US China Data Look Different and Time Is Running Out for Australian Earnings

- Clifford Bennett, Chief Economist at ACY Securities

- 16.08.2021 06:45 am undisclosed

Australia Tick Tick Tick...

NSW new cases steadily in 400s, hospitalisations growing.

Northern Territory, NSW, Victoria, ACT now all have lockdowns.

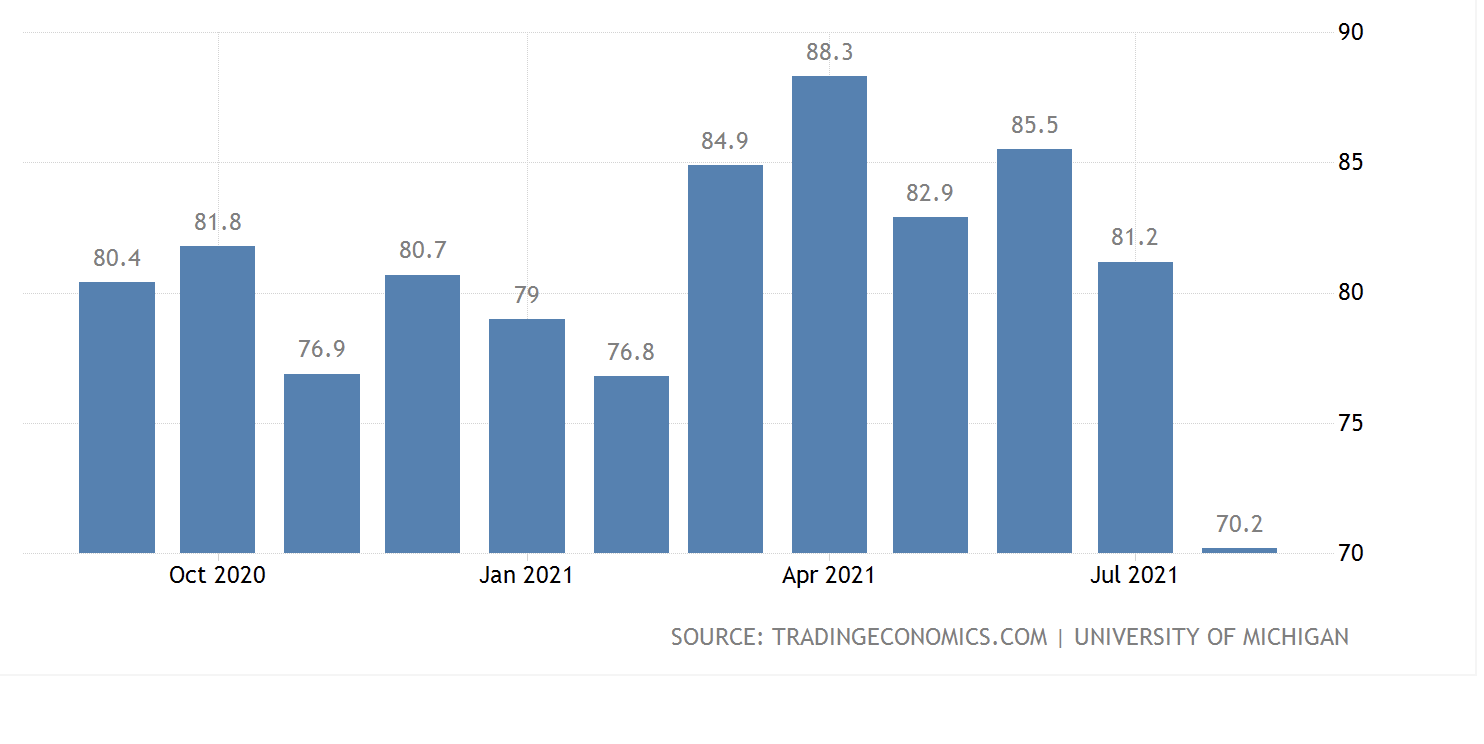

US Consumer Confidence collapsing to new post start of crisis lows.

The rolling over of the US economy, running on false aggregate data created by stimulus measures the equal of 30% of annual GDP, is only accelerating.

US500

Showing some initial signs of high rejection. Nothing too serious at this point, but increased economic disruption is a very likely outcome of the current Delta surge.

The down move slightly more pronounced. This market still has ZERO pricing in of lockdowns, let alone the Recession we have already begun.

Earnings, earnings, earnings, it is ll about earnings the bulls say. this is incredibly irresponsible, given earnings are about the post first wave stimulus boom, and the future is about an economy in recession.

Good day,

The NSW Premier has finally said it.

Even, if we get to 80% vaccination rates, if there are still high case numbers such as 500, then we cannot go back to life as normal and reopen. There will be on-going restrictions. The nature of those restrictions will depend on the case numbers that still persist.

A personal observation, is that if case numbers are low enough, perhaps we will see a gradual opening up. It may be along the lines of re-opening retail and all normal business, but maintaining the 5km or 10 km rule? Allowing the economy to come back, but with limited mobility. Of course, any mix of the individual lockdown aspects currently being experienced may be what we end up seeing.

What is clear, is that there is not going to be a shift from the current red light lockdown situation, to that of green for go.

More like amber. I use to tell my children what the traffic lights meant. Red for stop. Green for go. Amber for go very fast! However, in this situation, it is more likely to be a go-slow, for many months to come.

Unfortunately, my forecast last week, that we are already in the midst of a recession Q3, Q4, perhaps leaking into Q1 2022, is looking increasingly probable.

As for global markets, all highlighted previous themes remain in place. We have some new members to our audience today. Welcome to our team.

A quick catch all summary or our thoughts follows below.

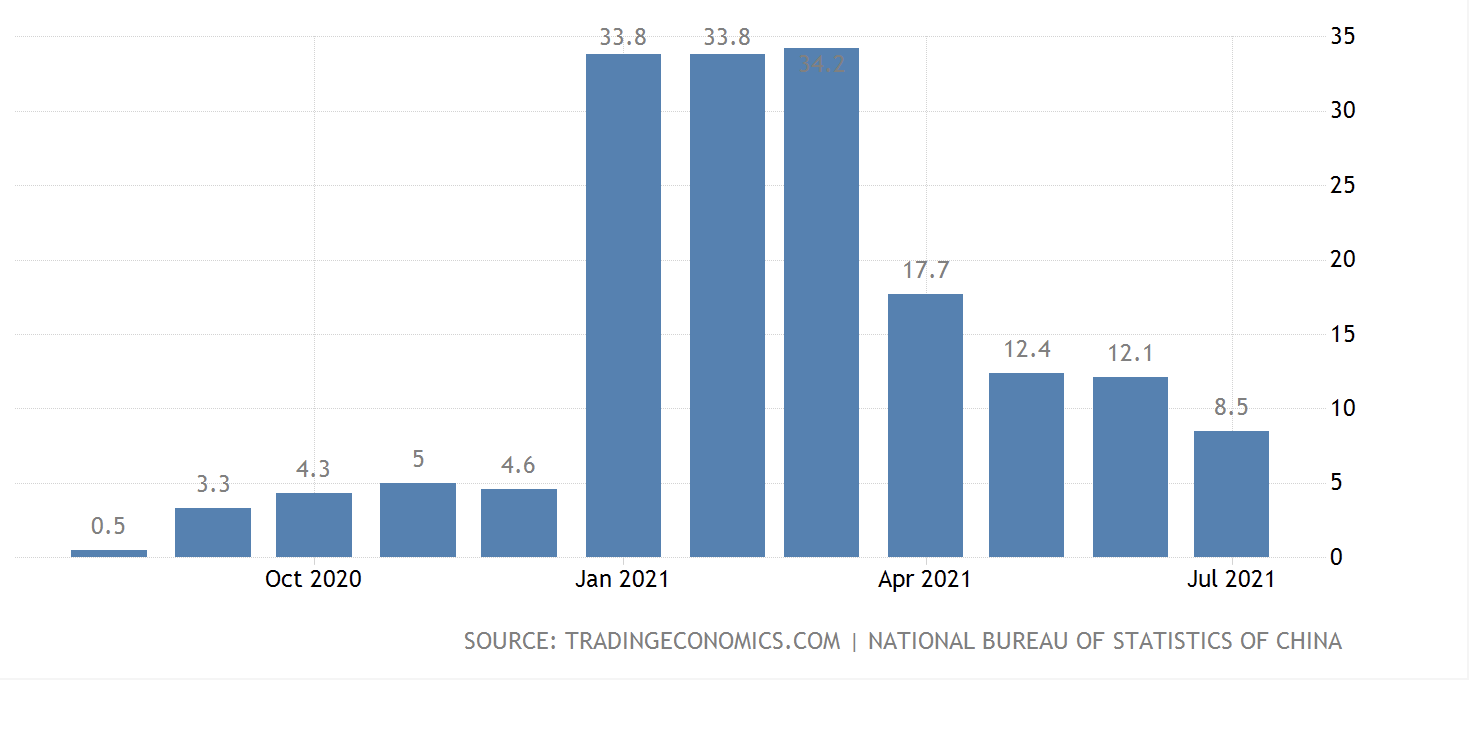

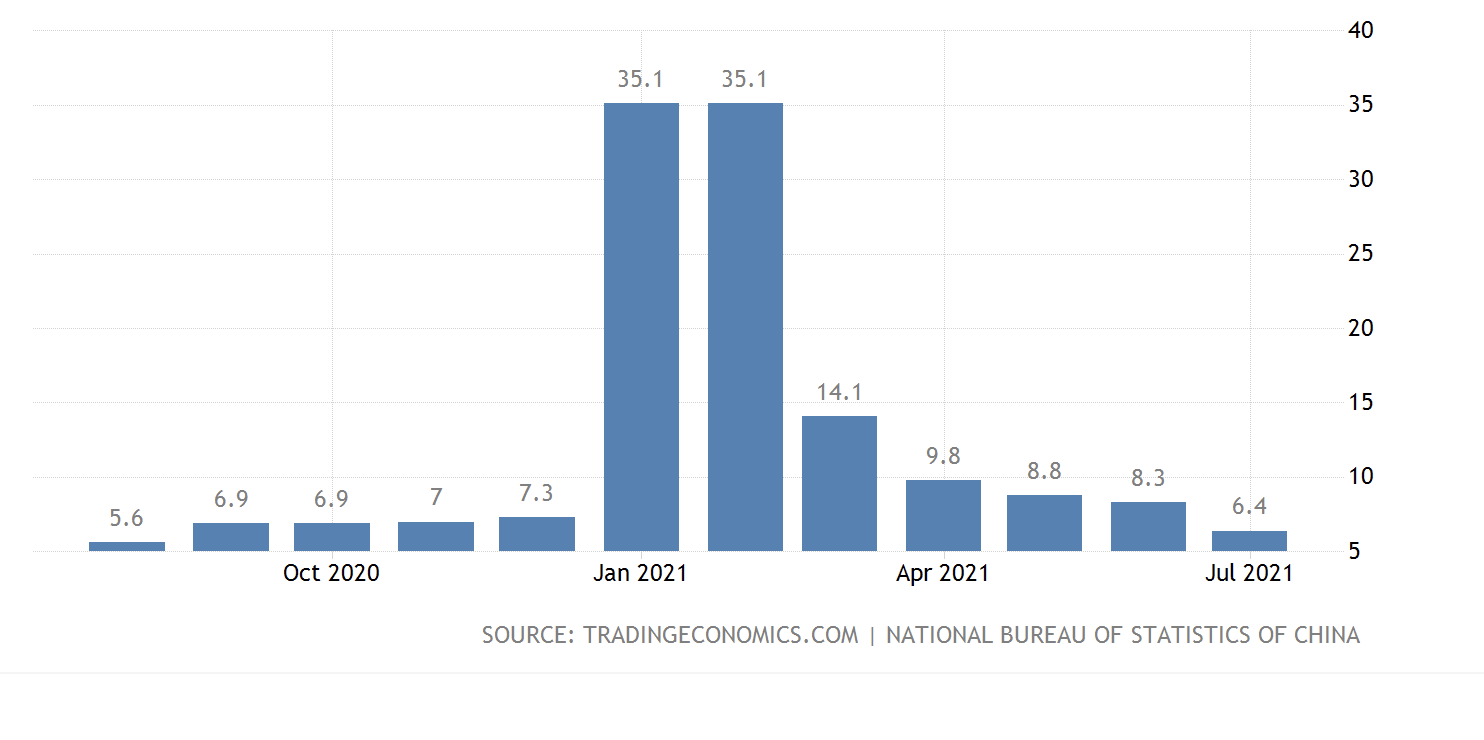

China data merely reverting to norm.

While there are reasons for concern at the rate of fall back in China's various data series, retail sales, industrial output and fixed asset investment, all below, are simply returning to more normal pre-Covid levels.

Concern over the possibility of an over-shoot to the downside are probably overdone. As the central bank remains willing to adjust policy if need be. Reasonable stabilisation at still high levels of growth being the most likely outcome.

Our approach to the world; “look out the window economics”.

Applying common sense to a fast evolving world.

Reading across the horizon economic insights and practical forecasting with both opportunity and risk identification.

Key themes I have been suggesting over the past few months have been.

A rolling over of the US economy.

Twin tsunami of Delta and Inflation, both to be higher and longer lasting than even the Federal Reserve, or RBA, currently anticipate.

Inflation is being driven by the 'freedom of pricing’ phenomenon, which has been sweeping the world for all business from the corner store to the global corporation. This is a power they have not had for the past two decades, due to the advent of true competitive price pressures. In 2009, in the midst of massive quantitative easing I stood alone in forecasting there would be no inflation due to globalisation.

Now, with market share more secure, and the both real and also excuse of supply chain disruption, businesses everywhere are raising prices to fatten profit margins.

Hence, high inflation will be durable. In the first instance, this inflation wave fattens earnings. A bizarrely positive force for corporations. Nonetheless, in the longer term, it will still eat away at the existing economic foundations by way of falling consumer buying power.

The Federal Reserve and the RBA are both tragically behind the curve on this issue. The outcome, post the current delta wave, will be more aggressive interest rate hiking cycles than would have otherwise been necessary. Central bank belief in 'transitory inflation' will wreak havoc for years to come.

This central bank delay on removing some of the over-stimulus currently in place, unavoidably means a more volatile economic cycle for many years to come.

The latest rally in US stocks is also being driven by ‘delta fear' fear around the world. US stocks are actually going up as a global hedging fear trade. Foreign capital inflow to the USA is now back at 1992 levels. This is the exact opposite of the usual sound investment or greed cycles these markets have previously experienced.

At some point, global investors will switch from US safe haven stocks, to Gold.

Commodities have generally peaked. Gold will separate and move higher. Back to $2,500.

Oil is the most attractive way to hedge a moderation in global growth from current levels, and especially from the lofty Nirvana type expectations most economists and investment banks have held.

That is, until US stocks turn down. This is inevitable, as Main Street fails to achieve the fast pace of growth beyond achieving the previous absolute size of the economy, going forward from here.

The Australian market is particularly vulnerably now, as it has followed the US stock climb, been given booster shots by the Afterpay purchase and CBA earnings. Yet, we are now in a recession.

Earnings are strong, due to perhaps the highest per capita stimulus measures in the world, when we have had close to the lowest number of actual cases. Earnings are however, backward looking. Australian markets are trying to look backwards, and/or leap frog to some distant Nirvana imagining. When, the reality on Main Street here too, is a far different story as outlined in my report previously sent.

At .7745, I forecast a target of 70 cents for the Australian dollar, with risk to .6850. this forecast has not changed.

The US dollar is expected to continue to strengthen toward 1.1100 Euro.

There are economic forces already at play in the world, particularly around the primary driver of inflation, that appear little understood by the market in general.

Thank you for your time, and we look forward to contributing to your success.