Pursuit of Immediate Payments: a Thought Paper

- Soumya Kuber, Senior Consultant, Banking & Financial Services at Mindtree

- 25.10.2016 09:45 am payments , Digitalisation , Soumya is a Senior Business Analyst / Consultant with 10+ years of experience working with European and American giants in the fields of Banking & Financial services, Aerospace & Defence, Communications, Media & Entertainment verticals; with significant exposure to Business Process Management

The digitalization of our economy, with the spread of smartphones and of electronic commerce, necessitates the payments industry to constantly level up. Emerging new technologies lead to changes in consumer habits, who are making online purchases on the go.

Instant payments, or ‘immediate’ or ‘real-time’ payments, are the new next step in the harmonization of payments aimed at supporting competitiveness and economic growth and will be the main focus in the next coming years.

Immediate payments can help address the demands of consumers who transact in real-time – this is also fueled by the ubiquity of connected devices that stimulate the consumer’s expectation for immediacy in Omni-channel. Digitization of the supply chain or Industry 4.0, or the “Fourth Industrial Revolution”—calls for real-time payments to be enabled for corporates that can help them gather data and analyze financial transactions data in real-time, derive financial insights, and help reduce the effort involved in reconciliation.

With customers increasingly expecting ease, speed, convenience, security and always-on processing for their payments transactions, the momentum behind immediate payments is now relentless.

Difference between Immediate Payments and Electronic Payments:

Instant payments are processed in near real time, while funds usually take up to one business day to reflect on a payee’s account in the case of credit transfers, and up to one business day or more in the case of card payments.

Today, the very large portion of electronic payments are processed via batch processing. All individual payment transactions received during a specific period of time during a business working day are grouped into a single batch file which is then submitted for further clearing and settlement usually at the end of day.

The processing of instant payments is distinct, as the processing, clearing and settlement of payments take place based on a transaction-by-transaction basis in real time as soon as they reach a PSP system.

Apart from meeting consumers’ rising expectations around payments, the banking industry is facing intense pressure to create ubiquitous immediate payments systems that can be used by all financial institutions globally. Immediate payments could become the new normal for banks, acting as the banking world’s response to payment initiatives from new competitors especially digital wallets such as V.me (Visa’s mobile wallet).

As these entrants pave their way into the payments market, supporting the progress towards immediate payments is becoming an imperative for banks. Failure to embrace and support immediate payments may put banks at risk of losing market share, relevance, customer relationships and revenues.

Some features of immediate payments

- 24x7 availability—consumers should be able to make or receive a payment at anytime / any day.

- Immediacy— Near real time/ real time availability of funds being transferred to the recipient’s account.

- Certainty—Real time notification to both payer and recipient that payment has been accepted or rejected by the recipient’s bank.

- Richer data standards— ISO 20022 is becoming the standard for financial processing, including for many of the new immediate payment systems - as data sets are standardized to enable greater interoperability, improve payment efficiency and carry richer information with the payment.

- Alias/proxy/tokens—In parallel to the demand for immediate payments, there is demand to proliferate ways to connect and transfer funds real-time. This requires the use of addressing databases linking aliases such as mobile phone numbers, email addresses, social media ids, or virtual account numbers to bank account information.

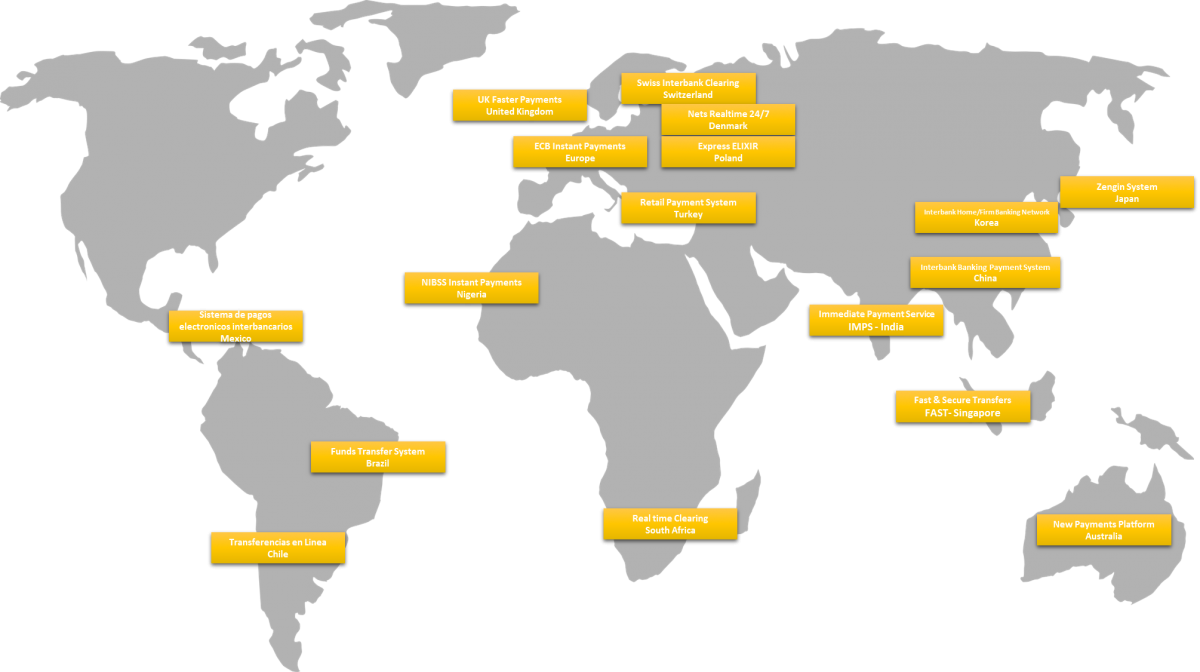

Immediate Payments – A global view of a few Instant Payments

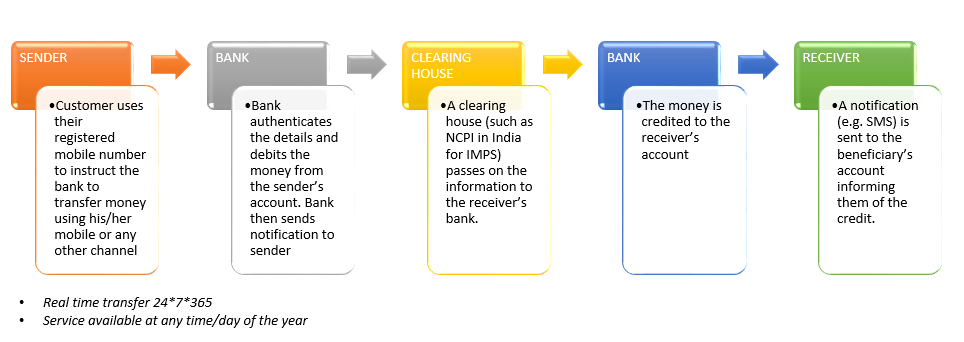

How does it work?

Immediate payments are electronic payment solutions available 24/7/365 resulting in the immediate or close-to-immediate interbank clearing of the transaction and crediting of the payee’s account with confirmation to the payer (within seconds of payment initiation). This is irrespective of the underlying payment instrument used (credit transfer, direct debit or payment card) and of the underlying arrangements for clearing (whether bilateral interbank clearing or clearing via infrastructures) and settlement (e.g. with guarantees or in real time) that make this possible.

Immediate payments are electronic payment solutions available 24/7/365 resulting in the immediate or close-to-immediate interbank clearing of the transaction and crediting of the payee’s account with confirmation to the payer (within seconds of payment initiation). This is irrespective of the underlying payment instrument used (credit transfer, direct debit or payment card) and of the underlying arrangements for clearing (whether bilateral interbank clearing or clearing via infrastructures) and settlement (e.g. with guarantees or in real time) that make this possible.

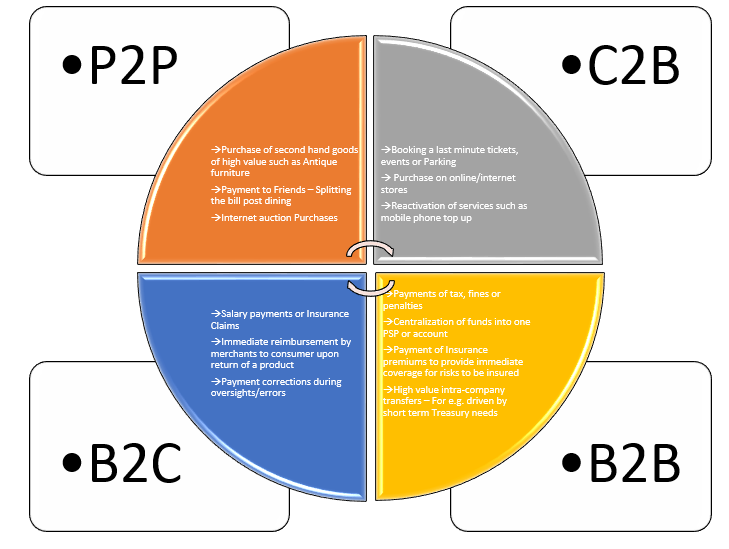

Categories of Real time Payments:

CATEGORY | DESCRIPTION | SIZE OF TRANSACTIONS | KEY CONSIDERATIONS |

Business to Business (B2B) | Supplier Payments | Low |

|

Business to Consumer (B2C) |

| Medium – High | |

Consumer to Business (C2B) |

| Medium – High | |

Domestic Peer to Peer (P2P) | Repayment for Friends/Family | Low – High | |

Cross Border Peer to Peer (P2P) | Remittance to Friends/Family | Medium – High |

Some examples of Fintech Payment Innovators:

Company | Founded in | Valuation in Billions (USD) |

Paypal | 1998 | 47.0 |

Klarna | 2005 | 2.3 |

Adyen | 2006 | 2.3 |

Braintree | 2007 | Sold to PayPal for $800m |

Mozido | 2008 | 2.4 |

Square | 2009 | 5.6 |

Venmo | 2009 | Sold to PayPal for $26m |

Stripe | 2010 | 5.0 |

Disruptive effects of immediate payments on the Banking Landscape

For an immediate payment product to support initiation and reporting in real-time to end customers in the value chain, many existing products and channels need to be attuned to enable the same.

The shift to immediate payments also has a ripple effect of accelerating other developments in payments channel and processes. For example: Introduction of alternative ids for banking and payments transactions, facilitating the use of smartphones communicating both peer-to-peer with each other and also with POS terminals using Bluetooth or near-field communications (NFC).

The most vital change required by the onset of immediate payments is a shift of service mindset for banks. Banks must step up to deliver payment related services to stay on top of the game. For retaining and winning customers in the future, banks must shift their entire product and service mindset towards immediate delivery.

Where legacy payments systems are concerned, the changes required for supporting immediate payments are wide-ranging.

- With systems having to operate in real time and be always available 24x7 every day of the year, any level of unavailability needs to be reduced to an absolute minimum.

- Core functions must be available on a continuous basis, with no planned maintenance downtime in order to deliver a minimum of 99.99% availability.

- The move to 24x7 operation also implies that currently common end-of-day processing must be restructured.

- The complexity increases manifold for banks operating in multiple domestic markets, by the need to support multiple immediate payment schemes using the same underlying core banking systems.

Immediate payments also impacts other key / peripheral components of the payments architecture landscape including initiation channels, payments order management, payment engines, core banking, fraud systems, document services and archiving systems.

Impacted product systems extend beyond current accounts, as consumers expect real-time transfers to/from other accounts such as savings accounts and credit card accounts. Such pervasive bearings within banks are mirrored by equally wide ranging impacts across corporate/public authority stakeholders and central clearing & settlement providers.

Impact of PSD2 on Immediate payments:

On October 8, 2015, the European Parliament adopted the European Commission proposal to create safer and more innovative European payments (PSD2). The new rules aim to better protect consumers when they pay online, promote the development and use of innovative online and mobile payments such as instant payments, and make cross-border European payment services safe. The objectives of PSD2 include:

- Standardising, integrating and improving payment efficiency in the European Union

- Offering better consumer protection

- Promoting innovation in the payments space and reducing costs

- Incorporating and providing clarity on the use of emerging payment methods such as mobile payments and online payments

- Create a equal playing field for payment service providers - enabling new companies to get into the payments space

- Harmonise pricing and improve security of payment processing across the European Union

- Incorporate new and emerging payment services into the regulation

Benefits of Immediate Payments

Consumers | Businesses/Government | Payment Service Providers (PSP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use Cases for Immediate Payments

Lessons Learnt

Markets that have gone through the pain of implementation have seen a surge in innovation to address a wide range of use cases, further spurring adoption by users. In particular, there appears to be a trend where demand for mobile payments is driving P2P real-time payments, which in turn are leading to consumer-to-business real-time payments.

- Start with a clear end-customer proposition, against which all functional and technical requirements are compared.

- Establish a broad reach for the initiatives as early as possible, building commitment from stakeholders to support the delivery of the agreed service proposition.

- Include fraud, compliance, risk and credit management experts at an early stage.

- Ensure early engagement with service users of all types—consumers, business, government, etc.

- Set strong communications strategy, vital for successful execution of the program.

- Anticipate strong demand and rapid transaction growth.

The way forward

As the roll-out of immediate payments schemes continues, banks that have yet to develop the capabilities required to participate in the real-time payments ecosystem should start doing so.

Moving to real-time payments generates new possibilities not just in consumer propositions but also across corporate cash management, mobile services for SMEs, and more. Banks should be moving now to identify these opportunities and develop ideas for addressing them. Wherever your bank is based, and wherever it operates, immediate payments is coming. It’s time to get ready for the real-time, everyday banking world.