Building a Case for Banking of Things

- Deepthi Rajan, Head - Market Research, Supply Chain Services at RBS

- 22.06.2017 11:00 am undisclosed , Deepthi Rajan is leading the Market Research group at Royal Bank of Scotland, where she focuses on research and insights around strategies on Supply Chain Services. Her primary focus areas are digital sourcing strategies and enterprise-wide transformation. Prior to joining RBS, Deepthi Rajan was IT Innovation Strategist at one of the largest private banks in India, evaluating myriad technologies and their applications across multiple industries. Her areas of interest are Analytics, Blockchain and Digital Strategy.

The networked economy of devices could hold promise for accelerating both banking services and operations to the next level of seamlessness

On the one hand, rising operating costs have led banks to explore technologies that could reduce the cost of operations and increase revenue while minimising costs.

On the other hand – the consumer side - clamour for ‘super-convenience’ has already reached a crescendo with banks engaging customers in discussions around sharing data for personalised services. Location based offers, personal financial management, robo-advisory are instances of solutions that rely on customers’ willingness to share personal information in exchange for convenient, contextual, customised advice and services.

So why should ‘super-convenience’ draw any attention when digital has improved the convenience of banking?

Going beyond digital

Undoubtedly, digital banking heralded the era of accessibility. Digital levelled the playing field for both established and upstart players, paving the way to move beyond the Age of Information Asymmetry, where information was held under the control of a select few.

Admittedly, analytics has played a crucial role in furthering the evolutionary journey, generating insights delivered at the right time through the right channel with the right messaging. The blend of digital with analytics has thereby, helped shape the Age of Information Democracy.

But for banks aiming to move beyond the role of transaction facilitators to information brokers and advisory partners, there are newer frontiers to conquer.

Here comes the Internet of Things

There’s a revolution brewing and it’s marching towards the bastion of financial services, so say the tech experts.

A lot of hype exists around the technology called Internet of Things or IoT. Turns out it’s not a technology. It’s a framework.

Still, what is it?

In a nutshell, IoT comprises sensors, actuators, software and electronics that can be embedded in physical objects or ‘things’ – think anything - from cars, homes, clothes, streetlights, to even human bodies – all connected through either wired or wireless networks and using the Internet Protocol to communicate with the Internet. At its simplest, IoT is the coordination and communication of the data generated by all such interconnected things.

(Image: Interconnected mesh of every day objects. Source: The Hacker News)

Let’s take the retail or the consumer facing side – an average customer uses up to 3-5 devices (smartphones, smartwatches, IPTV, laptop, desktop) to connect to internet. Household devices such as refrigerators, washing machines, thermostats and so on, if connected, will generate thousands if not millions of data. Add automobiles and wearables to the mix - the volume only grows larger. Essentially the permutations and combinations of the range of ‘things’ that can be connected to spawn data are only bound by imagination.

So, can banking remain untouched by IoT? Should banks even bother given the security, privacy and interoperability challenges posed by IoT? Yet, is it wise for banks to remain immune to this technology?

Certainly, novelty of a technology shouldn’t be the reason for considering it. Given the pace at which new technologies are introduced, it’s easy to get blinded and side-tracked by the sheer dazzle of the variety.

The real benefits of any technology can only be evidenced through identifying practical use cases. And in looking at how IoT can transform banking, there are many scenarios where the coming together of the two, IoT and banking, will benefit not just the customers but banks themselves.

Banking + IoT = Banking of Things

Banking’s mainstay is lending and taking deposits, while managing risks. But increasingly a sophisticated and demanding customer base means banks must find ways to stay relevant by not just meeting customer expectations but also devising new experiences.

Banking of Things (BoT) could help create new products, services or business models. BoT could usher in an era where products are designed not by banks but led by customers. Customers would be incentivised to build a product or a service, say a home loan or savings account, and decide the interest rate, which in turn will be dependent on behavioural factors such as customers’ utility payment patterns or eating habits, new age indicators of characteristics such as prudence and health consciousness.

Additionally, BoT could give rise to unique partnerships forged between banks and industry players, from not just within but also outside the financial services ecosystem. These could simplify or enhance the value propositions besides addressing challenges banks typically grapple with – those of compliance, unified view of customers, and customer experience.

Here are some potential use cases for banking of things in consumer finance and banking operations, each designed to simplify or improve some aspect of banking:

Appliances-turned-POS Terminals

What if home appliances could signal when they are about to malfunction? What if the appliances could place orders for their replacements or schedule repair and also initiate payments, on behalf of customers? Effectively, BoT could transform any object such as a fused bulb or faulty thermostat into a point of sale terminal, placing orders and seamlessly connecting to online payment systems. Data, read by smart sensors embedded in all such objects, would be streamed continuously to a cloud based analytics platform. Banks could extract and combine this information with other transactional data to proactively alert customers to maintain adequate balance in their accounts in addition to recommending potential cost saving options.

Banks thus, could operate along the entire continuum, from facilitating payments to being real time advisory partners.

Thank you, Jeeves, er, refrigerator

Smart fridges are already here, alerting users to replenish their fridges when the food quantity levels decrease. The data generated by the fridges could be of interest to the banking providers, who can study the food consumption patterns of customers to tailor the right set of products and services such as offering ‘Amazon-like’ services – using data from the smart fridges to predict food ordering schedules, complemented by simplified payments.

Not without my debit card

Wrong passwords and forgotten identification documents have long been the nemesis of our banking experiences.

Increasingly, biometrics is used to unlock mobile devices, access apps, and authenticate payments. Extending use of biometrics to customer authentication at branches and ATMs means customers would no longer have to carry documents or payment cards to identify themselves when they are at any of the physical channels.

From implants to payment models

When Frank Sinatra had crooned, “I’ve got you under my skin, I’ve got you deep in the heart of me, so deep in my heart, that you’re really a part of me”, he certainly wouldn’t have thought someday implantable sensors in the hearts would literally make his words come true.

Banks could partner with healthcare companies that monitor customers’ vitals through not just wearables but implanted sensors tracking everything from blood pressure, sugar levels to cardiac health. Assuming a consultative role, banks could provide personalized health tips, discounted membership offers at health clubs and information on recommended health care specialists. Besides seamless payments, banks could offer custom payment options based on subscription or pay per use models.

Scaring the living ‘street’lights out of intruders

Video is set to be the fastest growing type of content and that includes data from closed-circuit TV cameras installed near most ATM centres. Over the last few years, video technology has seen major innovations, from improvements in resolutions and image quality to analytics. Big data and cloud have contributed to analysing huge volumes of video data while providing much needed benefits of scalability and off-site storage.

Smart sensors embedded within ATMs and CCTVs, combined with advanced video analytics can help banks address the problem of customer validation. Currently, banks authenticate customers at ATMs by payment cards. However, there is no way to ascertain if the person swiping the card is the actual card owner. An interconnected mesh of sensors in the ATMs and CCTVs would alert the back-end systems about such discrepancies, triggering in-built security measures that would either prevent or delay dispensing cash unless the identity of the person is established.

Security within ATMs themselves could be further transformed through smart video analytics to detect adverse events such as tampering, based on data streaming through a connected mesh of smart sensors in ATMs, CCTVs, street lights, and loud speakers. For example, smart CCTVs on sensing malicious attempts could call out the activity via IoT-connected loud speakers to deter the event while alerting bank’s security. Such a scenario could pre-empt any potential loss of data, damage to bank’s properties and even customers’ lives.

On the trail

When banks dispatch sensitive account information such as bank account details and ATM pins to their customers through third party delivery companies, there is a danger of either the delivery companies misplacing the package or the delivery landing in wrong hands. With sensors embedded in the delivery packages, both banks and customers can track in real time, the documents’ location and the exact delivery time, saving the hassle of coordinating with the delivery companies.

Another use case could be that of tracking usage of assets such as automobiles, provided to customers through auto loans. This would allow banks to assess if the assets are being used appropriately, especially in the event of a car theft, intentional fraud or default. This is not unlike the use case devised by insurance companies who have partnered with automotive makers to fit automobiles with sensors that enable them to monitor parameters such as driving speeds. Data thus collected, is used by insurance providers to gain better insights on usage behaviour and used to offer customised products and services at differential pricings.

Treading the path of caution

Implementing BoT, like other disruptive technology deployments, would also carry a high element of risk, especially given the numerous endpoint devices that will need to be secured from cyberattacks. As custodians of customers’ money, banks have to focus on providing useful and secure innovations while protecting customers’ privacy and adhering to exacting compliance measures.

The best is yet to come

The potential for BoT’s applicability is immense and could extend beyond retail or operations to corporate and commercial sectors such as farming, mining and manufacturing.

Now a point of contention might be, “But clearly offering services in areas such as healthcare or household appliances are neither within traditional banking domain nor are banks equipped to do this job better than the incumbents, so why should banks even think of operating in these areas?

The time has come for banks to question whether they should remain financial service providers only or reinvent themselves as “service providers”. With companies from industries as diverse as hardware (Apple, Samsung), social media (Facebook), or information technology (Google) entering the financial services space, banks risk being reduced to playing a very small role (as opposed to being synonymous with financial services) in the overall financial ecosystem.

It has, therefore, become imperative for banks to offer products and services that would help them build more meaningful and symbiotic relationships with their customers – beyond transactional offerings. And that means banks must find opportunities emerging in non-traditional areas and choose the ones where they are best positioned to provide additional value to customers as well as develop new revenue streams.

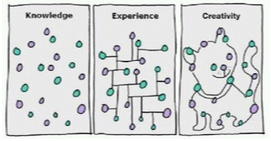

And if one were to go by the trends, then we know it’s not even about technology to begin with. Some of the finest institutions have gone under, not because they didn’t understand technology or because they lacked the knowledge. They simply underestimated the power of creativity.

(Image: Creativity is imagining the possibilities. Source: Cliff Pickover)

Creativity backed by innovation means BoT could become another potent tool to deliver compelling customer experience. And then again what is customer experience? Succinctly put, it’s the sum of customer preferences, expectations and values. Many variables, many possibilities - yes, banks would have to be careful about striking the right balance between meeting expectations and being non-invasive, while keeping convenience at the heart of their interactions with customers. Alas, the dichotomy of how much and when, will persist.