Published

- 07:00 am

Super.com, an all-in-one savings platform, has raised $85 million in debt and equity to help it build out a WeChat-like super app.

Late last year, Super.com rebranded from Snapcommerce and launched SuperCash, a cashback card that provides users the opportunity to build credit without the barriers within the traditional financial industry.

The firm has since been building out it all-in-one savings super app, providing users with discounts and savings across multiple categories. It claims over five million customers worldwide, helping them save over $150 million to date.

The company's model follows in the footsteps of so-called "super apps" widely used internationally, such as WeChat, which has user numbers in the billions.

"Super.com's diversified business model now drives savings across all facets of our customers' lives, from travel to fintech. It's great to see market excitement match our own as we rapidly build the first savings super app focused on everyday Americans," says Super.com CEO Hussein Fazal.

Related News

- 01:00 am

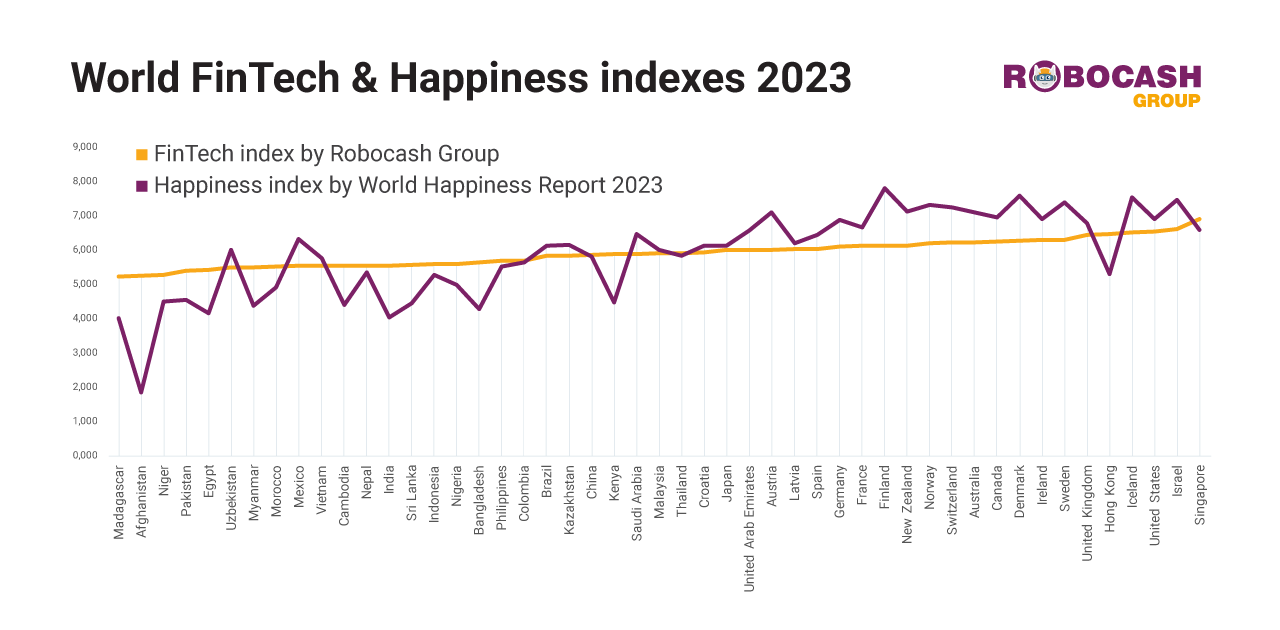

The World Happiness Report 2023 provided an index to indicate the level of happiness in countries around the world. Robocash Group analysts developed an index to indicate the level of national fintech development.

A comparison of the National Happiness Index and the Fintech Development Index revealed a high correlation between them, with a coefficient of 0.74 (out of a maximum of 1.0). The more developed a country is in terms of fintech, the happier its population is, and vice versa. Evidently, the availability of modern financial options, their degree of development and the current fintech market can have a tangible impact on someone's personal perspective.

Singapore is one of the frontrunners in the fintech development index according to Robocash Group, sitting at the top with 6.9 points. The nation's leadership is a combination of high financial & digital engagement and considerable contribution from the fintech sector. This ensures a balanced outlook in terms of business operations. Israel took second place with 6.6 points, followed by the United States with 6.55 points, Iceland with 6.52 points, and Hong Kong finished fifth with 6.47 points.

In terms of happiness, Finland, Denmark, Iceland, Israel, and the Netherlands became the leaders of the global ranking.

The study results reinforce the notion that fintech solutions are becoming an integral part of today's lifestyle and are increasingly important in daily activities.

Robocash Group analysts add: “Interestingly, the correlation between the level of happiness and the level of wealth of the population was not as high as initially thought. Its coefficient of 0.58 indicates the presence of a clear relationship, yet also confirms the validity of the expression that happiness is not all about money.”

Related News

- 01:00 am

The recent fall in fintech investment will strengthen the financial services sector in the long-term, says a leading financial services figure.

Rafal Andzejevski, founder of the London-based financial services provider PayAlly, has argued that a drop in fintech deals last year will expose the weaker players in the industry and encourage organic growth.

The intervention follows a report from accounting firm KPMG which revealed a 56% fall-off in UK fintech investment in 2022, following 2021’s record-high levels. This includes a significant drop in venture capital funding for fintech companies.

Andzejevski has warned that fintech’s heavy obsession with VC is unsustainable and is likely to cause a crash in the sector if it continues unchecked. He believes VCs pumping money into firms before selling them on at an inflated price is a negative trend that risks creating a ‘fintech bubble’.

While the number of fintech deals in the UK fell from 724 in 2021 to 593 in 2022, the majority of the deals in 2022 were VC deals (312), highlighting venture capital’s continued dominance of this market.

Andzejevski said: “The drop in investment into fintech companies should be welcomed – having less capital flowing around puts the impetus on firms to scale through organic growth, not through inflated valuations. The primary focus for any start-up should always be building strong foundations and growing a business from the ground up.

“Smaller firms in financial services should embrace the trend towards more M&As as they provide a way to maintain their place in the market and weather economic uncertainty, which there is plenty of in the current market.”

London recently climbed ahead of San Francisco and New York to become the world’s biggest centre for fintech investment. Andzejevski says London must be wary of the pitfalls of a fintech bubble if it’s to retain its global crown.

Andzejevski continued: “London has become a global beacon for financial services thanks to its world-renowned regulatory framework, its booming tech sector, and its independence as a financial market. It also has a rich history as a financial business hub, meaning it is full of world-leading institutions and experienced professionals.

“But if it is to retain its global crown, London must be wary of the fintech bubble exploding because of an excess of companies with bloated valuations and very little real worth. To build a financial services business that can be successful in the long-term, it takes time and strong foundations – not just pockets full of VC money.”

Related News

- 01:00 am

Due diligence and compliance automation specialist KYC Hub is pleased to report a successful and strong performance over the last 12 months which has seen it sign 55 new customers, launch new products, and win several leading industry awards. With financial crime a fast-growing and ever-evolving challenge, KYC Hub is on a strong upwards trajectory and plans to double its headcount over the coming year to meet growing demand. To support this expansion, it will also seek Series A funding over the next 12 months.

Financial crime risk presents a major challenge to financial services institutions. Heightened geo-political risk, as with the Russia-Ukraine war, has increased the scope for money-laundering. Trade-based money laundering and invoice fraud is on the up, and there are growing concerns in the crypto-currency space. These are also exacerbated by potential misuses of generative AI tools for fraud and money laundering by criminals. To combat suspicious activity, regulators worldwide are imposing new standards on financial institutions to detect and resolve financial crime risks. The UK’s second Economic Crime (Transparency and Enforcement) Bill1 and the enlargement of the EU’s anti-money laundering package2 are two cases in point. With embedded and open finance, new sectors and innovative fintechs are coming under particular regulatory scrutiny, as the growing status and size of some new players mean they represent a bigger risk to the market.

“Financial crime risk is evolving rapidly,” states Jay Rao, Co-founder, KYC Hub. “We are helping financial institutions, large and small, to put in place a more robust infrastructure that helps them to understand the customer better and keep in touch with new risks and regulatory changes. In particular, we enable them to adopt a flexible and configurable approach by automating key risk detection processes, providing no-code workflow orchestration capabilities, and superfast building, configuration and deployment of customer risk detection journeys. We are also working to help them overcome network risk via our knowledge graph, as financial institutions are now expected to establish whether any entity in the payer’s or payee’s network is tainted.”

Key product developments from KYC Hub over the last 12 months include the launch of OpsFlow, an RPA-powered3 solution that provides no-code, end-to-end customer risk detection, onboarding, monitoring, and orchestration. It has also developed a real-time Scenario Engine for transaction monitoring, which helps institutions understand the risks associated with any given transaction. Alongside this, it is currently developing an AI-engine to understand and improve the false positive rate for transaction monitoring. KYC Hub’s continued investment in its product and solutions has been instrumental in driving customer growth and international expansion. The new signings over the last year have seen it acquire clients in Dubai, APAC, Canada, and the US.

Looking ahead, KYC Hub is confident of meeting its ambitious growth targets, with a key objective being to grow its enterprise customer base, achieve stellar results for clients, and to scale its workforce to accommodate this.

“We are excited for the coming year and to continue with our growth plans,” said Farnoush Mirmoeini, Co-founder, KYC Hub. “Following significant investment in our sales and growth teams last year, we are set to make a number of new hires, with plans in motion to recruit a Chief Data Scientist, a Head of Engineering, and to expand our marketing team. We will also continue to invest heavily in R&D to ensure our solutions use the latest technological advances to combat financial crime and provide better risk management tools to financial services players.”

KYC Hub’s growing success is confirmed through several award wins. Over the course of the last year, it has collected the honours for the most innovative client onboarding and lifecycle management solution in the A Team Innovation Awards, as well as best sanctions and PEPs4 solution in the RegTech Insights Awards USA. It has also featured in several rankings namely the Startup 100, the RegTech 100, Tech Women 100, and the Women in Fintech Powerlist.

Related News

- 07:00 am

Commenting on her appointment, Eaton stated: “The dispute and chargeback domain is arguably the most important, yet most misunderstood, cornerstone in commerce today. Offering a tremendous competitive advantage to card payments, this protection mechanism continues to drive adoption rates at record numbers. Characterized by a bittersweet climate, we couldn’t be at a more exciting and opportune time. With the surge of first-party fraud, expansion of alternative payment methods, and newly entitled frictionless demands, the evolution of technology and shift in consumer behavior inspires transformative change. I am incredibly proud of what we have accomplished so far and look forward to leading the organization during this exciting time.”

Gary Cardone comments: “Monica has excelled in every facet of the business, a thought-leader, one of few true industry experts, with an unbelievable work ethic, who has made considerable contributions to the entire payments industry. She has guided the company showing impressive growth (top and bottom line) from inception, and executed our acquisition of Artefacts in 2019, which is now fully integrated, proving competency and resilience in both domestic and international markets.”

Monica Eaton continues: “I would like to thank Gary for his valuable contribution over the past decade. His expertise in identifying new markets is unmatched and I have greatly appreciated his partnership and mentorship through the years. Chargebacks911 is uniquely positioned with its people, products, and relationships, to drive innovation and transformative change – I couldn’t be more excited to lead us into this next phase of growth.”

Related News

- 07:00 am

Trustly has today announced its Open Banking-based payment method is available on health and wellness retailer Holland & Barrett’s online store in the UK. The partnership will enable Holland & Barrett to process customer payments using Trustly, which allows consumers to pay directly from their bank account in checkout.

Holland & Barrett is one of the largest UK retailers to embrace this type of account-to-account payment technology and is Trustly’s first major eCommerce partnership in the UK since its acquisition of UK-based Open Banking platform provider Ecospend, enabling connectivity with over 80 banks and a consumer reach of approximately 50 million consumers.

By implementing the technology, Holland & Barrett will solve several payment challenges including refunds, reconciliation, and rising costs relating to payments. Holland & Barrett was able to integrate Trustly’s payment services into its current infrastructure with ease, thanks to Trustly’s long term relationship with Adyen, the global financial technology platform of choice for leading businesses.

Daniel Hecker, Chief Product Officer at Trustly comments:

“We are looking forward to supporting Holland & Barrett with tangible results from easier and more streamlined payment solutions for them and for their customers. With significant growth predicted for account-to-account payments, this partnership is just the latest example of UK retailers looking to modernise their payment methods, ensuring their checkout technology is ready for the future. ”

Jonathan Haywood, Director of Omnichannel Customer Development at Holland & Barrett comments:

“The launch of Trustly’s solution will help drive growth across our business, providing an effective payment method to our customers. We handle significant volumes of transactions every day and this partnership is a great example of how we aim to provide an exceptional service to our customers. Thanks to the Adyen gateway, the integration of Trustly’s services has been incredibly straightforward and we anticipate rapid adoption of the technology.”

Related News

- 04:00 am

Taavi Rihvk, Compliance Lead at Coinmetro, commented: “Delays when looking to take advantage of cryptocurrency price movements can mean sizable losses, so the need for speed and simplicity in onboarding is key to customer satisfaction. Regulatory compliance is also of the utmost importance. OCR Labs Global provides speed, trust, and allows us to make our customer onboarding experience even more user-friendly and frictionless as part of our growth plans.”

Russ Cohn, General Manager International at OCR Labs Global, commented, “Coinmetro aims to offer their customers the very best in identity verification whilst automating as much as possible, making us a perfect match. The customer experience battle, regulatory challenges, and competition facing the cryptocurrency market are well known, and we are glad to help Coinmetro scale their business faster whilst answering compliance needs and reducing operational overheads.”

Related News

Brian Hughes

SEO Content Manager at Shah Web Solutions

As the constantly shifting financial markets evolve, so do savvy traders' strategies in their quest for profit. see more

- 03:00 am

Fintech Week London is returning for its third year this June, bringing together some of the most influential players in the financial technology industry. The highly anticipated week-long programme will once again feature a two-day conference running between 19 - 20 June - and this year held at the innovative Tottenham Hotspur Stadium - as well as the hotly-contended Fintech Awards London 2023.

The flagship event will bring together international leaders from the worlds of fintech and financial services in London, a primary global hub for both sectors. In doing so, Fintech Week London will provide attendees with exceptional learning and networking opportunities, utilising the location’s unique layout and unmatched high-tech event and hospitality areas, as well as offering unparalleled access to the city’s fintech elite. At its core, the event aims to cultivate new partnerships between business leaders in a moment of considerable need.

By choosing to host this year’s event at the Tottenham Hotspur Stadium, Fintech Week London has selected a venue uniquely positioned to foster partnerships and new industry connections. The leading venue offers numerous breakout areas, comprising both open lay-out loges as well as private (closed door) suites to be used for one-to-one meetings. Attendees can also take advantage of several exciting experience activities including stadium tours and ‘The Dare Skywalk’, the UK’s first controlled descent from a stadium roof.

Alongside discussing the difficulties associated with the current economic picture, the leading fintech event will cover some of the most prevalent topics affecting the sector right now, including the rise of embedded finance solutions, the growing importance of fintech for good and the ever-expanding role of cryptocurrencies across our daily lives. With a mission to help the sector move from ‘Flux to Flow’, leading experts and speakers will explore these impactful topics plus many more salient industry issues.

Additionally, the event will put a specific focus on the power of fintech in London, as well as the state of funding in fintech. The latter topic will be supported with a detailed review from Fintech Week London itself, which will be published during the event. Rather than shying away from challenging discussions, the event will tackle the most salient issues affecting fintech and financial services right now.

The first batch of speakers will be announced imminently, with senior decision-makers from leading fintechs, banks, investment firms, regulatory bodies, media companies and service providers to be included. By gathering players from high-street banks to challengers, technology giants to disruptors, the event is uniquely placed to host important, high-stake discussions, which are critical for the further development of both sectors.

Speaking on the event, Raf De Kimpe, CEO of Fintech Week London commented: “Last year we welcomed over 800 attendees to Fintech Week London, including the Mayor of Chicago, Lori Lightfoot. This year we’re looking to go further than ever before and aim to deliver an unmissable, landmark event for individuals working across the fintech and financial services sectors at the amazing Tottenham Hotspur Stadium.

“Ultimately, no modern venue fits the ethos of Fintech Week London better than the state-of-the-art stadium, which combines award-winning hospitality with digital-first connectivity. The arena allows us to offer attendees new and exciting opportunities for networking and collaboration activities via the stadium’s numerous breakout areas, as well as a host of unique experiences, such as the skywalk and stadium tours, that will help to inject some much-needed relaxation into what’s set to be a busy week.”

The event has already announced some of the exciting speakers taking to the stage including Louise Hill, Co-Founder and COO of GoHenry, Simon Boonen, Fintech Lead at ING, Gihan A.M Hyde, CEO of Communique and David M. Brear, CEO of 11:FS.

The full programme and list of speakers will be revealed shortly. To become a partner, or to book your place, please visit: www.fintechweek.london

Related News

- 09:00 am

42Markets Group, the financial and capital markets fintech investment group, has secured $10m in growth funding from Convergence Partners, a leading private equity investor dedicated to the technology sector across sub-Saharan Africa, after it recently closed its Convergence Partners Digital Infrastructure Fund (CPDIF) at $296m.

The fresh capital will support 42Markets in accelerating the development and expansion of its portfolio companies – Mesh (NL, mesh.trade), Andile (UK, andile.net) and FX Flow (SA, fxflow.co).

“We are delighted that our strategy is endorsed by Convergence who has a track record of picking companies that change markets” says Andries Brink, 42Markets Group CEO. “We have built an ecosystem of specialised Fintech businesses, all with their own uniquely scalable, frictionless or decentralised platform or services solution for the distribution of financial assets between responsible parties. With this injection of connected capital, we will be able to grow at the rate that the market for our platforms and services demand of us.”

Brandon Doyle, CEO of Convergence Partners, added: “This is one of our first investments in the digital transformation of financial markets. We see 42Markets as an emerging winner in this space. Their group companies have a long track record of consistent double-digit growth and a quality leadership team with deep expertise and experience in the capital markets.”

Fourteen leading global development finance institutions (DFIs) based in Europe, the US and Africa are the investors in CPDIF and Brink says that “we are proactively seeking to engage with these investors to determine opportunities to work together”.

Christian Roelofse Investment Officer responsible at FMO, the Dutch DFI, has stated that “With this investment in companies like 42Markets, we believe that digitally enabled financial inclusion will be advanced. Through our partnership with Convergence Partners, we are proud to be associated with innovative companies that are developing relevant solutions for the biggest needs of our time.”