AI, Machine Learning and Sentiment Analysis Applied to (i) Financial Markets (ii) Retail and Consumer Markets

- Dr. Richard Peterson,, CEO at MarketPsych

- 09.02.2018 09:00 am AI

This article was written by Dr. Richard Peterson, CEO of MarketPsych, and plenary speaker at the upcoming conference in India: “AI, Machine Learning and Sentiment Analysis Applied to (i) Financial Markets (ii) Retail and Consumer Markets”.

“Rip Van Winkle would be the ideal stock market investor,” Richard Thaler, the Nobel prize-winning behavioral economist, points out. He adds: “Rip could invest in the market before his nap and when he woke up 20 years later, he’d be happy. He would have been asleep through all the ups and downs in between. But few investors resemble Mr. Van Winkle. The more often an investor counts his money - or looks at the value of his mutual funds in the newspaper - the lower his risk tolerance.”

Indeed, it is difficult to use sentiment in investing precisely because as humans, we become caught up in the waves. Too often we are unconsciously influenced by the stories and beliefs of the herd, adopting them as our own.

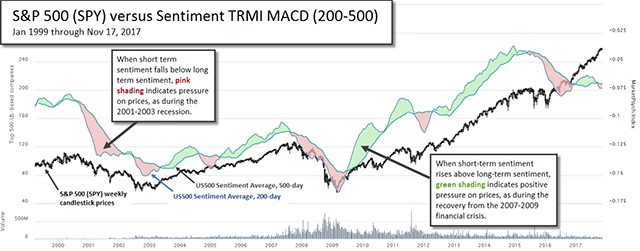

We can see a rough representation of the sentiment cycle using media sentiment averages. These seem to precede S&P 500 price movements since 1998. Below we can see that when the shorter-term moving average of sentiment (200 days) is greater than the longer term moving average (500 days), the market tends to rise. Those periods of more positive recent media are colored with green shading below. When the 200-day average is more negative, the market tends to follow to the downside (pink shading).

Fundamental human behavior is consistent across cultures. Consistent with that observation, this pattern is in evidence globally. The cycle that we see currently in the S&P 500 is also present — and profitable — in developed markets globally. Images of the remarkable predictive nature of this pattern are visible for Nikkei and Hang Seng indices.

Most developing markets respond to media sentiment more quickly than developed markets, and the 200- vs. 500-day moving average convergence divergence (MACD) appears too slow in the Bovespa and the China Composite. Perhaps these markets are driven more by short-term speculators than long-term investors or slow-moving institutions, and so the volatility is more violent. Consistent with that observation, the 30-90 MACD of sentiment seems to work best in China and Brazil.

In this currently bullish global market environment, investors should always keep in mind that when times are good, our reference point (expectations) rise, and we become susceptible to the “house money effect”. It is difficult to conceive of worsening conditions at such times. In truth, we ought to be most on alert precisely when everyone else is complacent.

Behavioral economist and psychiatrist Richard L. Peterson is CEO of MarketPsych, a training and sentiment analytics firm. To hear him speak more on these topics, attend the conference in Bangalore, India on 13 – 14 March 2018: AI, Machine Learning and Sentiment Analysis Applied to (i) Financial Markets (ii) Retail and Consumer Markets.