Published

- 03:00 am

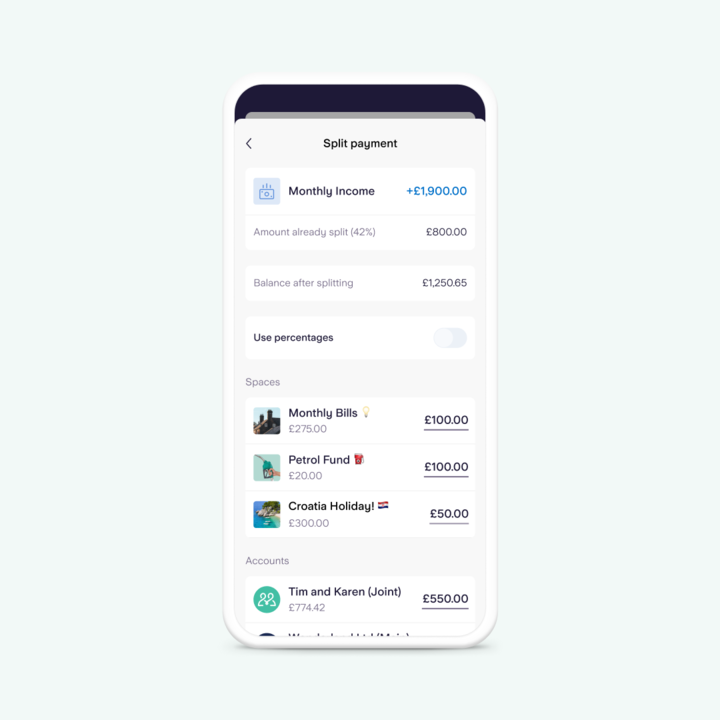

Starling Bank customers can now organise their salary payments across their account. The new feature, called ‘Split payment’, allows customers to decide how much of an inbound payment, such as their salary, to put away and where, including their saving Spaces, joint accounts, additional accounts and Kite cards.

‘Split payment’ users can organise inbound payments either by value or percentage. Funds are then organised instantly, with no need to make lots of individual transfers of different amounts to different accounts or Spaces.

The tool aims to make money management easier for Starling’s GBP Current Account and Business Current Account holders. It joins the bank’s rich features designed to give people more control over their budget, including Bills manager, virtual cards and the Budgeting planner.

Helen Bierton, Chief Banking Officer at Starling Bank said: “Our customers can take their budgeting to the next level with Split payment, and organise their finances in seconds.”

To use the ‘Split payment’ feature, simply go to your transaction feed in the app by swiping up on the homescreen. Select an incoming payment that you’ve received within the last 3 days. There is no maximum or minimum value that the incoming payment needs to be. Select ‘Split Payment’. From there, you can use values or percentages to move money around your accounts.

Related News

- 09:00 am

NatWest is set to launch Tap to Pay on Android, a new way for businesses to take payments on their mobile phone, via the NatWest Tap to Pay app. Through their payments service, Tyl by NatWest, customers can now turn compatible Android devices into contactless mobile card readers and accept in-person contactless payments on their own Android phones.

This new soft point-of-sale solution from NatWest will offer customers the flexibility to accept payments without the need for physical hardware. Evolving customer preferences and increasing costs for businesses across the board have led to the need lower cost solutions, and NatWest’s Tap to Pay on Android solution enables businesses to offer quick and seamless payments from a device they already own. Following a quick and easy set-up process, businesses can present customers with a payment screen on their Android phone and accept a form of contactless payment securely, including credit and debit cards, as well as other digital wallets.

While there’s still a place for physical card terminals, Tap to Pay on Android provides an alternative, proving to be particularly pertinent to businesses that don’t require a fixed solution, or who are infrequent sellers and may want a product that fits a seasonal schedule. It also benefits larger businesses that want a cost-effective way to enable a larger workforce to take payments without needing a large pool of payment terminals. With fast integrations and no additional hardware required, NatWest Tap to Pay on Android makes it even easier for businesses to enable in-person contactless payments with minimal cost and effort, giving businesses another way to capture revenue.

As part of an initial rollout phase, Tap to Pay on Android will be available for a small cohort of Tyl by NatWest merchants, before a full launch later this year. This will equip NatWest with useful insights from customers on their experience using the new product, to ensure the full rollout provides a seamless experience for their loyal business customer base and their own end customers.

Mike Elliff, CEO of Tyl by NatWest, says: “NatWest Tap to Pay on Android is an exciting innovation that will give our customers more flexibility to accept in-person payments anywhere. We understand that business owners are always looking for ways to streamline their operations, boost sales and connect with their customers regardless of location, all while benefiting from tech to make their own sales experience seamless. This new product enables us to meet their needs and put contactless payments into the pockets of countless businesses, optimising the payment experience for all.”

Related News

- 03:00 am

XS.com, the multinational global FinTech and financial services provider has today announced that it has taken on the position as the Diamond Sponsor of the Money Expo Mexico 2023 taking place in the Centro Citibanamex on 24th - 25th May, in partnership with event organisers HQMENA.

Paulo Baptista, Senior Business Development Manager LATAM at XS.com will be conducting an educational seminar during the event. Baptista is an experienced Business Development Manager with a demonstrated track record in the financial services industry. He has a strong focus on Portfolio Management, Risk Management, Customer Service, Sales, and Strategic Planning and will be available throughout the event to meet visitors and answer any questions they may have.

Andrea Ilies, the Global Head of Events at XS.com, commented on the sponsorship of the Money Expo taking place in Mexico:

“We are delighted to announce our role as Diamond Sponsor of the Money Expo Mexico 2023, one of Mexico's premier financial services events. The organizers continuously strive for innovation in their approach to exhibitions within the region. As part of their interactive series of educational and networking events across Latin America and beyond, XS.com takes great pride in being associated with this event. We extend a warm invitation to all participants, and encourage them to join our team of highly skilled professionals for engaging discussions and personalised assistance with their queries. At XS.com, we are excited about the opportunity to connect with attendees and showcase our cutting-edge trading solutions and services.”

Michael Xuan, Executive Director at HQMENA said:

“We are incredibly excited to have XS.com partnering with us at the Money Expo Mexico 2023 as our Diamond Sponsor. The event offers a unique platform to engage with a diverse audience of over 3,000 attendees. This includes financial brokers, investors, traders, IBs, affiliates, and B2B technology providers who are actively shaping the market. We are excited to have XS.com present and highlight their products and services, personally connect with potential clients and investors and reach a wide-ranging audience spanning the financial services industry. Don't miss this chance to make valuable connections and expand your reach within the dynamic financial landscape in South America.”

The XS.com sponsorship offers the opportunity to connect with a leading service provider and enhance traders skills, knowledge, and investment strategies. The XS Group is excited to establish connections with participants, showcasing the broker's cutting-edge trading solutions and services.

Related News

- 02:00 am

Castlepoint Systems, experts in data management and ethical AI for cybersecurity has been listed in the fourth annual CyberTech100 list.

The list highlights those organisations having a significant impact in the growing cybersecurity space for financial services, and celebrates the most innovative CyberTech companies across the globe that are improving the cyber defences of financial institutions.

Founded by CEO Rachael Greaves and CTO Gavin McKay - and based on their direct experience working in public sector data management - Castlepoint Systems is the only company in the world that can give complex enterprises complete visibility of all the information in their environment, making it easier for them to know what they have, where it is, and who is doing what to it.

Castlepoint Systems works with a global cross-section of leading financial organisations including the Australian Government Treasury to ensure that their cybersecurity is not only compliant right now, but ready to scale for the future.

In a market that is evolving due to the digital challenges being increasingly posed by companies and individuals alike, such as generative AI, the CyberTech sector is proving to be an area of considerable future growth. Between 2023 and 2030, the industry is predicted to grow a CAGR of 13.8% from $172.3bn to $424.9bn.

This year’s CyberTech100 includes some of the widest and most diverse businesses in the sector. A longlist of over 1,000 firms was produced by FinTech Global, with a panel of analysts and industry experts voting on the finalists. Castlepoint Systems was one of the companies selected based on their innovative use of technology to solve a significant industry problem and generate cost savings as well as efficiency improvements across the security value chain.

CEO Rachael Greaves stated: “To be included in the CyberTech100 list is hugely rewarding, and reinforces the value that CastlePoint Systems is bringing to financial institutions around the world. As we scale and grow, we continue to leverage our unique technology to help organisations manage their data. Risks come in all shapes and sizes, from ransomware to data breaches. The only way to be fully prepared and to properly mitigate risks is to know exactly what data you have, where it is, what laws apply to it and who has access to it. With effective information management, businesses can tap into a superpower. We are here to enable financial institutions to do just that.”

“As challenges such as ransomware, phishing and data breaches still plague financial institutions, there has never been a more important time for businesses to use CyberTech solutions,” said FinTech Global director Richard Sachar. “With the average cost of data breaches being in the millions, it is critical firms look for solutions that can guarantee their protection, particularly as the tough economic climate puts pressure on finances. This year’s CyberTech100 list arms companies with the necessary information to find the industry change-makers who are providing companies with the opportunity to be well protected against these threats.”

Rachael was also recently included in the Innovate Finance ‘Women in FinTech Powerlist 2022’ in category Senior Leaders (CEOs, CFOs, Founders, Executive Team Members) as a result of her outstanding hard work and achievements over the previous 12 months. In 2022, Rachael was announced Australia’s most outstanding woman in IT security, and also won the RegTech female entrepreneur of the year category, with her business also taking home the RegTech Association’s Australian business award.

The full list of the CyberTech100 and detailed information about each company is available to download at www.CyberTech100.com.

Related News

- 01:00 am

Brite Payments, one of Sweden’s fastest-growing fintechs and a leader in instant bank payments, today announced its Brite Instant Payments Network (IPN). Brite IPN is a proprietary network that leverages the capabilities of open banking to give merchants and businesses a complete, out-of-the-box instant payments and payouts solution.

Uptake of open banking payments across Europe is increasing as businesses see benefits from an operational and cost perspective while valuing the convenience and security they offer customers. However, the full potential of open banking payments is yet to be realised. Brite has taken an open banking-first approach to build a network that enables 24/7/365 instant payments processing while helping address the limitations of SEPA Instant and the fragmented nature of real-time payments in Europe. Additionally, Brite IPN enables instant payments and payouts in markets and currencies outside the Eurozone.

“Open banking has enormous untapped potential but businesses need easy-to-integrate products that deliver real and immediate value. Brite IPN is the ‘engine’ that enables us to process payments instantly and equip businesses with a true out-of-the-box solution,” said Lena Hackelöer, Founder & CEO, Brite Payments. “We have been building our next-generation proprietary network since Brite was founded in 2019, and I am excited to announce Brite IPN as a significant step forward in our mission to support merchants and businesses with a faster, more convenient, and secure open banking payments solution.”

Brite IPN powers instant payments and payouts products that offer merchants significant advantages over traditional open banking payments (i.e. Payment Initiation Services or PIS) by taking full receipt of incoming funds and settling them rapidly on behalf of merchants across Europe. Supported by Brite IPN’s merchant FX capabilities, merchants can also fund or request settlement in a currency of their choice.

Key benefits:

- 24/7/365 processing – eliminates reliance on traditional bank clearing cycles and cut-off times while reducing risk and mitigating fraud

- Automated reconciliation and reporting – reduces operational costs

- Smart routing – payments are optimised for speed and most efficient routing

- Merchant FX – Brite IPN can exchange FX upon request, helping bridge the gap between Europe’s instant payment schemes

- End-to-end payment visibility – Brite provides insights into the payment status of every transaction initiated through its network

The Brite IPN announcement follows significant growth over the past year, with the second-generation fintech more than doubling revenue and transaction volume on its platform in 2022, and increasing its headcount by nearly 100 per cent during this period. Brite serves merchants and businesses across a wide range of verticals, in an ever-expanding number of markets across Europe.

Related News

- 09:00 am

Tietoevry Banking has launched Tap on Phone - now available for partners and clients across Europe. This innovative solution allows merchants to accept payments from any contactless card or mobile wallet directly from their Android device, such as their standard mobile phone.

Payment acceptance can now be enabled without the need for traditional card payment terminals, just software download from an app store is all it takes to get going. Tietoevry Banking’s Tap on Phone solution will allow merchants to go-to-market quickly, and additional services can be integrated seamlessly, allowing partners to stay ahead of the curve in a fast-evolving payments landscape.

The latest partner to utilise Tietoevry Banking's Tap on Phone solution will , who will provide it to Electronic Cash Register (ECR) vendors and other Point of Sale (POS) partners.

"We are delighted to launch Tap on Phone to our partners in the Nordic markets initially, and then across wider Europe. We have developed a strong partnership with Tietoevry Banking and will focus on delivering this innovative payment technology to integration partners across the payments eco-system in the years ahead,", says Douglas Oest, Business Development Manager in Axxtrans.

“We are happy to have Axxtrans onboard and look forward to providing other merchants across Europe with this innovative payment solution together with new and existing partners in the region,” says Kevin Grönvall, Head of Card Acquiring in Tietoevry Banking.

“Tap on Phone is a product which fits with our ambition of launching scalable, innovative, sustainable, and secure solutions. We anticipate high demand from merchants of all sizes for Tap on Phone in 2023, a product which is anticipated to be globally worth around $76.3 billion by the end of 2025,” Grönvall adds.

Tietoevry Banking will launch the Tap on Phone solution in Europe with an initial set of partners in Q2 2023, underpinned by an ultra-high availability processing platform and 24/7/365 support as standard.

Related News

- 04:00 am

XTB, global fintech, is expanding its investment offer in the MENA region. Starting May 22nd, investors will have the opportunity to invest in stocks from the 15 largest stock exchanges in the world, including the NYSE, LSE and Deutsche Boerse.

XTB has been systematically expanding its offer with new products. This is driven by the desire to offer the users of the proprietary investment platform the widest possible opportunities of capital allocation options. For several years, investments based on real stocks and ETFs have been increasingly popular. From May 22nd, investors from the MENA region will have access to these types of investments.

New investment opportunities

Until now, XTB's offer in the MENA market was based on CFDs. The last two years of the global fintech in this market show that there is enormous investment potential in this region, thus the expansion of the product offering.

Starting from May 22nd, XTB's offer in the MENA market will include real stocks (from the European and US stock markets) and ETFs (from the European markets). Users of the XTB platform will have the opportunity to purchase stocks and ETFs from up to 15 of the largest stock exchanges in the world, including The New York Stock Exchange, London Stock Exchange and Deutsche Boerse.

- The development of our product offer in the MENA market is a natural step in our growth. Our goal is to provide our clients with a full investment spectrum so we are constantly working on the development from both the perspective of products but also technology - says Omar Arnaout, CEO of XTB. - I will also not hide the fact that our branch in Dubai is one of the fastest growing. This shows the enormous interest in financial markets in this region and I am pleased that local investors will gain new investment opportunities - Arnaout adds.

Investors interested in stocks and ETFs at XTB will receive an extremely attractive offer in financial terms. The minimum transaction value starts at 10 EUR. However, what is important, the investment platform does not charge any commissions for such transactions until the monthly turnover exceeds 100 000 EUR. Above this limit, transactions in stocks and ETFs are charged a commission of 0.2% (min. 10 EUR).

Increased interest in the capital market

The addition of stocks and ETFs to XTB's offer is the expansion of possibilities for users with different investment strategies. CFD-based instruments are characterized by high volatility and are intended for active investors, where stocks, and especially ETFs, are products for people leaning towards more passive investing. In some markets, e.g. in Poland, Portugal, Romania and the Czech Republic, a significant part of XTB clients buy shares and ETF funds.

- The recent years during the COVID-19 pandemic, the tense geopolitical situation and rampant global inflation have created many investment opportunities in the market. Both for proponents of active and passive investing. I am pleased that with the expansion of XTB's offer in the MENA region, local investors will gain new investment opportunities - says Achraf Drid, director of XTB MENA.

In the first quarter of 2023, XTB generated over EUR 64.4 mm in consolidated net profit. This is a record quarterly result in the company's history. Furthermore, the total number of clients on the global investment platform exceeded 721,000, with an increase of over 104,000 in the first quarter of this year alone.

Related News

- 05:00 am

OKX, the second-largest crypto exchange by trading volume and a leading Web3 technology company, has issued updates for the day of May 21, 2023.

OKX Launches New 'Steady Trader' Copy Trading Category

OKX has launched a new category under its Copy Trading product, called 'Steady Trader'. The new category is designed to help users easily select and copy the trades of users with the most stable trading performance.

OKX's Copy Trading product aims to enable regular traders to replicate the trading success of lead traders on the platform, by copying their strategies and automatically executing them in real-time. At the same time, lead traders can earn a portion of the profit from traders who have replicated their trades.

Note: There is risk involved in trading; users should refer to OKX's Risk and Compliance Disclosure before using the Copy Trading product.

Related News

- 04:00 am

FinTech Automation (“FTA”) announced today that Tactive Advisors has licensed FTA’s UniFi core banking and WealthTech applications that will be used as the technology infrastructure for the Tactive WealthTech Platform. The partnership enables Tactive to further develop their technology strategy of a unified wealth management platform to include insurance, banking, and alternative solutions that offers a holistic financial services platform to its financial advisor partners and their clients. The FinTech Automation Infrastructure-as-a-Service will be the foundation of the Tactive Platform to assist their advisors in truly compete in a financial services market increasingly dominated by larger financial institutions.

David Joon Park, Founder and CEO of FinTech Automation said, “Independent financial advisors have always done a good job of offering high-touch service to their clients but have been incapable of offering a combined banking and wealth management solution while maintaining their ability to remain independent. With the Tactive platform, it will create a formidable holistic financial services platform their advisors can harness to offer truly unbiased financial solutions to solve client needs.”

Joe Gissy, Founder and CEO of Tactive, added, “The Tactive Platform was specifically designed to support advisors through a comprehensive tech stack enabling them to scale their business, and by incorporating FinTech Automation’s Infrastructure-as-a-Service, we will continue to disrupt the current financial advisory space and lead in the new evolution in WealthTech.”

Related News

- 07:00 am

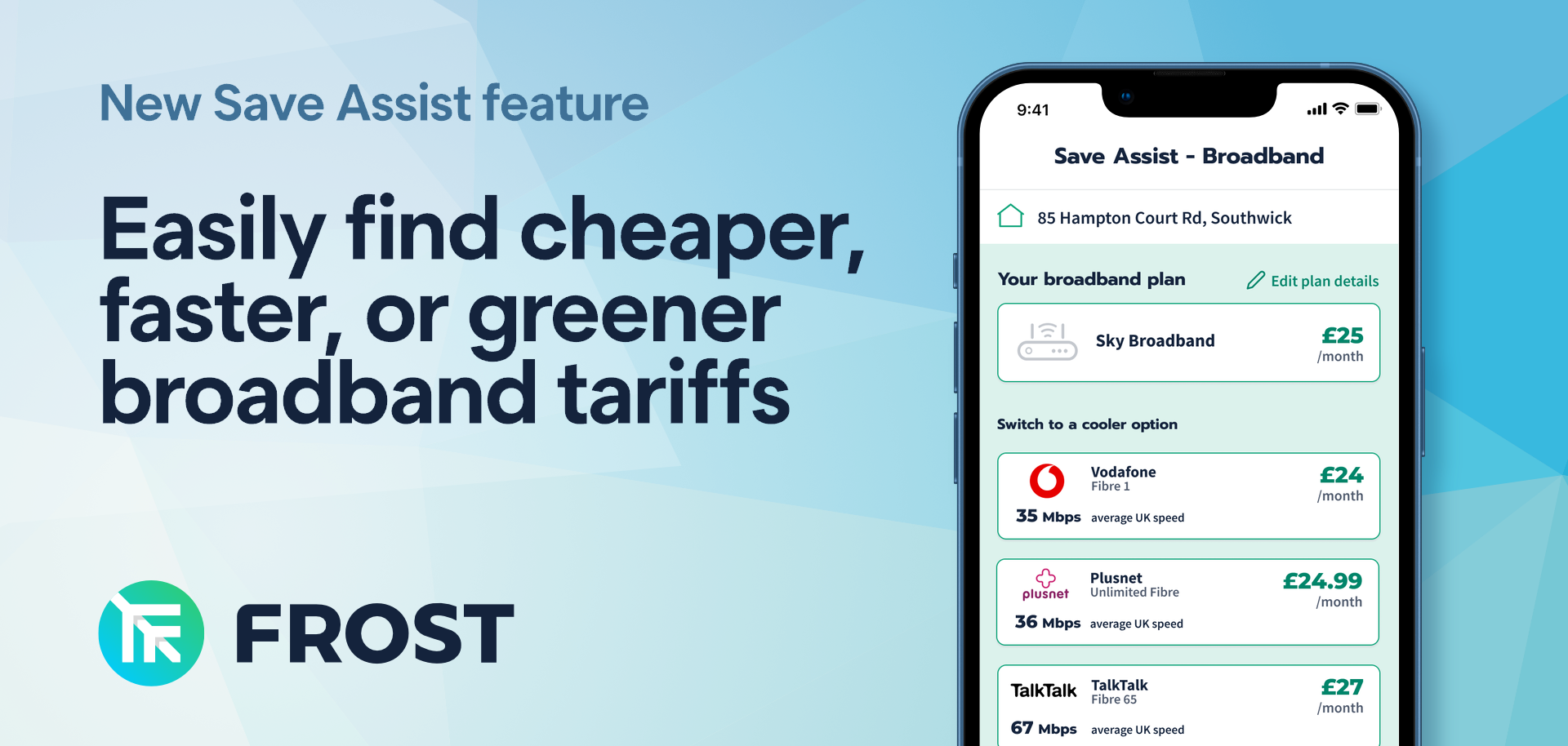

Frost, the innovative personal finance app, has announced the expansion of its automated provider switching tool 'Save Assist' to include broadband switching services. The announcement comes in response to the recent 17.3% broadband price hike in April, as reported by Money Saving Expert, leaving consumers struggling to keep up with their bills.

Save Assist has already proven to save households hundreds of pounds each year, and is set to increase over time. By providing consumers with the latest information and best deals, Frost helps individuals manage their finances effectively. With the addition of Broadband Switching to its roster of capabilities, Frost is tackling the rise in bills by identifying promotional discounts and alerting consumers to upcoming contract changes. By using Frost, individuals can make smarter choices about their spending.

The Frost app lets consumers view real-time price comparisons and switch providers, where required. Individuals can also track their monthly spending and usage of broadband packages to generate a more tailored plan which meets their needs without overspending. In addition, Frost highlights green broadband options, showing more sustainable providers with cheaper tariffs. This feature is particularly beneficial for consumers who are interested in making the switch to a greener lifestyle.

Furthermore, Frost educates consumers on greener choices, and will soon be able to plant trees in customers' names for in-app referrals, whilst forming alliances with the greenest companies in each sector to get its users the best price.

During a time when the cost of living continues to rise, the launch of Broadband Switching on the Frost App could not be timelier. Millions of customers worldwide are being hit with significant price hikes due to increasing demand for faster and more reliable internet services, which requires significant investment into infrastructure and increased operational costs. With the Frost App, it is now easier for consumers to dodge these price spikes whilst maintaining a high level of broadband service.

Speaking on the product line expansion, co-founder Pawel Oltuszyk said, "We are proud to be offering such a valuable tool to our customers during these uncertain times. By providing an easy-to-use platform that empowers individuals to make better financial decisions, we hope to help millions of households regain control of their personal finances."

The Frost App is available to download for free on iOS and Android devices.