Published

Hans Tesselaar

Executive Director at BIAN

The pandemic was a wake-up call for many financial services organisations who had no choice but to become digital entities practically overnight. see more

- 08:00 am

LPA, the capital markets software and advisory firm, today announced that it has appointed Maria Weege as its Head of Marketing, a year after she joined the company as Digital Marketing Lead.

Based in the firm’s headquarters in Frankfurt, Mrs Weege will be instrumental in rolling out LPA’s international brand to the institutional capital markets clients that LPA works with, and position the firm as a disruptive business that is helping to accelerate the transformation of capital markets through technology.

Mrs Weege has over a decade of marketing experience, working with German and international brands before joining LPA in July 2021. Most recently, she was Head of Marketing for ACREDIS AG, a subsidiary of Swiss private clinics group, Pallas Kliniken.

Commenting on her appointment, Mrs Weege commented: “LPA has a fascinating position in the market, with a well-established client base and operating in an industry that is undergoing significant change and transition. I'm delighted to be stepping into this role as part of our leadership team, creating a marketing approach that is dynamic, modern and diverse in its ambitions."

She continued: "Our newly released mantra of Defy, Deploy, Run gives a marketing team a lot of creative space to work with and I’m excited to work with LPA’s talented workforce and management team to deliver a brand message that is compelling, noticeable and differentiated in the financial services industry.”

Peter Schurau, CEO of LPA, added: “Developing internal talent is a priority for us at LPA. When we were seeking to appoint a Marketing lead, there was no question that this should be Maria. She is a hugely experienced and creative marketer and knows the business intimately. We wish her all the best of luck as she works closely with our 400 employees across the 12 global locations we are present in to promote the best possible image for the LPA business and its people.”

Related News

- 01:00 am

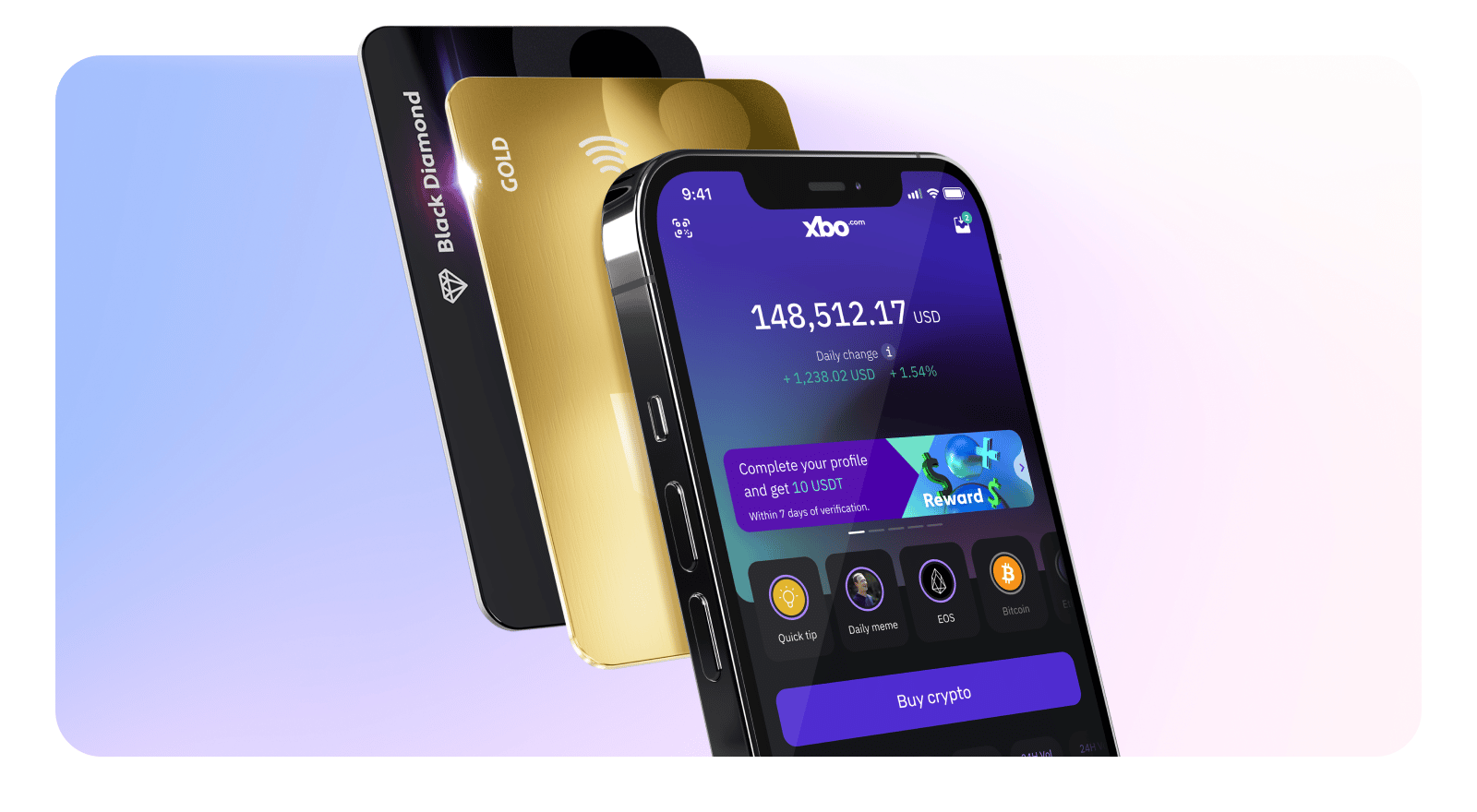

XBO.com, the cryptocurrency exchange making the benefits of crypto more accessible to everyone, launches its platform that merges gaming-inspired UI and top security solutions to offer traders a user-friendly and reliable alternative to existing exchange platforms. Following XBO.com’s pre-launch, where early registrants could earn special rewards and account privileges, the exchange platform is ready for use by any and all crypto users.

A cryptocurrency post appears on social media every two seconds. Institutions are buying up digital assets even during the bear market, yet retail investors—the ones crypto is meant to be financially literate—are still novices. Overall, only 4.2 per cent of the world population actually owns these digital assets. That’s in large part because crypto exchange platforms lack simple, easy-to-use designs and tools, which hinders new adopters who don’t have the resources to learn tech and financial literacy.

XBO.com meets the need for a user-friendly and accessible crypto trading platform. Leveraging an intimate familiarity of crypto users’ pain points and a deep understanding of social gaming UX, XBO.com makes buying and selling digital assets simple and enjoyable for both amateur and experienced crypto users who find traditional crypto trading platforms intimidating.

XBO.com offers a loyalty program that guarantees benefits to users with each accumulation of points and transition between the stages. In the Diamond tier, for example, users obtain 10 times the value of the crypto reward, compared with the Gold tier. The Diamond tier requires 650,000 XBO points (XP). XBO.com’s contest offering Bored Ape Yacht Club (BAYC) NFT owners the opportunity to lease their asset’s IP is still ongoing, and the winner’s NFT will be branded as the official mascot of XBO.com.

As part of XBO.com’s platform launch, pre-registered users are immediately upgraded to the Gold status account, which grants them commissions on crypto deposits, exchange cashback, spot trading, crypto rewards, and more. Early registrants also have the chance to achieve the Black Diamond tier, the most luxurious status on the platform. In addition, for the launch XBO.com presents one of the most appealing referral programs on the market today: For each friend user invites they will receive up to 80% of the friend’s trading fees for the first three months, up to 60% for the next three months, and up to 40% past the first six months.

“XBO’s platform has arrived to empower every type of crypto user, no matter how new or old they are to the crypto world,” says CMO of XBO.com, Shimon Baron. “With the launch of our easy-to-use exchange platform, we are standing strongly behind our vision that crypto is for everyone. Crypto platforms can be both easy to use and highly rewarding, and we are here to prove that.”

Related News

- 07:00 am

The 2022 B2B Payments Survey, now in its 6th year, conducted by Strategic Treasurer and Bottomline, reveals that more companies are asking banks for an embedded financial experience. It’s expected that APIs will have the biggest impact on B2B payments over the next two to three years, with both larger (51%) and smaller (39%) companies identifying this as their top choice.

An embedded finance experience within ERPs is now an expectation that customers have with demand for this rocketing to 39% in 2022 from 29% in 2021. This increased interest in embedded solutions highlights the growing importance of customer convenience and open communication with their banks and financial institutions.

This year’s key findings also include:

· Large and small companies identified that security (66% v. 50%), ease of use (55% v. 47%) and breadth of functionality (48% v. 25%) have the highest impact on their decisions to use an innovative fintech solution

· 14% of North American companies suffered one or more losses due to serious fraud attempts, with 21% of large corporations experiencing one or more losses compared to 11% of smaller businesses

· Banks that now offer B2C payment solutions have risen from 29% of respondents in 2020 to nearly half (46%) in 2022

The annual survey, which polled 801 executives from banks and corporates globally found small and large companies agree that fraud detection/prevention (34% v. 33%) and cash flow forecasting (45% v. 39%) technologies are where they intend to invest significantly over the next 12 months.

“The sixth iteration of the B2B Payments Survey has pointed out that banks listen to the changing payments needs of their corporate customers. Over the last year, we have seen more banks offering solutions surrounding APIs, cash flow management and cash forecasting for their customers,” said Gunita Bindra, Vice President of Product Management and Partnerships at Bottomline. “As the demand for B2C payment solutions continues to grow globally, the bar for better B2B solutions is being effectively raised. This year’s survey responses are a testament to that, with companies also paying increasing attention to ease of use for innovative payment technologies.”

Additionally, the survey revealed that more AP systems were breached in 2022. Compromised payable systems and processes increased from 7% in 2021 to 11% in 2022, with 8% of breaches connected to an insider/employee.

“Once again we see that securing information and processes in B2B payments continues to be at the top of the mind for treasury and finance practitioners. This is a rational response,” said Craig Jeffery, founder and managing partner of Strategic Treasurer. “As technology develops and its adoption advances, strong fraud prevention and mitigation features are necessary components of any solution aimed at easing the burdens and reducing the errors of the status quo. Manual processes and siloed controls are no longer commercially reasonable approaches. Automation is key to efficiency and security for the future of treasury payments.”

Related News

- 08:00 am

Debit cards drive growth as contactless usage continues to rise and consumer spending recovers after the height of the pandemic. Card usage will keep growing as new spending habits developed during the pandemic will persist

Spending with payment cards rebounds quickly

New research by RBR shows that worldwide expenditure on payment cards reached over $42 trillion in 2021, representing a rise of 23%. This rapid increase came as economies around the world recovered from the effects of the COVID-19 pandemic, which led to a marginal fall in payment card spending in 2020. RBR’s new report, Global Payment Cards Data and Forecasts to 2027, shows that growth in total purchase volume was seen across debit, credit, and prepaid cards, and in all regions. Excluding China – which accounted for 50% of total card spending across the globe – growth remained high at 22%.

Credit card spending increases as international travel resumes

The study shows that debit cards saw the largest increase in spending, rising by 25% to stand at $28 trillion. The increasing number of contactless debit cards, as well as changes in consumer behaviour that developed over the course of the pandemic, encouraged an uptick in the usage of such cards for low-value transactions. There was strong growth in credit card expenditure, which rose by 20% reflecting the recovery of travel and entertainment after the easing of pandemic restrictions in many countries.

Purchase volume worldwide, 2019-2021 ($ trillion)

Source: Global Payment Cards Data and Forecasts to 2027 (RBR)

Robust growth worldwide with card expenditure up by over 20% in all regions

RBR’s report reveals that the most rapid growth in percentage terms was seen in the Middle East and Africa region, where card spending rose by almost a third. This was driven by credit card expenditure, which recovered from a 9% fall in 2020 to an increase of 30%. Asia-Pacific saw the greatest absolute growth, primarily the result of an increase in debit card spending as contactless debit transactions continue to cannibalise cash usage in the region.

Daniel Dawson, who led RBR’s Global Payment Cards Data and Forecasts to 2027 study, commented: “The global payment card market has recovered strongly, despite the lingering effects of COVID‑19. Card usage will keep growing, as new habits that developed during the pandemic such as higher usage of contactless and e‑commerce stay in place”.

Related News

- 05:00 am

Independent fund and investment manager WCM Investment Management has cut reconciliation time by two-thirds following a tripling of its assets under management (AUM) over the last three years, thanks to the use of Gresham’s Managed Services.

WCM Investment Management uses Gresham’s Managed Services to aggregate data from more than 55 custodians as well as reconcile positions, transactions, cash and foreign currencies across 1,500 accounts and 2,500 cash buckets. The Managed Services solution for WCM includes cloud hosting, reconciliation support to identify exceptions, data aggregation, and reporting.

A desire to keep its operations team lean and efficient led the firm to begin the process of extending its partnership with Gresham in 2019 to include a managed service model. Since then, the partnership has played a vital role in enabling WCM to rapidly scale from managing $30 billion in AUM at the end of 2018 to over $107 billion by the end of 2021.

Prior to the partnership with Gresham, WCM was challenged with an infrastructure combining a portfolio management system and manual spreadsheets storing data. To overcome this challenge, WCM initially implemented Gresham’s Control for investment management and Data Services back in 2013, when the firm was managing less than $3 billion in assets.

“As our business underwent a period of significant growth, we found that the increased volume and complexity of data and reconciliations were putting more and more stress on our operations team which would have required adding headcount,” said Julianna Jones, Operations Manager for WCM Investment Management. “Thanks to Gresham’s Managed Services, we are actually predicting another 50% reduction in reconciliation time, down to 15 hours per week. This is all due to Gresham’s team always finding more ways to improve our process even as we grow and expand into new markets.”

“The operational challenges of reconciliation, data collection and validation, and the subsequent effects on reporting are well understood in the investment management industry in the face of increased market volatility and uncertainty,” added Jennifer McMackin, Senior Vice President of Data and Managed Services at Gresham Technologies. “With Gresham acting as an extension of WCM’s operations team and evolving with its business growth, it is easier for them to scale to increased volumes of business, align accounts, streamline month-end processes, and be more responsive to clients.”

Related News

- 06:00 am

Ratio, a new kind of fintech platform that combines payments, predictive pricing, financing, and a frictionless quote to cash process into one platform for SaaS and technology companies, today emerged from stealth and announced raising $11M in venture funding and a $400M credit facility for customer financing. Led by a team of industry veterans, Ratio is rewriting the rulebook for SaaS pricing and financing, driving value for vendors by delivering a new set of tools to accelerate growth in the turbulent market.

The subscription economy is now a $1.5 trillion segment of the recurring revenue market, with industries ranging from software to razor blades deploying subscription-based business models — but companies still face challenges with deferred cash flow, steep discounting, and the time needed to recoup customer acquisition costs, even as customers’ desire for payment flexibility is growing more ubiquitous. The current cash flow crunch has only exacerbated this problem. That’s where Ratio comes in: its game-changing platform allows SaaS companies and other recurring revenue businesses to provide embedded buy now, pay later (BNPL) services that granularly match their customers’ cash flow needs. This provides ultimate flexibility to the customer while boosting sales for vendors and giving them immediate access to the value of the customer contract.

Simultaneously, Ratio allows SaaS businesses to leverage their recurring revenue streams to unlock instantaneous new non-dilutive capital — without having to give up additional equity, dilute control of their business, steeply discount their products or spend countless hours in an always-be-fundraising mode. Ratio’s platform is built around two powerful core products:

- Ratio Boost, a fully integrated BNPL payment, optimized pricing, and checkout product, embedded via API into the seller’s systems and processes at the point of sale. Customers get ultimate payment flexibility, by matching their cash flow needs, and a frictionless buying experience automatically tailored to their company’s unique needs, while vendors get paid cash upfront for each customer contract, minimizing discounting and dilution. Better yet, by applying machine learning to financial and behavioural data, Ratio Boost can validate and optimize product pricing and payments for churn risk, lifetime value, and willingness to pay.

- Ratio Trade, a non-dilutive upfront capital solution for high-growth SaaS and recurring revenue companies backed by their portfolio of contracts. With Ratio Trade, vendors no longer have to discount their offerings or dilute equity to access working capital — and they can access financing in days, not months, to keep growing their brands.

Together, Ratio’s technologies offer a compelling solution for both SaaS vendors and SaaS buyers in today’s increasingly cash-constrained environment. With 80% of SMB buyers expecting a recession this year, the ability to streamline payments over time and maintain a cash operating buffer makes software purchases far easier to justify. For enterprise buyers, with budgets tightening, BNPL solutions enable easier purchasing decisions for IT purchases. And with funding for the SaaS sector now waning, Ratio’s solution enables vendors to boost sales, maximize revenues, and reduce the need for costly discounting in order to finance their growth.

Ratio’s founders and management team have deep roots in the SaaS and technology spaces, with proven experience building large software businesses and early-stage companies. Together, they created Ratio to solve the challenges they themselves experienced running major SaaS businesses and startups. Founder and CEO, Ashish Srimal, has held executive positions at SAP and Medallia. He was also previously the founder and CEO of SmarterMe, the world’s first intelligent mobile assistant for sales, and has advised numerous SaaS, venture, and private equity firms. Cofounder and CTO Mason Blake also co-founded UpCounsel, the world’s first B2B legal marketplace, where he served as CTO and eventually as CEO. The company later exited to LinkedIn where he led the service marketplace team before founding Ratio.

Additionally, Chief Commercial Officer Carlos Chou held senior executive and revenue leadership positions at SAP, Hewlett-Packard, Oracle, and notably at Siebel Systems, where he served as President prior to the acquisition by Oracle. And Chief Risk Officer Sai Uppuluri is an 18-year industry veteran with extensive experience leading risk, analytics, and structuring operations for major fintech companies and financial institutions including Standard & Poor's, OnDeck, and SaaS fintech leader ODX.

Ratio’s investors include Streamlined Ventures, Cervin Ventures, 8-Bit Capital, HoneyStone Ventures, multi-billion dollar asset managers and a range of tech CEOs from both large and small companies.

For SaaS vendors, Ratio’s offerings mark a new era in intelligent, effective, and customer-centric pricing — and a powerful new approach to raising non-dilutive growth capital. "We believe deeply in transforming buyer experiences. Ratio is further extending the buyer experience into the closing experience. With Ratio Boost we see many ways for SaaS companies to sell more deals faster - we do it by speeding up the procurement process for our customers,” said David Keane, CEO of Bigtincan.

“We created Ratio to revolutionize the way that SaaS companies and technology businesses price, get paid and fund their growth,” said Ashish Srimal, Ratio co-founder and CEO. “Payment flexibility, intelligent and iterative pricing, combined with a frictionless quote to cash process is the new strategic frontier for SaaS growth. We use data, machine learning, and finance as tools to unlock this growth lever for our customers. This creates a win-win for both tech buyers and sellers — buyers get more payment flexibility to match their cash flow and procurement constraints, and sellers get more revenue acceleration tools. Our mission is to democratize the way that we buy, sell, and fund technology. We imagine a world where every buyer and seller of technology — no matter whether they’re in New York or Nairobi — has access and the opportunity to buy and build the best. In short, we help accelerate and democratize the way that software eats the world.”

"We think Ratio is a game changer for SaaS companies. The way it uniquely combines finance, pricing, and an intelligent checkout flow in a simple and elegant solution has not been seen before in SaaS. The solution not only increases the speed to close and drives higher ACV/TCV, but enables much-needed improved cash flow for high growth tech companies,” says Ullas Naik, General Partner at Streamlined Ventures. “Ratio is on the forefront of two critical trends; first, the ability for SaaS companies to leverage their recurring revenue to their benefit and second, embedded intelligent sales and finance tools to enable greater efficiency. Ratio gives companies a new and powerful strategic lever to accelerate growth.”

Related News

- 04:00 am

Kyriba (“the Company”), a global leader of cloud-based finance and IT solutions, today announced the launch of Cash Management AI, a new solution based on Artificial Intelligence, which uses data science technologies to predict cash availability with increased speed, control and reliability. The new solution improves companies' cash management and forecasting capabilities. It will therefore mobilise greater confidence and precision for the financing of investments, an important priority for treasurers given the current environment of rising interest rates and market volatility.

According to a recent survey by IDC, 93% of finance leaders leverage real-time insights and 99% of have adopted business intelligence to make better liquidity decisions. The report finds that finance leaders without a strong data strategy incorporating APIs, BI and AI become burdened by inferior solutions and are unable to consume, analyse and leverage terabytes of structured and unstructured data efficiently.

“With increasing market volatility, CFOs are demanding greater accuracy and reliability from their cash forecast,” said Jean-Baptiste Gaudemet, SVP of Data Analytics at Kyriba. “Data science and analytics are needed to learn from the vast amounts of information that finance teams manage every day. Artificial intelligence helps CFOs harness data to make more informed, rapid and effective decisions.”

“As interest rates continue to rise, an imprecise forecast translates to underinvested cash and inefficient borrowing. Since the opportunity cost of cash is also increasing, CFOs are demanding greater confidence in their cash forecasts to optimise enterprise liquidity,” said William Goodall, VP of Sales Northern Europe at Kyriba.

Key features of Kyriba's Cash Management AI include:

- Artificial Intelligence (AI): Using built-in Machine Learning, Cash Management AI automatically learns from historical data and continuously improves predictions with new data

- Confidence Levels: Users can adjust forecasts in real-time by selecting the optimal confidence level based on the organisation's strategy and risk profile

- Business Intelligence: Users can view data in dashboards available as standard with flexible filters, adjustable forecast periods, cash budget calculations, and more

“Artificial intelligence increases data validity and accelerates the capacity to view and analyse data in a real-time and dynamic way with considerably more reliability, making it possible to better forecast cash flow at the company or group levels,” said Antoine Fulpin, former Group Treasurer of numerous listed international companies and Advisor to the General Management of Kyriba in Europe.

This product is part of a series of data science-based offerings that will be previewed at Kyriba Live (Paris) on October 4, 2022, at Maison de la Mutualité.

Related News

- 07:00 am

Today, the Consumer Financial Protection Bureau (CFPB) published a report offering key insights on the Buy Now, Pay Later industry. The report, Buy Now, Pay Later: Market trends and consumer impacts, finds that the industry grew rapidly during the pandemic, but borrowers may receive uneven disclosures and protections. The five firms surveyed in the report originated 180 million loans totalling over $24 billion in 2021, a near tenfold increase from 2019.

“Buy Now, Pay Later is a rapidly growing type of loan that serves as a close substitute for credit cards,” said CFPB Director Rohit Chopra. “We will be working to ensure that borrowers have similar protections, regardless of whether they use a credit card or a Buy Now, Pay Later loan.”

Buy Now, Pay Later is a form of interest-free credit that allows a consumer to fully purchase a product, and then pay back the loan over four instalments, with the first instalment typically being a down payment on the purchase. Most Buy Now, Pay Later loans to range from $50 to $1,000, and are subject to late fees if a borrower misses a payment.

Buy Now, Pay Later rose to prominence in the past decade as an alternative form of credit for online retail purchases. The lending option has gained traction with consumers who seek the flexibility of being able to pay for goods and services over time, but who may have been leery of other credit products.

Once a niche financial offering that was heavily concentrated in apparel and beauty, Buy Now, Pay Later has now branched out to industries as disparate as travel, pet care, and even groceries and gas. Apparel and beauty merchants, who combined to account for 80.1% of originations in 2019, only accounted for 58.6% of originations in 2021.

Other highlights of Buy Now, Pay Later loan usage include:

- Loan approval rates are rising: 73% of applicants were approved for credit in 2021, up from 69% in 2020.

- Late fees are becoming more common: 10.5% of unique users were charged at least one late fee in 2021, up from 7.8% in 2020.

- More purchases are ending in returns: 13.7% of individual loans in 2021 had at least some portion of the order that was returned, up from 12.2% in 2020.

- Lenders’ profit margins are shrinking: Margins in 2021 were 1.01% of the total amount of loan originated, down from 1.27% in 2020.

The marketing of Buy Now, Pay Later loans can make them appear to be a zero-risk credit option, but today’s report identified several areas of risk of consumer harm, including:

- Inconsistent consumer protections: Borrowers seeking Buy Now, Pay Later credit may encounter products that do not offer protections that are standard elsewhere in the consumer financial marketplace. These include a lack of standardized cost-of-credit disclosures, minimal dispute resolution rights, a forced opt-in to autopay, and companies that assess multiple late fees on the same missed payment.

- Data harvesting and monetization: Many Buy Now, Pay Later lenders are shifting their business models toward proprietary app usage, which allows them to build a valuable digital profile of each user’s shopping preferences and behaviour. The practice of harvesting and monetizing consumer data across the payments and lending ecosystems may threaten consumers’ privacy, security, and autonomy. It also may lead to a consolidation of market power in the hands of a few large tech platforms that own the largest volume of consumer data, and reduce long-term innovation, choice, and price competition.

- Debt accumulation and overextension: Buy Now, Pay Later is engineered to encourage consumers to purchase more and borrow more. As a result, borrowers can easily end up taking out several loans within a short time frame at multiple lenders or Buy Now, Pay Later debts may have effects on other debts. Because most Buy Now, Pay Later lenders do not currently furnish data to the major credit reporting companies, both Buy Now, Pay Later and other lenders are unaware of the borrower’s current liabilities when making a decision to originate new loans.

Buy Now, Pay Later providers are subject to some federal and state oversight. The CFPB has enforcement authority over providers of credit, and it has authority to supervise any non-depository covered persons, such as a Buy Now, Pay Later provider, in certain circumstances. Some states consider Buy Now, Pay Later to be consumer credit and require state licensing or registration, as well as compliance with state consumer credit laws, while other states do not require licensing or registration for Buy Now, Pay Later products with no interest or finance charges.

To address the discrete consumer harms, the CFPB will identify potential interpretive guidance or rules to issue with the goal of ensuring that Buy Now, Pay Later lenders adhere to many of the baseline protections that Congress has already established for credit cards. As part of this review, the agency will also ensure Buy Now, Pay Later lenders, just like credit card companies, are subject to appropriate supervisory examinations.

To address emerging risk issues with data harvesting, the CFPB will identify the data surveillance practices that Buy Now, Pay Later lenders should seek to avoid.

To reduce the risk of borrower overextension, the CFPB will continue to address how the industry can develop appropriate and accurate credit reporting practices. The agency will also take steps to ensure the methodology used by the CFPB and the rest of the Federal Reserve System to estimate household debt burden is rigorous.

Today’s report comes after the Bureau announced a market monitoring inquiry in December 2021 to gain more insight into the industry. In January 2022, the CFPB submitted a public notice and request for comments from the public on their experiences dealing with Buy Now, Pay Later loans. The data and insights in the report are based on feedback from that request, along with deidentified submissions in the public CFPB complaint database and publicly available financial filings and other source material from the five firms who received the Bureau’s market monitoring orders.

Related News

- 06:00 am

PPRO merchants will soon have the ability to integrate buy now, pay later services from Australian provider Zip at the point of checkout.

Zip, which includes Zip Pay and Zip Money, becomes the first Australian BNPL method to be added to PPRO’s digital payments infrastructure and sits alongside other Australian local payment methods.

The new integration allows PPRO’s global partners and their merchants to offer Australian consumers a way to pay with their preferred checkout option when they shop online.

Tristan Chiappini, VP and head of partnerships Apac at PPRO, comments: “Australians are ahead of the curve when it comes to using alternative payment methods like instant bank transfers, digital wallets, and BNPL products to transact online. In fact, the popularity of BNPL continues to grow in the country, it will soon overtake credit and debit cards as a preferred payment method. The addition of Zip to our Australian payments mix enables us to better serve our PSP partners and their merchants, giving them greater access to Australian consumers and the country’s booming e-commerce sector.”

Earlier this year, PPRO acquired Alpha Fintech in a deal that will strengthen its presence in Asia Pacific and enable it to offer a plug-and-play orchestration layer that will let its customers integrate products and services faster and at scale.

For Zip, which is looking for a buyer for its UK subsidiary and recently nixed a deal to acquire US-based Sezzle, the agreement opens up access to PPRO's ecosystem of cross-border payment services providers and merchants.

Tommy Mermelshtayn, chief strategy officer at Zip, says: “This exciting new alliance will allow us to globally scale our partner ecosystem by supporting our core markets, and better manage our partner onboarding process."