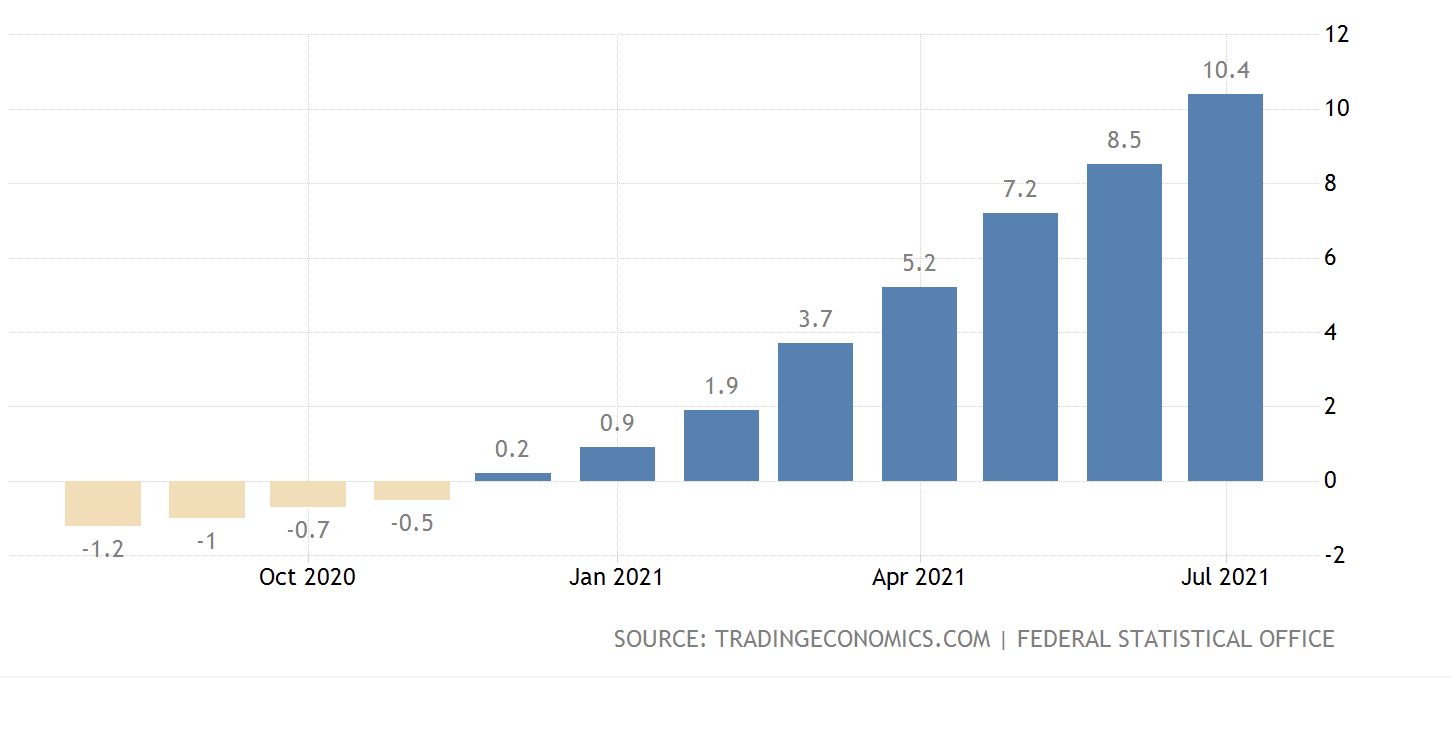

German Producer Prices

Rising to 25 year highs. The global inflation wave is only beginning to build.

The world may also be facing the return of Donald Trump.

Such are the failures of the current administration in regard to Delta, Afghanistan and the economy. The economy is now near per-coved levels. However, with over 5 million fewer jobs, this is a lot of votes given the broader family impact this has.

While, I am not calling such an eventuality at this point, the perfect scenario for the Trump team was always going to be Biden to drop the ball on the economy, and for any other possible blunder.

None of these policy issues are straight forward, but in the end, it is simple voter perception of such events that matters. There is definitely a shift away from Biden. If the Republicans offer up Trump as their candidate, voters will have a bizarre choice to make at the next Presidential election. It is a few years away, but is becoming increasingly curious in nature.

And could be ever more divisive.

Overall, despite Friday's strength in the US, this week could be one of caution among investors across several markets. Any further shift toward US and/or global economy downside hedging, could see Gold gather pace rather quickly.

It is difficult to see any bullish aspect to the Australian stock market. That hasn't stopped the market previously, from being blindly optimistic. The real pressure in the economy to the downside this time however, is becoming highly visible.

High Vis warning jackets for all.

Clifford Bennett

Friday's video click image or use link: https://youtu.be/cEh8kG9UX2A