The Rising Need for Database Monitoring in Financial Services

- Matt Hilbert, Technology writer at Redgate Software

- 25.09.2024 10:00 am #DatabaseMonitoring #FinancialServices

Every IT and data team in Financial Services is already faced with many challenges. They manage large database estates with Personally Identifiable Information (PII) that is particularly sensitive, requiring governance and process protection. They have to constantly adapt to changing customer expectations with better products, more seamless experiences, and five-nines availability. They’re expected to deliver new features and services quickly, while keeping data safe.

All of which would be enough to cope with, but the database landscape is changing, benchmarks are moving, and the stakes are becoming higher for those who want to remain competitive in an already competitive sector.

The results of those changes can be seen in Redgate’s 2024 State of the Database Landscape report. Based on a survey of over 3,800 IT professionals from businesses of every sector and size around the world, it explores the latest technology areas and issues that data professionals are now faced with.

The Financial Services edition of the report dives deeper into the data and its findings show that there are particular challenges – and opportunities – for those in the sector.

Database DevOps is becoming the norm

A significant finding of the Database Landscape report was that 73% of organizations have already adopted Database DevOps across some or all of their projects, or are planning to do so in the next two years. The key drivers for doing so are to increase the speed of delivery of database changes, enable the faster resolution of issues, and minimize application downtime.

For those in Financial Services, adoption rises further to 78%. Notably, 58% have already introduced Database DevOps in some form compared with 48% across other sectors, demonstrating the sector is well ahead of the curve. It should also be the benchmark that those in the sector should aim to achieve to remain on par with their peers.

High performing IT teams are releasing changes faster

The leading driver for introducing Database DevOps is to increase the speed of delivery of database changes, and it works too. DORA’s Accelerate State of DevOps Report has consistently found that high performing IT teams deploy changes faster and have a lower change failure rate.

Across all sectors in the Database Landscape report, 31% deploy database changes to production in one business day or less, but this rises to 36% in Financial Services. It rises yet further to 65% when looking at the time it takes to deploy changes in one week or less, compared with 53% across all sectors. This is a clear sign that IT teams in Financial Services which use advanced software development practices release value to their customers and their businesses sooner.

Multiple types of database are now in use

Over the last few years, there has been a marked increase in the take-up of multiple database platforms. 79% of organizations now use two or more different database platforms, for example, compared with 62% in 2020, and over 40% use four or more.

In Financial Services, it’s slightly different. Some do use more than four databases, but 72% use three or less, compared with 57% across other sectors. So while Financial Services organizations have moved to multi-database environments, they are doing so at a slower pace.

This is probably because much of the data they handle is relational transaction data which needs to be ACID compliant. It has to be Atomic, Consistent, Isolated and Durable in order for transactions to be reliable. Traditional relational databases like SQL Server, Oracle and MySQL are particularly known for their robust support of ACID transactions and are therefore more favored.

The cloud is becoming clearer

Almost every organization is now using the cloud in some way, prompted by the scalability and flexibility, high availability and reliability, and cost efficiencies it offers. Those in Financial Services are no different and 29% now host their production databases mostly or all in the cloud, compared with 36% across other sectors.

There’s a sign that not everything in Financial Service is moving to the cloud, however, with 42% planning a hybrid approach in the future compared with 36% elsewhere. It appears that there remains a preference in the mix for legacy on-premises databases which are mature, well-proven and stable, with consistent workloads.

Comprehensive, in-depth monitoring is now a requirement

The rise in the use of Database DevOps, the increase in the speed of database deployments, and the mix of multiple database platforms both on-premises and in the cloud, is highlighting a greater need for dedicated database monitoring in Financial Services. This was a standout highlight from the Financial Services edition of the Database Landscape report:

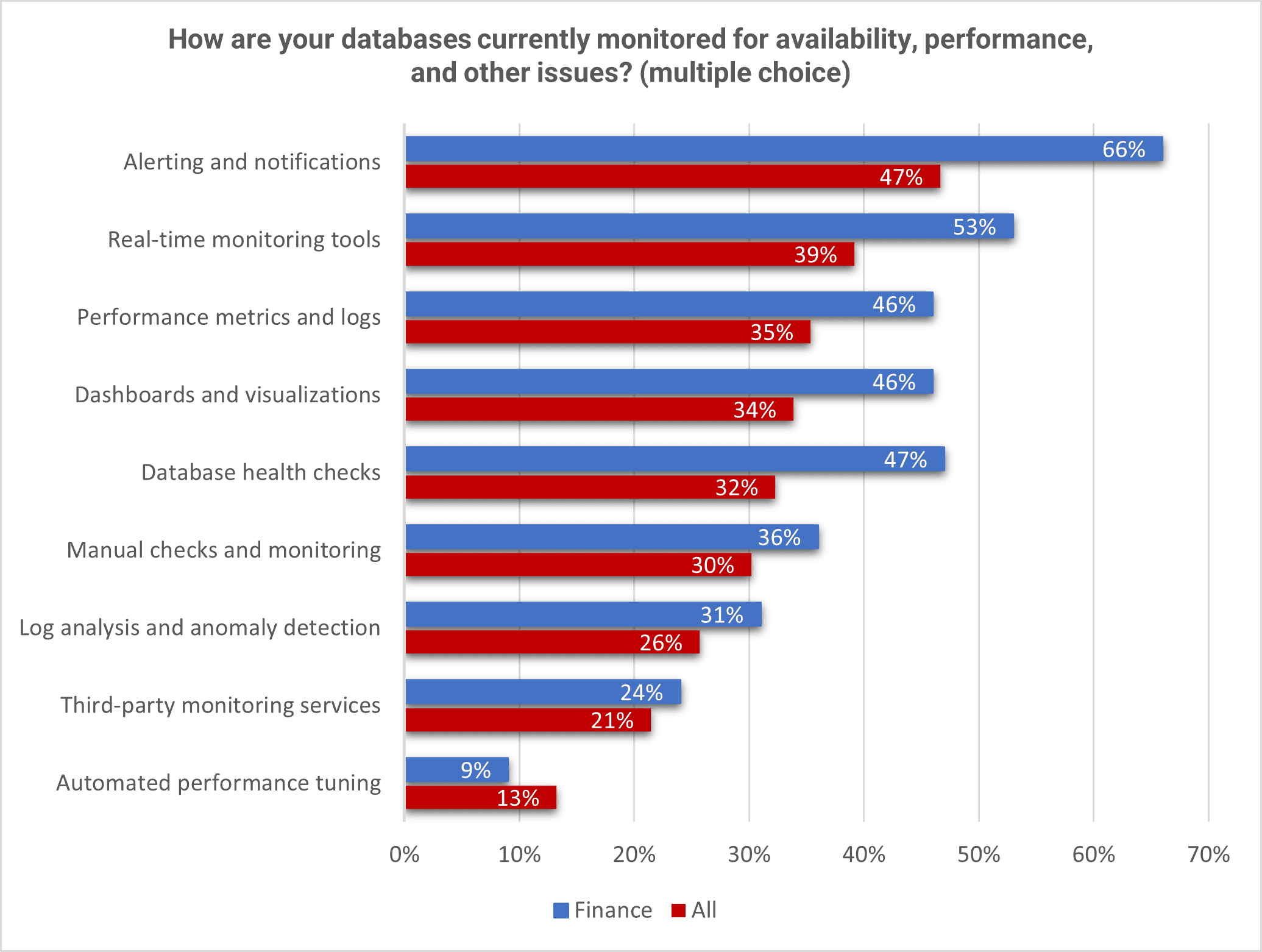

Just one glance at the bar chart tells the story – across every aspect of database monitoring apart from one, those in Financial Services monitor their databases more closely, more often and more comprehensively. Alerts and notifications, performance metrics and logs, database health checks, and log analysis and anomaly detection are all relied on far more. There is also significantly more use of real-time monitoring tools, dashboards and visualizations, and third-party monitoring services.

This is probably because, where multiple database platforms and cloud environments come into play, this is beyond the capability of basic infrastructure monitoring tools which cannot be expected to provide an estate-wide overview with comprehensive, deep-dive insights, customizable alerts and a consistent user experience across every database.

Instead, those in the sector need a monitoring solution that can monitor entire hybrid estates, whether on-premises, on Virtual Machines, or hosted on cloud platforms like Azure or AWS. It should also offer a clear, consistent picture across every platform, provide a standardized approach to monitoring any and every database, and provide a single pane of glass view of every server at a glance.

In this way, those in Financial Services IT can ensure they meet the more exacting demands for data integrity, compliance, performance, high availability and security that are expected in the sector.

To discover more about the importance of monitoring, read the article: How the Financial Services sector is moving to the cloud, and what it means for monitoring

For a closer consideration of monitoring tools, read the article: 5 things to look for in a database monitoring tool

To see how Redgate Monitor helps to optimize performance, ensure security, and mitigate potential risks with fast deep-dive analysis and customizable alerting, visit the resource page.