Published

- 06:00 am

Many of the Anti Money Laundering (AML) systems within banks are no longer fit for purpose according to a white paper published by NetGuardians, the Swiss anti-financial crime FinTech. Machine learning-based solutions for AML can monitor the ever-growing number of instant payment transactions far more effectively.

The paper, titled ‘The Future of Transaction Monitoring for AML’, exposes the weaknesses of traditional rules-based AML monitoring systems to accurately detect suspicious transactions in the digital age. But even if existing AML monitoring systems were effective, according to NetGuardians, the spread of instant electronic payments means banks’ current systems would come under impossible strain.

Without effective safeguards, instant payments can enable industrial-scale money laundering to occur without banks being aware, despite their legal obligations to prevent it. NetGuardians cites findings from global management consulting firm McKinsey, “For most banks, more than 90% of transaction-monitoring alerts turn out to be false positives. Of those alerts that do result in a suspicious activity report filing, 80% to 90% are not acted upon.” However, transaction monitoring systems based on machine learning result in greater accuracy and fewer false positives, leading to more efficient use of compliance resources.

According to the UN Office on Drugs and Crime, approximately USD$1.6tn, equating to around 3.6% of global GDP, is laundered every year. Alarmingly, however, less than 1% of the proceeds of crime are successfully confiscated each year, according to Europol, suggesting that when AML monitoring systems fail to correctly identify money laundering transactions, the criminals will likely profit from the funds.

NetGuardians predicts that the threat posed by ineffective AML systems to the credibility of national financial regulators will ultimately drive uptake in new technologies that can improve oversight and increase detection and recovery rates.

Thierry Divenot, NetGuardians’ Global Head of Sales & Marketing, said: “Machine learning solutions for AML transaction monitoring are capable of drastically reducing the instance of money laundering and improving compliance. However, this transformative technology can only reach its full potential if banks and regulators are willing to embrace the future, which requires acceptance and determination across the banking industry. NetGuardians hopes this white paper will serve as a wake-up call and highlight the possibilities that can be achieved by a shift toward modern technology.”

For more information on how banks can make the transition to machine learning-based AML transaction monitoring, read ‘The Future of Transaction Monitoring for AML’ white paper online at the following link (also available for download): https://www.netguardians.ch/all-about-aml-transaction-monitoring/

Related News

- 08:00 am

The Mass Payments arm of Ebury, the global financial technology firm, is delighted to announce that it has been appointed by InCorp to provide payroll payments for its underlying clients.

InCorp Global, a leading provider of corporate services and business advisory across the APAC region, will engage Ebury Mass Payments to facilitate payroll payments throughout Singapore, Australia, Hong Kong, India, Indonesia, Malaysia, Philippines and Vietnam.

By using Ebury Mass Payments, InCorp is expanding its offering to cover clients’ end-to-end payroll processing needs.

Ebury’s Mass Payments solution provides InCorp’s clients with frictionless transactions across multiple currencies, whilst safeguarding client money and reducing counterparty risk. Ebury and InCorp understand the need for employee payments to arrive both on time and at full value. Leveraging Ebury’s 99.97% payment success rate allows InCorp’s customers to benefit by working with the global leader in international payroll payments.

Ebury Mass Payments supports businesses across various sectors, including insurance providers, payroll providers, pension administrators, financial institutions and other industries. Its cutting-edge technology and bespoke client services deliver unmatched, award-winning support for any company needing high-volume payment and execution solutions.

Ebury has the ability to settle in over 200 countries across 130+ currencies with a geographical footprint spanning 32 global offices. It has transacted over $21 billion in the last 12 months.

Owain Walters, Global Managing Director of Ebury Mass Payments, commented: “We are excited to partner with InCorp to provide payroll payment services to their clients across the APAC region. We have significant expertise in international payroll and are a proven partner for businesses around the world that need global currency coverage.”

Edmund Lee, Group CEO of InCorp Global, said: “We are delighted to be able to offer our clients a full end-to-end payroll solution. Ebury’s track record and combination of technology and service made them a natural partner for InCorp.”

Related News

- 01:00 am

A strong close to 2022 and global customer wins in Q1 2023 provide increasing momentum for Curity's identity management for APIs solutions. Recent wins include TransferGo, Binogi, and ToucanToco operating in the FinServ, education and technology industries respectively.

TransferGo, a UK-based financial services company that enables quick and safe money transfers for individuals, aims to use the Curity solution for their main customer-facing services. The Curity Identity Server will allow them to customize authentication and registration flows to use in various login scenarios to increase flexibility. They are also determined to use Curity’s Hypermedia Authentication API in their mobile applications to achieve seamless browser-less login for a streamlined user experience.

Binogi, a company offering multilingual learning applications and high-quality content for middle schools, learners and teachers in Europe, North America and Africa, is making a major architecture shift. Its main goal is to ensure global scalability and that the data privacy of learners is well protected. Using the Curity Identity Server they can build a shared global layer and still meet local data privacy demands without duplicating the system for each separate location. Binogi will also be able to easily offer local and specialized login solutions, such as organization specific SSOs.

For the Boston-headquartered ToucanToco, a customer-facing analytics platform that empowers companies to drive engagement with data storytelling, the decision to choose the Curity Identity Server was based on the excellent multi-tenancy, federation and configuration automation possibilities. They would allow them to ensure their users have a smooth and secure login experience.

Stefan Nilsson, Chief Commercial Officer (CCO), comments on the recent additions to Curity’s customer list: “We are pleased to see that companies of diverse industries continue to see the value and usefulness of our product. We look forward to working with our new customers and supporting them in establishing a solution that helps protect their users and APIs and facilitate new innovations.”

Related News

- 03:00 am

Tezos India, a leading blockchain adoption entity announced today that it has joined hands with Zeeve, a leading Web3 infrastructure provider to enable businesses and developers to adopt blockchain technology without any hassle. The combined power of the two brands will empower web 2.0 businesses to come on-chain and help developers at a mass level to deploy their applications on the blockchain without worrying about managing the infrastructure.

The integration of Tezos blockchain on Zeeve platform will allow businesses to execute seamless blockchain operations through Tezos node in a matter of minutes. The collaboration will work as a plug-and-play service for businesses and developers where the backend will be fully managed by the experts. We can now say goodbye to time-consuming and complicated deployment processes, and say hello to hassle-free management with Zeeve.

Zeeve's cloud-based solutions will provide developers with a secure, scalable, and reliable platform to build and host their blockchain applications, while Tezos India's expertise in Tezos blockchain development will ensure that the applications are robust and meet the needs of the businesses that use them. Zeeve's BaaS offering allows developers to focus on building their applications while the service provider manages the infrastructure and ensures it remains agile and operational.

Commenting on the development Om Malviya, President of Tezos India, said “At Tezos India, we are always keen to collaborate with brands that share our vision for the adoption of blockchain. We found a like-minded partner in Zeeve and their enthusiastic team has the potential to ensure a smooth transition of businesses to Web 3.0. This partnership aligns with our mission to foster innovation and enable seamless access to our blockchain technology. We look forward to seeing the positive impact of this collaboration on the Tezos ecosystem.

Commenting on the development Dr. Ravi Chamria, Co-founder and CEO of Zeeve, said “Tezos is among the top smart contract platforms and we are excited to launch support for Tezos Blockchain protocol on the Zeeve platform, including elastic APIs and dedicated full nodes for the Tezos developers and non-custodial staking infrastructure for Tezos validators. Zeeve ensures enterprise-grade web3 infrastructure for web3 developers and validators across protocols.”

Tezos India is an open source aimed at identifying and removing barriers facing blockchain adoption. Tezos India has created strategic alliances with reputed brands to enable businesses to leverage the power of blockchain technology for taking their business to the next level. Tezos India recently launched India’s first NFT-based cricket strategy game ‘Cricket Stars’ on its blockchain. Tezos India is a 75,000+ strong community with over 6000 developers developing on the Tezos blockchain in India.

Related News

- 04:00 am

Digital pensions provider Penfold has surpassed £200m in assets under administration (AuA) this month - 2.6x £76m AUA just under a year ago.

The platform attributed the strong growth to a combination of customer growth via new workplace clients signed and customers making transfers of old pensions, as well as individual customers making regular contributions.

Penfold has seen the number of workplace customers increase from 2,500 this time last year to over 18,000 in March 2023 many of whom are first-time savers. The provider also recently signed new clients Deel, Otta and Dice, all contributing to an accelerated growth in assets. The provider's number of signed-up customers also increased to 77,000.

Founded by Pete Hykin, Stuart Robinson and Chris Eastwood in 2018, Penfold achieved its £100m AuA milestone in July 2022, and has now hit the £200m mark in just under 8 months.

In light of these results, the provider plans to continue investing in winning new workplace clients and accountants and onboarding even more savers to their tech-first pension. On a mission to help everyone adopt healthy saving habits to feel good today about life tomorrow, the provider is transforming the pension saving experience from something complex and admin-intensive to something that feels motivating and engaging.

Penfold co-founder, Chris Eastwood, said: “We're so delighted to have hit this milestone, which demonstrates both the appetite consumers have for the new kind of pension we offer and the hard work of our team.

“Penfold enables our customers to clearly see how much they have saved, what that will pay for and how to increase their savings for the lifestyle they want when they finish working. This clarity helps combat the retirement savings crisis that we've been sleepwalking towards for too long.

“That so many companies are increasingly choosing us for their workplace pension is also heartening as it means they want to work with us in helping their employees look after their financial wellbeing. It's particularly gratifying to achieve this result against the backdrop of the cost of living crisis, which shows just how much people value safeguarding their future.”

Fred Cudmore, VP of Finance at digital wealth app Chip, and a partner with Penfold commented: ‘Chip's mission is to help people build long-term wealth and we were looking for a like-minded pension provider to help our staff save more for their own future. That meant choosing a company that made it easy for them to actually engage with their pension savings.

The Penfold app makes that simple, but the onboarding experience also helped massively. Our staff were shown how to use the app by a dedicated account manager, had the opportunity to ask questions, and were given jargon-free answers. They moved us over from our previous provider and completed the onboarding within two weeks so, given the service we received, it’s no surprise to us they’ve hit this milestone in growth. It is always great to see young innovative fintech companies doing so well. Congratulations Penfold!’

Related News

- 02:00 am

Leading forecourt retail specialist Suresite Group has announced its new ‘unattended’ contactless payment solution is now live, and has exceeded initial demand expectations, positioning the company as a pioneer for this largely under-served market.

Thanks to a strategic partnership with payment solutions provider Vianet in late 2022, Suresite has developed a solution to meet the rising demand for unattended card transactions and the increasing appetite for contactless payment solutions among consumers. Juniper Research’s latest Contactless Payments research predicts contactless transactions will grow 130% globally in the next five years, taking the market size from its current $4.7tn to $11tn in 2027.

The launch of this new payment solution marks a significant milestone for Suresite Group, providing momentum to penetrate new markets, such as vending.

Nick Horne, sales and commercial director at Suresite Group, says: “In today's economic climate, cost savings, smart decision-making, and efficient operations are essential for businesses to navigate financial pressures and uncertainties. As a result, automated retail businesses are on the rise, driven by changing customer expectations and experiences that require an evolution in payments. Thanks to our focus on innovation and customer-centric solutions, we’ve been quick to identify and address these evolving demands with this new launch, which is already taking us into new verticals. With the ability to accept payment via contactless devices at any unattended site, we’re providing customers with the prospect of ‘more-sales-less-cost’, which - excitingly - puts us at the forefront of a growing industry that’s been largely under-served and overlooked.”

The new solution sees the firm’s market-leading acquiring services join forces with Vianet’s contactless payment solution hardware, which is available in two versions, the Smart Contact and the Smart Contact Pro - making it an exciting option for merchants too.

With zero hardware costs, customers benefit from a competitive, user-friendly and highly secure payments solution able to futureproof most unattended solutions such as washing machine services, coffee machines, charging points, and unmanned jet washes and air and vac stations.

Demand has been high in the initial weeks following the go-live date, with customers impressed by a number of key benefits. These include:-

- the hardware is highly secure being PCI level 1 certified

- transaction fees are competitive

- customers can receive cash in their bank from 24 hours

- there are additional capabilities to advertise other services

What’s more, with direct access to a first-class engineering team, 24/7 tech support and Suresite’s 5* feefo-rated customer service team, customers have also been impressed by the comprehensive level of support on offer.

Related News

- 06:00 am

Today, investment platform Lightyear announces the launch of its web application. The most highly requested feature will enable customers to manage their portfolios, buy/sell shares and research 3,000+ instruments available on Lightyear.

The importance of offering a web platform has been clear from customer feedback and feature requests. Over half of Lightyear’s customers (57%) have said that access to their account and data on a bigger screen, like a desktop or laptop, is something that comes into play when choosing which broker to invest their money with.

Within Lightyear’s web platform, customers will have a full overview of their investments and information about the 3,000+ stocks and ETFs available. Users will be able to track their portfolio performance, earned interest and also buy and sell shares through web. All order types will be supported, which on Lightyear include Market, Limit and Repeat Orders. The web platform also supports currency conversions between GBP, USD and EUR within Lightyear’s multi-currency account.

Evolving its web offering through customer feedback will be a main priority for Lightyear’s team moving forward. Some requested features include a wide range of research and analysis tools, including an events calendar, price targets, and fund highlights — which Lightyear is looking to bring to the platform over the next few months.

In recent months, Lightyear has launched research features like Portfolio Insights and Profit and Loss Explainer, as well as the option to earn interest on uninvested money in GBP, USD & EUR. Banks pay interest to Lightyear for its customer money, and the company chooses to pass on this interest to benefit customers. Lightyear’s formula for interest payments is simple: the amount is always the central banks’ base interest rate, minus a 0.75% fee.

Most recently, the company added over 100 UK stocks from the London Stock Exchange, as well as expanding its services into Hungary. These events shortly followed the launch of German and Dutch stocks

Martin Sokk, Co-founder and CEO at Lightyear, comments: “Many investors prefer to manage their portfolios on the big screen — myself included. We knew a web app would be a part of Lightyear’s journey in the long term, but by speaking to customers we quickly realised it wasn’t something we should kick down the road, so we’ve been researching and building to get to this point less than one year after our European launch.”

Jani Kiilunen, Lead Product Manager at Lightyear, adds: “We spend a lot of time speaking to our users to truly understand which products they need from us, and what’s the best way to build them. True to that, we ran customer interviews with customers from all over Europe before starting to build our web app, as well as beta tests with the first iterations, to make sure we’re building a product that fits investors’ needs. I’m very excited about where we got to with the help of our customers, and can’t wait to keep iterating on our web platform based on further feedback and requests.”

Related News

- 09:00 am

iProov, the world leader in facial biometric authentication technology, and Authsignal, provider of the leading global fraud automation platform, today announced a new partnership focused on protecting consumers and enterprises from fraud across the U.S., Europe and Asia Pacific regions.

There has been an explosion in the online ecosystem, and it’s continuing to gather pace. It’s predicted an estimated 70% of new value created in the economy over the next decade will be based on digitally enabled platform business models. As a consequence, organizations are continually looking for ways to streamline processes and speed customer up on-boarding and maintaining a smooth user experience while ensuring that they have high levels of protection against the constantly evolving threat landscape. Creating digital trust is key to its success yet previously reliable verification technologies such as one-time passcodes no longer provide the identity assurance organizations need for high-risk use. Face verification technologies have emerged as a secure and convenient alternative for individuals to verify their identity at onboarding/enrollment or to re-authenticate themselves via their user-facing camera on their smartphone, laptop, or tablet cases.

The partnership sees Authsignal incorporate iProov’s patented Biometric Solution Suite into its fraud prevention orchestration platform to further enhance its user authentication services and robust security protocols. iProov delivers an effortless user experience with the highest levels of biometric security to help prevent fraud, identity theft, and other cybercrime during online onboarding, authentication, and identity verification.

“Balancing end-user experience and security is an evergreen challenge for organizations,” said Andrew Bud, founder and CEO of iProov. “Our technology proves that it’s possible to marry the two into a solution that’s easily deployed, with a focus on user security and privacy. We are excited to be partnering with Authsignal to deliver this crucial service that provides companies and consumers with the utmost protection from online fraud.”

Authsignal is focused on solving customer problems in mid-market and enterprise space and is empowering customers across the airline, financial services, fintech and marketplace sectors to protect user accounts by enabling them to implement technology solutions faster and simpler than ever before. Teams can observe fraud risk in near-real time and adjust how they manage this risk via a no-code-rules engine.

"We're focused on enabling our customers to secure their user journeys and deliver best-in-class customer experiences. In doing so, we must continually look at how we can enable our customers to further enhance their user's experience," said Justin Soong, CEO, Authsignal.

"iProov is leading the way in facial biometric verification, and we're delighted to be partnering with them to integrate the iProov Biometric Solution Suite into our orchestration platform. This will add yet another layer of assurance and protection in our one-click marketplace to protect our customers against the increasingly complex threat landscape."

Related News

- 08:00 am

SendFriend, a B2B fintech company creating embedded solutions for cross-border payments, announced today that it rebranded as Diameter Pay. The company also announced reaching a milestone of $60 million in payments processed so far in 2023.

One of the first companies to settle payments on the blockchain, SendFriend was founded as a fintech company focused on financial inclusion. Last year, it evolved into a B2B payments platform, offering embedded cross-border payments to international banks, after securing a $2.9M European Union R&D grant that same year. Today, the company operates as Diameter Pay and serves institutions that have traditionally been excluded from the USD-dominated global financial system such as emerging Asia, especially China, continuing its focus on inclusion.

“Diameter Pay is a response to today’s global marketplace, which desperately needs safe international fund transfers but often fails emerging, fast-growing regions for arbitrary risk or geopolitical reasons,” said Founder and CEO David Lighton. “The rebrand to Diameter Pay illustrates our commitment to being the shortest distance between opposite sides of the globe for money movement. A diameter stretches across the width of a globe, but isn’t seen on the surface–just as we aim to do through our technology. Having now surpassed $60M in payment processing across the globe in 2023 as an embedded solution, we’re doing just that."

The phenomenon of correspondent banks “de-risking” from regions such as the Caribbean, East Asia, Africa, and Latin America has been disruptive to local institutions and economies, with the number of active USD correspondents plummeting from 100 to 65 in the last decade. Meanwhile, McKinsey & Co. projects cross-border payment revenues will grow 35% between today and 2027 to a staggering $238 billion annually. In an increasingly complex legal, regulatory, and technology environment for the US and the world, with unexpected influence from geopolitics and supply chains, global trade will grow but with more investment in safety and security.

Diameter Pay addresses risk by adding a layer of compliance automation to its processing capabilities and US bank relationships in order to meet sanctions and AML controls. Diameter has served banks’ underlying clients in diverse industries including pharmaceuticals, manufacturing, extractives, financial services, shipping, and hospitality–with an emphasis on safety.

Looking ahead, Diameter plans to deploy API-based automation for all of its payments as well as additional layers of compliance automation in transaction monitoring and screening based on machine learning in the coming year. This work comes on the heels of its 2023 acquisition of DigiPli, a provider of regtech solutions. The company is also onboarding multiple new clients, which represent undisclosed processing volumes.

Related News

- 06:00 am

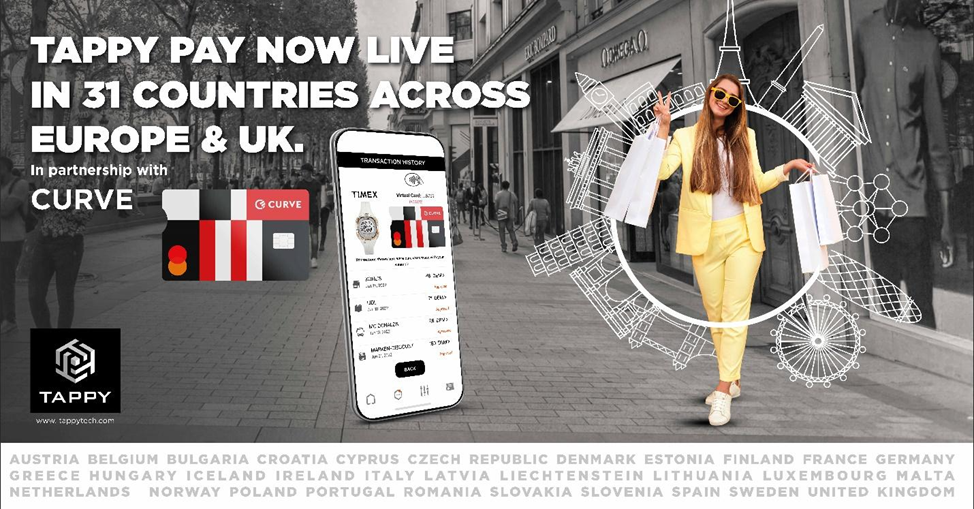

Tappy Technologies (Tappy), the world’s leading wearable and digital payments solution provider, today launched a partnership with Curve, the one-of-a-kind digital wallet that empowers users to maximize rewards from existing cards, to transform the way Europeans choose how and where to pay on the go. Tappy’s world-renowned watch and jewellery brand partners can now offer Tappy-enabled payment wearables to Curve’s customers in 31 countries across the European Union and United Kingdom.

To transform their favourite wearables into cutting-edge mobile payment carriers, all a user needs to do is download the Curve app (available in the Apple App Store, Google Play, and Huawei AppGallery), link their Curve digital wallet to their existing bank accounts, debit or credit cards and simply tokenize and provision it into the wearable through Tappy Pay.

Wayne Leung, CEO and Founder of Tappy, said, "We are thrilled to announce the launch of our Wearable Token Services Platform in partnership with Curve, which is available throughout Europe and the UK. This collaboration is poised to provide significant benefits to our partner brands, empowering them to extend their payment wearable offerings to a vast customer base throughout the region.”

Shachar Bialick, CEO and Founder of CURVE said, “We are very excited to partner with Tappy to give our customers in the UK and EU more control over their existing cards by turning their wallet into wearable technology. Curve has always been about convenience for customers – whether that’s with a physical card, on a phone, a smartwatch or any other type of wearable. Our work with Tappy will help us bring Curve to people across the globe who are on-the-go and already using wearable technology every day, furthering our mission to simplify and unify the way our customers spend, budget and earn rewards.”