Product Profile

Screenshots

Product/Service Description

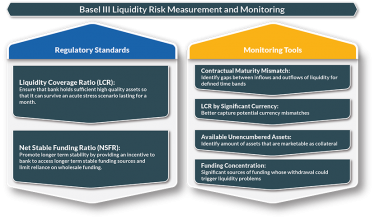

LCR aims to ensure that a bank maintains an adequate level of unencumbered, high-quality liquid assets that can be converted into cash to meet its liquidity needs for a 30 calendar day time horizon under a significantly severe liquidity stress scenario. Fintellix LCR covers all three aspects related to LCR, HQLA, Cash Inflows and Cash outflows, with an exhaustive coverage of banking products and securities with respect to LCR requirements.

The NSFR is designed to ensure that long term assets are funded with at least a minimum amount of stable liabilities in relation to their liquidity risk profiles. Equipped with tools for stable funding classification, Fintellix makes the bank’s ability to track, report and complete all NSFR related requirements seamlessly.

Customer Overview

Features

- Robust platform offering.

- Derived Dimension Engine for multiple classification requirements.

- Flexible Object element framework for assigning multiple types of weights based on Business Rules.

- Configurable business rules for all reporting logic.

- In-built Reporting

Benefits

- Flexible on-demand reporting.

- Extensibility and Scalability.

- Platform Agnostic.

- Improved Business Performance.