Leveraging Blockchain to Facilitate Instant Payments

- Soumya Kuber, Senior Consultant, Banking & Financial Services at Mindtree

- 26.12.2016 07:30 am Blockchain , Soumya is a Senior Business Analyst / Consultant with 10+ years of experience working with European and American giants in the fields of Banking & Financial services, Aerospace & Defence, Communications, Media & Entertainment verticals; with significant exposure to Business Process Management

Immediate payments is the need of the hour today. With instant payments, you have a transaction that takes place within seconds without error, also with an immediate confirmation to the buyer and the seller.

In my previous blog, I have elucidated some use cases for Instant payments for Consumers and Business.

Modern businesses, are turning towards more efficient ways of managing the transaction processing as they prefer faster and real time fund availability by paying minimal fees. The key focus of Business is predominantly on making payments faster while eliminating fraud and creating a transparent ecosystem.

Many banks are exploring Blockchain as a potential technology to cut costs of their immensely expensive payment-processing infrastructure and cumbersome back office systems that would improve the transparency of financial transactions.

For example: Settlements: Blockchain could simplify and streamline the trade processes in asset management systems by providing an automated trade lifecycle where all parties in the transaction would have access to the exact same data regarding a trade. This would lead to considerable infrastructural cost savings, effective data management and transparency, faster processing cycles, minimal reconciliation and the likely elimination of brokers and intermediaries overall.

Are Blockchain solutions the best fit to make the payments process more efficient and transparent for consumers? This blog is an attempt to uncover the same.

WHY BLOCKCHAIN?

The Blockchain is a distributed database that provides an unalterable, (semi-)public record of digital transactions. Each block aggregates a timestamped batch of transactions to be included in the ledger/Blockchain. Each block is identified by a cryptographic signature. These blocks are all back-linked; which means, they refer to the signature of the previous block in the chain, and that chain can be traced all the way back to the very first block created. Per se, the Blockchain contains an un-editable record of all the transactions made. It is instant, virtually un-hackable, fully automated, end-to-end transaction system built on a private permission-based network.

Public & Private Blockchains

A public Blockchain is one that anyone in the world can read, anyone in the world can send transactions to and expect to see them included if they are valid, and anyone in the world can part-take in the consensus process – the process for determining what blocks get added to the chain and what the current state is. As a substitute for centralized or quasi-centralized trust, public Blockchains are secured by crypto-economics – the combination of economic incentives and cryptographic verification using mechanisms such as proof of work or proof of stake, following a general principle that the degree to which someone can have an influence in the consensus process is proportional to the quantity of economic resources that they can bring to bear. These Blockchains are generally considered to be “fully decentralized”.

A fully private Blockchain is one where write permissions are kept centralized to one organization. Read permissions may be public or restricted to an arbitrary extent. Prospective applications include database management, auditing, etc. that are internal to a single company, and hence public readability may not be necessary in many cases at all, though in other cases public auditability is desired.

Lately, larger banks and financial institutions have shown more interest in private Blockchains especially for Fraud prevention that is a major concern.

The public Blockchain, particularly for financial institutions, poses governance system and standards issues and unknowns, which potentially opens the door for a host of potential security concerns.

Blockchain is expected to enable businesses to eliminate unnecessary, and also expensive, intermediaries and significantly reduce processing time from days to near real time.

Such a system would not only aid banks to eliminate costly overheads, but would provide a lower-cost money transfer product attractive to large multi-national organizations with high frequent cross-border funding and transactions.

By removing central intermediaries, streamlining connections between counterparties and recording data on a tamper-proof block chain, the distributed ledger technology has the potential to improve speed, transparency and efficiency with which payments are made.

Connected consumers increasingly expect to be able to buy and pay anywhere at any time today. Consequently, digitalization is changing how people do business and is creating possibilities for payment systems.

The Blockchain solutions are intended to make the payments process more efficient and transparent for consumers. Blockchain targets Peer-to-Peer ecosystems, which implies that no intermediary will exist between the payer and the payee).

For example: The Blockchain-based Ripple network transfers value within seconds, which makes it virtually instantaneous.

Some Use Cases

Blockchain is used for transferring money in cryptocurrencies. It can also be used for numerous other transactions, such as securities transfers, property/land registrations, documentation/ collateral management and many more. It represents a ground-breaking manner to register and transfer any digitally represented value in a secure and decentralized manner; so in the future it might revolutionize the banking & financial industry.

1. For companies that are able to use a Blockchain implementation, it may allow them to save a considerable amount of time out of their payroll processes.

- With Blockchain, the time taken to credit salaries for a company’s employees can be reduced to Near Real Time (NRT) due to the sheer ability to put transactions onto Blockchain and enable payments clearance almost instantly.

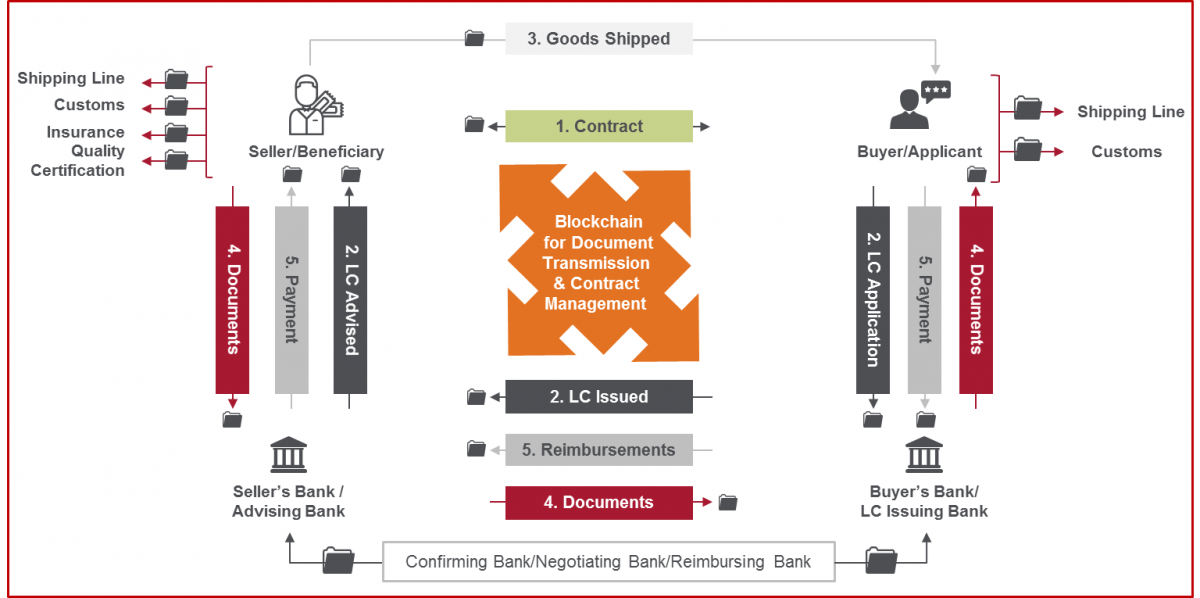

2. Trade Finance use case – Letter of credit transaction:

Enabling Letter of Credit transactions (document transmission and smart contracts) involving multiple parties across various phases.

Business benefits:

- Easy and Faster Document Management & transmission

- Document traceability

- More transparency

- Fraud prevention

- Real time access to document across involved parties

- Faster Letter of Credit payments as per smart contracts

- Reduced cost of transactions

3. Cross Border Payments: While it may be important for companies to be able to send quick payments nationally, sending cross-border payments on an international level in a timely and cost effective manner is vital.

- Companies especially exposed to currency fluctuations can benefit with Blockchain to consumers with speedy remittances and other payments.

- Faster payments need to be screened for fraudulent transactions, as the desire to make payments as fast as possible also needs to guard against fraudulent transactions.

4. Eliminating fraudulent transactions such as an intentional double send can also be prevented by taking into account the aspects of the transactions on the network.

- Blockchain will help to determine whether a transaction is connected to peers, and thereby compute whether this transaction is going to be cleared.

- If the score is very high, the companies can flag this transaction as secure and approve it to be cleared off and provide credit for this transaction.

- Conversely if the score is low, say less than 99%, the transaction can be flagged as a fraudulent one, and can be investigated further.

IMPLEMENTATION:

Blockchain technology uses facets of various disciplines, such as peer-to-peer (P2P) networking without central coordination, cryptography and game theory (strategic decision making).

Although Blockchain cannot overnight replace traditional payment and clearing systems; Regulators and innovators have a very delicate balance to keep in implementing Blockchain for faster payments.

- An in between approach could be taken, where the traditional architecture gets used for completing payments faster and a Blockchain network gets used for reporting and archival of transactions.

- This would help in achieving the dual purpose of speed and security. It would also mean that Blockchain would come in as a value add to the existing architecture and infrastructure of the central banks and clearing and settlement networks rather than as a complete replacement.

- The only thing that needs to be figured out would be costs, as institutions will have to maintain both the traditional and Blockchain networks.

- However at the same time, it would leverage the benefits of both the architectures, which would help reduce hacks, as well as achieve the financial objectives to prevent illicit money circulation.

- For Cross-Border payments - a predictive analysis based algorithm can be employed to check whether the likelihood of a transaction's confirmation and rating it with a score that can be generated. This can be examined against factors such as mining fees, quality of outputs the transaction is trying to spend, the type of signature and transaction propagation. Companies that are interested in implementing Blockchain can be provided with powerful analytics which predict areas vulnerable to ransomware attacks, thus helping them to be better equipped to meet these threats. Data analytics can also help provide dashboards and reports according to user preferences dashboards that display the potential areas where a ransomware attack is probable, so that this would help them to prepare well. This can provide important lessons for the company that can help them to map the most frequent APIs that are being used by the customers.

CHALLENGES:

The imperative question to ask is whether a decentralized payments system overcomes security, throughput, and other potential hurdles and presents a meaningful situation to the incumbents?

Instant payments and Blockchain complement each other. The infrastructure/architecture for immediate payments is still open to vulnerabilities and faces security issues. It is also currently uncertain if Blockchain is proficient in supporting significant retail payment traffic.

- Blockchain seems to overcome security concerns, but the speed of the completion of the transaction is a challenge initially. This is mainly because the transaction registration process in a Blockchain infrastructure is not as forthright as it is in a traditional database architecture.

- There is also a significant amount of cost involved in registering a transaction in a Blockchain network as compared to the traditional client-server architecture.

- Another issue that may arise is maintaining strict peer-to-peer structure in a large group. Despite proclaimed peer-to-peer principle, many intermediaries have appeared, including wallet providers and exchanges.

- As the anonymity makes it attractive for illegal organizations, advanced reporting and filtering system may be necessary for Blockchain in the future, but it will prove to be expensive.

- The question of implementation typically revolves around the security of vital transactions and how they need to be protected, validated and authorized.

- The scalability of Blockchain has not been properly tested due to the fact that the number of present-day Blockchain users is relatively small, while developed financial market is huge.

- Increasing the network of Blockchain users might even have an adverse impact on security – which is one of the cornerstones of the peer-to-peer technology as described previously.

- Each transaction per user is checked by many others concurrently, which is the basis of Blockchain security; more the transactions, fewer are the users that can check each of them.

- Contradictions between Blockchain & Instant Payments: Less cost and more speed happen to be the forte of instant payments, which gets violated by the Blockchain principle. Besides, the belief that computing power will increase in future to counter the complexity of Blockchain, resulting in transaction blocks being registered quicker, goes against the principles of Blockchain as it might become more open for tampering. Thus, as computing power increases, the complexity of the transaction block registration in the Blockchain network should also increase automatically.

For Example:

Payments players like SWIFT which have legacy systems in place have limited flexibility and face severe security threat, especially after the Bangladesh bank heist.

• In February 2016, instructions were issued to steal US$951 million from Bangladesh Bank, the central bank of Bangladesh via the SWIFT network. 5 transactions issued by hackers, worth $101 million and withdrawn from a Bangladesh Bank account at the Federal Reserve Bank of New York, succeeded, with $20 million traced to Sri Lanka (since recovered) and $81 million to the Philippines (about $18 million recovered. The Federal Reserve Bank of NY blocked the remaining thirty transactions, amounting to $850 million, at the request of Bangladesh Bank.

Blockchain in the Instant Payments World:

- A team of researchers at Royal Bank of Scotland (RBS) reports to have demonstrated that Blockchain technologies could support a new banking industry clearing system similar to the UK’s existing Faster Payments scheme. They built a clearing and settlement mechanism based on the Ethereum distributed ledger, codenamed Emerald. The aim of the project was to see whether Blockchain could be used for an international clearing system, where there is no central authority to regulate payments. To achieve this, RBS attempted to replicate a domestic clearing system – such as the UK’s Faster Payments – using a Blockchain distributed ledger. The test results evidenced a throughput of 100 payments per second, with six simulated banks, and a single trip mean time of three seconds and maximum time of eight seconds. This is the level appropriate for a national level domestic payments system.

- Circle announced that Blockchain payments can be made using the iMessage platform. The Blockchain company now allows Apple’s iMessage users to send payments in several currencies such as U.S. dollars, Euros and pounds sterling, via the instant messaging service. By adding the payments functionality to iMessage, users can now quickly send and receive payments without incurring any fees. Circle for Android also provides the same payments capability.

- Visa, BTL Group now offering Blockchain payment system: Visa has tested a system it created that would enable lenders to send funds using Blockchain tech. The testing has been going on for about a year-and-a-half and involves BTL Group’s technology, which helps process bank-to-bank payments. The Blockchain payment system may eventually rival SWIFT’s system, which allows banks to send messages and make large money transfers.

- MasterCard, Stripe partnership helps sellers receive payments faster: MasterCard and Stripe have partnered on an initiative to make marketplace payments faster. Stripe marketplace sellers can now receive payments more quickly. Stripe’s instant payouts solution has provided MasterCard Send with the capability of sending real-time payments.

CONCLUSION

• The vital inference is that cryptocurrencies are not a disruptive threat to the banks or card networks such as Visa/MasterCard, Money to Order models like Western Union) for cross border remittances, however that the impact will be more from its ability to open up newer markets and penetrate new customers.

• Banks in theory are well positioned to confront the changes triggered by the rise of distributed ledgers, but in practice the situation is more complex.

• A permissioned public ledger could remove the need for a central clearing house in the form of Visa and MasterCard. Nevertheless, the bank’s analysts still see limited risk to these card schemes, arguing that the decision by the likes of Apple to tap into their business will certainly them in a strong position.

• Regulatory and other hurdles may have forced most start-ups to partner with, rather than compete against, incumbent banks, but distributed ledgers will create winners and losers within the banking industry.