An Innovative Financial Platform for Banking – Single Window Finance

- Saurabha Sahu, Senior Consultant at Mindtree

- 04.11.2016 07:30 am Banking

This document is intended towards Banks, Financial Regulatory Authority and the Information technology organizations, who are working towards the innovative solution providing for the financial ecosystem.

This document also will provide an innovative solution for an individual, Small Corporate, Proprietary and Partnership organizations, who are unable to manage their financials effectively and efficiently.

Today in this digitalized, Innovative and business oriented world people are looking out for a platform, where the financials can be managed in an efficient and better way. As we are aware everyone hold an account for managing their financials. People are holding different kind of accounts, like Savings, Investments, and Business etc. to facilitate their day today activities. Below are some of the situation how people maintain accounts at Banks:

- A single account with a Single Bank

- Multiple Accounts with a Single Bank

- One Account each at different Bank

- Multiple Accounts with Multiple Banks

1. Background/Problem Statement

In this competitive and business oriented environment, everyone wants to grow, make their business flourish in bright colors. Why Banks will be behind the race? Banks also do look out for business through their sales force. When the customer base of a bank increases, then automatically the business grows. Growing a business does not only mean tapping into new accounts or new customers but also cross-selling to existing customers and thereby increasing the wallet share. Banks always intend to provide a “BEST IN CLASS” service for achieving the highest customer satisfaction.

Today’s banks have key focus towards ensuring data privacy and security, which has become a major concern for a bank in terms of safeguarding customer information. Any loss of customer’s personal or financial data could prove to for a disastrous to the bank in terms of reputation as well as loss of business. Banks are enabling and promoting their own infrastructure landscape of applications for the customers to overcome these security concerns. Banks also provide a unique identity coupled with secure password for their customers to interact with the bank’s applications.

Looking from a customer perspective, each customers are provided with their specific user-id and password. Customers need to remember multiple user-ids and passwords, when they have multiple accounts maintained with multiple banks. Memorizing multiple user-id’s and passwords has become a challenging task for the customer.

As a joint effort of Information technology and Regulator of Banks, it is possible to overcome this problem.

Information technology companies can assist Banks to run a competitive and successful business, by creating innovative solution towards enabling banking services for customers. Regulator of Banks can enable and leverage the information technological solutions for achieving the future of Banking.

2. Solution:

Solution of above problem lies in providing a single window platform to the customer.

A single platform (interactive/effective/easy to use), which can provide customers to interlink all their bank accounts and provide a 360o (360 degree) view across all accounts. Customers can initiate any kind of transaction for any bank. Platform will be enabled with API (Application Program Interface) based request and response services. Each request and response can be traced starting from the initiation till the conclusion.

Customers need not login for a specific banking application (Online or Mobile Application) to initiate an instruction but can use the single platform for login purpose. Service will not be limited to Transfer or collection, it can also be extended as below:

Self-Initiated Request:

- Standing Instruction Request

- Domestic Liquidity Management Setup

- Cheque/ Check/ Giro Book Request

- Direct Debit Mandate Request

- Direct Pay (Transfer Request)

- Utility Bill Payments (Electricity /Insurance /Telephone)

- Loan repayments

- Buying from e-commerce sites

- Collecting funds from registered parties

- Statement request

A Single platform which can support the domestic financial market, Cross-Border Domestic as well as Cross-Border International ecosystem.

Please Note: Currently this solution is perceived only for Domestic Financial Ecosystem.

3.1 Business Use Cases:

Let us try to understand and comprehend the use cases for a single platform enabled services.

CASE – 1: Sample Use Case: (Without Declaring a Primary Bank)

Business Case:

Transfer of funds from one account to other, through another Bank.

- Customer has registered all the bank accounts as a single activity /one time setup.

- Customer holds multiple accounts at multiple Banks (Bank-A, Bank-B, Bank-C).

- All Bank accounts are present on the single platform.

- All the Banks are operating from a single country.

Process flow and Steps:

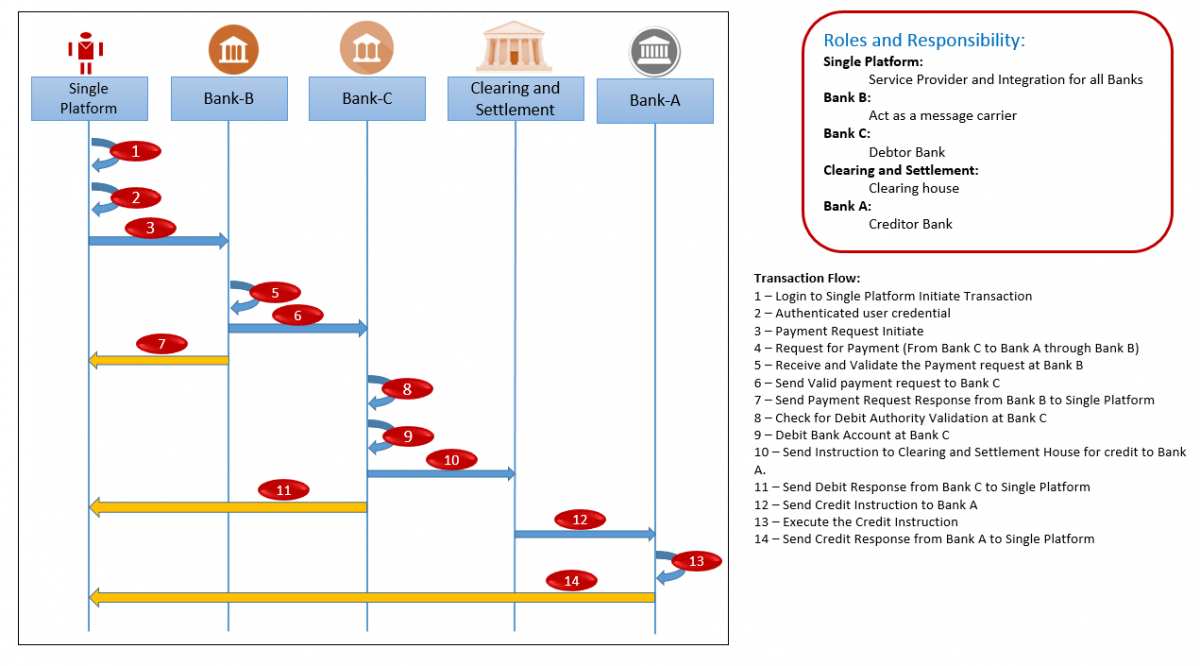

Figure 1: Transaction Process Flow: Without Declaring a Primary Bank

- Customer Login to the page Online /App of the Single Platform.

Please Note:

- Customer need to provide the User-Id and Password and select Bank B for authentication.

- Login with Bank B by providing the authenticated User-Id and Password.

Please Note:

- User-Id and Password authenticated by the Single Platform from the selected Bank B.

- Payment Request Initiate

- Request for Payment (From Bank C to Bank A through Bank B)

- Receive and Validate the Payment request at Bank B

- Send Valid payment request to Bank C

- Send Payment Request Response from Bank B to Single Platform

- Check for Debit Authority Validation at Bank C

- Debit Bank Account at Bank C

- Send Instruction to Clearing and Settlement House for credit to Bank A.

- Send Debit Response from Bank C to Single Platform

- Send Credit Instruction to Bank A

- Execute the Credit Instruction

- Send Credit Response from Bank A to Single Platform

CASE – 2: Sample Use Case: (Declaring a Primary Bank)

Business Case:

Transfer of funds from one account to other, through another Bank.

Description: “Customer can initiate a debit transaction from a Secondary Bank (B) to a Secondary Bank (C) for crediting to the Primary Bank (A)”

- Customer has registered all the bank accounts as a single activity / one time setup.

- Customer holds multiple accounts at multiple Banks (Bank-A, Bank-B, Bank-C).

- All Bank accounts are present on the single platform.

- Customer declared Bank-A as Primary.

- Customer declare Bank-B, and Bank-C as Secondary.

- All the Banks are operating from a single country.

Process flow and Steps:

Figure 2: Transaction Process Flow: Declaring a Primary Bank

- Customer Login to the page Online /App of the Single Platform.

Please Note:

- Customer need to provide the User-Id and Password for the Primary registered bank.

- Login with bank by providing the authenticated User-Id and Password.

Please Note:

- User-Id and Password authenticated by the Single Platform from the Primary Bank

- Payment Request Initiate

- Request for Payment (From Bank C to Bank A through Bank B)

- Receive and Validate the Payment request at Bank B

- Send Valid payment request to Bank C

- Send Payment Request Response from Bank B to Single Platform

- Check for Debit Authority Validation at Bank C

- Debit Bank Account at Bank C

- Send Instruction to Clearing and Settlement House for credit to Bank A.

- Send Debit Response from Bank C to Single Platform

- Send Credit Instruction to Bank A

- Execute the Credit Instruction

- Send Credit Response from Bank A to Single Platform

3.2 Additional Possible Use cases:

Below are some of the possible use cases through single window platform.

Self-Initiated Transfer Request: (Own Account Transfer)

- Transfer of fund from Primary Bank to any other Bank which is registered as secondary.

- Transfer of fund from Primary Bank to any an un-registered Bank.

- Transfer of fund from other Secondary Bank to Primary Bank.

- Transfer of fund from through Secondary Bank to Secondary Bank.

Self-Initiated Transfer Request: (Account Transfer other than self)

- Transfer of fund from through Primary/Secondary Bank for any other Beneficiary.

Self-Initiated Collection Request:

- Customer can initiate a collection request from Primary Bank.

- Customer can initiate a collection request from Secondary Bank.

3. Dependencies/ Limitations for Implementation:

Below are some of the dependencies and Limitations which is perceived.

- Banking Financial Regulatory will agree to provide this kind of unique platform.

- This innovative platform will be a success, when it is approved by the Banking Financial Regulatory.

- Banks need to agree to be a part of the single window platform.

4. Advantages of Single Window Banking:

This will provide enormous advantage and benefit to the financial ecosystem. Some of the Advantages can be noted:

- Customer can start using the Single Window of Banking for multiple Banks.

- No need to memorize multiple user id and password

- Authentication of Password credentials will be strong

- Reduction in fraud and Black Money circulation.

- Shared Infrastructure for all Banks, in turn will reduce the maintenance and operating cost.

- Imaginative Fund Wallet creation without taking the fund from Bank Account.

- Tracking and funds will be easy.

- Easy Liquidity Management (inter Bank and Intra account).

- Banks will have higher and healthy competition

- Easy and faster settlement of funds

- Bank can take service charges from customers, however transaction cost will be low.

5. Conclusion:

The amalgamation of Banking and Innovative Information Technology can bring new solution for customers and create a healthy financial ecosystem. The API based single platform can be one of the stepping stone towards the innovative solution of Financial Ecosystem. This will enable Banks to provide a “BEST IN CLASS” services for their customers and overall ecosystem.

Here is how various stake holders will work when a Single Window Banking is implemented –

Role of Customer:

- Application Based:

- Download the Single platform.

- Register for their Banks (Accounts)

- Declare Primary Bank (Optional)

- URL Based:

- Register for their Banks (Accounts)

- Declare Primary Bank (Optional)

Role of Bank:

- Enable API based request and response services for customer agreed services.

Role of Single Platform:

- Enable API based request and response services.

- Providing a support activity functional/Business (enquiry /per and post transaction status) and technical.

Role of Bank Regulators:

- Monitoring and tracking of financial ecosystem by enabling the functionalities for financial and non-financial service providers