Published

- 06:00 am

Today the Basel Committee on Banking Supervision unveiled its latest progress report on banks' implementation of the Principles for effective risk data aggregation and reporting.

The report is based on the results of a self-assessment survey completed by authorities having supervisory responsibility for G-SIBs and reviews progress in implementing the Principles during 2016. It notes that, while some progress has been made, most G-SIBs have not fully implemented the Principles and the level of compliance with the Principles is unsatisfactory.

In view of the results and to promote further adoption of the Principles, the Basel Committee has made the following additional recommendations:

Banks should develop clear roadmaps to achieve full compliance with the Principles and to comply with them on an ongoing basis.

Supervisors should: (i) communicate the assessment results to their banks and provide the necessary incentives to achieve full compliance with the Principles; and (ii) continue to refine their techniques to assess banks' compliance with the Principles.

The Committee will continue to monitor the G-SIBs' progress in adopting the Principles. The Committee also strongly suggests that national supervisors apply the Principles to institutions identified as domestic systemically important banks (D SIBs) three years after their designation as such.

Related News

- 08:00 am

Harbortouch, a market leader in point-of-sale (POS) payment solutions, is setting up a product development division in Lithuania. The division, which will be the company’s first outside the US, is expected to employ approximately 60 IT specialists.

“We have chosen Lithuania because of the talented IT specialists available here and the country’s excellent infrastructure,” says Harbortouch’s CEO Jared Isaacman. For Mr. Isaacman, who founded the company when he was 16 years old, the presence of other major players from the US IT sector also gave Lithuania an advantage. “The success of other innovative US companies such as Uber in the development of integrated systems in Lithuania has convinced us that we must establish here,” he comments.

When choosing a location for the new division, the company considered other countries in the CEE region such as Poland, the Czech Republic, Estonia, Latvia, Hungary and Romania, before opting for Lithuania.

In addition to touch-screen POS solutions, Harbortouch also processes payments through electronic cash registers and credit card terminals. The company’s payment processing services enable payments with credit, debit, gift and loyalty cards. Harbortouch has received numerous international awards for its technology solutions in the field of POS payments.

Established in 1999, the company is now a market leader, servicing approximately 300,000 businesses in the US in its 17 years in business. Annually, approximately €10.5 billion of payments are made through the Harbortouch system. The company’s revenue in 2015 was roughly €280 million, and its operations have been profitable for over a decade now. The company currently employs around 400 people.

“This project is especially interesting in relation to Lithuania’s growing financial technology cluster,” comments Mantas Katinas, director general of the foreign investment promotion agency Invest Lithuania. “That’s because the system being developed by Harbortouch incorporates hardware solutions, IT development, and big data technology,” Mr Katinas continues. “These are solutions of the future, and the Harbortouch project will certainly contribute to the country’s ability to compete going forward.”

Mindaugas Sinkevičius, Lithuania’s Minister of the Economy, believes a business-friendly environment is helping to attract the likes of Harbortouch to Lithuania. “Lithuania has become the first location for Harbortouch’s operations outside its home market,” says the Minister, “and the number of examples of foreign investors engaged in the development of innovative products is on the rise. This demonstrates that the Lithuanian Government has chosen the right direction in ensuring favourable conditions for the establishment of not only local businesses but also leading foreign companies,” concludes Mr Sinkevičius.

Jared Isaacman is a three-time finalist of the Ernst & Young Entrepreneur of the Year Award, and is also a co-founder and CEO of Draken International, a contract air services provider. An avid pilot, in 2009 he broke the world record for the fastest speed around the world in a light jet.

Related News

- 09:00 am

Today Commcise, the eminent provider of integrated commission management solutions for investment management firms, and ITG, a major independent broker and financial technology provider, reported that their research payment and management technology solutions have been integrated to provide a seamless end-to-end MiFID II research solution.

The solution allows asset managers to administer the complete research management process from trade unbundling, reconciliation, budgeting, vendor due diligence and invoice management, research consumption tracking, research evaluation (aka broker vote), research accounting by desk/strategy, RPA custodial aggregation and reporting, all with a single front-to-back audit trail and integrated workflow.

Under MiFID II, due to come into effect on 3 January 2018, asset managers will be required to be more rigorous in managing their research spend and have robust processes in place to evidence this. Commcise and ITG can help asset managers with every aspect of these regulatory requirements, including ensuring all trading activity is unbundled from research fees and evidencing a fair-allocation of research charges to fund level.

Using transactions to pay for research, whilst additionally managing budgets at a desk/strategy/fund level, introduces new complexities for asset managers. Given the short timeline to comply, most firms are considering a process to address these new complexities. The Commcise/ITG solution looks to address this difficult challenge more holistically. Commcise tracks and manages budgets at a desk/strategy or fund level. Where research is managed at a desk level, Commcise automatically pro-rates all research funding and research consumption down to fund-level using daily accounting data to manage more granular fund-level research charges that have been communicated to clients. Commcise calculates fund-level rebates in real time and delivers these instructions to ITG for repayment back to a given client.

Amrish Ganatra, MD at Commcise said “We are very pleased to announce our latest integration with ITG, a market leader in the provision of investment solutions and RPA custodial aggregation services. This is further evidence of the open nature of our platform.” He added, “Commcise are focused on delivering the most regulatory compliant solutions to our clients and this integration with ITG allows firms to manage the end-to-end process in a simple way. Through our combined technology offering, industry expertise and global network, we help asset managers evidence compliance with the MIFID II regulations today”.

Jack Pollina, MD at ITG, commented “This integration with Commcise enhances the value of our comprehensive research payment account solution. With MiFID II fast approaching, investment firms need to rethink their research spend processes and ensure what they have in place is compliant with the new regulations. By collaborating with key partners like Commcise, we can help clients have the best end-to-end solution, meeting their investment research needs as well as their regulatory obligations.”

Related News

- 03:00 am

Today Mastercard announced that Erika Brown Lee has joined the company this month as senior vice president and assistant general counsel for privacy and data protection. Brown Lee will report to JoAnn Stonier, the company’s chief information governance and privacy officer.

She will lead the team that provides advice for and ensures compliance with privacy and data protection laws across the company’s products and services. Brown Lee will also work closely with information governance and cybersecurity teams to develop policies and manage regulatory interactions.

Brown Lee joins Mastercard after more than three years at the United States Department of Justice (DOJ), where she was the chief privacy and civil liberties officer, serving as a principal advisor to the Attorney General and other senior leaders. In this role, she oversaw compliance for the department’s programs and initiatives, while also co-chairing the management team responsible for responding to potential data breaches and cyber incidents.

“Erika brings a unique perspective and experience in managing privacy programs across the government, regulatory, and private sectors,” said Tim Murphy, general counsel and chief franchise officer for Mastercard. “We look forward to her contributions in balancing the need for continued innovation with protecting the privacy and security of our customers’ data.”

Brown Lee joined DOJ after several years in private practice at Norton Rose Fulbright, where she managed data breach analysis and notification procedures and advised clients on state, federal and international data requirements. Earlier in her career, Brown Lee served at the Federal Trade Commission, including in the Division of Privacy & Identity Protection.

Brown Lee holds a Master of Laws from the London School of Economics and Political Science, a Doctor of Jurisprudence from the University of Miami School of Law, and a Bachelor of Science from Boston College. She is a credentialed Certified Information Privacy Professional (CIPP) for both Europe and the United States.

Related News

- 08:00 am

Whilst the major headlines in the telecommunications market have been reserved for B2C mega deals such as BT’s acquisition of EE for €14.5bn, it is in the B2B market where the volume of the M&A activity reshaping the sector is really taking place.

The lines that once separated telecoms and IT service players have become increasingly blurred over the past several years, and large scale acquisitions such as NTT’s acquisition of Dimension Data have filtered down into the mid-market where acquisition activity is beginning to really flourish. The SME market in particular, where there are fewer entrenched relationships looks ripe for consolidation.

A series of private equity investments into buy-and-build vehicles across telecoms and IT services over the last 12 months look set to accelerate this drive towards a unified communications model in the B2B market. Investments over the last year have included:

- Lyceum’s €57m acquisition of Timico, a managed cloud service provider. Lyceum reportedly have ambitious plans to accelerate the business’ shift to becoming an end-to-end provider as well as pursuing acquisitions to accelerate growth;

- GCP’s investment in Arrow Business Communications for which it has provided a “significant acquisition fund” to strengthen its hosting, data and IT services portfolio; and

- Beech Tree’s €40m buyout of Wavenet, a specialist provider of unified communications services to UK SMEs for which it has committed “a significant acquisition war chest”.

Existing consolidators have also kept corporate financiers busy with transactions such as Maintel’s €55m acquisition of troubled rival Azzurri Communications, and LivingBridge-owned Metronet’s €54m acquisition of hosting services provider M247 in October last year.

Unsurprisingly given the level of demand for assets, valuations in the market appeared to hold firm through the initial Brexit decision and have even shown signs of improvement during 2017. Multiples for listed IT services and telecoms firms hit their peak in the last half of 2012 reaching an average of 14x EBITDA before falling between 2013 and 2015 to a low of 8.3x. However, valuations began to recover during 2016 before reaching a steady 12.1x EBITDA in the first quarter of 2017.

As telecoms and IT service providers vie for control of the changing landscape, business models will need to evolve to meet the challenges posed by this expansion of capabilities. However, factors including attractive growth rates, strong recurring revenues, a significant buy-and-build opportunity and the potential resulting synergies will continue to mean that the unified communications sector is an attractive market for investors in the coming months and years.

Related News

- 05:00 am

According to Chartis Research, Wolters Kluwer has been named a Category Leader in its 2017 RiskTech Quadrant for Enterprise GRC Solutions. It notes the fourth consecutive time it has earned this distinction. Wolters Kluwer advanced to a top five position among vendors participating based on its governance, risk and compliance capabilities, moving up another notch since the last time Chartis conducted its Enterprise GRC Solutions market update.

Among the specific enterprise GRC capabilities that Chartis assessed, Wolters Kluwer was named a category leader in three areas, including Operational Risk Management; IT Risk Management; and Audit Management. Wolters Kluwer also earned a best-of-breed designation for Third-Party Risk Management, and an enterprise solution ranking for the Model Risk category.

The RiskTech Quadrant® is a proprietary methodology developed specifically for the risk technology marketplace, taking into account vendors’ product and technology capabilities, as well as their organizational capabilities. Chartis evaluates vendors on two key factors—completeness of offering and market potential. According to Chartis, category leaders featured in the report, such as Wolters Kluwer and its comprehensive platform, OneSumX®,demonstrate a clear strategy for sustainable, profitable growth matched with best-in-class solutions.

“Category leaders are those that can provide a true enterprise GRC offering, with a broad array of technical capabilities and an equally impressive range of support services,” said Peyman Mestchian, managing partner at Chartis. “Leading firms will go beyond the traditional definition of GRC to develop more wide-ranging, integrated approaches that cover a greater variety of risk, performance, and environmental factors.”

“Wolters Kluwer is pleased to again be recognized as a leader by Chartis,” said Chuck Ross, vice president andgeneral manager of Compliance Program Management and Investment Compliance for Wolters Kluwer. “Our strong position in this report underscores our continued commitment to meeting the evolving needs of risk, compliance, finance and audit professionals through our unique combination of industry knowledge, technology and services.”

Earlier in 2017, Wolters Kluwer was named a Category Winner in Chartis’ RiskTech100® Report for Regulatory Reporting, and it earned a RiskTech Quadrant point solutions ranking in Chartis’ Risk Management Systems for the Insurance Industry 2017 Market Update.

Related News

- 07:00 am

Today Fiserv, Inc., a world leading provider of financial services technology solutions, announced that Iroquois Federal Savings & Loan Association, headquartered in Watseka, Illinois with $580 million in assets, has selected the Premier core account processing platform and a wide range of integrated Fiserv solutions as the new technology foundation for its organization.

The bank, which once focused heavily on mortgage lending and CDs, has significantly grown its commercial portfolio in recent years. Looking to the future, bank leaders wanted a technology partner that will support continued commercial growth, while also improving the customer experience for retail and mortgage customers.

“As we expand our markets, we need to be prepared to meet the demands of a diverse range of businesses in addition to today’s tech-savvy consumers,” says Walter Hasselbring III, president and CEO, Iroquois Federal Savings & Loan Association. “Fiserv helps us create the digital presence needed to attract business customers and deliver a more satisfying experience for our retail customers. We’re also able to efficiently support all types of commercial lending.”

Hasselbring cites integration between Fiserv applications and the cohesive customer experience of Business Online™ for business online banking and Mobiliti Business™ for business mobile banking as major factors in the decision to choose Fiserv.

The bank expects its staff to benefit from the intuitive navigation of Fiserv solutions, the automation of manual tasks and the ability to easily find and view important information. These capabilities help bankers move seamlessly through their day and serve customers quickly – improving the customer experience and further supporting the bank’s growth.

“Serving the commercial market is a revenue opportunity for financial institutions of any size, and we want to help our clients succeed in both the business and retail banking markets,” says Byron Vielehr, group president, Depository Institution Services, Fiserv. “Our recent and ongoing investments in commercial banking capabilities help ensure that our financial institution clients have the solutions they need to meet the diverse expectations of their business customers.”

In addition to selecting Fiserv online and mobile banking solutions for consumers and businesses, Iroquois Federal will add CheckFree® RXP® and CheckFree Small Business for online bill payment, Popmoney® for personal payments, TransferNow® for account-to-account transfers and a range of card services and item processing solutions.

Related News

Chris Skinner

Chairman at Financial Services Club

I’ve just returned from the United Arab Emirates (UAE) where there were a number of events. Just a few weeks ago, I was in Bahrain, talking at a conference about FinTech as usual. see more

- 07:00 am

Today the Navigators Group, Inc. announced the promotion of Ciro M. DeFalco to Executive Vice President of The Navigators Group, Inc. Mr. DeFalco has served as Senior Vice President and Chief Financial Officer since December 2011.

"This promotion recognizes both the significant responsibility of the chief financial officer and Ciro's accomplishments in the role over the past five years, " said Stanley A. Galanski, President and Chief Executive Officer of Navigators. "His leadership goes far beyond the financial performance of the organization."

Mr. DeFalco joined Navigators in September 2011. He has a B.B.A. degree in accounting from Pace University and an M.B.A. from Columbia University Graduate School of Business.

Related News

Product Profile

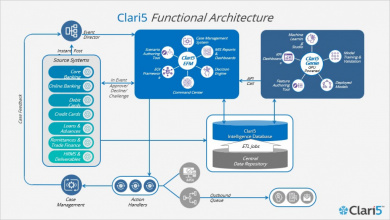

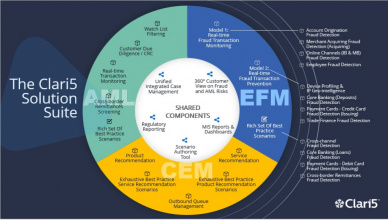

Clari5 Enterprise Fraud Management

Screenshots & Video

Product/Service Description

Clari5 is a next gen enterprise platform for real-time intelligence, using the best of technology for the most cost effective real-time intelligent solutions for financial institutions in the financial crime risk management domain. Clari5 real-time intelligence solutions are deployed enterprise wide using commodity hardware in some of the biggest global banks. Clari5 Enterprise Financial Crime Management Solution suite provides real-time anti-fraud and anti-money laundering capabilities on a unified real-time intelligence platform.

Clari5 Enterprise Fraud Management (EFM) is a real-time Enterprise Wide Fraud Detection, Monitoring and prevention solution that monitors suspicious patterns across transactions, events, users, accounts, systems in real-time and responds with the right action to pass or block transaction, or generate real-time alerts for manual investigation.

Customer Overview

Features

- Proactively combats cross channel, cross product fraud across the enterprise real-time

- Customer aware solution that monitors 360 degrees digesting all transactions and actions

- Silo Breaker solution that combats sophisticated fraud with real-time, actionable insights

- Employs intelligent models based on neural network, time series and complex analytics to deliver insight

Benefits

- Perform fraud prevention in real-time as banking transactions occur

- Prepackaged Scenarios and built-in interfaces across Products/Channels to achieve quick ROI

- Dynamically profiling suspicious devices, cards, merchantsor payees for preventing fraudulent transactions

- Expedited fraud investigation based on Investigation Workbench and Integrated case management

- Integrated reports and dashboard giving insights on the efficiency and effectiveness of the fraud prevention

Platform & Workflow

Cash Transaction Reports, Suspicious Transaction Reporting / Suspicious Activity Reporting, Non-Profit Transaction Reporting, Counterfeit Currency Reporting, Cross-border Transaction Reporting. Management Reporting - Role based Management Reporting and Dashboarding using embedded Enterpsise BI platform