New collaboration models in banking

- Thomas Pintelon, Co-founder at Capilever.com

- 03.09.2019 12:45 pm Banking

Bank offerings and customer expectations are evolving fast. For each specific client need, specific solutions need to be built, requiring lots of investments, IP and expertise. To keep up, banks can’t afford to reinvent the wheel every time. Therefore they are opening up, and welcoming the win-win collaboration with specialist third parties that can help them improve their offering. Depending on scope, those partners can be large (typically well-established core banking providers) or small (innovative niche service providers).

Boost innovation through collaboration

When banks have an open IT architecture they can more easily collaborate with other parties. Such open architectures allow easy integration of new value-added services, built and maintained by third party providers.

Over the last years, banks have created services on their back-ends, so that easy integration with a multitude of front-end channels is possible. These exposed back-end services can just as well be used to plug in third-party innovative software packages and even SaaS solutions with expertise and IP in a specific domain.

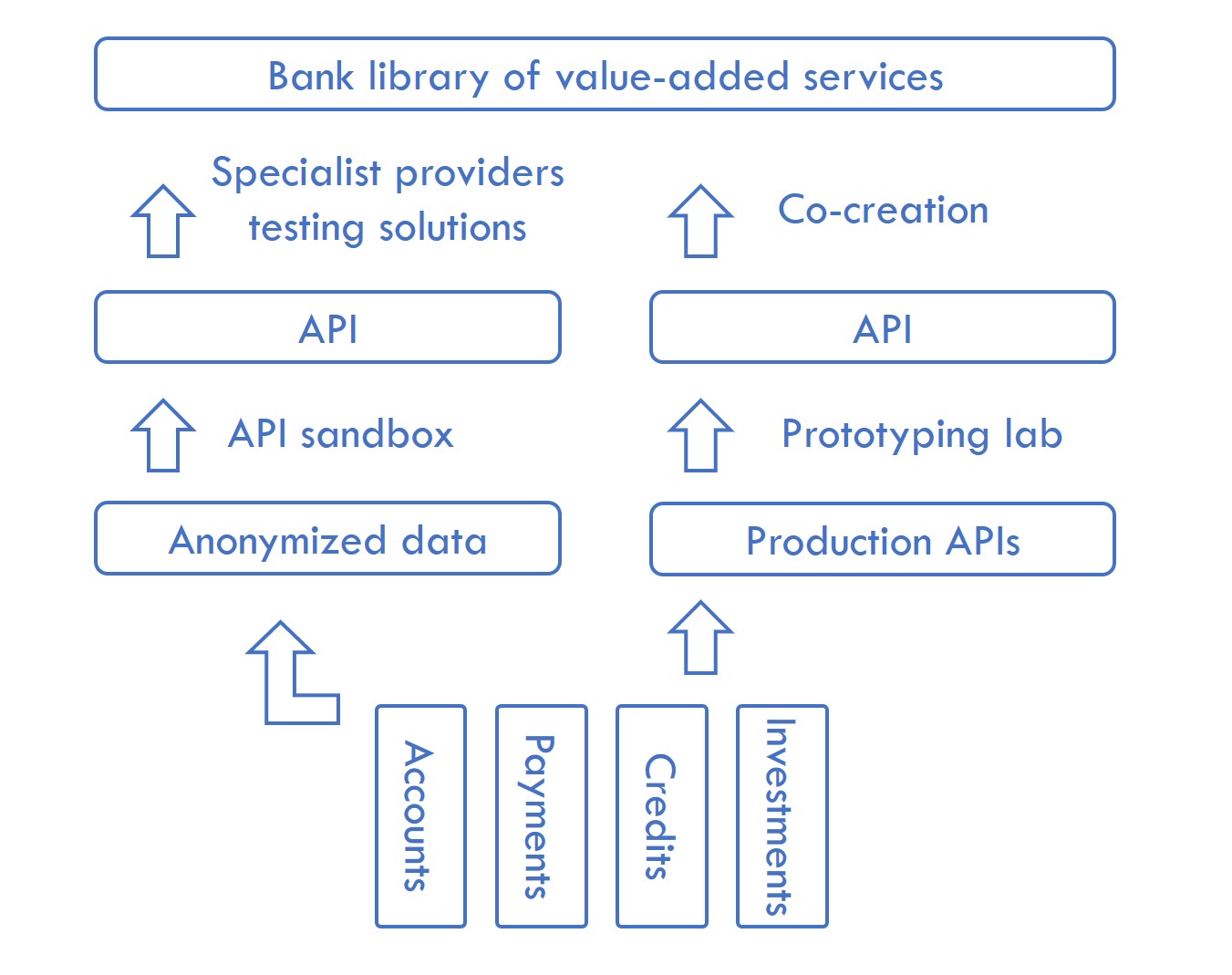

By following this strategy, banks ultimately create their own library of value-added services (or app store) targeted towards their customers, with a smart combination of internally developed solutions, and external innovation brought in by third party experts (for example via acquiring software packages, co-creation or integration of SaaS solutions, potentially tested via the bank API sandbox). Ultimately offering the best solution for each of their customer needs.

Participating in API marketplaces

Another source of innovation (and associated new business for banks) will originate from outside. API marketplaces for financial services are generating increasing revenues; some will cannibalize existing bank revenues, others will generate new bank revenues.

Depending on strategy and data/service monetization models, banks can decide opening up externally via API marketplaces. In these market places, banks can expose services for both back-end transaction fulfilment (for example PSD2 payment initiation) or front-end client engagement (for example a low-friction loan origination journey). This allows external providers to integrate some of these bank services in their offering (for example car loan origination by car dealer).

Opening up account and payment back-ends has been in scope of PSD2 / Open Banking v1, so most banks are ready for this. However lots of efforts are still required in other banking domains like credits and investments.

Let’s consider the example of PFM/BFM which is quite popular nowadays. Currently these solutions offer aggregation for accounts and payments, with advanced services like savings goals, budgeting techniques based on expense categories, forecasting, etc. Often credits and investments are however underexplored, with a lack of value-added services linked to credits (for example flexible financing solutions, review the traditional credit risk, credit scoring) or investments (for example investment advice, investment communities, innovative investment initiation, etc.).

Depending on the bank strategy for opening up, some of these cool offerings will be offered by external partners, others through the bank’s own channels, or by both.

Ultimately, consolidation of such API marketplaces in aggregated overlay-marketplaces / -hubs for the financial services industry allows third parties (and banks!) to reach multiple banks (and others like insurances etc.) through one API. And this is great, as it will allow all participants in this ecosystem to contribute towards the greatest and coolest services that end-customers will need and appreciate most.