Published

- 04:00 am

Can HMRC successfully Make Tax Digital while still struggling to push out the self assessment protocol? A survey of 1000 UK SMEs, commissioned by cloud accountancy software Pandle, has uncovered that despite feeling well informed on the recent changes to the system, almost half (49.23%) of all SMEs have lost money in the submission process.

In light of HMRC moving forward with its plan to Make Tax Digital, two thirds (62.64%) of people felt prepared for the change. While nearly 20% of people were unaware of the change to Making Tax Digital, 48.3% were concerned over the process becoming more cumbersome and 13% worried about not being “tech savvy” enough to navigate the system.

To mitigate concern and allow SMEs gradual transition, the Spring Budget 2017 announced that it would allow over 3.1 million SMEs until 2019 to begin keeping digital records and send HMRC regular quarterly updates of any and all tax data. This will allow companies to continue getting to grips with the self assessment process, as well as what will be expected of them digitally in the future.

The Making Tax Digital Plan is currently in it’s testing stage for online billing and reporting, and will move forward incrementally through 2020.

“It’s great that HMRC is allowing SMEs extra time to adjust to the system,” said Lee Murphy, owner of Pandle. “While there’s a lot of information available on the current system, these things are never as easy in practice as in theory. It will be increasingly important for companies to understand the self assessment by 2019 when quarterly reporting is required. We conducted this survey for insight on how we could best contribute to SMEs who are struggling with the current tax system.”

Related News

- 01:00 am

AFEX, world's largest non-bank provider of global payment and risk management solutions, has introduced the PayFEX Prepaid Mastercard.

Related News

- 04:00 am

FlexTrade Systems, the world leading provider of multi-asset execution and order management systems, is deligheted to announce “FlexAR” – an augmented reality trading application offering an extraordinary, new way of visualising and presenting trading via the company’s award-winning FlexTRADER EMS.

FlexAR builds on existing technology and APIs within FlexTRADER’s open architecture offering an interactive order blotter, trade ticket and charting, all presented in a virtual space. Components can be placed throughout the real world, allowing traders to see and interact with the markets in a completely unique manner.

Andy Mahoney, business development director of FlexTrade UK Ltd., in London, commented, “With consumer technology evolving at such a rapid pace, we are constantly on the lookout for new and innovative ways to improve trading.”

“We initially experimented with virtual reality trading, but the feedback was that the fully immersive headsets were too overwhelming, shutting off real-world events. With the advent of the Microsoft HoloLens augmented reality headset, we found a good middle-ground, bringing virtual trading into the real world.”

Future releases of FlexAR will introduce interactive alerting alongside the FlexTRADER blotter, three-dimensional basket visualisation, and the ability to present data from third parties using FlexTRADER’s renowned open architecture.

Related News

Joris Lochy

Product Manager at The Glue

- 02:00 am

Today Rego Payment Architectures, Inc. reveals a major milestone. This week the joint technology development team tested the Alpha version of the OINK payment platform. With just six months having passed since OINK made the pivot to being a mobile based payment platform for the youth market, Rego CEO John Coyne proudly announced that the Alpha test was a "complete success."

"Having identified that 70% of our customers (the youth market) use Amazon as their preferred online purchasing site, it made sense to see if the test would work there. I'm pleased to say that the development team did it, without a hitch. Now, the fact that it works means that we can enter the market as planned but it's no guarantee of adoption."

Buying something on Amazon is something that millions of people do every day. However what makes this test unique is that it required OINK's highly complicated interplay of compliance, contract models, and the existing payment infrastructure.

"To protect our customers and their children, and to comply with commerce regulations for children under 18, OINK uses a proprietary set of models that until now only theoretically worked in a mobile application. Now we have proven our theory in the real world." Coyne said today, underlining the efforts of his development team, "We've done something very, very difficult, in a time frame nearly unheard of for a major application."

This speed-to-development was enabled by the use of Artificial Intelligence techniques, allowing the system to perform its own reasoning in solving complex internal relationships.

Arian Verbeek, the lead developer for the team in the Netherlands, pioneering those techniques said, "For the Alpha release to be successful, both the back end and front end (phone and user experience (UX) had to operate seamlessly in conjunction with one another. The added complexity of development was integrating both the AI components and the front-end with teams operating in the Netherlands and Los Angeles. We were certainly all a bit nervous there for a moment, but the success of this test moves us forward and proves the architecture is sound."

Dave Aparo, a Director on Rego's LA team is delighted with the results and said, "This is a testament to the technical and project management skills of both teams. But it is also a tribute to our unique architecture that combines components of both artificial intelligence, for complex decision making, and standard programming tools used to develop the user experience."

This testing will continue through May, from the internal branches that determine process flow to the integration points for our banking partners and we will subject our system to multiple levels of security testing to prevent hackers from compromising our system or stealing our data. It's an exciting time as Rego takes the new OINK from concept to reality.

Related News

- Product Reviews

- 17.04.2017 11:52 am

INDATA is a known leader in providing software, technology, and services for buy-side firms. The area of the company’s expertise also expands into trade order management (OMS), compliance, portfolio accounting, and front-to-back office delivered via iPM Epic. This is the industry’s first investment technology platform, designed for the era of big data. The company’s mission is to provide clients with cutting edge technology products and services to increase operational efficiency while reducing risk and administrative overhead.

INDATA’s iPM, an Intelligent Portfolio Management technology platform enables end-users to efficiently collaborate in real-time across the enterprise. Moreover, it contains the top class functionality that is demanded by sophisticated institutional investors. Cloud-based solution provides universal accessibility and eliminates the need for in-house IT. As the product is highly customizable, the pricing strategy is also quite flexible. It will basically depend on the number of required services and clients’ needs. Besides, there is a solid library of reports including client statements, holdings, transactions, performance, attribution, billing, and other areas. Reports can be fully customized by the client and also by INDATA, as a service. State-of-the-art big data visualization tools are also available for business intelligence type reporting.

The iPM Epic is designed for buy-side investment management firms, in order to help companies increase end-user productivity and enhance the investment process. In addition, investment firms are offered assessment of real-time risk, compliance, and performance monitoring, as well as consolidated tools for marketing activities. Implementation of iPM Epic has proven its business agility through decreasing operational risk & administrative overhead, while providing investment managers with greater transparency and a competitive advantage for targeting and managing new and existing business. Thus, it will be extremely useful for asset managers, registered investment advisors, banks and wealth management firms, pension funds and hedge funds.

iPM Epic has been developed to work effectively with a variety of large data sets, both internal and external to the investment management firm, which are routinely used within investment management with great effort and with the significant expenditure of resources.

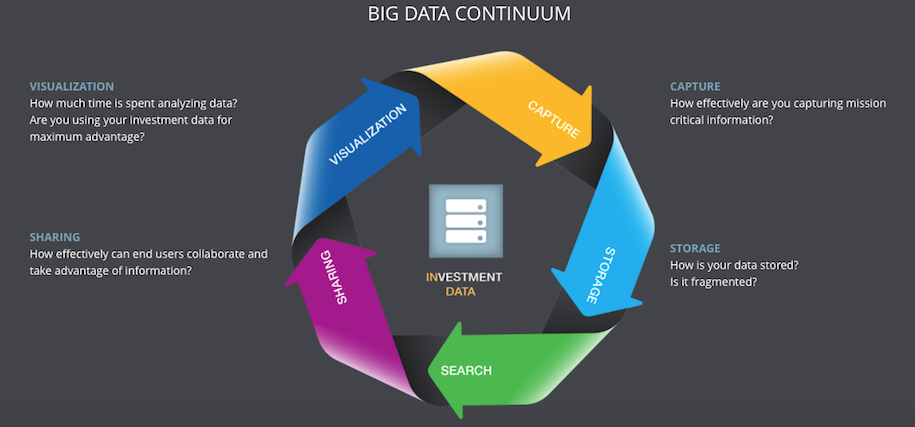

To be more specific, iPM Epic helps companies automate data management issues, including each aspect of investment processes, such as capture, storage, sharing, analysis and visualization of data from a from, middle and back office perspective. Furthermore, the software increases efficiency through enhancing user workflow. Particularly, users can operate efficiently and make better decisions, while having a real-time control over the entire processes. Finally, the know-how can be leveraged via IPM cloud, a private cloud hosting solution to ease installation, maintenance, and on-going support.

The main product features are:

- iPM OMS links traders with portfolio managers, executing brokers, compliance and back office staff in real-time, resulting in efficient and error-free trading

- It includes a complete Investment Book of Record system that provides fully configurable and customizable dashboards that of both real-time and historical information from the system, as well as external systems.

- iPM Compliance actively monitors pre and post-trade compliance, as well as operational risk challenges. It automatically warns compliance officers when a compliance issue requires additional control.

- iPM Epic, based on big data technology, combines a sophisticated enterprise data management system (EDM). It allows managing their internal and external data sources effectively, in order to create a single source of data across the firm, which can be accessed timely.

- iPM Back Office is a multi-tool and diverse currency portfolio accounting system. It maintains transaction archives, capital changes, dividends, pricing, and all other back-office portfolio management functions. It also has a wide range of back-office tools, such as automated reconciliation capabilities.

- iPM Performance constantly monitors rates of return on multiple levels, including total portfolio, asset classes, sectors, industries, securities and composites on a multi-currency basis.

No doubts that INDATA will keep delighting its potential customers and current users with innovative, genuinely sophisticated and cost-effective solutions in the long run.

INDATA’s iPM Epic Is the Industry’s First Investment Software PlatformOther Product Reviews

- Case Studies

- 17.04.2017 08:59 am

A major credit card issuer needed a smoother and more secured authentication process for their mobile users.

Looking to increase the security of its mobile wallet while also making the authentication process easier, the company turned to SecuredTouch for its continuous & seamless mobile authentication.

Other Case Studies

- 08:00 am

Etherisc, an Insurtech startup based in the Munich area, has won the Blockchain Oscar for Most Innovative Blockchain Startup. The competition was produced by The Cointelegraph as part of Blockshow Europe 2017, and was conducted over several weeks. Six promising startups were shortlisted. In the final ceremony on 6 April 2017 in Munich Etherisc presented the project to a jury and received a prize of €5,000.

"We feel proud and humbled to win the Blockchain Oscar for most innovative blockchain startup," said Etherisc co-founder Stephan Karpischek. Co-founder Christoph Mussenbrock adds, "It is a great honor and an amazing boost for our endeavor to create an open protocol for decentralized insurance applications."

A focus on decentralized insurance applications

Etherisc aims to make the purchase and sale of insurance more efficient, enable lower operational costs, provide greater transparency to the insurance industry, and democratize access to reinsurance investments. The company co-founders have deep backgrounds in mathematics, research, the banking and finance sectors, and enterprise IT.

"Etherisc is a company that promises to disrupt and transform a large part of the global insurance industry for millions of travelers," according to Mussenbrock. "It can offer a variety of new products and services to customers, while leveraging blockchain technology to achieve new levels of transparency and kick off a new era of policy securitization."

Leveraging blockchain's revolutionary power

"BlockShow Europe is a major international event for showcasing established blockchain solutions," according to its organizers. "Blockchain can provide every company with transparency and disintermediation, help with process integrity, and just simplify things."

Etherisc focused on writing individual policies for flight delays with its winning submission. The Flight Delay Dapp (fdd.etherisc.com) is described as "a parametric insurance application for consumers" and is built on the Ethereum blockchain.

In an alpha test, it provided flight delay insurance to attendees of an Ethereum developer conference.

Etherisc's decentralized insurance market will use cryptographic tokens to create what its co-founders call "highly customized economics. Our goal is to tokenize reinsurance risks and make them available on a global open access marketplace," they said.

Related News

Glenn Bolstad

General Manager at Appway

Recently, the banking industry has been buzzing about chatbots, or more technically: conversational interfaces. see more

- 04:00 am

Transworld Systems Inc., a leading analytics-enabled provider of accounts receivable management and loan servicing solutions, announced the launch of Rocket Receivables, a new web-based self-service platform that allows businesses to purchase and manage TSI's reminder letter and contingency collections services.

Offering both fixed-fee and contingency-based collections options, Rocket Receivables is changing the way businesses approach debt recovery and increase their bottom line.

TSI launched Rocket Receivables in order to provide a solution for the customers that prefer to make purchase decisions online, on their time, 24/7. Employing a two-stage approach to collections, Rocket Receivables provides businesses with the flexibility to manage their accounts receivable by utilizing either a letters series, traditional contingency collections, or a seamless combination of the two.

Rocket Receivables' self-service website is built to empower users to determine how they want to handle their accounts receivable by providing them with 24/7 online support tools and a dedicated client support staff available in order to maximize their recoveries.

"Ecommerce has changed the way individuals research products and make informed buying decisions," said Howie Schnuer, TSI's Chief Marketing Officer. "With Rocket Receivables, we're able to offer businesses a 24/7 research and buying solution for those that want to work with an experienced company, but on their time."