Published

- 09:00 am

Stig Kjos-Mathisen, managing director of NBX, says: "Many of our customers have been patiently waiting for this, but now the launch is finally a fact and the feedback is overwhelming. The advance interest for this card has been fantastic and we are very excited and are looking forward to enhancing this product further. Google Pay and Apple Pay are already in the making with more features on the drawing board. NBX will together with Enfuce and Visa make the NBX Visa® credit card the most exciting credit card in the Nordics.”

Denise Johansson, Co-Founder and Co-CEO at Enfuce, comments: “The launch of the NBX Visa® credit card is a turning point for the Norwegian financial market. As the first of our customers to offer this type of consumer access to cryptocurrency, Enfuce is proud to help enable the future of Bitcoin in Nordic countries and across Europe. Our technology is the perfect solution for the roll-out because it is safe, secure and we’re excited to see where this partnership will take us.”

Monika Liikamaa, Co-Founder and Co-CEO Enfuce, comments: “Cryptocurrency is a burgeoning market, and innovations such as the NBX credit card allow consumers to engage with cryptocurrency in a whole new way, while also enabling providers to be fully compliant with regulations. Opening up the market through everyday spending is a unique proposition and we are excited to be able to deliver such a safe, secure and clearly highly sought after product.”

Related News

- 05:00 am

Public, a US-based multi-asset investing platform, launches today in the United Kingdom, entering its first market outside the United States. With the firm’s UK expansion, Public aims to be the preeminent place to invest in US-listed equities, offering over 5,000 stocks, deep data and insights, and a simple and transparent fee structure with zero commission trading and low FX fees.

UK members can build a portfolio on the Public app with over 5,000 US-listed equities and access features that provide additional data and context, such as custom company metrics, Morningstar research, earnings call recordings, and insights from a community of millions of investors, all in one place.

Starting today, members can access the app on a rolling basis on both iOS and Android devices. Key product features available at launch include:

Over 5,000 stocks: Public has over 5,000 US-listed equities on its platform, providing UK investors with a broad range of options to build their portfolios, from large-cap tech to dividend stocks, to emerging markets stocks. The platform aims to offer the widest range of US-listed equities available to UK investors.

Commission-free trading and low FX fees: Public members can trade stocks commission-free during market hours. Unlike many other brokerages, Public converts members’ currency from GBP to USD when they deposit funds rather than on every individual trade, which can result in fewer FX transactions and significantly lower fees.*

Advanced data and insights: Investors can access data and context that can help them make more informed investment decisions. UK members can access custom company metrics, Morningstar research, earnings reports, and breaking news, all in the same place they invest. Investors can tune into daily live shows about the markets and a community of analysts, company executives, and creators to discuss the markets. Many of these features are available to all Public members, while some are part of Public Premium, the company’s paid subscription tier.

"London and the broader UK market has always been the financial epicenter of Europe, so it’s a natural place for Public to start our international expansion,” said Leif Abraham, co-CEO and co-founder of Public. “Public has always had European roots: my co-founder and I are both European, and we have a team across multiple European countries, including the UK. We’re excited that now it won’t just be the team in Europe and the UK, but the members we serve.”

"Our first goal with launching Public in the UK is to be the best place to invest in US stocks,” said Dann Bibas, GM of International at Public. “With over 5,000 US listed stocks, competitive FX fees, commission-free trading during US market hours, and comprehensive data on all listed stocks, we aim to be the best place for UK investors who want to explore the US markets."

Public has raised over $300M in venture capital funding. Investors include Accel, Greycroft, Lakestar, and Maria Sharapova, and JJ Watt the NFL star and new owner of Burnley FC. The company has team members in New York, Copenhagen, London, and Amsterdam. Public does not participate in Payment for Order Flow (PFOF) as a source of revenue, instead all orders are routed directly to the exchanges and other execution venues.

Currently, the US product offers additional asset classes, such as ETFs, Treasuries, crypto, and alternatives, which may be available in future releases in the UK. We also aim to launch Investment Plans in the UK, a tool that allows members to create customized recurring investments.

Related News

- 06:00 am

Temenos today announced that Convera, the largest non-bank global B2B payments provider, has selected Temenos Payments Hub running in the Temenos Cloud to modernize its payments infrastructure.

The move to Temenos Software-as-a-Service (SaaS) will help Convera to drive efficiency in payment processing from inbound funding to outbound disbursements and massively scale with the aim to double its payments volumes in the next five years and expand its payment rails. Temenos SaaS will help enable Convera to compete in the highly dynamic payments market

Convera will overhaul its payments engine by progressively replacing legacy systems with Temenos’ robust, scalable platform to standardize its international commercial payments on a single platform. Temenos’ platform capability to intelligently route payments over Convera’s global partner bank network will allow for greater efficiencies and improved customer service. Convera will also use Temenos’ data hub capabilities for real-time data management. Temenos’ composable platform can easily integrate with Convera’s existing infrastructure which includes integrated compliance systems and payment gateways, increasing automation and time to value.

Temenos’ highly scalable platform with proven localization and ongoing investment in US and global compliance will enable Convera to process payments in a highly efficient and standardized manner. Temenos’ cloud-native platform will offer real-time payments and resilience giving Convera the business agility required to benefit from new market initiatives such as instant payments and ISO 20022. With Temenos payments platform, Convera will also continue to enhance its straight through processing (STP) rates through advanced exception handling.

Convera – which was previously part of Western Union – is the largest non-bank fintech in global B2B payments and makes cross-border money transfers simple by allowing its customers to transact globally with ease. Convera offers services ranging from currency exchange to hedging solutions and has capabilities in 140+ currencies across 200+ countries and territories. The company serves more than 30,000 customers, which range from small business owners and enterprise treasurers to educational institutions, financial institutions, law firms and NGOs.

Convera selected Temenos after a competitive process including US incumbent vendors and specialized payment vendors. Temenos offers a single platform across all banking verticals, fintechs, and associated business segments including payments and core banking, and as a result it benefits from higher investment in R&D.

Patrick Gauthier, Chief Executive Officer, Convera, said: “Temenos payments platform will underpin Convera’s growth strategy as it transforms into a modern, technology-led, global B2B payments organization, focused on innovation, value, and exceptional customer service. After extensive assessment, we selected Temenos both for its superior cloud technology capabilities and the trust in the team and its local operations. Temenos is the platform of choice for massive scale; we have a clear path for global expansion and look forward to partnering with Temenos with its global expertise to support us along the way.”

Philip Barnett, President Americas, Temenos, said: “We are excited to be selected by Convera, one of the largest fintechs, to modernize its payments infrastructure. We see tremendous growth opportunities in the payments space, and we continue to heavily invest in our single code base across core banking and payments making our offering the most compelling in the market. With Temenos Payments Hub running on Temenos SaaS, Convera will have a modern payments platform which can scale massively and propel its expansion plans. With our SaaS solution, Convera will stay agile and at the forefront of innovation and deliver fast, reliable, and transparent payment services to its corporate customers. Temenos offers a proven SaaS model together with robust US pre-configured capabilities, which is compelling for financial institutions of all sizes to move to Temenos.”

Temenos Payments is ranked #1 best-selling payments system in the IBS Sales League Table 2022.

Related News

- 02:00 am

Payhawk, the fast-growing spend management platform which combines company cards, reimbursable expenses, and accounts payable in one solution, today announces its release of a money management handbook to help startups Founders and CFOs that have raised VC funding to manage their cash flow and build a business that lasts beyond the difficult first year.

The new handbook, ‘How to demonstrate robust cash flow control post VC funding: A guide for CFOs and Founders’ covers two broad topics: what to prioritise when managing cash flow, and how to use spend management solutions to control spending post-VC fundraising. It’s aimed at startup Founders and CFOs who have raised VC-funding and are looking to build longevity.

The Covid-19 pandemic has manifestly changed how companies handle their finances. Some businesses have seen a partial recovery to their revenue and growth, whilst many others have been forced to reassess payment terms with suppliers and customers. The economic downturn of recent months has also contributed to reduced sales and impacted cash flow for many, particularly new businesses. In this climate, CFOs and Founders will often seek investment to drive revenue growth, whilst struggling to maintain sufficient cash flow, the cause of failure for nearly 50% of startups.

Even in a fluctuating market, it is crucial that startups sustain their operations; and for scaleups, to keep their investors happy. One key way to do this is with good cash flow management. Investors optimise for success by backing companies with a clearly defined path to revenue generation, profitability, and high margins. Once an investment is made, they expect to see good control of cash flow, gross profit, net burn, and runway.

Early-stage companies are frequently early adopters of automation in tech, such as spend management software. Payhawk’s handbook offers concrete advice to Founders and CFOs that want to get the most out of their spend management software, to support day-to-day operations for their business, and for their investors, to demonstrate good unit economics, strong cash flow control, and concrete actions for profitability.

Hristo Borisov, Payhawk CEO and Co-founder says, “We’re pleased to launch our handbook, ‘How to demonstrate robust cash flow control post VC funding: A guide for CFOs and Founders.’ We’ve collated research and insight from a variety of VC firms and startups that gives Founders and CFOs the inside scoop on spend management in both the early stages of their business, and once they’ve secured VC funding. At Payhawk, we ourselves used these same tools to beat the statistics and become Bulgaria’s first unicorn, so we have confidence in our findings.”

Contributors to the handbook include VC firms, QED Investors and Early Bird Digital East Investors; investment analytics specialists, Essentia Analytics; and startups Heroes, VICIO, Rentals United and Hypoport. You can read the handbook here.

Related News

- 07:00 am

ION, a global provider of trading, analytics, treasury, and risk management solutions for capital markets, commodities, and treasury management, announces that LookOut has won the Risk Technology Awards 2023 Trade Surveillance Product of the Year. Created by LIST, an ION company, LookOut is a multi-compliance solution for trade and market surveillance, regulatory reporting, and business analytics designed for investment firms (buy-side and sell-side) and trading venues.

The Risk Technology Awards recognize outstanding software solutions in the credit, operational, and enterprise-wide risk management sectors that help the industry overcome various challenges. To address the growing complexities, volumes, and extreme events affecting financial markets, the LookOut team continuously upgrades the solution to match evolving regulations. This ensures that compliance teams have the data and features required to refine their analysis.

LookOut adheres to trading regulations across Europe, the US, and the APAC region. It is enhanced by machine learning (ML) and artificial intelligence (AI), which allow compliance teams to triage alerts efficiently and accurately, and investigate the severity thoroughly before escalating. LookOut has particular strengths in analyzing orders, scrutinizing RFQs, trades, and public market data. Built-in automated detection patterns examine both market data and operator’s behavior to maximize efficiency and minimize false positives.

Commenting on the win, Mirko Marcadella, LIST’s Chief Product and Marketing Officer, said: “We are thrilled and humbled by this recognition of LookOut as an effective solution for capital markets. LookOut navigates through all the major regulatory landscapes, complying with surveillance regulations. The solution meets the MAD/MAR, MiFID/ MiFIR, SFTR obligations, conflict of interest and personal dealings for Europe, and similar requirements in other parts of the world. I honor the LIST team behind this outstanding product, and thank our clients for their trust in us and their commitment to trade surveillance.”

Related News

- 08:00 am

Liminal, a leading provider of wallet infrastructure and custody solutions is delighted to announce the appointment of Manhar Garegrat as the Country Head, India & Global Partnerships. With his extensive experience in the blockchain industry, Manhar brings valuable insights and strategic leadership to further strengthen Liminal's position in the Indian market.

As a seasoned business leader, Manhar Garegrat has successfully spearheaded growth and strategic initiatives, propelling two of India's largest digital asset businesses to new heights. His close collaborations with various government departments, ministries, and influential think tanks have been instrumental in shaping digital asset regulations in India. With key positions at ZebPay and CoinDCX, he played a pivotal role in scaling CoinDCX from a promising startup to a remarkable $2 billion company.

In his current role as Country Head, India & Global Partnerships, Manhar will play a pivotal role in expanding Liminal's presence. Leveraging his expertise in executive leadership, policy initiatives, and business management, he will make significant contributions to Liminal's mission of providing secure and compliant custody solutions to enterprises and crypto-native organizations.

"Liminal Welcomes Manhar Garegrat as a Valuable Addition to our Team," said Mahin Gupta, Founder of Liminal. "With his deep understanding of business requirements and his passion for blockchain and Web3, coupled with his strong leadership skills, he will be instrumental in driving Liminal's growth in the digital asset management space in India. We are confident that Manhar's expertise and vision will contribute significantly to Liminal's success."

Manhar Garegrat expressed his excitement about joining Liminal, stating, "I am honored to be a part of Liminal and contribute to the transformation of the digital asset management ecosystem. Liminal's commitment to security, compliance, and innovation aligns with my personal beliefs, and I look forward to leading the team in India to achieve new heights. With India at the forefront of decentralized finance, I am excited to enable the growth of Web3 enterprises and contribute to reimagining fintech on the back of blockchain in India."

Related News

- 08:00 am

NatWest has today enabled Tap to Pay on iPhone to all eligible businesses across the UK.

Apple’s contactless payment acceptance technology is now available to UK businesses via the NatWest Tap to Pay iOS app.

Tap to Pay on iPhone provides businesses with a simple solution to seamlessly and securely accept contactless payments using an iPhone and NatWest’s Tap to Pay app — with no additional hardware or card readers required.

Tap to Pay on iPhone accepts contactless payments, including Apple Pay, contactless credit and debit cards and other digital wallets. When merchants use the NatWest Tap to Pay app on their iPhone, they simply need to ask customers to hold their preferred form of contactless payment near the merchant’s iPhone and the payment will be made seamlessly and securely.

Apple’s Tap to Pay on iPhone technology uses the built-in features of iPhone to keep businesses’ and customers’ data private and secure. When a payment is processed, Apple doesn’t store card numbers on the device or on Apple servers, so business owners can rest assured knowing their business stays theirs. Tyl is backed by NatWest, meaning customer payments are in safe hands with the trust and security of one of the UK’s biggest high street banks.

Tap to Pay on iPhone is easy to set up and easy to use. On an iPhone XS or later running the latest iOS version, merchants can simply download the NatWest Tap to Pay app on the App Store. New merchants can set up Tap to Pay on iPhone within the NatWest Tap to Pay app and start accepting payments quickly, while existing merchants can speak to Tyl by NatWest to get Tap to Pay on iPhone added to their account.

Mark Brant, Chief Payments Officer, NatWest said: “Customers now expect the convenience and wider choice of using contactless credit or debit cards, as well as digital wallets such as Apple Pay, to make seamless and secure purchases wherever they shop. Equally, entrepreneurs and businesses are always looking for ways to streamline their operations, boost sales and connect with their customers regardless of location, all while benefiting from tech to make their own sales experience seamless. And for aspiring entrepreneurs, you just need a good business idea and an iPhone to start getting paid – enabling a whole new wave of opportunities.

“Tap to Pay iPhone within the NatWest Tap to Pay app enables us to meet all of these needs and put contactless payments into the pockets of businesses, optimising the in-person payment experience for all. NatWest was one of the first UK banks to bring Apple Pay to customers in the UK, and we are proud to continue to provide access to the latest in payments technology by being one of the first to bring Tap to Pay on iPhone to merchants in the UK.”

Merchants also benefit from an all-in-one NatWest Tap to Pay app that allows them not only to accept contactless payments but also to track sales and transaction history on their day-to-day business performance. They can couple this with further insight and support available within Tyl’s sophisticated customer portal which helps merchants track sales trends, payments and invoices while setting up marketing and loyalty programmes to drive further business.

Related News

- 07:00 am

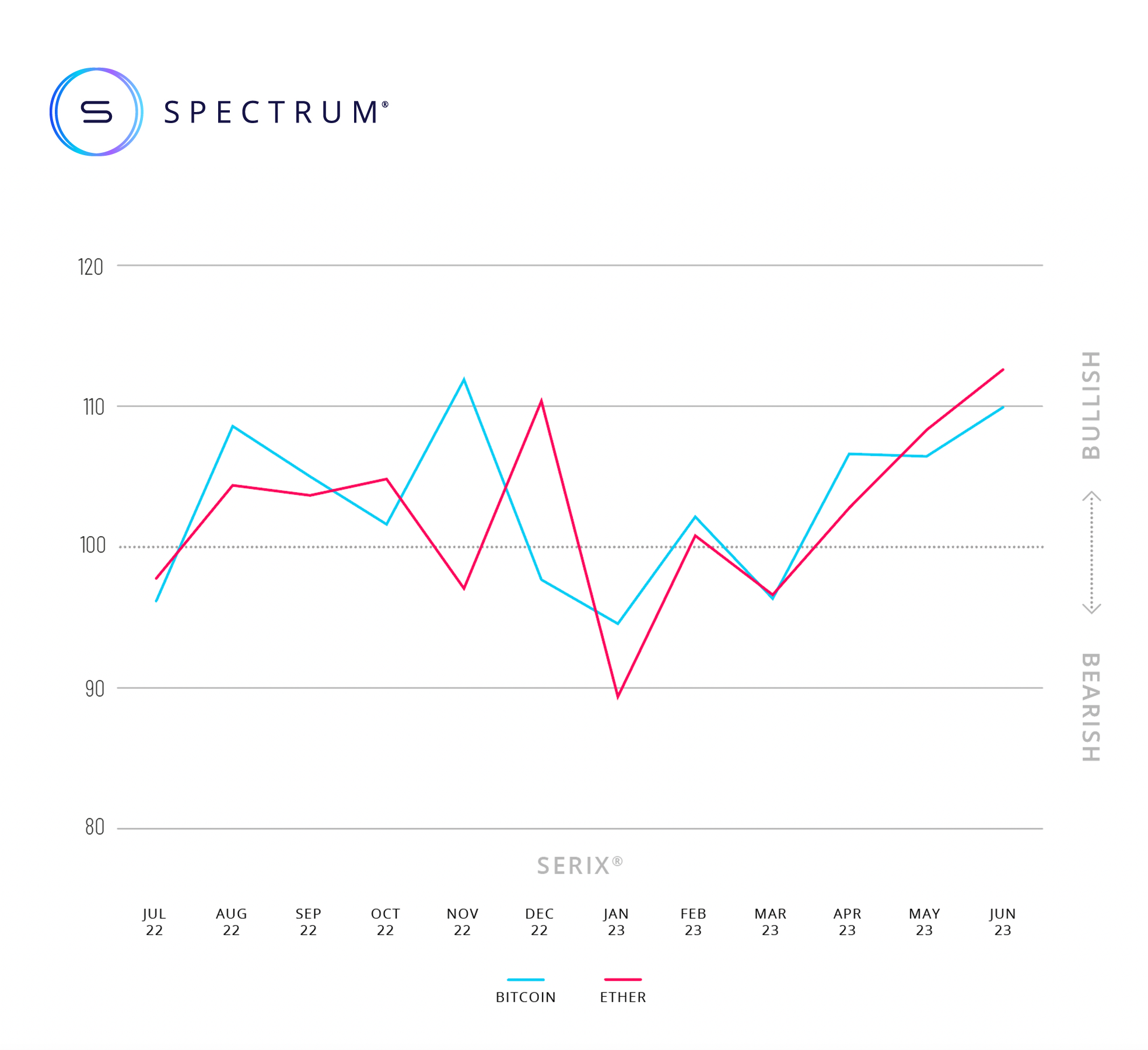

Spectrum Markets (“Spectrum”), the pan-European trading venue for securitised derivatives, has published its SERIX sentiment data for European retail investors for June, revealing retail investor sentiment towards cryptocurrencies Bitcoin and Ether has risen consistently since the index hit its lowest point in January 2023.

The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

The SERIX sentiment index for Bitcoin hit 110 points in June, the highest level since the start of this year. This bullish sentiment from European retail investors can also be seen in improving sentiment towards Ether, which reached 113 in June.

In recent months the price for Bitcoin has risen from around 16,000 US Dollar, in January, to over 30,000 US Dollar in June, whereas Ether’s price rose from roughly 1,200 US Dollar to above 1,900 US Dollar in the same period.

Using the securitised derivatives listed on Spectrum, retail investors can take long or short exposure on the two cryptocurrencies, the relevant instruments being tradable 24/5, and giving them additional tools to hedge exposure and manage risk. Trading these products on a regulated trading venue offers transparency and investor protection a.

“Interest in cryptocurrencies continues to grow, though their price volatility means investors are increasingly exploring different ways of gaining differentiated exposure to the asset class, including through derivatives. Our choice to offer this within a regulated environment, being the first to do so on-venue on a 24/5 basis, has also been welcomed by European retail investors that value trading on a regulated trading venue,” explains Michael Hall, Head of Distribution at Spectrum.

“We expect this momentum to continue, supported by more, and more diverse, products coming onto the market. The fact that a much clearer regulatory regime for digital and crypto-assets is emerging in Europe with the European Council adopting new rules on markets in crypto-assets, in particular MiCAR, is another welcome development that will give further reassurance to investors in this asset class,” Hall adds.

In June 2023, 102.5 million securitised derivatives were traded on Spectrum, with 34.1% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

84.1% of the traded derivatives were on indices, 10.5% on currency pairs, 3.4% on commodities, 1.7% on equities and 0.3% on cryptocurrencies, with the top three traded underlying markets being DAX 40 (31.5%), NASDAQ 100 (19.5%), and S&P 500 (18.7%).

Looking at the SERIX data for the top three underlying markets, the DAX 40 and the NASDAQ 100 both remained bearish at 97, and the S&P 500 fell from an already bearish 98 to a low sentiment of 88.

Calculating SERIX data

The Spectrum European Retail Investor Index (SERIX), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment:

SERIX = (% bullish trades - % bearish trades) + 100

Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded.

Related News

- 04:00 am

Bitso, the leading financial services company powered by crypto in Latin America with more than 7 million customers, announced its exclusive business partnership with Mobile Streams Plc. (MOS), the company specialized in data intelligences, specialist in next-gen content, and creator of Heroes NFT CLUB.

Thanks to this alliance, Bitso will boost the offer of sports NFTs of Heroes NFT Club through different strategies such as campaigns for users, joint collections or exclusive promotions for the Bitso community, which represents a next step for the Latin American cryptocurrency company towards the world of Web3.

According to the latest Research and Markets report, the NFT market forecasts a 33.4% growth between 2022 and 2028, as well as an increase in the value of spending on non-fungible tokens of $5.777 million through 2028, thanks to which more and more industries such as sports, entertainment and hospitality are using this technology to better interact with their customers and offer exclusive benefits to their most passionate customers.

"For us, generating strategic alliances with top-level partners has been essential to make our mission a reality. This alliance with Mobile Streams represents our commitment to continue offering attractive products adapted to the needs of our community in Mexico, where the devotion for sports becomes evident every season and we are convinced that it will give us the opportunity to take that sporting passion to the Web3 world at the hands of Heroes NFT Club to continue growing and providing different ways of making crypto useful to users in the country,” Bárbara González Briseño, CEO of Bitso in Mexico, said.

Powered by MOS, the web3 NFT Heroes Club sports platform helps fans buy, collect and trade NFTs that provide unparalleled access to unique sports experiences and take passion for the sport to a new level, from traveling to a game on the team bus, VIP tickets for the day, products signed by players and even dinner with the most renowned athletes. Bitso, for its part, provides its clients with a first-class platform with the aim of building and bringing attractive and agile businesses closer to its clients.

"We are delighted to announce this partnership with Bitso and proud to be working with the leading crypto company in Latin America to make our mission of connecting fans with the experiences and content they are most passionate about come true. We are confident that the market reach and Bitso technology, added to our NFT licenses and sports products, will make a very powerful combination for fans in Mexico," Mark Epstein, CEO of Mobile Streams plc, said.

Related News

- 02:00 am

Ante Spittler, CEO at Moss, said: “At Moss, our mission is to automate spend management to make month end as seamless as possible for modern finance teams. That’s why we’re excited to offer GoCardless for repayments. It removes one more point of friction for our customer, and helps fulfil our ethos of using automation to help SMBs save time and money.”

Alexandra Chiaramonti, VP and General Manager, EMEA at GoCardless, said: “Moss is a dynamic European start-up and we’re excited to play a pivotal role in its expansion plans. By combining the best of bank payments to get paid on time, every time with a relentless focus on saving businesses time and money, GoCardless and Moss can help millions of SMBs across the continent and beyond.”