Capchase, a startup in the United States that assists entrepreneurs in obtaining non-dilutive capital, has raised $80 million in a Series B round led by 01 Advisors. The round was co-led by QED, Caffeinated Capital, Bling Capital, ScifiVC, Thomvest Ventures, Tusk Venture Partners, Invesco, and Gaingels.

All content with RSS

Visa today announced it has completed its acquisition of Tink – an open banking platform that enables financial institutions, fintechs and merchants to build financial products and services and move money. Through a single API, Tink enables its customers to move money, access aggregated financial data, and use smart financial services such as risk insights and account verification. Tink is integrated with more than 3,400 banks and financial institutions, reaching millions of bank customers across Europe.

Lunar, a Daniosh neobank, has raised €70 million in new capital to prepare for the launch of new crypto trading and business-to-business payments products. The new funding round follows the Nordic challenger's €210 million Series D funding round in July of last year. The firm has now raised a total of €345 million and is valued at just under €2 billion.

Consumer finance platform Lendable, based in London, has raised £210 million in a funding round led by the Ontario Teachers' Pension Plan Board. Lendable, founded in 2014, connects global institutional investors and borrowers across all major product categories, including loans, credit cards, and auto finance.

Acorns, the savings and investing app, has raised $300 million from private investors at a $1.9 billion valuation, after abandoning plans to go public via a Spac. According to CNBC, TPG led the Series F round, which included participation from BlackRock, Bain Capital Ventures, Galaxy Digital, and basketball star Kevin Durant's venture capital firm.

Lloyds Bank has invested £5 million for a 20% stake in invoice financing startup Satago and will roll out the platform for its Single Invoice Finance and whole of book Invoice Factoring customers.The deal with Satago follows a competitive tender process and a six month trial of the technology. Once deployed it will introduce a new digitised proposition for lending to the bank's SME customers.

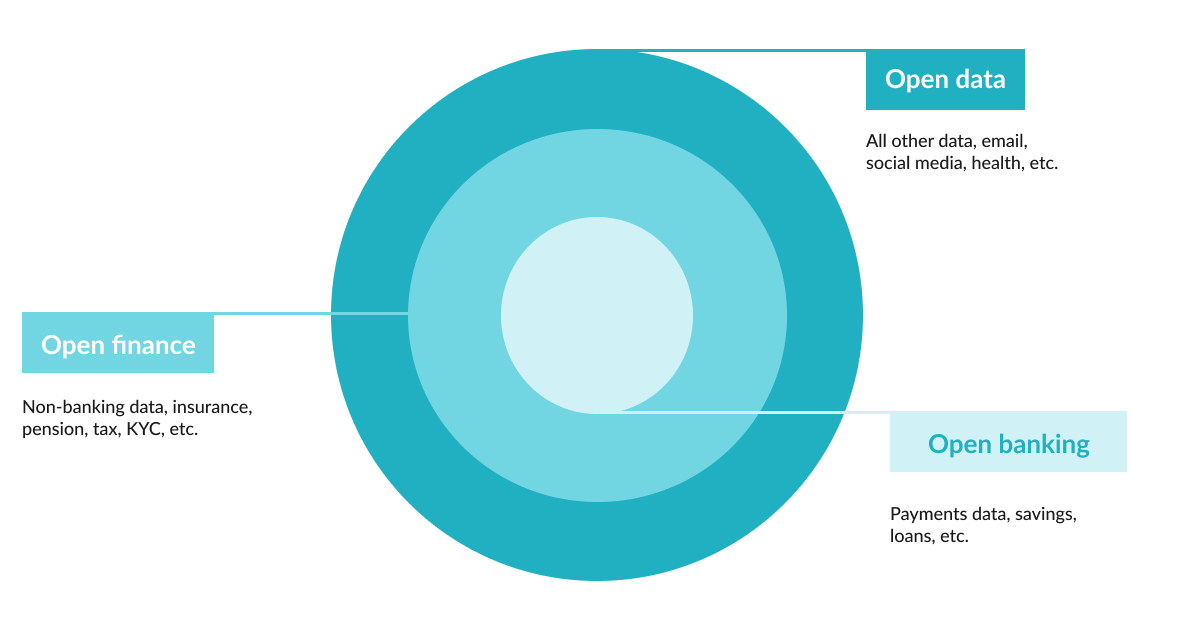

Although it hasn’t been long since open banking became a popular topic of debate, a new confusing term emerged – open finance. What is open finance and how is it different from open banking? Is open finance regulated by a legal framework? Let’s dive deeper into this concept and see how open finance can benefit individuals in the long run.

What is open finance?

Role to provide continued support for information security as Hyland accelerates its cloud-first vision

AstroPay, the online payment solution of choice of over five million users in the world, today announced the expansion of Payment Links across Latin America, now launching in Peru, Chile, Mexico and Colombia. This is part of the company’s plans to introduce it worldwide following the first launch in Brazil in December 2021.

Surecomp® today announced that it is partnering with the Global Legal Entity Identifier Foundation (GLEIF) - the Swiss-based organization which supports the implementation of the Legal Entity Identifier (LEI) and the availability of the Global LEI Index - to facilitate Know your Customer (KYC) compliance and provide customers with immediate certainty and authentication that the credentials of their trade counterparts are verified and trustworthy.