Major Economic and Market Matrix Review

- Clifford Bennett, Chief Economist at ACY Securities.

- 05.08.2021 05:00 am trading

It is not a time for

It is step up

re-focus

what is going on here time.

Good morning,

Let's cover the bases quickly for once and get to what matters.

Even aggressively.

Undeniable:

Stocks are over-valued significantly, relative to the US domestic and global economy levels of actual absolute economic activity.

The world has never been awash with so much money, made and borrowed from the future. These funds are seeking fast appreciation.

Cover-19 is on the rise with the more dangerous Delta, and now an even more contagious vaccine resistant Lambda variant coming out of Peru. Indonesian has now experienced 100,000 deaths. Everyone believes the US will not impose lockdowns again, and while probably correct, is not a sure thing. US hospitalisations are now higher than they were in the worst of the first wave. This is horrific and something the market cannot ignore for much longer.

The US economy is only back to similar pre-covid levels now, and still with significant labor and supply chain disruption, only because of 30% of GDP having been injected by stimulus measures and the support of bond buying and near zero interest rates.

The US economy has been a free-for-all making money frenzy, due to all of these measures. I strongly believe none of this actually creates a long term strong economic base. Large tracks of the USA have still not recovered, and what would be the situation without the taking of future tax payers money to use now?

The same can be said of many economies around the world, though not to the same extent. Except for Australia.

Australia has had the smallest number of cases in the world and the highest per capita stimulus measures. No wonder Australians felt invincible. This is now being tested by on-going wider small covid outbreaks, that feel a little like the start of a major forest/bush fire.

The equities world is emotionally and sentiment driven by the USA, but this is the old model. As I argued at the APEC Summit, in Vladivostok in 2012, we would, and now are, to see three equal super-powers and economic regions. President Putin referred to my comments in his closing speech, as he felt there would be four, with the addition of Russia. He had a point, but I think I got it right.

In yesterday's video, I mentioned, just as I had started all economic talks in Australia in recent years with, "I am Australian, therefore I am Asian".

Australia desperately needs to shed the huge chip on its shoulder about being European, and accept we will increasingly be part of a booming Asian region. And I do mean this, even from the lofty levels already achieved in Asia. This is our economic future, and we will continue to reap huge benefits from our geographic location and our mineral rich and agriculturally strong topography. We could do a lot better on the domestic policy front and also in how we deal with our neighbours over the back fence. To further maximise the potential of our natural gifts.

We have to take all of this in for our big picture long term outlook. Then zoom in gradually to get our investment balance correct and be able to scale across the huge valleys and mountains of current global markets.

We want to be invested in the future, via stocks and other assets. Such investment activity generates jobs and prosperity for all. This is the beauty of capitalism. At the same time, we need to be investing at the right moments.

Is now a right moment?

It comes down to the many fundamental negatives, and the many actual positives that are already over-priced, becoming actual negatives then for the market, against, the world being awash with money and the fear trade of record investment capital flows to the USA from the rest of the world.

When you consider the world is awash with money and that much of that money has been going to the USA, the mind boggles at that level of buying power of US stocks.

The Einstein equation of the moment then,

World awash with money investment power

minus

Main Street on-going true struggle economic and health

equals >>> ?

Our only clues in this regard are the price action of the various indices. Of course, there are sub-plots like tech major brands having a strength of market control, and being to some degree covid resistant. Though not as immune as many have suggested.

Taking all that into account, and then focusing on the price action, what we can be sure of is as follows.

The US and Australian equity markets are both in a state of consolidation at extremely high, even record levels. I say consolidation for the US based on the more immediate price action.

Should the global equity market continue to be influenced by US stocks, then the world is at a tipping point as to which sides of the above equation will win out. Given the 'Awash' side has already been dominating for some 18 months.

Should the global equity market become increasingly balanced in sentiment influence among the three clear economic regions of Europe, China/Asia and the Americas, lead by Germany/France, China, USA within those regions, then right now with increasing focus on what is happening in China, a more bearish tilt in overall global sentiment, may not be far away.

We were among the very first to highlight inflation and delta as much larger risks than our competitors were seeing. They were not seeing. They were extrapolating. Now, all of this is becoming self evident to a point that becomes increasingly difficult to avoid.

My view, is that any further break-down in price action, given the current shift in the debate toward the points we have been making for some time, is a major risk scenario. One with a too high level of probability to just go to the beach in search of sand.

Intelligent and appropriate use of the available hedging tools and strategies is vitally important right now. Perhaps urgent.

Still expecting the Fed to begin tapering this year, and raise rates next year to combat runaway inflation. A full year ahead of the latest Fed President's comments.

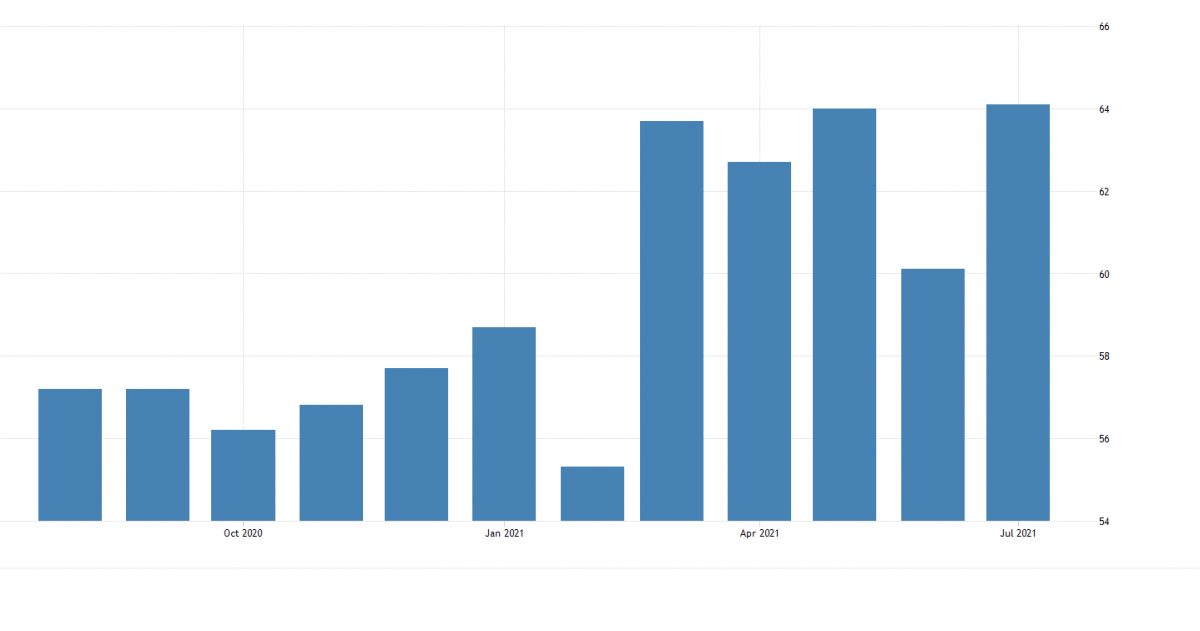

US ISM Manufacturing PMI

Rose to 64.1 in July. This has certainly bucked my rolling over thesis, but it is the only indicator that has done so for some time. My feeling is this is a snowflake number, will not last long, but I do have a bias here. We will increase our watch on other immediate data moving forward.

This high number is a run on from school openings and other forms of opening up, and for these reasons, may not be sustained. Within this number there was also a 16 year high surge in pricing. Inflation is going to go ballistic in the USA.

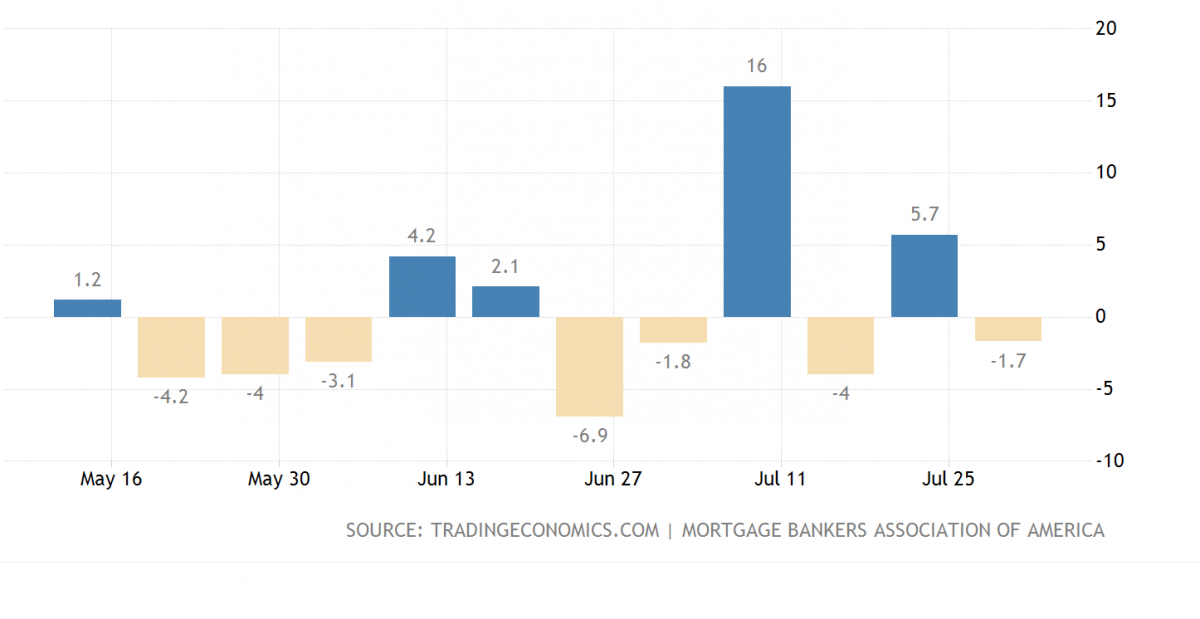

US Weekly Mortgage Applications

We did say last week's bounce in mortgages would not last and the trend would remain down. The housing bubble no one is seeing, is already bursting.

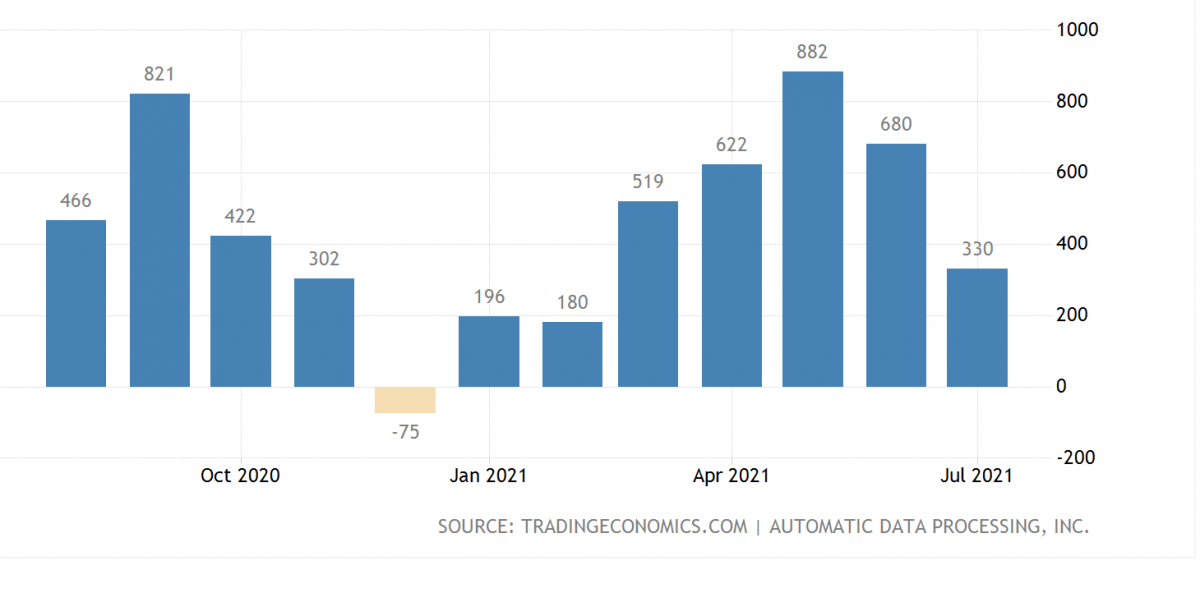

US ADP Employment Index

Private-sector hiring is now slowing quickly and dramatically.

This is a new and major moment in the history of US stock prices. The Australian market, given immediate economic shutdown risks, is particularly vulnerable to any US stock downturn.