Published

- 03:00 am

Temenos today announced that Mbanq, one of US’s leading Banking-as-a-Service (BaaS) providers, has expanded its relationship with Temenos to accelerate BaaS adoption in the US.

The agreement deepens the companies’ collaboration after last year’s launch of a joint Credit Union as-a-Service offering (link).

Temenos has also made a minority investment in Mbanq to capture the BaaS market which has seen explosive growth on the back of embedded finance valued at $7 trillion market capitalization by 2030. BaaS enables any brand or FinTech to embed relevant financial services into their customer journeys with a modern front and back-end technology package.

Mbanq is a leading BaaS provider in the US, one of the fastest-growing BaaS markets in the world. Mbanq targets brands across a number of sectors such as Ivy League Universities, top sports teams and celebrities offering them a comprehensive ‘as-a-service’ package such as branded deposit programs and debit cards, credit cards, lending and payments. Furthermore, Mbanq has robust relationships with numerous partner banks providing compliant banking operations and enabling them to participate in the lucrative BaaS market.

Temenos composable banking platform combined with Mbanq’s complimentary technologies such as a multi-currency, multi-asset patented digital wallet, brings to market a differentiated BaaS proposition for FinTechs and brands on the one hand and modern and compliant banking and payments capabilities to the regulated partner banks on the other.

Temenos and Mbanq offer an end-to-end BaaS infrastructure including regulatory support to help FinTechs launch in just a few months and with a cost-effective, pay-as-you-go model. Consumer brands can embed banking and payments services offerings fast and at a low cost.

This partnership opens up the opportunity to target mid-sized banks in the US, enabling them to not only launch BaaS services such as deposits, credit cards or Buy Now Pay Later, but also future-proof their technology stacks by kicking off an incremental core banking renovation. Temenos and Mbanq enable these banks to overcome the limitations of their legacy technology by serving brands and FinTech at scale using modern API-based, cloud-native technology. Hence, banks can avoid being sidelined by nimble new entrants and can also open up new revenue streams.

Max Chuard, Chief Executive Officer, Temenos, said: “We are excited to expand our strategic partnership with Mbanq and deliver an end-to-end BaaS technology proposition. This move will extend Temenos’ target addressable market by opening up a new channel to offer BaaS services directly to consumer brands, an incremental market to our business.

“Temenos is offering a unique end-to-end BaaS proposition, which can power the technology needs of all BaaS ecosystem participants. Together with Mbanq we bring to market a unique combination of capabilities in embedded finance underpinned by broad and massively scalable functionality, combined with value-add services such as regulatory and compliance.

“Mbanq and Temenos have the opportunity to deliver this, and the increased and accelerated investments from both parties will leverage this market momentum. I expect this partnership to become one of the key sources of growth for Temenos in the very important US market.”

Vlad, Lounegov, Chief Executive Officer, Mbanq said: “We are delighted to expand our partnership with Temenos. Powered by Temenos open platform, Mbanq expands its BaaS value proposition across the entire spectrum of embedded finance, from concept to delivery to operations. Mbanq enhances its technology stack to offer embedded finance at scale to any e-Commerce brand.

“This game-changing partnership will drive our company’s growth and help regulated and unregulated entities transform their offerings, technology and customer experiences in the digital post-pandemic world.”

Related News

- 05:00 am

Data and analytics firm, LexisNexis® Risk Solutions, has been selected to provide Hodge with a full end-to-end solution for customer onboarding and ongoing monitoring, incorporating AML screening, transaction monitoring and case management, all within a single platform.

Hodge is an independently owned bank offering a range of specialist mortgage and savings products to private and commercial clients. It has more than 85,000 customers across the UK. The bank was looking to automate its onboarding and ongoing know-your-customer (KYC) reviews and approached LexisNexis Risk Solutions to help.

The RiskNarrative™ orchestration platform will help Hodge onboard new customers faster and more efficiently, without compromising on risk. The platform will help to ensure the bank protects its customers effectively and supports a great user experience, whilst helping the bank to meet its compliance obligations.

RiskNarrative is used by a range of different industry sectors to confidently onboard customers, detect fraud and identify risk, including banks, lenders, e-commerce providers, and payments services firms.

As part of its ongoing digital transformation programme, RiskNarrative will first be deployed into the bank’s most mature product, Savings, and later into the wider ecosystem for B2B customer onboarding.

Natalie Fowler, Onboarding KYC Manager at Hodge, said: “The RiskNarrative platform is going to allow us to save time and resource, and therefore costs by automating this process. It will also help with timely decision-making and ensuring the customer onboarding experience is a great one.”

“At Hodge, we are all about making life simpler for the customer and so having this automated service available and allowing a more accurate onboarding and ongoing screening process, as well as ensuring Hodge is compliant and consistent, is vitally important for us as a business.”

“It’s great to be working with Hodge to help them with their digital transformation. I champion any bank that looks to modernise, adopt new technology and address 21st-century challenges. With the RiskNarrative platform, Hodge will be able to deliver an exceptional and frictionless customer experience,” said Aaron Harvey, Business Development Director for LexisNexis Risk Solutions.

Related News

- 06:00 am

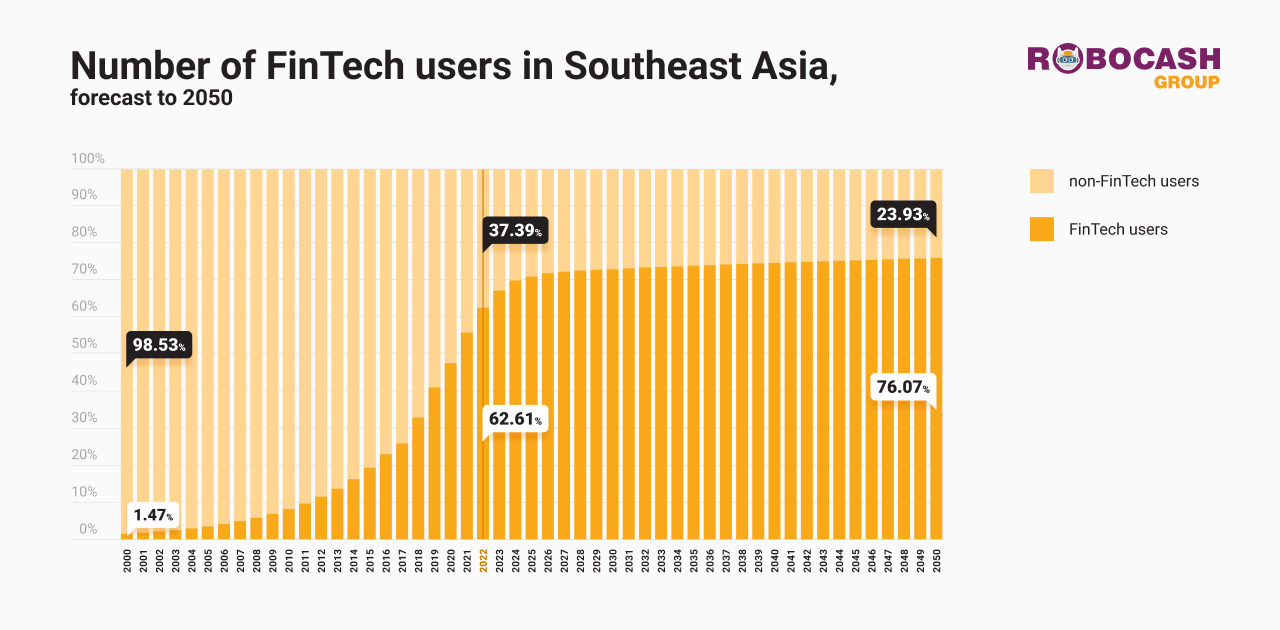

As of October 2022, in the SEA region, there were about 426.5 million users of five fintech industries (alternative lending, digital investment, digital assets, digital banking, and digital payments). This is approximately 63% of the total population of Southeast Asia. By 2050, this figure will rise to 76%.

Over the past 33 years, the population of Southeast Asian countries has aged quite considerably. During this period, the number of people aged 65+ increased by 190.2%, the number of young and middle-aged 15-64 - by 76.7%, and children 0-14 by only 3.6%.

It is expected that the total population of the SEA region will grow by 17.9%, from 681 million in 2022 to 803 million in 2050. The largest increase (2x) will occur in the 65+ segment of the audience.

The analysts of Robocash Group said that there is a lack of young people from 0 to 14 years old, whose number promises to grow by only 1.7% over the next 28 years. All this will obviously affect every segment of fintech. Those actively using financial technologies (people aged 15-64) will grow old by 2050 and move into the 65+ group, thereby increasing its share. For the most part, these will be women, who already outnumber men.

“As a result, in terms of the long-term trend, by 2050, the most promising audience for the financial technologies in Southeast Asia is expected to be women over 38 years old, whose share will grow significantly against, bolstered by a life expectancy of 81 years. With an ageing population, fintech industries such as digital payments, banking, insurance, and healthcare could grow significantly”, they added.

Related News

- 09:00 am

Cashflows, the platform that makes it easy for merchants to accept payments, today announces that, despite more than half (52%) SMBs indicating that they would be open to switching payment providers, 78% do not know how to do so.

The data suggests that businesses could be trapped in relationships with providers unfit to serve their needs at a time when rising business costs mean efficiency and competitive pricing in the payments process are more important than ever. Cashflows asked 250 payment decision-makers within small and medium businesses (SMBs) about how they would go about changing payments provider if needing to do so. When asked whether they knew where to find impartial information about acquirers, 25% said they don’t look anywhere and 17% admitted to not knowing where to look.

Nearly a fifth (19%) of respondents said that poor customer service would be a trigger for them to switch. In addition, over a quarter (25%) called out higher than-acceptable levels of technical downtime as a potential reason to make a move.

However, less than a third said their payments partners had been helpful (29%), understanding (25%) or educational (25%) while less than a quarter said they had been kind (22%). Shockingly, many went on to list examples of where their payments provider had been actively unhelpful in the past, including being in a hurry to get off the phone (16%), making them feel they weren’t a priority (13%), or being rude (11%).

When asked about the qualities that are most important, reliability (40%) and fast settlement (35%) came out on top, with a fairly even split across access to alternative payment methods (30%), excellent customer service (28%), simple and comprehensive data and reporting tools (28%), transparent costs (26%) and access to a dedicated account manager (24%).

Paul Clarke, Chief Product and Innovation Officer at Cashflows said, “The data we’ve uncovered is disappointing. SMBs are vital to the industry and the UK economy as a whole so they must be considered and valued.

SMBs must have access to unbiased and impartial information so they can make informed decisions for their businesses. This aligns with the Payment Systems Regulator’s (PSR) recent report, outlining a need to increase access, choice and competition in the payments industry to benefit SMBs. Hopefully, the changes the PSR has outlined should help build a fairer payments industry to fit business needs.”

The data has been published in the second report in the People Behind Payments series ‘The Challenge to Change’. The report can be downloaded here: Further chapters will be released in the coming weeks.

Related News

- 06:00 am

nCino, Inc., a pioneer in cloud banking and digital transformation solutions for the global financial services industry, today announced that Hamburg Commercial Bank (HCOB) is now live on the nCino Bank Operating System®. nCino is supporting the Bank’s workflow from the processing of transactions in the pipeline, through structuring and credit decisioning to help expedite processes and enable increased efficiencies.

With representation across Germany’s metropolitan regions and in select markets in Europe, HCOB is a speciality financier, serving commercial clients and financing projects in the real estate and shipping sector, as well as in the renewable energy and infrastructure industry. The Bank recently won the "Euromoney Award for Excellence 2022" in the global category "World's Best Bank Transformation" and boasts some of the best financial metrics in banking in Germany.

“We have transformed Hamburg Commercial Bank into a focused and profitable commercial bank within a few years and we intend to build on this foundation and expand our business in a measured manner. The nCino implementation is a great example of the execution of this strategy,” said Jan Lührs-Behnke, Head of Credit Office at Hamburg Commercial Bank. “We look forward to continuing to work with nCino as we are already achieving very positive results in terms of speeding up our processes, working more efficiently and creating a better customer experience”.

“We’re extremely proud to be partnered with HCOB and to have successfully deployed the nCino platform in Germany,” said Charlie McIver, Managing Director - EMEA at nCino. “HCOB has been one of the most ambitious business and cloud tech transformations I have ever witnessed. nCino replaced consolidated data and replaced disparate legacy systems to create a single platform for credit origination and review. Through nCino, HCOB now has a flexible platform for the seamless initiation of financing to decision through to the booking of the loan. With the foundational implementation complete, we really look forward to further innovating HCOB’s capabilities.”

The nCino Bank Operating System transforms the way financial institutions (FIs) operate and interact across multiple business lines. nCino allows FIs to provide a personalized digital experience over the course of end-to-end financial journeys from onboarding, account opening, loan origination, data-driven insights and analytics spanning all lines of business and channels. nCino streamlines employee, client, and third-party interactions resulting in increasing data optimization, profitability, efficiency, transparency, and regulatory compliance.

Related News

- 03:00 am

According to the British Business Bank’s latest report, UK Venture Capital Financial Returns 2022, UK VC funds with a 2008 to 2013 vintage have generated a pooled Total Value to Paid In Capital (TVPI) multiple of 2.20, which is 0.11 points higher than last year, demonstrating that UK VC fund valuations have so far been resilient to the adverse headwinds affecting global financial markets.

Deterioration in exit opportunities and fundraising conditions

Although UK VC market performance remained steady until the end of March 2022, the Bank’s engagement with 14 UK fund managers suggests a deterioration in exit opportunities and fundraising conditions, which reflects changes in the economic landscape compared to 12 months ago. While the majority of fund managers surveyed (64%) still see there are good quality deals in the market, nearly three-quarters of fund managers reported exit conditions have deteriorated over the last year, providing further evidence of a difficult environment for portfolio company exits.

Fund managers were also less optimistic about current fundraising conditions, compared to the previous survey. Only 7% of fund managers thought current fundraising conditions were good or very good compared to 79% in last year’s survey and no fund managers thought conditions had improved compared to a year ago, but 64% thought they had worsened.

UK VC funds continue to perform well compared to their US counterparts

Historically US VC financial returns were considered by many in the VC industry to be substantially higher compared to UK VC funds. Analysis of data within this report suggests that this is not the case, and returns continue to remain very similar between these two geographies since 2002.

Overall fund returns for UK VC funds with 2002 to 2017 vintage years show a pooled Distributions to Paid In Capital (DPI) multiple of 0.84 and a pooled TVPI multiples of 2.27. US funds of the same vintage generated higher pooled DPI multiples of 1.19, but the US pooled TVPI multiple of 2.31 is very close to the UK’s figures.

UK’s top-performing VC funds generate high returns but performance lags behind the top US funds

VC market returns are driven by the performance of outlier funds. Previous reports identified that the top-performing US funds have substantially higher TVPI multiples than the top UK VC funds and this remains true in the latest data. The UK top performing one percentile funds with a 2002-2019 vintage generated TVPI return multiples of approximately 14, compared to around 29 in the US. However, the UK’s TVPI multiple is an improvement on last year’s 11.

Outside of the top two percentile funds, UK upper decile funds outperform the US, showing UK funds have more consistent performance. Whilst TVPI multiples include unrealised assets, whose values may not be realised, a similar picture is seen for DPI multiples where the top percentile UK VC funds generate a return of six, but US VC funds generate a DPI of over 22.

The performance of these outlier funds makes a disproportionate contribution to total market returns. The improved performance of these top UK funds suggests that UK VC could be an attractive asset class for investors.

British Business Bank funds performance continues to rise

As the largest UK-based LP investing in UK VC, the British Business Bank is committed to being transparent on the performance of the VC funds in which it has invested.

Returns on British Business Bank-supported funds continue to rise as funds mature, finds this year’s report. VC funds supported by the Enterprise Capital Funds (ECF) programme are outperforming the market in terms of their realised returns. For ECF-backed funds, the pooled DPI multiple is 0.65 overall, but 0.78 for other LPs due to the prioritised return structure. Both these DPI multiples are higher than the wider UK VC market DPI multiple of 0.53 for funds of the same vintage years.

British Patient Capital (BPC) was established in June 2018 and seeded with funds from the Bank’s VC Catalyst programme which operated between 2013 and mid-2018. VC funds in BPC’s portfolio with a 2013-2019 vintage have generated a pooled TVPI multiple of 1.94. This is higher than a year ago (1.73) but is lower than the wider UK VC market multiple of 2.19 for funds of the same vintage. This can be partly explained by the BPC portfolio being less mature than the wider VC market, reducing BPC's relative performance.

Matt Adey, Director of Economics at the British Business Bank, said: “The continued financial returns of UK VC relative to counterparts in the US are promising as UK VC continues to show good performance. While it is encouraging that returns have remained resilient, the economic headwinds facing global markets are reflected in our fund manager engagement results, the impact of which will be seen in future data.”

UK Venture Capital Financial Returns 2022 is the fourth year the British Business Bank’s has published a report looking at the financial performance of UK VC funds. This report includes the fund performance data of 167 UK VC funds with a 2002-2020 vintage, and draws on data from both the British Business Bank and commercial data providers including PitchBook and Preqin, as well as a survey of UK VC fund managers, making it the largest source of information available on the performance of UK VC funds.

Related News

- 01:00 am

Buckzy Payments, Inc., a leading real-time cross-border payments company, today announced it has secured USD$14.5 million in Series A financing. Buckzy will use the funds to enter new geographies and support the expansion of its product offerings.

This all-equity financing was led by Mistral Venture Partners and Uncorrelated Ventures, with participation from new investors Luge Capital and Blue 9 Capital, and existing investors Revel Partners. As part of the round, Karim Gillani, former Xoom and PayPal executive and current General Partner of Luge Capital, will become a board advisor.

Founded in 2018, Buckzy enables real-time cross-border payments and Banking-as-a-Service capabilities through an embedded finance platform that is secure, scalable, modular and fully compliant with regulations. This powerful offering is quickly gaining traction with financial institutions looking to better serve their own customers through a best-in-class experience. Since going live in 2020, Buckzy has added over 140 customers to its client roster including traditional banks, neobanks and fintechs.

"This round of financing is a validation of Buckzy’s vision to create an intelligent and automated international payment system,” said Abdul Naushad, Founder and CEO of Buckzy. “We’re on a mission to build the plumbing for real-time money movement globally, the same way high-speed internet fundamentally shifted the communications industry.”

As a licensed money transfer company, Buckzy works with some of the largest banks around the world to enable real-time international payments that are reliable, secure and affordable. The platform is sophisticated yet user-friendly and offers multi-currency bank accounts, local settlement accounts, real-time FX quoting and booking, all with no hidden fees or unnecessary overhead costs.

"The cross-border payments market is approximately $150 trillion globally, and is still significantly underserved,” said Code Cubitt, Managing Director at Mistral Venture Partners. “Buckzy is blazing a path for a much better customer experience, more automation and lightning-fast payments. We are proud supporters of Buckzy’s impressive team, which has the right blend of experience, expertise and insight to build the next generation of cross-border payments.”

The Buckzy payment network currently disburses funds to over 80 countries, including the UK, India, the whole of the EU, the Philippines, the United Arab Emirates and many more. The company recently expanded its network in Latin America, covering Argentina, Brazil, Chile, Colombia, Guatemala, Honduras, Mexico, and Uruguay.

Related News

- 03:00 am

TrueLayer, Europe’s leading open banking platform, today announced its collaboration with cryptocurrency exchange Coinmama in Europe. Coinmama has been at the forefront of the financial revolution ever since its inception in 2013 when it allowed customers worldwide to buy Bitcoin with cards.

However, traditional payment methods weren’t built to deliver efficient fiat to crypto on-ramps. Cards and digital wallets generate costs through interchange fees, chargeback penalties and time-consuming manual tracking processes. There is also the issue of rising card fraud in Europe, which totalled €1.55 billion in 2020, with card-not-present fraud accounting for 76% of those cases. France, Germany and Spain all ranked in the top five for card fraud losses.

Determined to continue evolving its exchange, Coinmama wanted to introduce account-to-account payments across Europe and turned to market leader TrueLayer. With TrueLayer Payments integrated into the Coinmana platform, customers now benefit from an improved experience when purchasing cryptocurrency. It removes the need to enter any card or bank account details that can lead to errors and failed payments. Instead, customers simply select the ‘Instant Bank Transfer’ option when purchasing cryptocurrencies, authenticate their identity through biometrics with their selected bank and confirm the payment.

As a result, Coinmama customers across Europe can easily purchase cryptocurrencies with confidence. Coinmama also safeguards itself as TrueLayer Payments are authenticated directly with the bank, making them SCA compliant and dramatically reducing the opportunity for card-based fraud and chargebacks. The UK and further European markets are due to go live over the coming months.

Martin Kølbæk, VP of Payments at Coinmama, said: “Our mission is to make purchasing cryptocurrencies as safe and straightforward as possible. A critical part of that is providing the fastest, digitally native payments option. The integration of secure, instant open banking payments across the UK and Europe with TrueLayer aligns perfectly with our vision of delivering an enhanced experience to our customers.”

Nick Tucker, Head of Financial Services at TrueLayer, added: “As consumer interest in cryptocurrencies continues to grow, so does the expectation of a frictionless experience. With investing every second counts and yet according to YouGov research a quarter of European investors have missed out on an investment opportunity because funds didn’t appear in their accounts quickly enough. TrueLayer’s instant account to account payments are solving this for Coinmana, enabling the exchange to differentiate and drive customer loyalty through a more intuitive fiat on ramp. We look forward to working with them and building on our collaboration across more European markets in the coming months.”

Related News

- 07:00 am

Bank of the Philippine Islands (BPI), the oldest bank in the Philippines and a pioneer in digital banking, has partnered with the global B2B digital micropayments platform DT One to launch an international mobile load service.

With this partnership, Overseas Filipinos (OFs) in Australia, Canada, China, Italy, Malaysia, Saudi Arabia, Singapore, the United Arab Emirates, and the United States can stay in touch with their loved ones in the Philippines. By using their BPI Online credentials, they can easily buy loads for their international mobile phones by accessing the International Load facility in BPI QuickPay. To date, BPI has over 3.8 million active online users, of which 600,000 are Overseas Filipino Workers (OFWs).

Expats in the Philippines will also be able to take advantage of this international mobile load service once they are signed up to BPI Online.

“BPI will be the first bank in the Philippines to launch this kind of service, further driving our mission to achieve more for the Filipino people and create an unrivalled customer-first experience. An easy and reliable way to stay connected with family and friends overseas is more important than ever, especially now as we enter the Christmas season. Our partnership with DT One marks another significant step in our aim to better serve the needs of our clients with digitalization,” said Alexander G. Seminiano, Senior Vice President, BPI Digital Channels Group.

“DT One is delighted to help enhance BPI’s digital solutions, making it easier for the bank’s customers to send mobile loads in real-time. An OFW based in Dubai can load a local prepaid SIM from their BPI online account, helping them stay connected to family and loved ones back home in the Philippines over the special Christmas season. Or a mother in the Philippines can load her daughter's Singapore prepaid SIM to keep in touch even when she is studying overseas. DT One continues to look for ways to unlock more value for our customers using non-cash micropayments, whether digital gift cards/vouchers, gaming pins, bill payments, or mobile loads,” said Peter De Caluwe, Chief Executive Officer of DT One.

To send mobile top-ups, customers can access BPI QuickPay via the BPI Mobile app or the website (www.bpiquickpay.com) and select “International Load”, input the international mobile number they want to load and select the transaction denomination. Payment confirmation is sent to their registered email address.

Related News

- 07:00 am

nCino, Inc., a pioneer in cloud banking and digital transformation solutions for the global financial services industry, today announced that the Bank of New Zealand (BNZ) has selected the nCino Bank Operating System® as a key technology platform.

nCino’s single cloud-based platform enables financial institutions to more effectively onboard clients, make loans, manage loan life cycles, and open deposit and other accounts across lines of business and banking channels.

Mark Bernhardi, Managing Director of Australia, and New Zealand at nCino says, “Now, more than ever, financial institutions require an end-to-end digital and customer-centric platform approach in order to meet the increasing and changing expectations of their customers at speed. We look forward to partnering with BNZ on this journey.”

With more than $100 billion NZD in assets (USD 56.2B), BNZ has operated in New Zealand since opening its first office in Auckland in October 1861. The bank employs over 5,000 people in New Zealand.

BNZ Executive Customer, Products, and Services, Karna Luke says, “Our customers have high expectations, and BNZ is continually seeking improvements to our exceptional customer experience delivery through careful investment in digital capabilities and operational excellence.”