Product Profile

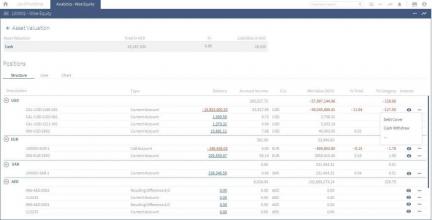

Screenshots & Video

Product/Service Description

Prospero is a comprehensive system that cover all apsects of financial operations: Wealth Management, Asset Management, Fund Administration and Independent Asset Management/Family Office.

Prospero allows for great productivity gains, in particular by giving access to your operations department to a system that will allow them to capture their transactions and administer their portfolios. It supports multi-language character sets, is multi-currency, and has checks field validation. It can also be accessible through the Web.

One of the main features of Prospero is its ability to adapt to new requirements of any financial institution easily and in an extremely flexible way without code change, but through user-defined table-driven rules.

All asset classes and investment products can be managed by Prospero: Equities, Fixed Income, Structured Products, IPOs, Private Equity, Funds, Real Estate and Derivatives.

Prospero is the ideal system to manage consolidation of portfolios, creation of family hierarchies, benchmarking, printing of statements, mirroring and monitoring of positions held with banks or with external asset managers. In addition, Prospero is delivered with an integrated report generator that gives the end user the ability to customize his/her reports.

Prospero is the first integrated financial system that places the client relationship and customer service at the center of the application. The benefits for the users are a significantly increased productivity and better service to their customers.

Customer Overview

Features

- Offers interfaces to other financial institutions and lets you consolidate assets held at those institutions

- Captures trades for online routing to brokers or banks--thereby eliminating faxes and double capture, making calls unnecessary, and offering a full audit trail of orders

- Lets you trade any kind of financial instrument and create single or bulk orders directly from investment plans

- Supports OTC instruments including Private Equity, Derivatives and Real Estate

- Allows you to create model portfolios and rebalance vs. a benchmark or another model portfolio

- Compares your performance to a benchmark or model portfolio and details performance attribution and contribution

- Lets you manage several portfolios sharing the same profile with a few clicks

- Warns you when investment restrictions are breached

- Updates all positions instantly in a single system

- Calculates fees and commissions, and compares them to those charged by other firms

- Calculates and tracks trailer fees on products and assets under management

- Can be accessed by clients online

- Stores all legal documents, including correspondence and financial plans, in one place

- Stores leads, client information, investment profiles, and contact reports in a CRM module

- Lets you add features and products as your requirements change

- Includes a flexible, graphical reporting feature that displays results and creates fact sheets and consolidated statements

- Gives your reports your firm’s look and feel and adds a personal touch to your client relationship

- Offers an integrated GL that support multiple accounting standards. The system may as well be interfaced with standard accounting packages.

Benefits

- Manage 360° information on prospects and clients

- Automate trading and operations

- Implement compliance rules and restrictions

- Slice and dice performance

- Integrated reporting and BI tool to customize your reports

Platform & Workflow

We are currently integrating AJGrid on our screen blotters to allow in-screen data manipulation. In addition, all report data is available on a separate database schema “Prospero_Reports” where any 3rd party application can connect to collect data.

Finally, the available REST APIs allow reporting systems to query directly the database for data mining.