Product Profile

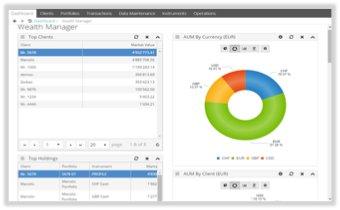

Screenshots

Product/Service Description

The IMSplus Investment Management platform (available on desktop, web and mobile) serves the BFSI industry with specialised solutions for each sector. IMSplus is built to offer flexibility and ease-of-use, fulfilling complex and evolving business requirements in the global Investment Management domain.IMSplus is an integrated, yet modular investment management platform that effectively supports the respective operations of any type of financial entity. Its range of advanced solutions serves: Wealth Management, Asset and Fund Management, Personal Banking and Brokerage, Custody, Insurance Investment Management and Family Offices. These solutions can be deployed as standalone installations or complement the institution’s existing infrastructure as there are ready-to-use interfaces to many 3rd party platforms and a flexible configuration is available to meet specific organizational needs.

Customer Overview

Features

- Multi-entity design, accommodating international operational models with full support for local business processes

- Full support for a wide set of instruments such as equities, bonds, funds, ETFs, term deposits, FX, derivatives, swaps, precious metals ,real estate and private equities

- Powerful, multi-currency management and reporting

- Multi-dimensional monitoring of performance, profitability and risk

- Dynamic transaction toolkit, providing easy customisation and adaptability

- Customer-centric philosophy with complete KYC and CRM tools compliant with local regulations

- Automated workflow environment, contributing significantly to paperless operations, rapid information exchange and a 360° view of all system entities

- Provision to serve clients over branches, call centers, the web and mobile devices

Benefits

- Cost reduction and profitability margins optimisation

- Close monitoring of all Investment Management operations and improved risk control

- Empowerment of sales and fast new product launches across multiple domains and borders

- Tailored services per client segment ensuring improved customer experience

- Gradual deployment options for fast, low cost and risk-free projects

- Rich functionality and state-of-the-art architecture securing scalability to meet any business change

- Technology- and vendor-independent integration capability

- Fast Return on Investment