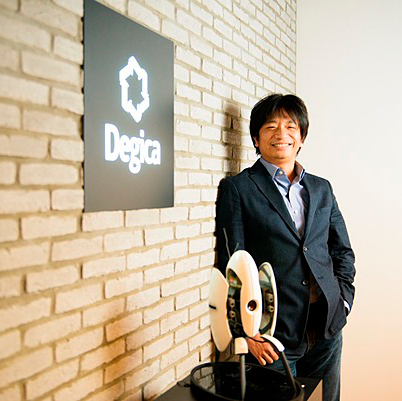

Can Payments Open Up Japan to Greater Internationalisation?

- Jack Momose, CEO at Degica

- 26.01.2022 03:30 pm #payments

With a wealthy population of more than 125 million and a healthy respect for goods produced in the US and Europe, it’s easy to see why Japan is an attractive market for western businesses looking to expand. Yet for many years now, the Japanese market has been left largely untapped by these companies. Why? Because it has long been a highly difficult market to enter from the outside.

This comes down to a few key challenges: physical distance, cultural differences, and the language barrier. The first of these is now perhaps the least concerning: the rise of a globalised e-commerce market has made it far easier to transact remotely. The other two challenges have proved more persistent. Japanese remains a language largely unfamiliar to most merchants in the west, yet it is a critical element in providing a smooth customer experience. In the absence of much wider uptake of Japanese in the west, technology is beginning to fill the gap, with translation functions rapidly growing in sophistication. In particular, new optical character recognition (OCR) technologies are now able to scan full pages, identify the text – even when embedded in images – and provide rapid, accurate translations and localisations, taking context and specifics into account.

That leaves cultural differences. Having acknowledged that Japanese perceptions of western goods and services are highly favourable, that makes the final hurdle to opening up Japan to international sales not a marketing one, but rather an issue with the last mile – payments.

Payment behaviours and preferences in Japan can be very different from their equivalents in Europe and the US. While on the face of it, card payments are still the most popular method, the majority (52%) are run through local providers such as the Japanese Credit Bureau (JCB) that are little known by merchants outside the country. What’s more, card transactions are just one of many other popular methods, often radically departing from the typical western models. Most notably, Japanese consumers are in the habit of settling online transactions in person at their local convenience store, or Konbini. Here the customer selects payment via Konbini at the online check-out, the online store notifies the customer’s chosen Konbini, and the customer has a certain amount of time to go to the Konbini and settle the transaction in cash, after which the goods are released.

Other solutions such as eWallet payments from a mobile device are also growing in popularity, ahead of markets in the west, with consumers increasingly choosing to pay by scanning a QR code on their phones. Appealing to a younger demographic, these solutions, offered by the likes of PayPay, LINE Pay and Merpay, also incorporate loyalty rewards that help make them a popular choice.

For western merchants, it can be an intimidating array of new payment methods to incorporate into their offerings. Yet, as technology advances, it is becoming markedly simpler for these businesses to onboard new payment methods in a straightforward way. Fintechs, for instance, are able to offer aggregation services that enable merchants to onboard a wide range of payment methods onto their platforms via a single technical integration, including methods unique to the Japanese market. This could be the key to overcoming the final barrier and opening up the Japanese market to the rest of the world.