Published

- Product Reviews

- 17.04.2017 11:52 am

INDATA is a known leader in providing software, technology, and services for buy-side firms. The area of the company’s expertise also expands into trade order management (OMS), compliance, portfolio accounting, and front-to-back office delivered via iPM Epic. This is the industry’s first investment technology platform, designed for the era of big data. The company’s mission is to provide clients with cutting edge technology products and services to increase operational efficiency while reducing risk and administrative overhead.

INDATA’s iPM, an Intelligent Portfolio Management technology platform enables end-users to efficiently collaborate in real-time across the enterprise. Moreover, it contains the top class functionality that is demanded by sophisticated institutional investors. Cloud-based solution provides universal accessibility and eliminates the need for in-house IT. As the product is highly customizable, the pricing strategy is also quite flexible. It will basically depend on the number of required services and clients’ needs. Besides, there is a solid library of reports including client statements, holdings, transactions, performance, attribution, billing, and other areas. Reports can be fully customized by the client and also by INDATA, as a service. State-of-the-art big data visualization tools are also available for business intelligence type reporting.

The iPM Epic is designed for buy-side investment management firms, in order to help companies increase end-user productivity and enhance the investment process. In addition, investment firms are offered assessment of real-time risk, compliance, and performance monitoring, as well as consolidated tools for marketing activities. Implementation of iPM Epic has proven its business agility through decreasing operational risk & administrative overhead, while providing investment managers with greater transparency and a competitive advantage for targeting and managing new and existing business. Thus, it will be extremely useful for asset managers, registered investment advisors, banks and wealth management firms, pension funds and hedge funds.

iPM Epic has been developed to work effectively with a variety of large data sets, both internal and external to the investment management firm, which are routinely used within investment management with great effort and with the significant expenditure of resources.

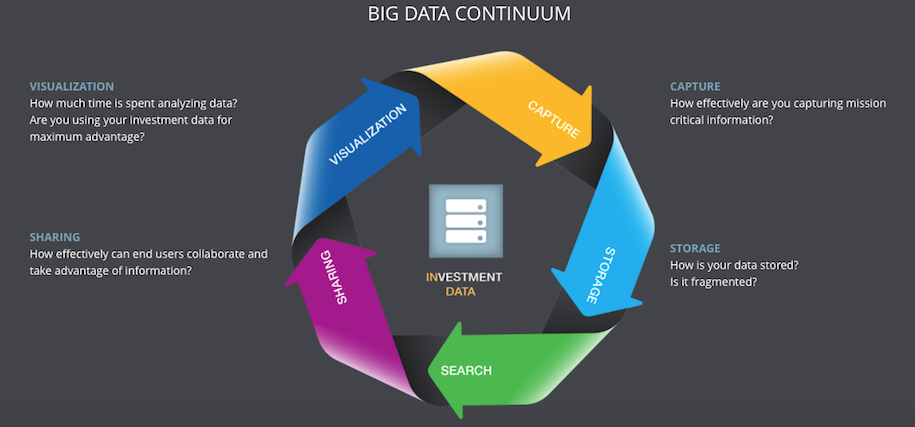

To be more specific, iPM Epic helps companies automate data management issues, including each aspect of investment processes, such as capture, storage, sharing, analysis and visualization of data from a from, middle and back office perspective. Furthermore, the software increases efficiency through enhancing user workflow. Particularly, users can operate efficiently and make better decisions, while having a real-time control over the entire processes. Finally, the know-how can be leveraged via IPM cloud, a private cloud hosting solution to ease installation, maintenance, and on-going support.

The main product features are:

- iPM OMS links traders with portfolio managers, executing brokers, compliance and back office staff in real-time, resulting in efficient and error-free trading

- It includes a complete Investment Book of Record system that provides fully configurable and customizable dashboards that of both real-time and historical information from the system, as well as external systems.

- iPM Compliance actively monitors pre and post-trade compliance, as well as operational risk challenges. It automatically warns compliance officers when a compliance issue requires additional control.

- iPM Epic, based on big data technology, combines a sophisticated enterprise data management system (EDM). It allows managing their internal and external data sources effectively, in order to create a single source of data across the firm, which can be accessed timely.

- iPM Back Office is a multi-tool and diverse currency portfolio accounting system. It maintains transaction archives, capital changes, dividends, pricing, and all other back-office portfolio management functions. It also has a wide range of back-office tools, such as automated reconciliation capabilities.

- iPM Performance constantly monitors rates of return on multiple levels, including total portfolio, asset classes, sectors, industries, securities and composites on a multi-currency basis.

No doubts that INDATA will keep delighting its potential customers and current users with innovative, genuinely sophisticated and cost-effective solutions in the long run.

INDATA’s iPM Epic Is the Industry’s First Investment Software PlatformOther Product Reviews

- Case Studies

- 17.04.2017 08:59 am

A major credit card issuer needed a smoother and more secured authentication process for their mobile users.

Looking to increase the security of its mobile wallet while also making the authentication process easier, the company turned to SecuredTouch for its continuous & seamless mobile authentication.

Other Case Studies

- 08:00 am

Etherisc, an Insurtech startup based in the Munich area, has won the Blockchain Oscar for Most Innovative Blockchain Startup. The competition was produced by The Cointelegraph as part of Blockshow Europe 2017, and was conducted over several weeks. Six promising startups were shortlisted. In the final ceremony on 6 April 2017 in Munich Etherisc presented the project to a jury and received a prize of €5,000.

"We feel proud and humbled to win the Blockchain Oscar for most innovative blockchain startup," said Etherisc co-founder Stephan Karpischek. Co-founder Christoph Mussenbrock adds, "It is a great honor and an amazing boost for our endeavor to create an open protocol for decentralized insurance applications."

A focus on decentralized insurance applications

Etherisc aims to make the purchase and sale of insurance more efficient, enable lower operational costs, provide greater transparency to the insurance industry, and democratize access to reinsurance investments. The company co-founders have deep backgrounds in mathematics, research, the banking and finance sectors, and enterprise IT.

"Etherisc is a company that promises to disrupt and transform a large part of the global insurance industry for millions of travelers," according to Mussenbrock. "It can offer a variety of new products and services to customers, while leveraging blockchain technology to achieve new levels of transparency and kick off a new era of policy securitization."

Leveraging blockchain's revolutionary power

"BlockShow Europe is a major international event for showcasing established blockchain solutions," according to its organizers. "Blockchain can provide every company with transparency and disintermediation, help with process integrity, and just simplify things."

Etherisc focused on writing individual policies for flight delays with its winning submission. The Flight Delay Dapp (fdd.etherisc.com) is described as "a parametric insurance application for consumers" and is built on the Ethereum blockchain.

In an alpha test, it provided flight delay insurance to attendees of an Ethereum developer conference.

Etherisc's decentralized insurance market will use cryptographic tokens to create what its co-founders call "highly customized economics. Our goal is to tokenize reinsurance risks and make them available on a global open access marketplace," they said.

Related News

Glenn Bolstad

General Manager at Appway

Recently, the banking industry has been buzzing about chatbots, or more technically: conversational interfaces. see more

- 09:00 am

Transworld Systems Inc., a leading analytics-enabled provider of accounts receivable management and loan servicing solutions, announced the launch of Rocket Receivables, a new web-based self-service platform that allows businesses to purchase and manage TSI's reminder letter and contingency collections services.

Offering both fixed-fee and contingency-based collections options, Rocket Receivables is changing the way businesses approach debt recovery and increase their bottom line.

TSI launched Rocket Receivables in order to provide a solution for the customers that prefer to make purchase decisions online, on their time, 24/7. Employing a two-stage approach to collections, Rocket Receivables provides businesses with the flexibility to manage their accounts receivable by utilizing either a letters series, traditional contingency collections, or a seamless combination of the two.

Rocket Receivables' self-service website is built to empower users to determine how they want to handle their accounts receivable by providing them with 24/7 online support tools and a dedicated client support staff available in order to maximize their recoveries.

"Ecommerce has changed the way individuals research products and make informed buying decisions," said Howie Schnuer, TSI's Chief Marketing Officer. "With Rocket Receivables, we're able to offer businesses a 24/7 research and buying solution for those that want to work with an experienced company, but on their time."

Related News

- 07:00 am

Today MoneyGram and Ant Financial Services Group today reported that the companies have entered into an amendment to the definitive agreement under which MoneyGram will merge with Ant Financial. Pursuant to the amendment, Ant Financial increased the offer price to acquire all of the outstanding shares of MoneyGram from $13.25 per share to $18.00 per share in cash. The MoneyGram board of directors has unanimously approved the Amended Merger Agreement.

The offer price of $18.00 per share provides approximately $320 million in additional cash consideration to MoneyGram stockholders from the prior agreement. The per share consideration represents a premium of approximately 64 percent to MoneyGram's volume weighted average share price over the prior three month period ended January 25, 2017, the day prior to the original transaction announced with Ant Financial. The transaction is valued at approximately $1,204 million for all of MoneyGram's common and preferred shares on a fully diluted basis. Ant Financial will assume or refinance MoneyGram's outstanding debt.

Pamela Patsley, Executive Chairman of MoneyGram, said, "Throughout this process, our board of directors has remained laser-focused on maximizing value for MoneyGram stockholders, while taking into account price, the ability to complete a transaction and other important considerations. We are pleased to offer even more value to our stockholders through the amendment of our merger agreement with Ant Financial. We continue to be excited about the transaction, which we are confident will provide substantial benefits to all of our stakeholders, including stockholders, customers, agents and employees."

Alex Holmes, Chief Executive Officer of MoneyGram, added, "As I have stated previously, we believe this transaction will significantly benefit consumers throughout the world who depend on innovative and reliable financial connections to friends and family. We share Ant Financial's commitment to successfully completing the transaction, which will allow us to grow our business, making money transfers easier for customers and providing a wider selection of services for the agents who serve them around the world."

Doug Feagin, President of Ant Financial International, said, "We look forward to joining forces with MoneyGram, which will add valuable cross-border remittance capabilities to the Ant Financial ecosystem, serving our more than 630 million users globally. Over the past few months, we have enjoyed working closely with the MoneyGram team and remain committed to our plans to invest further in the MoneyGram business. We plan to grow the U.S.-based team and create even greater opportunities for the MoneyGram community as we pursue our shared vision of global inclusive finance in an increasingly digital era."

Mr. Feagin continued, "We are fully committed to maintaining the MoneyGram brand that has earned the trust of millions of customers. As part of Ant Financial, MoneyGram will have access to resources to further enhance its technology, systems and anti-money laundering and compliance programs."

Following the completion of the transaction, MoneyGram will operate as an independent subsidiary of Ant Financial and retain its brand, management team, IT infrastructure and headquarters in Dallas, Texas. All of MoneyGram's current procedures and protections related to data security and personally identifiable information will remain intact.

MoneyGram and Ant Financial have already made significant progress towards obtaining the regulatory approvals necessary to complete the transaction, including obtaining antitrust clearance in the United States and filing for certain state licensing approvals. The transaction is subject to the approval of MoneyGram stockholders, obtaining remaining regulatory approvals, including the clearance of the transaction by the Committee on Foreign Investment in the United States, and other customary closing conditions. The transaction continues to be expected to close in the second half of 2017. The transaction is not subject to any financing conditions.

MoneyGram stockholders of record as of April 7, 2017 will be asked to vote on the Amended Merger Agreement at a special meeting of the stockholders of MoneyGram scheduled for May 16, 2017. Thomas H. Lee Partners and certain MoneyGram executives who collectively own approximately 46 percent of the outstanding voting shares of MoneyGram previously entered into agreements with MoneyGram to vote in favor of the transaction, which agreements remain in effect following entry into the Amended Merger Agreement. The MoneyGram board of directors recommends that MoneyGram stockholders vote "for" the Amended Merger Agreement at the special meeting.

On April 14, 2017, MoneyGram received a binding offer from Euronet Worldwide, Inc. ("Euronet") (NASDAQ: EEFT) to acquire all of the outstanding shares of MoneyGram Common Stock and Preferred Stock (on an as-converted basis) for $15.20 per share in cash. Upon receipt of Ant Financial's increased offer on April 15, 2017, MoneyGram's board of directors, after careful review and consideration in consultation with its outside legal and financial advisors, compared the relative merits of the increased offer reflected in the Amended Merger Agreement with Ant Financial to the binding offer from Euronet and unanimously determined that the Euronet proposal was not superior to the Amended Merger Agreement and that entering into the Amended Merger Agreement was in the best interests of MoneyGram stockholders.

Related News

Simon Kavanagh

Lifecare Chief Designer at Tieto

The status quo of siloed data storage is unsustainable and the time to act is now. see more

- 02:00 am

Today ZeroStack, the leading provider of making self-driving private cloud and Nexenta, the global leader in Open Source-driven Software-Defined Storage (OpenSDS) announced a joint solution that integrates ZeroStack’s Intelligent Cloud Platform with Nexenta’s storage systems to create a pre-tested, completely automated, and fully supported converged private cloud solution. With this solution, enterprises and managed service providers can now leverage Nexenta’s industry-first hardware and protocol-agnostic Software-Defined Storage (SDS) portfolio, delivering complete freedom from storage hardware vendor lock-in, to build a highly resilient and high performing cloud for application development, running packaged enterprise applications and hosting.

The combined ZeroStack/Nexenta solution offers these unique advantages:

- Nexenta users can simply plug their storage devices into the ZeroStack Intelligent Cloud Platform via Nexenta’s REST API technology to access existing storage resources in a self-driving, on-premises cloud.

- Nexenta provides a multi-site disaster recovery solution that can back up ZeroStack cloud data.

“ZeroStack makes on-premises cloud simple and affordable, and this solution allows our customers to combine Nexenta solutions with the ZeroStack platform,” said Tarkan Maner, Chairman & CEO at Nexenta. “Our OpenSDS solutions give customers the storage agility they need, and ZeroStack’s cloud platform extends storage into the cloud for self-service use on a self-healing infrastructure.”

Both Nexenta and ZeroStack will market the solution to their customers and resellers. With this combined solution, Nexenta and ZeroStack resellers can offer their customers strategic advice on cloud and storage options while retaining customers who might otherwise have no choice but move to a public cloud provider.

“Nexenta has a unique storage solution for enterprises that want high performance and scalability,” said Ajay Gulati, CEO and Co-Founder at ZeroStack. “By combining our products into a single converged solution, we give our customers the fastest, most reliable access to data in a turnkey on-premises cloud solution.”

Related News

- 07:00 am

Euroclear, a trusted provider of post-trade services, and Paxos, a financial technology firm providing pioneering blockchain solutions, are delighted to announce the successful completion of their second pilot for Euroclear Bankchain, the new blockchain settlement service for London bullion due to go live this year.

The first pilot program took place in December 2016 with over 600 OTC test bullion trades settled on the Euroclear Bankchain platform over the course of two-weeks. The pilot was coordinated through the Euroclear Bankchain Market Advisory Group that includes participants working with Euroclear and Paxos in the roll-out of the new service.

"It has been exciting to watch the growth of the Euroclear Bankchain pilot program over the last month," says Seth Phillips, Bankchain Product Director at Paxos. "We doubled the number of firms and significantly increased interaction as participants were spread across six countries and four time zones. Most importantly, we're proving that the platform can deliver lower costs and lower risk for the London gold market."

Angus Scott, Head of Product Strategy and Innovation at Euroclear says: "We are encouraged by the extensive engagement of market participants in this second pilot and will continue as we further develop this new market infrastructure for the bullion market. The feedback provided is of great importance to make sure that our service will deliver real added value to the London bullion market through transparency, capital reduction and delivery versus payment settlement."

Both Euroclear and Paxos have continued to work closely with the London bullion market executing successful pilots to test and obtain feedback on the Euroclear Bankchain service. Paxos and Euroclear are on schedule for a production launch later in 2017 for the Euroclear Bankchain service.

Related News

- 05:00 am

Today INTESA SANPAOLO, a leader in banking industry in Europe, and EBA CLEARING have reported the successful execution of the first user testing activities for the Pan-European real-time payment platform of EBA CLEARING.

Starting from November 2017, account-servicing payment service providers (AS-PSPs) from all over SEPA will be able to use this highly flexible solution for payment products in euro that are fully compliant with the European Payments Council’s SCT Inst Scheme and in line with the ISO 20022 global messaging standards for real-time payments.

Mr. Stefano Favale, Head of Global Transaction Banking at INTESA SANPAOLO Group commented: “We are strongly committed to playing a leading role in the future of payments for the benefit of our customers. Both retail and corporate customers will be able to send credit transfers in real time across Europe, potentially reaching over 500 million European citizens and companies in a seamless way - and they will need nothing aside from their current account to do so. The end-to-end process between the originator and beneficiary accounts will take no more than 10 seconds. The payments will be irrevocable and settled in real time subject to pre-funding in central bank funds.”

Mr. Enrico Bagnasco, Head of IT at INTESA SANPAOLO added: “We have successfully started user testing for our November connection to this instant payment system thanks to our upgraded payment hub. We have been significantly investing in our payment architecture and applications over the past few years, in order to be more and more innovative and agile and to be able to take advantage of the new opportunities arising in this business,” while Mr. Luca Faussone Head of Operations commented: “24/7/365 system performance will require a new operations model and approach and we are making it a top priority to deliver this enhanced service level for our customers.”

Mr. Hays Littlejohn, CEO of EBA CLEARING, said: “Intesa Sanpaolo is the first future participant to connect directly to our test system and is amongst the 25 users currently preparing to go live this year. Together with those institutions that are planning to connect to the system in 2018, these early joiners represent nearly 85% of the SEPA Credit Transfer traffic processed by our STEP2 system today. More and more banks and service providers are developing services around our new platform, and we are confident that we will see a positive evolution of the reach of the service from the start of the ramp-up period on.”