Powell Waves Off Inflation Concerns; US Yields, Dollar Fall

- Michael Moran , Senior Currency Strategist at ACY Securities

- 30.08.2021 10:15 am trading

Aussie, Risk FX Take Off; Commodities, Equities Climb

Summary: US Federal Reserve President Jerome Powell sent the Dollar and bond yields tumbling in his speech at the Jackson Hole, Wyoming economic summit. Powell said that while recent rises in inflation are a cause for concern, they are likely to be temporary. In July, US policy makers said they believed that it could be appropriate to begin tapering this year. The benchmark US 10-year bond yield fell 4 basis points to 1.31%. A favourite gauge of the Dollar’s value against a basket of 6 foreign currencies, slid 0.41% to 92.67 from 93.05 on Friday. Risk appetite rose, while equities, commodities and resource currencies took off. The Australian Dollar outperformed, soaring 0.93% to settle at 0.7313 (0.7239). Against the Canadian Loonie, the Greenback slumped to 1.2612 from 1.2682, down 0.65%. The Kiwi (NZD/USD) rallied to close at 0.7012 (0.6950). Sterling rallied to 1.3760 (1.3698) while the Euro advanced 0.28% to 1.1797. The USD/JPY pair Dollar retreated 109.85 from 110.03, down 0.25%. Asian and Emerging Market currencies were all higher against the Greenback. USD/CNH (Dollar-Offshore Chinese Yuan) retreated to 6.4625 at the New York close, from 6.4845 on Friday. Against the Singapore Dollar the Greenback slid to 1.3458 (1.3550).

The DOW settled at 35,455 from 35,242 while the S&P 500 was last at 4,510, up 0.8% (4,475). Brent Crude Oil prices jumped 2.4% to USD 72.75 (USD 71.60). Spot Gold rallied 1.3% to USD 1,817.

Other global bond yields eased. Germany’s 10-year Bund yield was last at -0.43% from -0.41%. The UK 10-year Gilt rate slipped two basis points to 0.58%.

Data released Friday saw Japan’s August Tokyo Annual Core CPI ease to 0.0% from 0.1%, but higher than estimates of -0.2%. Australia’s July Retail Sales slipped to -2.7% from June’s -1.8%, lower than estimates at -2.3%. Germany’s Import Prices in July rose 2.2% beating forecasts at 0.8% and higher than June’s 1.6%. Canada’s Raw Materials Price Index (RMPI) eased to 2.2% from 3.9%, and forecasts at 2.7%. US July Core PCE Price Index fell to 0.3% from 0.4%. US Personal Income rose 1.1%, beating forecasts at 0.2%. Personal Spending fell to 0.3% from an upwardly revised 1.1% previously.

- AUD/USD – The Aussie Battler took off, extending its gains by a further 0.93% to finish in New York at 0.7313 from Friday’s opening at 0.7239. Risk-on, higher resource prices boosted the Aussie. AUD/USD pair hit an overnight peak at 0.7317.

- USD/CAD – Canada’s Loonie advanced against the Greenback on the higher Oil and commodities prices. The USD/CAD pair slumped to an overnight low at 1.2602 before settling at 1.2612 in New York. USD/CAD opened at 1.2682 on Friday.

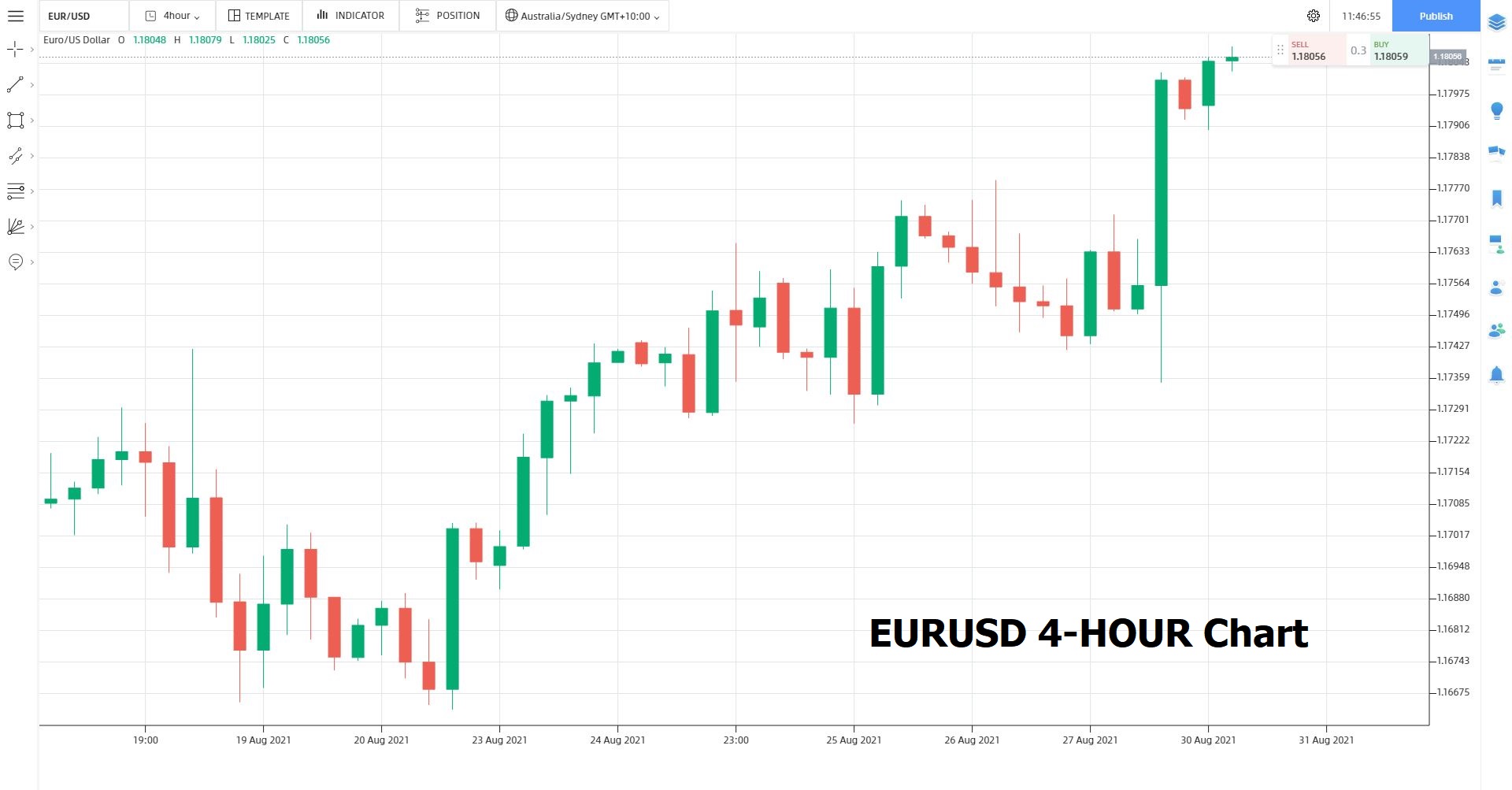

- EUR/USD – The Euro rallied to settle at 1.1795, up 0.28% from its 1.1754 opening on Friday. Broad-based US Dollar weakness lifted the shared currency. Overnight high traded for the EUR/USD pair was at 1.1802.

- GBP/USD – Sterling extended its advance against the US Dollar, finishing at 1.3760 in New York from 1.3698 on Friday morning. The British currency also benefitted from the overall weaker Greenback. GBP/USD soared to 1.3781 overnight highs, before easing to its NY close.

On the Lookout: The week ahead sees economic data releases take centre stage, culminating with the US Payrolls report on Friday. Other primary reports are China’s PMIs, released tomorrow. Australia reports its Q2 GDP on Wednesday.

Today kicks off with Japan’s Retail Sales report for July (m/m no forecasts, previous was 3.1%; y/y forecast 2.1% from 0.1% - ACY Finlogix). Australia releases its Q/Q Company Gross Profits (f/c 3% from -0.3% - Finlogix). Europe kicks off with Switzerland’s KOF Economic Leading Indicators for August (f/c 125 from 129.8). Eurozone August Final Consumer Confidence is next (f/c -5.3 from previous -4.4). Eurozone Economic Sentiment for August follows (f/c 117.9 from 119). Germany releases its Preliminary Annual Inflation Rate for August (f/c 3.9% from 3.8%). North America starts off with Canada’s Current Account (no forecasts, previous was +CAD1.18 billion). US July Pending Home Sales follows (m/m f/c 0.4% from -1.9%). US Dallas Fed Manufacturing Index for August rounds up the day’s data releases (no forecasts, previous was 27.3). All data forecasts are from ACY’s Finlogix Economic calendar.

Trading Perspective: The Dollar ended lower and on a weak note on Friday. Commodities, stocks, and bonds rallied following Powell’s remarks at the Jackson Hole economic summit. All occurred on a Friday where position adjustments were the order of the day. Risk appetite rallied. Ahead, we can expect to hear comments from other Federal Reserve speakers during the week. Heading into Friday’s huge US Payrolls report, expect further position adjustments.

FX traders will do well to keep their eyes on the US bond yield movements this week.

- AUD/USD – The Battler leaped out in front of the Greenback and its peers, boosted by risk-on, and stronger commodities and resources. AUD/USD closed at 0.7313 (0.7238 Friday). The Australian Dollar traded to 0.7317 overnight highs. Immediate resistance lies at 0.7320 followed by 0.7350. Initial support can be found at 0.7285 followed by 0.7255. Australian GDP release on Wednesday could be huge. We can expect consolidation today within a likely 0.7280-0.7330 range today. Prefer to sell the Aussie today, am not bullish at current levels.

- USD/CAD – against the Canadian Loonie, the Greenback slumped 0.65% to 1.2612 from a 1.2682 opening Friday. Higher Oil and commodity prices also boosted the Canadian Dollar despite a fall in Canada’s Raw Materials Price Index. USD/CAD hit an overnight low at 1.2602. Immediate support lies at 1.2610 followed by 1.2590 (strong). The next support level can be found at 1.2550. Immediate resistance lies at 1.2650 and 1.2680. Look for the USD/CAD pair to trade a likely range today of 1.2600-1.2670. Prefer to buy dips at these levels.

- EUR/USD – the shared currency rallied 0.28% against the overall weaker US Dollar to 1.1797 in late New York. On Friday the Euro opened in Asia at 1.1753. Overnight peak for the EUR/USD pair was at 1.18023. Immediate resistance for today lies at 1.1800 followed by 1.1830. Support lies at 1.1775 followed by 1.1750. Today sees the release of Eurozone Consumer Confidence and Business Climate as well as Germany’s Harmonised August CPI. Tuesday sees Eurozone Flash CPI estimates. Look for consolidation in a likely range between 1.1760-1.1810. Prefer to sell rallies.

(Source: Finlogix.com)

- GBP/USD – The British currency soared to an overnight high at 1.3781 before easing to settle at 1.3760 in New York (1.3698 opening). Overnight low traded for Sterling was at 1.3679. For today, immediate resistance can be found at 1.3780 followed by 1.3810. The next resistance can be found at 1.3830. Immediate support on the day lies at 1.3740 and 1.3710. There are no major UK data releases today. Tomorrow sees UK consumer credit and mortgage approvals. Look for the GBP/USD pair to trade a range between 1.3700-1.3780. Preference is to sell rallies.

Have a productive week ahead all, happy trading, happy Monday.

Analysis written by Michael Moran, Senior Currency Strategist.