Australian Recession to Intensify Fed Minutes Confirm Tapering Forecast

- Clifford Bennett, Chief Economist at ACY Securities

- 19.08.2021 11:00 am trading

Good morning, With 57 new cases in Victoria today, all of South East Australia will remain shut down for an extended period. The Australian recession we were the first to call, is happening. Stocks are currently falling as forecast.

The US Federal Reserve minutes have also confirmed our forecast of a few months ago, that the Fed would begin tapering this year. In fact, at any moment now.

snapVIEW

The Australian market, is, to use a trader's term... tanking.

This is precisely what it should be doing.

The Australian economy is not only already in recession, though the data will not confirm this belatedly until early next year, but this recession will both intensify and extend across the time horizon, as Delta begins to hit and move like a freight train. This is not what any one wants, but to keep one's head in the sand believing what we want to believe, would be a tragic investment error.

US stocks are certainly exhibiting that 'exhaustion of buyers' downside look. This is when significant corrections, mini-crashes can occur. The Fed minutes are being touted as the catalyst, and many will be looking to buy the dip, but any bounce should probably be sold. This is likely the beginning of a sustained decline. Possibly of greater quantum than any would prefer.

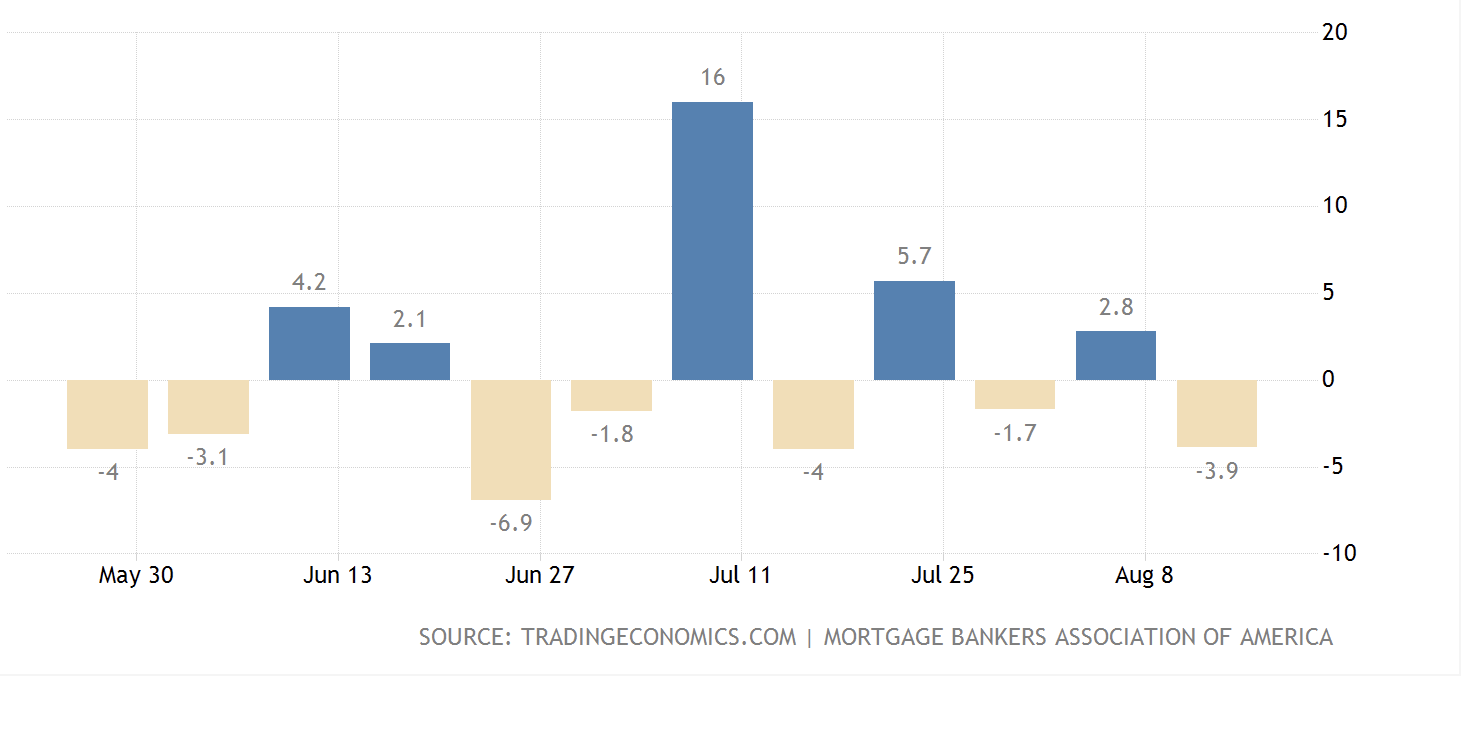

US Mortgage Applications

Bouncing around, but extremely concerning. Again, the US housing bubble burst we have been warning of for some time is unfolding before our eyes. Other commentators seem caught speechless.

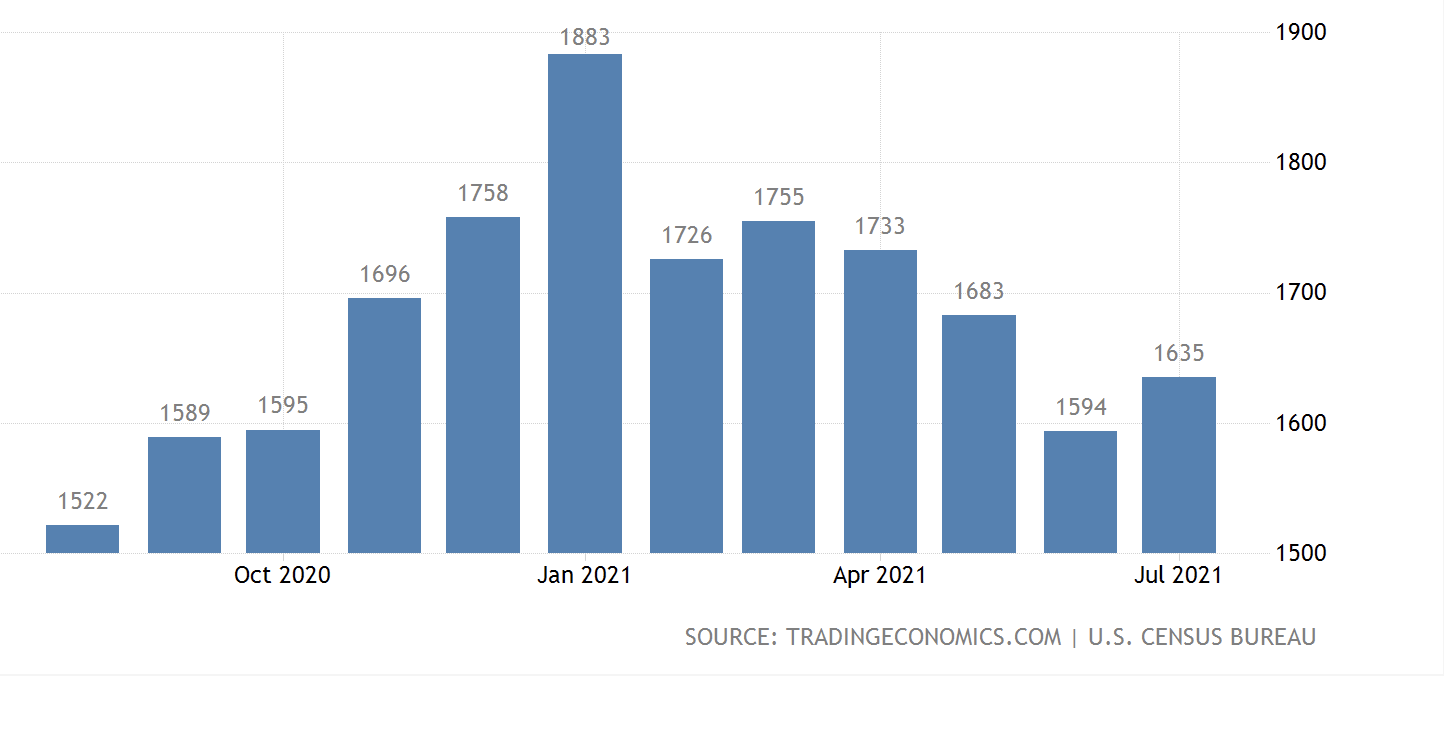

US Building Permits

Remain in a softening trend and again of concern.

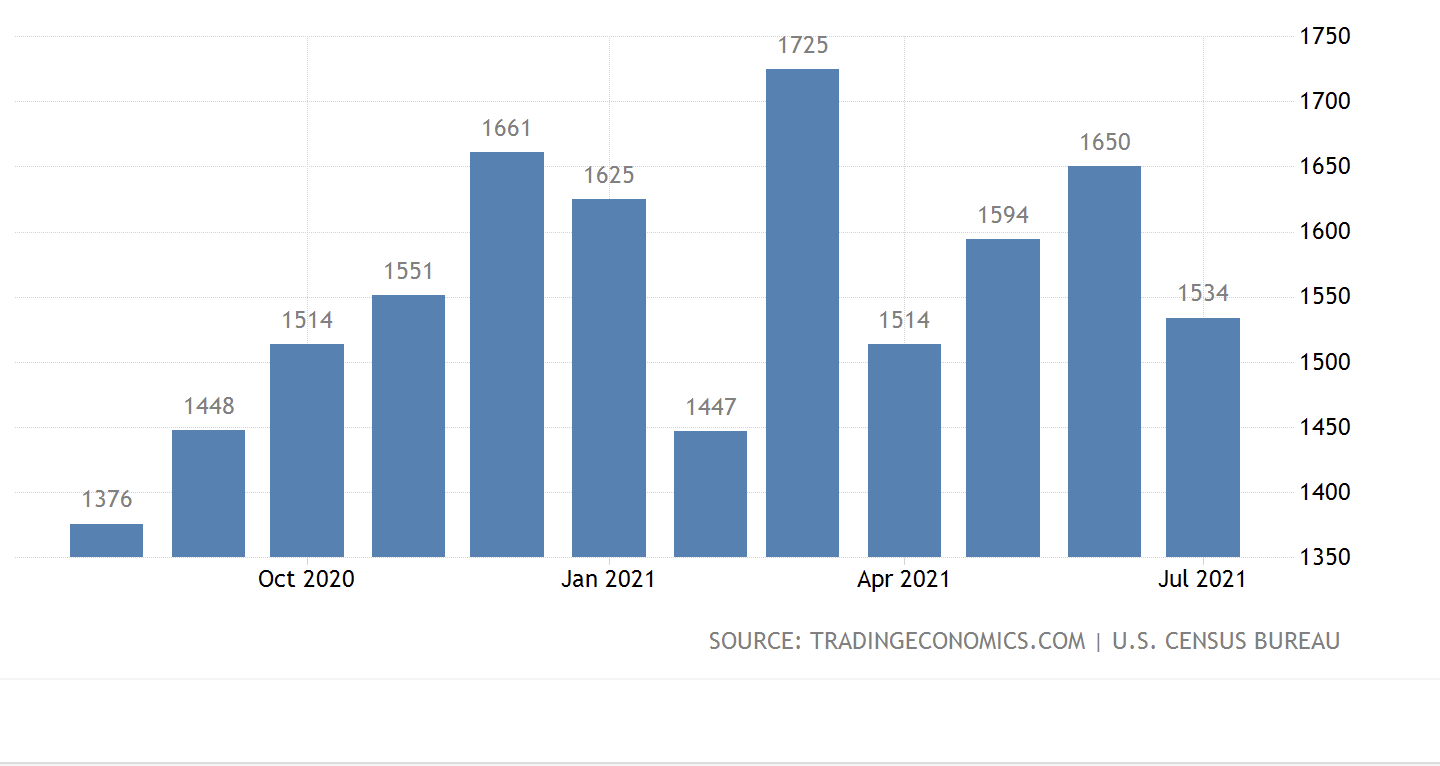

US Housing Starts

Quite a sharp drop. Housing bubble bursting.

The silence on all this in the US, though occasionally has had a mention in the Wall Street Journal, is simply due to the pain of the 2007/09 bubble.

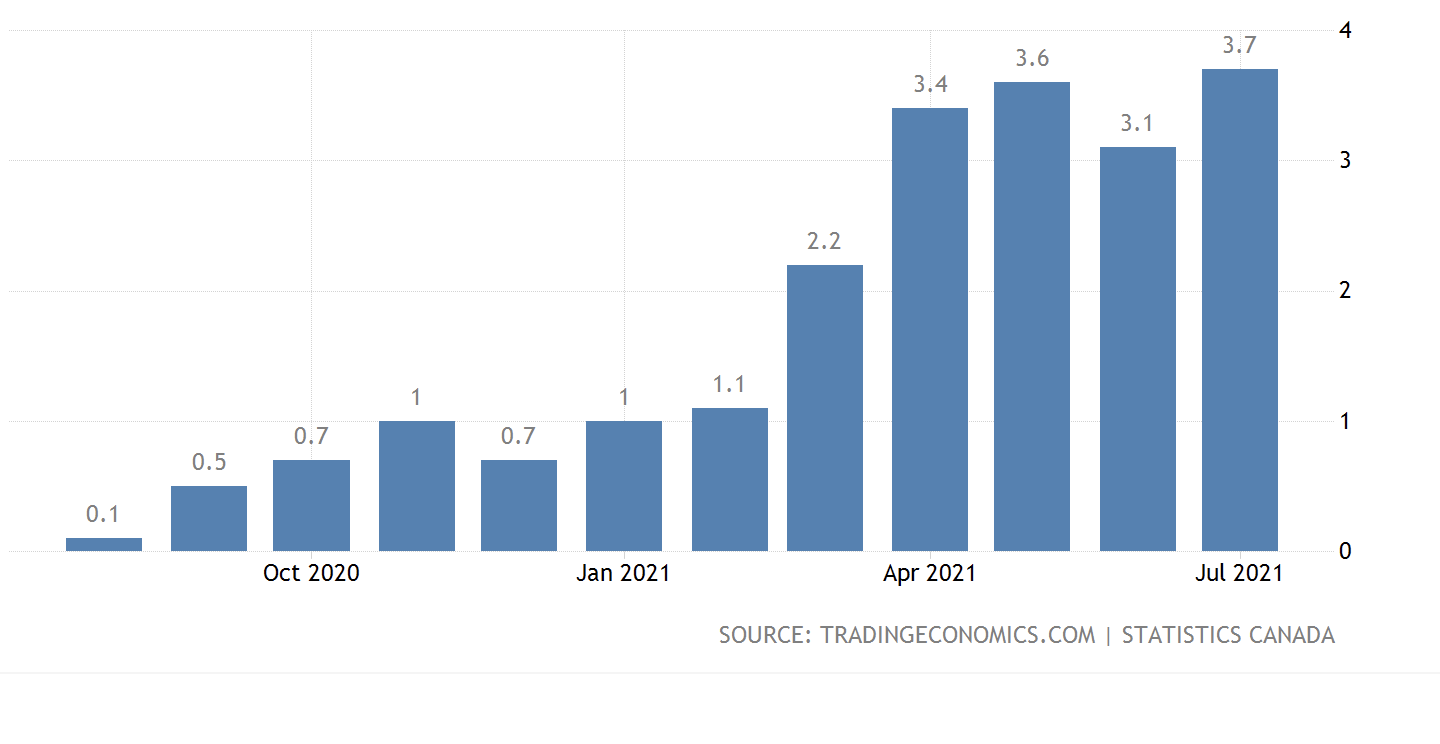

Canada Inflation

Remaining firm, and likely to start higher just like the USA, Australia and the rest of the world will.

Fed officials expressed a range of views on the appropriate pace of tapering asset purchases, but most noted that it could be appropriate to start reducing the pace of asset purchases this year.

Federal Reserve playing catch up to the obvious.

Well behind the curve.

US500

Vital support for maintenance of the dominant sentiment belief of buying the dip, is at 4370. A decline through there, in the days or weeks ahead, would be serious indication of a large quantum correction having begun. The one we have been warning of for some time.

Another sharp drop is likely imminent. Any momentary upward correction, should be seen as a hedging opportunity.

Gold the one that shines

Continues to be favoured as possibly the next big thing. Remaining firm in the face of a rising US dollar.

Australian dollar

Under extreme pressure. Can drop precipitously at any time.

Targets .7000 .6850.

Our central themes continue to unfold unfortunately.

Delta surging globally, and intensifying in Australia.

US inflation higher than others expected, and likely to continue at high levels for the next 1-2 years. The Federal Reserve is behind the curve. and this will result in a more damaging hiking cycle further down the track. Tapering to begin immediately as forecast.

Australian recession. We are in it, and it gets worse. Australian dollar and stocks to have severe declines.

Whatever we can imagine, we can do way more.

Click on image or use this link to watch now: https://youtu.be/2noUhOgdNIY