Published

- 07:00 am

OSTTRA, the global post-trade solutions company, today announced it has successfully delivered the first cross-currency swap conversions of USD/SGD swaps from SOR to SORA. The service will expand to cover other indices subject to cessation in the coming months.

OSTTRA has been working with the industry since 2021 to enable market participants to overcome the complex challenge of transitioning from legacy Libor benchmarks to new risk-free rates (RFRs). The latest service, an industry first, facilitates the multilateral conversion of uncleared cross-currency swaps away from legacy benchmarks to alternative risk-free rates (RFR).

The conversion process generates overlay transactions, in the form of market standard interest rate swaps and overnight index swaps, which are submitted to clearing, minimising the risk and present value (PV) impact. Any remaining PV impact from the overlay trades is settled in cash between the participants of the conversion run, making the process market risk neutral.

The first multilateral conversion, for USD/SGD swaps, was completed by eleven market participants, whilst a second conversion was performed by twenty-one participants ahead of CCP conversion for the SGD SOR benchmark. The service is also available to customers with legacy benchmark exposure in cross-currency swaps referencing other indices subject to cessation, including those in MXN, PLN, ZAR and CAD.

The new conversion service is delivered by OSTTRA triReduce and triBalance, while connectivity to CCPs for the overlay swaps is provided via OSTTRA MarkitWire. The process has been carefully coordinated with a highly engaged group of market participants.

“As one of the largest market makers in SGD derivatives, DBS is actively working with OSTTRA to convert its bilateral SOR cross currency swaps into SORA in preparation for a smooth industry transition to SORA,” said Andrew Ng, Group Head, Treasury & Markets, DBS Bank. “Through close collaboration with key industry players, an innovative solution was developed to reduce legacy SOR positions in the industry in line with regulatory requirements.”

“OCBC Bank is proud to have participated in the inaugural CCS conversion in the SGD rate derivative market,” commented Kenneth Lai, Head, Global Treasury, OCBC Bank. “We remain committed to working with the industry and our clients towards the transitioning of SOR to SORA, and the overall development of Singapore as a key financial centre.”

“UOB has been actively working with OSTTRA and is pleased to have participated in the Bilateral USD/SGD Cross-Currency Swaps conversion from SOR to SORA. This partnership paves the way for a smooth IBOR transition for SOR/SORA,” added Leslie Foo, Group Head, Global Markets, UOB. “We are very encouraged by this collaboration and look forward to working closely with the industry participants and OSTTRA in the future development of the SGD derivatives markets.”

“Our engagement with the industry over the last two years highlighted that market participants are committed to finding innovative solutions to reduce their exposure to legacy benchmarks,” said Vikash Rughani, Business manager at OSTTRA triReduce and triBalance. “We are pleased to provide our non-cleared conversion service to help market participants overcome the technological and operational challenges of implementing fallback procedures and waiting until the deadlines for the respective legacy rates.”

Related News

- 04:00 am

Integral, a leading currency technology provider to the financial markets, announced today that C. Hoare & Co., the UK’s oldest privately owned bank, has used Integral’s cloud-based SaaS FX technology to enable its customers to access market liquidity and competitive FX rates across both their business and personal accounts.

In the face of continued technological innovation, private banks and wealth managers are partnering with providers to realize the potential of technology and give their customers the best services without the significant costs of building their own infrastructure.

Integral’s FX technology solution offers best-in-class liquidity aggregation, a highly configurable pricing engine and seamless API integration. The solution enables the bank to better serve their existing customer base and address new market segments.

“Integral’s sophisticated SaaS technology provides us with the capabilities to service our customers with the reassurance of Integral’s expertise and high-quality technology,” said Phil Tither, Treasury Relationship Manager at C. Hoare & Co.

“We are delighted to work with one of the oldest financial institutions in the world, bringing our unrivalled experience and market-leading technology,” added Harpal Sandhu, CEO, Integral. “C. Hoare & Co. and their customers will benefit from our cloud-based SaaS offering, delivering fully automated and highly configurable FX workflow.”

Related News

- 05:00 am

Adyen, the global financial technology platform of choice for leading businesses, is publishing economic research that finds that retailers could potentially add £169 billion in revenue to the sector in the UK if they switched to a unified commerce approach and stopped operating in silos.

The economic analysis conducted by the Centre for Economic and Business Research (Cebr) found that unified commerce gave retailers a 16 percentage point boost to their growth rate in 2022.

Adyen commissioned Opinium to poll 2,000 consumers and Censuswide to poll 500 businesses in the UK to understand how inflation is affecting behaviour among shoppers and how businesses are adapting to this change. Economic modelling by the Cebr shows how global unified commerce, which involves connecting online and offline payments in one system, supports greater retail resilience in a challenging operating environment.

More than half of UK consumers (62%) said they spend more time searching for the best deals and prices because of the current financial climate, while a quarter (25%) said they spend more time evaluating the quality of a product before making a purchase. In response, 43% of businesses believe the impact of inflation means they need to offer discounts to consumers year-round.

The research found that, in face of the rising cost of living, personalisation and loyalty have become increasingly important to consumers. More than half (53%) want to see more personalised discounting from retailers. And 31% say they want businesses to remember their preferences and previous shopping experiences so that browsing is more tailored. Retailers are finding it hard to deliver on this, with 48% suggesting it’s now harder to categorise customers.

The tech advantage

More than half (57%) of consumers say that they’d be more loyal to retailers that let them buy online and return in store, and almost a third (31%) suggested they’d have better shopping experiences if a business enables them to shop in store and finish online or vice versa.

Further, when consumers were asked about how technology makes them feel when shopping in store, the result was positive. Almost a third (29%) said they were happier because shopping was quicker. And 16% said it meant they were able to visit the store more frequently.

Despite the findings, the business research uncovered that just 14% of businesses in the UK have already invested in unified commerce. This compares to 44% beginning to invest and 28% in the consideration phase.

“Consumer behaviour has evolved over the last few years, and the decisions businesses make now around tech investment have critical outcomes,” said Alexa von Bismarck, President, EMEA at Adyen. “Our research highlights how the use of technology and, in particular, unified commerce, can support businesses. It gives them a more agile, sophisticated approach that helps them to understand customer trends and shifting demands.”

“Customers expect a personalised and data-driven experience both online and in physical retail spaces. Unified commerce unlocks the power of data by streamlining information into one central platform where insights can be easily accessed . It gives a powerful overview of customers so that their expectations can be met when shopping. Organisations in the retail sector are operating in one of the fastest paced industries on the planet. And technology has proven its significance in ensuring operations are resilient in the current environment.”

Related News

- 09:00 am

Bright Data, the market-leading public web data platform, has been added to the Amazon Web Services (AWS) ISV Accelerate program, a co-sell program for AWS Partners who provide software solutions that run on or integrate with AWS. Bright Data facilitates unique scalable web data collection within the AWS environment.

The AWS ISV Accelerate program provides Bright Data with co-sell support and benefits to meet the growing customer needs through collaboration with the AWS field sellers and consulting partners globally. Co-selling offers better customer outcomes and assures mutual commitment from AWS and Partners.

"The AWS ISV Accelerate program provides us with an excellent opportunity to expand our business through partnership with AWS, one of the world's leading cloud platforms," said Tamir Roter, Bright Data’s Chief Corporate Development Officer. "We are excited to work with AWS to accelerate sales cycles and deliver unparalleled customer value in the Cloud, on a global scale.”

Through this partnership companies across multiple market sectors can now reach enhanced business results, by integrating data and security insights from public web data, and their internal data, providing their customers with a complete, fully integrated data cloud solution. Bright Data has already secured joint business in 7-digits USD through co-sell with AWS across several transactions and use-cases, including:

- Jungle Scout, the leading all-in-one platform for sellers on Amazon, collects real-time data on ecommerce, manufacturing, and consumer demand.

- SEON, helps online businesses reduce fraud, collecting web-data signals on merchants, customers, and payments.

- Government agency, enhancing cyber security.

- Company providing digital copyright protection.

Related News

- 07:00 am

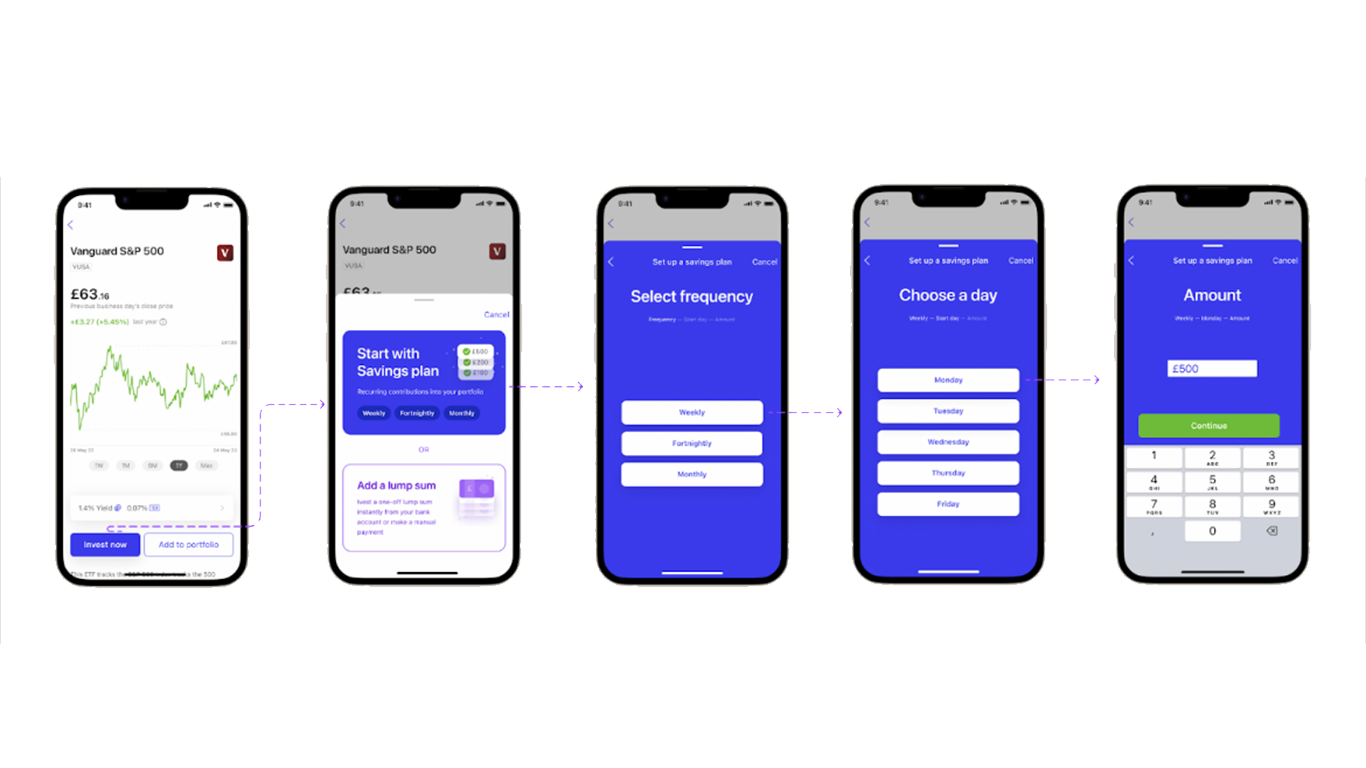

Exchange-traded funds (ETF) investment platform, InvestEngine, has today launched its new Savings Plan feature for customers in the UK, giving both new and experienced investors an easy solution to regularly transfer their income and savings into investments.

Utilising the latest innovations in open banking technology, Savings Plans will allow investors to make regular, diversified investments with greater ease and flexibility, creating a ‘little and often’ investment culture.

They will also help to open the door to less experienced investors. With 30% of UK adults feeling like investment is not for people like them*, the new Savings Plan feature enables consumers to invest as little as £10 a week in an ETF portfolio, helping more people to take those first steps towards regular investing.

Replicating the success of savings plans in Europe

Over the last few years, ETF savings plans have become an increasingly popular way for people to invest and save for their future, with significant growth in both the US and parts of Europe. In Germany, for example, ETF savings plans are projected to hit 20 million in number by 2026 – equivalent to a quarter of the population. Separately, the overall volume invested into ETFs by retail investors globally is expected to reach €350 billion by the same year.

The launch of new Savings Plans by InvestEngine looks to not only replicate, but build on the success of savings plans seen in Europe. This includes giving investors significantly more flexibility in how they invest in a portfolio of ETFs.

Rather than being restricted to purchasing and trading entire units of ETFs, which has been more commonly associated with savings plans elsewhere, InvestEngine’s users will be able to take advantage of automated fractional investing and purchase a fraction of any ETF on their platform from just £1. This also ensures that no funds are left dormant in an investor’s account, and instead means that every penny is invested and working towards growing their wealth.

Andrey Dobrynin, Co-founder and Managing Director at InvestEngine, said: “ETF savings plans have grown significantly in popularity around the world as a simple, low-risk way for people to invest little and often, and grow their wealth.

“While we have seen our financial lives transformed by tech innovations in recent years, the way we invest has not always kept pace, and is restricting people’s ability to put their money to work for the future.

“With the launch of our Savings Plans, we’re utilising the latest innovations in automation and investing, building on the success seen in countries like Germany and helping make the UK the investing capital of Europe.”

By bringing the latest innovations in Variable Recurring Payments (VRPs) to its platform, InvestEngine is enabling people to automatically invest as little as £10 - weekly, fortnightly, or monthly - from a bank account of their choice. Once received, it will be automatically invested based on the chosen investments. New funds are automatically invested according to the target weight set in the investor’s portfolio without them having to lift a finger.

Savings Plans users will have access to the same accounts, including InvestEngine’s fee-free ISA, the same range of 550+ commission-free ETFs, and will be able to choose to manage it themselves or have InvestEngine build and manage a portfolio that meets their needs.

Growing ETF awareness

The UK, together with Switzerland, were the leading ETF markets in April as the industry continues to grow in size. However, the majority of people in the UK have little awareness of ETFs. Research by InvestEngine found that less than half (47%) of people had heard of them, significantly below mutual funds (71%) and cash and stocks & shares ISAs (both over 90%).*

This is despite many people saying they choose investment or savings products based on factors which ETFs can provide, such as low fees (46%) and low risk (59%).* ETFs are becoming more popular due to their simple and diversified nature, coupled with vast amounts of choice.

Related News

- 06:00 am

Intellect Global Consumer Banking (iGCB), the consumer banking arm of Intellect Design Arena Limited, has launched its Open Finance Enabled Retail banking platform built on eMACH.ai at Money20/20 in Amsterdam. The new Retail Banking Platform empowers banks to create unique products and curate experiences by partnering with country-ready marketplace players. The platform encompasses end-to-end Retail Banking across Savings, Deposits, Payments, Cards, Lending, Trade Finance, Treasury and Digital Banking.

The retail banking platform is built on eMACH.ai (event-driven, microservices-based, API-enabled, cloud-native, and headless with underlying AI models). Being API-first with over 285 ready-to-use Microservices and the ability to connect with 1,214 APIs, the platform enables banks and financial service providers to:

● Compose autonomous business components for curating complete financial solutions ● Reduce Business and Technology Risks, lower maintenance costs, and increase scalability with cloud hosting

● Enable Sustainability through AI-based ESG rule engine in compliance with global standards

● Go-to-market faster with a country-ready Marketplace

The platform is available on a flexible and adaptive commercial model enabling banks to ‘Pay As You Grow’. Banks will be able to on-board customers in three minutes as well as integrate with FinTechs to offer products like deposits through aggregators, extend services beyond Bank’s core strength, drive ‘Application To Sanction’ in minutes, offer unique credit experiences like Buy Now Pay Later and more. Just in a few days banks can launch new products and collaborate with the vast network of ecosystem players seamlessly. All this is powered by this specialised No code - Low code platform.

The platform was launched at Money20/20 in Amsterdam where the attendees’ experienced unique ways of creating signature experiences through a live sandbox, tactile microservices table and compose-it-yourself perfume bar.

Intellect Global Consumer Banking Team at Money20/20 during the launch.

From left to right: Avik Dasgupta, VP, Marketing | Rikard Redin, Business Development Manager – Nordics | Viral Khandwala, Head, Engineering | Balaguru Ramachandran - Lead Architect, CBX Digital Platform | Selvakumaran S, Business Head - Central Banking, Capital Markets & Enterprise Solution Consulting | K Srinivasan, President & Regional Head, UK & Europe | Abhishek Verma, VP, Sales, Europe | Vikas Tripathi SVP, Sales, UK | Mithu Gupta, CMO & Head, User Experience

Rajesh Saxena, Chief Executive Officer, Intellect Global Consumer Banking (iGCB), said, “Our new Open Finance enabled Retail Banking platform opens up new opportunities for banks in global markets, representing the future of banking. Giving financial institutions access through a centralised eMACH.ai platform that is composable and extensible allowing endless possibilities.”

He further added, “Technology has been made highly accessible for banks enabling rapid deployment of business scenarios.”

The news follows the launch of iGCB’S Open Finance enabled Core Banking Platform on Cloud in April 2023 in London.

Related News

- 01:00 am

Griffin, the UK’s first full-stack Banking as a Service platform, today announced that it has raised $13.5 million (£11 million) in a Series A funding round led by global VC firm, MassMutual Ventures, with participation from existing investors Seedcamp, Notion Capital and EQT Ventures.

This funding round comes on the heels of Griffin's recent achievement in securing its UK banking licence with restrictions. It represents a significant milestone in its goal to deliver a best-in-class banking platform for fintechs. The new funds will be used to prepare for exiting the “mobilisation” period (also known as authorisation with restrictions), which is subject to regulatory approval. The funds will also be geared towards supporting Griffin’s commercial activities and further developing its embedded finance platform.

"We’re fortunate to have found in MassMutual Ventures an investor with such conviction in what we're doing," said David Jarvis, CEO of Griffin. "This funding round not only validates our mission and strategy but also equips us with the resources to continue to deliver our innovative banking solutions to more customers."

Ryan Collins, Managing Partner at MassMutual Ventures, commented: “Griffin’s licence and BaaS platform represent unique capabilities in the UK market and enable it to become a pillar for the fintech ecosystem. Its comprehensive product suite is tailored to serve fintechs, payment services providers and brands looking to embed finance offerings.”

Griffin continues to make strong headway on its quest to be the bank of choice for companies looking to embed finance. The fast-growing API-first bank has attracted early adopter customers such as embedded finance platform Liberis and notable partnerships with 11:FS and Cable. Griffin raised £12.5m last year in a round led by Notion Capital, and in 2020 raised £6.5m from EQT Ventures.

Griffin’s unique offering brings the power of SaaS to banking, with a developer-friendly Banking as a Service platform supported by a UK banking licence. Built from the ground up to serve fintechs and innovative brands looking to embed finance, Griffin will offer bank accounts (including interest bearing savings accounts), access to the UK’s payment rails, cards, an integrated ledger, and automated compliance technology.

Related News

- 03:00 am

ION, a global leader in trading, analytics, treasury, and risk management solutions for capital markets, commodities, and treasury management, announces that Soochow Securities Co. Ltd of Hong Kong has chosen its Fidessa equities trading platform. Soochow is an international financial services firm, headquartered in Suzhou, China, and will use Fidessa to grow its Hong Kong-based investment banking and brokerage services, and stay competitive in the global marketplace.

Soochow offers brokerage services for securities, funds, and bonds, alongside investment banking, dealing, asset management, and credit trading. To expand their businesses and build links internationally, Chinese brokerage firms like Soochow need reliable and scalable technology solutions to support their operations. ION’s Fidessa platform gives Soochow access to international trading and market data, and integrated risk management capability. This single, comprehensive solution delivers the benefits of simplicity, reliability, and automation.

Soochow is the 20th Chinese brokerage firm ION has partnered with since 2013. Fidessa provides an immediate, one-stop-shop trading platform for APAC and international equities markets, making it the ideal solution for Chinese brokers to navigate global finance’s complex and rapidly evolving landscape.

“ION is delighted to partner with Soochow Securities Co. Ltd to deliver a successful go-live of our Fidessa equities trading platform,” said Robert Cioffi, Global Head of Equities Product Management. “Fidessa is a trusted solution for brokers across the APAC region. We look forward to working with Soochow to support their expansion plans and achieve their business objectives.”

Li Chen, Vice Chairman at Soochow (HK), commented: “As the only listed securities company in Suzhou, we need technology that can simplify and automate workflows to boost efficiency and scale our business. We chose the Fidessa trading platform as it is the market leader in the equities space and the top choice for sell-side institutions.”

Related News

- 05:00 am

The Government Blockchain Association (GBA) honoured exceptional individuals and organizations for their groundbreaking use of blockchain technology in solving public sector challenges. The Annual Achievement Awards, presented on May 24, 2023, in Washington, DC, celebrated this year's outstanding winners.

- Rosemarie McClean, Chief Executive Officer, and Dino Cataldo Dell'Accio, Chief Information Officer received the award on behalf of the United Nations Joint Staff Pension Fund (UNJSPF), the Organization Award for a digital identity solution that enabled over 23,000 retirees across 180 countries, to provide their proof of life, using blockchain and biometrics technologies. Their innovative solution helped to streamline the pension administration process, reduce errors, and improve the overall client experience.

- Pradeep Goel, CEO of Solve.Care, a blockchain healthcare company, was awarded the Courage Award for his dedication to assisting war-ravaged refugees in the Ukraine conflict. Despite personal risks and costs, his "Care Shelter" project provided accommodation and meals for over 2,500 Ukrainians displaced during the war.

- Jon Trask, CEO and Founder of Dimitra Technology received the Social Impact Award for Dimitra's transformative work in global farming. Their Blockchain/AI solution fights hunger, reduces deforestation, and enhances crop yields. Dimitra's applications serve 16 countries and provide vital support to farmers in climate-ravaged areas.

- Mike Kanovitz, CEO of Jurat Blockchain earned the Innovation Award for integrating blockchain with legal court processes, empowering creators with smart contract tools, facilitating NFT swaps, and adding security against fraud.

- Sary Qasim, the GBA Regional Leader in the Middle East and North Africa, received the Leadership Award for his exceptional efforts in the Middle East/North Africa region, driving the adoption of the Blockchain Maturity Model (BMM) and establishing strategic relationships.

These winners join a prestigious list of former recipients, including:

- El Salvador President Najib Bukele for adopting Bitcoin as legal tender

- US Congressional Senior Staff Bill Rockwood for legislative leadership, and

- Utah County Commissioner Amelia Powers for pioneering blockchain-based voting systems.

The GBA's next award ceremony will be held in September 2023 during the Blockchain & Infrastructure conference (https://gbaglobal.org/blockchain-infrastructure/). The event will recognize blockchain solutions evaluated using the GBA's Blockchain Maturity Model (BMM) (https://gbaglobal.org/blockchain-maturity-model/) and earning the "Trusted Blockchain Solution" credential.

Related News

- 06:00 am

ClearBank, the enabler of real-time clearing and embedded banking for financial institutions, today announced its partnership with Allica Bank, the fintech challenger bank dedicated to supporting established UK small and medium businesses.

Allica Bank was founded to serve established UK SMEs (businesses with 10-250 employees) and provide them with tailored, human support, backed up with the latest banking technology—which established SMEs struggle to get from the big banks. It offers business current accounts and tailored lending products, powered by market-leading lending technology, such as an automated, instant decision-in-principle for business mortgages. It aims to be the go-to bank for established businesses within the next decade, and following significant growth in 2022—including 534% revenue growth, reaching £1.35 billion in lending, and a 76% increase in staff—it is well positioned to meet this ambition.

ClearBank is a key enabler for Allica’s ambitious growth. ClearBank provides Allica Bank with client money accounts and access to UK payment schemes, including Faster Payments (FPS), CHAPS and Bacs, powered by its API-first, cloud-native technology.

Allica launched its business current account to established businesses late last year, offering cashback rewards, no monthly fees and relationship manager support, along with a market-leading 3% AER integrated instant-access Savings Pot. It can also offer quick and secure transactions using FPS, Bacs and CHAPS. Allica believed it crucial to work with a provider that was closely aligned with its values and growth objectives to help it scale at pace.

ClearBank works with 15 of the UK’s newest banks—rather than competing with its own clients, it is a stable and profitable “bank for banks”.

Keith Middlemass, Chief Operating Officer, Allica Bank, said: “By offering a relationship-backed service, powered by modern technology, Allica is building the future of banking for established businesses. It is vital that we work with industry-leading partners that can grow with us as we scale. ClearBank is a leader in its field and is an obvious partner for us—we are on the same path both in growth trajectory, and in our values.”

Charles McManus, Chief Executive Officer, ClearBank, said: “With its focus on SMEs, Allica Bank is supporting the backbone of our economy—and we’re committed to helping them boost business banking in the UK. We're providing the speed, flexibility, and security Allica Bank needs to provide the very best services to UK SMEs.”

The two banks have been working together since July 2021. During that time both have announced that they have achieved profitability—with Allica being one of the fastest UK fintechs to ever achieve profitability—against the backdrop of a wider downturn in the fintech sector.