Another Day, Another Dollar, Gains Melt as Yields Fall

- Michael Moran , Senior Currency Strategist at ACY Securities

- 21.05.2021 04:45 am trading

Philly Fed Index Slumps; Up Next, Global Sales, PMI’s

Summary: “What a difference a day makes!”, the English lyrics of a popular tune in the 50’s swirled around in this writer’s head. Another day, another Dollar. Currencies bounced back strongly led by the risk leading Aussie, which gained back 0.8% to 0.7772 (0.7727) against the Greenback. A slump in the Philadelphia Fed regional business activity in May to 31.5 from 50.2 in the prior month (vs f/c at 40.8) pushed US bond yields, and the Dollar lower against its Rivals. The yield on the benchmark US 10-Year Treasury fell 5 basis points to 1.63% after hitting 1.69% yesterday. Despite hints of taper talk from the Fed in June, recent US data disappointments could delay any changes. Meantime, other global bond yields stayed flat. The Euro climbed back above 1.22 to settle at 1.2225 (1.2175). Sterling rose 0.58% to 1.4188 (1.4125). Against the Yen, the Greenback slid 0.45% to 108.77 from 109.22. The Dollar tumbled against the Swiss Franc (USD/CHF) to 0.8977 (0.9037). In contrast to that of its US counterpart, Switzerland’s 10-year yield rose 1 basis point to -0.19%. In early Sydney, the Greenback was lower against most Asian currencies. USD/SGD slipped 0.28% to 1.3305 (1.3350). Against China’s Offshore Yuan, the Dollar (USD/CNH) eased to 6.4310 from 6.4370.

Yesterday’s economic calendar saw Australian Employment unexpectedly drop by 30,600 jobs, although full-time employment increased. Australia’s Jobless Rate improved in April, with a fall to 5.5% from 5.6%. Japan’s Core Machinery Orders in April rose 3.7%, missing forecasts for a 5.1% increase. The UK Confederation of British Industry’s Order Expectations Diffusion Index climbed to 17.0 beating forecast of 0.0. Canada’s ADP (Private Sector) created 351,300 jobs in April after a downwardly revised March figure of 266,700 (from 634,800). Claims from individuals for Unemployment Benefits in the US improved, falling to 444,000 from 478,000 the previous week. The US Conference Board Leading Index (LEI) rose to 1.6% in April from 1.3% in March, beating estimates at 1.3%. Wall Street stocks rebounded as risk appetite improved. The DOW added 0.70% to close at 34,095 (33,865) while the S&P 500 rose 1.10% to 4,157 (4,112).

- AUD/USD – Despite the unexpected drop in Australia’s Employment for April (-30,600), improvements in the Unemployment Rate (5.5% from 5.6%) and a rise in full-time jobs lifted the Battler 0.8% against the Greenback. Overnight AUD/USD hit a peak at 0.77813 before easing to settle at 0.7772 in early Sydney and 0.7727 yesterday.

- EUR/USD – The shared currency reversed its slide against the Dollar, rebounding to 1.2225 from 1.2175. Germany’s 10-year Bund yield was unchanged at -0.11%, while US 10-year rates slid 5 basis points. Overall USD weakness also buoyed the Euro.

- GBP/USD – Sterling bulls returned with a vengeance following a paring of GBP longs yesterday. The British Pound bounced back to 1.4188 (1.4122 yesterday). Upbeat UK CBI Orders Expectations data contrasted with a fall in US Philly business activity. Which saw GBP/USD buyers return.

- USD/JPY – The Dollar fell back against the Japanese Yen weighed by the fall in the US 10-year bond yield. USD/JPY was last at 108.77 (109.22 yesterday). Overnight low for the Dollar was 408.747 Yen.

On the Lookout: Economic reports released today are huge for the market with Manufacturing and Services PMI’s from Australia, Japan, Europe, the Eurozone, Britain, Canada, and the US. Australia, the UK, and Canada release the latest Retail Sales reports. Today’s data dump kicks off with Australia’s Manufacturing and Services PMI’s were just released with Manufacturing PMI at 59.9, from 59.8 while Services were a touch lower at 58.2 from 58.8. Sales in Australia are expected to ease to 0.5% from the previous 1.3%. Japan releases its Flash Manufacturing PMI as well as National Core CPI reports. Europe sees the release French, German and Eurozone Flash Manufacturing and Services PMI’s. Analysts are looking for mostly good numbers from the rest of the globe. Sales data are expected to ease from the previous month. Analysts are looking for Britain’s Retail Sales to dip to 4.5% from 5.4%. Canada releases its April Retail Sales reports with both Headline and Core data forecast to fall to 2.3% from 4.8%. Eurozone Consumer Confidence (f/c -7 from -8) round up Europe’s reports. Finally, the US releases its Flash Manufacturing and Services PMI’s, and Existing Home Sales reports.

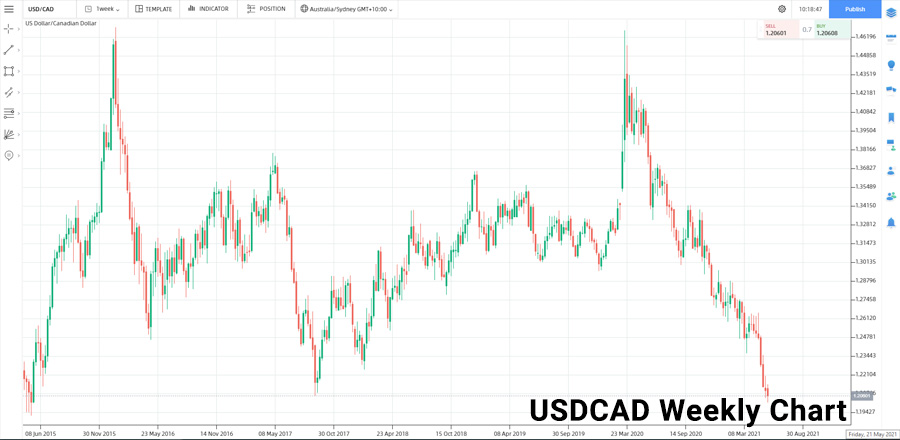

(Source: Finlogix.com)

Trading Perspective: What a difference a day makes indeed. The pendelum has swung back in favour of the currencies following another disappointment in US data. A drop in the US 10-year bond yield to 1.63% from 1.695 a week ago pulled the rug under the Dollar. Today boils down to the release of global and US PMI’s. Analysts generally expect stronger global PMI’s while the numbers in the US are forecast slightly easier. If the numbers justify the expectations, Dollar selling will intensify. However, any disappointments could see the currencies, where speculators continue to carry long bets, see a scramble back into the Greenback. Makes for a lively Friday, a fitting end to a lively week.

- EUR/USD – The shared currency ends the week on a bullish note above 1.22, currently settling at 1.2226. The Euro has immediate resistance at 1.2230/40 (overnight high traded 1.22282). The next level of resistance can be found at 1.2270 and 1.2300. Support on the day can be found at 1.2200 and 1.2170 (overnight low 1.21688). European and Eurozone PMIs are expected to be good, which may already be built into the Euro at current levels. Look for the Euro to stay supported first-up with a likely range of 1.2180-1.2240. The risk lies in a disappointment, which could frighten the long Euro speculators.

- GBP/USD – Sterling bulls returned to the British currency with renewed appetite lifting the Pound to 1.41924 before settling at 1.4188. Better-than-expected UK CBI Orders Expectations contrasted with the fall in the Philly Fed’s business activity which saw Sterling stay on the front foot against the Greenback. Immediate resistance lies at 1.4200, 1.4230 and 1.4250. Support can be found at 1.4150 and 1.4120 and 1.4100. Ahead of today’s release of UK Sales and PMI’s, expect GBP/USD to trade a likely 1.4150-1.4200.

- AUD/USD – The Aussie bounced back on the overall weaker Greenback, lower US yields and the market’s risk-on stance. AUD/USD traded to an overnight high at 0.77813, settling at 0.7772 in early trade. Markets reacted favourably to the overall picture painted by Australia’s Jobs report. Immediate resistance for the Aussie Battler lies at 0.7800 followed by 0.7830. Support can be found at 0.7750 and 0.7710. Expect a likely trade today of 0.7750-0.7800. Next potential mover may be Australia’s Retail Sales report (11.30 am Sydney).

- USD/CAD – The Dollar slipped against the Canadian Loonie to 1.2060 from 1.2124 yesterday. While Canada’s ADP Jobs gains were less than analysts had expected, nationwide house prices rose 1.9% from 1.1% previously, and beating estimates of 1.2%. The Loonie shrugged off a slump in Oil prices (Brent Crude Oil fell 2.6% to USD 64.95 (USD 66.70). Canada’s Retail Sales (both Headline and Core) are forecast to drop to 2.3% from a previous 4.8% because the country was mostly in lockdown last month. Current restrictions are expected to remain in place for the time being. USD/CAD has immediate support at 1.2050 (overnight low 1.2049) and 1.2010. Immediate resistance can be found at 1.2100 and 1.2140. Look for a likely trading range of 1.2050-1.2150 today. With USD/CAD near September 2017 lows, the risk is for a spike with shorts being squeezed on a Canadian retail sales miss and a better-than-expected result for US PMIs.

The end of the working week may well be another day, and another Dollar day. It will be a busy day for data releases. Expectations for global PMIs are mostly good. The risk is for a disappointment which could very well see the currency bulls heading for the exits. Happy trading and Friday all.