Published

- 05:00 am

“NICE Actimize’s holistic approach to surveillance breaks down barriers between data silos at ING Deutschland, thereby providing a deeper analysis and true risk detection,” said Chris Wooten, Executive Vice President, NICE. “As a long-standing provider to ING Deutschland, we’re committed to continuing to offer market-leading financial crime technology combined with our best-in-class cloud services team, with the mission of protecting ING Deutschland as well as its customers.”

Related News

Eddie Thornton

Writer at Adapty Tech Inc.

The introduction and explosive expansion of cryptocurrencies in recent years have completely changed the financial landscape. see more

- 06:00 am

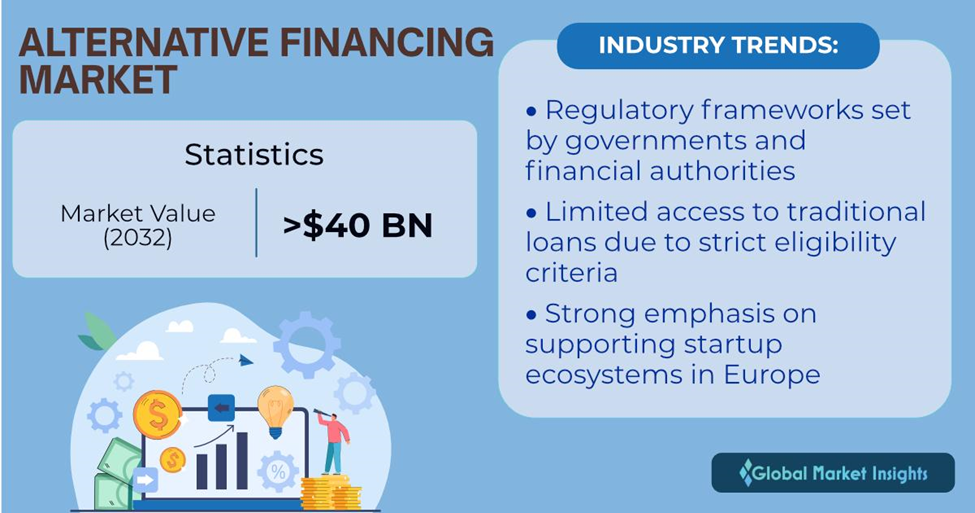

As per the report by Global Market Insights, Inc. “Worldwide Alternative Financing Market was valued at USD 10 billion in 2022 and will surpass a revenue collection of USD 40 billion by 2032 with an annual growth rate of 15% over 2023 to 2032.”

Rapid advancements in technology, particularly in fintech, have revolutionized the financial industry. Alternative financing platforms leverage technology to provide efficient and user-friendly services, enabling borrowers and investors to connect directly without intermediaries. In addition, the popularity of online platforms and mobile apps that allow borrowers and investors to participate in alternative financing transactions from anywhere and anytime has boosted the business dynamics. Regulatory frameworks set by governments and financial authorities are also driving industry trends.

The alternative financing market from the crowdfunding segment will depict a remarkable CAGR from 2023 to 2032, owing to the growth of the internet and digital platforms. Crowdfunding platforms offer these technologies to create online marketplaces, connecting individuals or businesses seeking funding with potential investors. Moreover, the capability to provide a wide range of investment opportunities across various sectors and stages of business development is set to fuel product adoption.

The alternative financing market from the individual financing segment is likely to account for a prominent industry share by 2032, as a result of limited access to traditional loans due to strict eligibility criteria and a preference for faster processing times and more flexible terms. The peer-to-peer approach eliminates the need for traditional financial intermediaries, reduces costs, and allows borrowers to access loans quickly.

Europe alternative financing market will grow considerably through 2032. European regulatory bodies introduce measures to support and promote alternative financing options, such as the Capital Markets Union (CMU) initiative, which aims to harmonize regulations across EU member states and make it easier for businesses to access alternative financing sources.

Prominent participants operating across the alternative financing industry are Credoc, Borrowers First, Finastra, GoFundMe, Funding Circle, Kickstarter, LendingClub, Kiva Microfunds, Upstart Network, Inc., Prosper Funding LLC, LendingCrowd, RateSetter, Quicken Loans (Rocket Mortgage, LLC), Sofi, and Zopa.

Alternative financing market news

In January 2023, RateSetter’s division Metro Bank, entered the digital car loan market in the UK. With this, the company aims to use RateSetter’s peer-to-peer technology for its broker partners. The paperless application allows eligible borrowers to access their car on the same day. The companies aim to expand their presence in other parts of the world.

In July 2022, Finastra, a financial services firm, introduced an embedded ‘alternative’ BNPL product that was intended to blend traditional regulated lending solutions with POS finance.

Source: https://www.gminsights.com/industry-analysis/alternative-financing-market

Related News

- 08:00 am

Revolut, the global financial super app with more than 30 million customers worldwide, has launched ‘Experiences’ - an in-app marketplace for tours, activities, and attractions, giving users the opportunity to book their travel experiences directly in the Revolut app and receive up to 10% cashback (T&Cs apply), great rates and no booking fees charged by us. So you've got more money for when you're away.

Available to Revolut customers in the UK and Europe, Experiences is the latest addition to the super app’s suite of travel products. Whether you want to view the Parisian skyline from the Eiffel Tower, traverse the rocky Agafay Desert on camelback, or take a relaxing dip in Budapest’s Széchenyi Thermal Baths, there are over 300,000 Experiences to choose from.

To start booking, existing customers can go to ‘Hub’ and click on ‘Experiences’ in the Revolut app. New customers can first download the Revolut app on their smartphones on Google Play or Apple Store and sign up to immediately access Revolut Experiences.

Customers can search locations, attractions, and experiences using filters to find their perfect day out, and book a range of available times and dates. Customers pay for the Experiences using their Revolut account, and cashback is paid instantly post successful booking completion. Customers can earn 3% cashback on Standard and Plus plans, 5% cashback on Premium, 10% on Metal and Ultra plans.

Revolut’s suite of features is the ultimate travel companion, as customers can book accommodation through Stays, split bills for group trips, exchange foreign currency in 30+ currencies, and travel insurance is included depending on the Revolut plan.

This time last year, the majority of countries in Europe had recently removed Covid travel restrictions, leading to a rise in travel. However, this year, Revolut data reveals that the interest in holidays is still rising, as the number of people in the UK spending on tourist attractions is up by 9% year on year (May 2023 compared to May 2022).

Christopher Guttridge, General Manager of Lifestyle Products at Revolut, said: “We know that new experiences are the best part of holidays. Therefore, we’re excited to now offer our UK and EEA customers access to the world’s largest marketplace for tours, activities, and attractions with the launch of Revolut Experiences.

“Experiences joins our suite of travel products, as we continue to deliver ongoing innovations aimed at meeting our customers’ travel needs to supercharge their trips - including holiday home rentals, hotels, travel insurance, and currency exchange. As the global financial super app, we continue to revolutionise travel, helping our customers experience the world seamlessly.”

The expansion of Revolut’s suite of travel products comes as it recently launched its new ultimate membership plan, Ultra, which offers ‘Cancellation for Any Reason’ insurance. Ultra members will be refunded up to £5,000 per year for flights, trains, accommodation or events (Insurance T&Cs apply).

Related News

- 01:00 am

Santander has received three global awards for the first time at the 2023 Euromoney Awards for Excellence: ‘World’s Best Bank for SMEs’; ‘World’s Best Bank for Financial Inclusion’ and ‘World’s Best Bank for the Emerging Markets’.

For the SME award, the magazine highlighted how Santander is “mixing advisory with products to power growth alongside clients” and “embracing the opportunity for relationship-forging that is presented in the SME segment through both financial and non-financial support.”

It is the third time in six years that Santander has been named the best bank in the world for SMEs and the third year in a row that the bank has been named ‘World's Best Bank for Financial Inclusion’. Santander has financially empowered more than 10 million people since 2019 and aims to provide access and finance to a further five million people by 2025. As part of these financial inclusion programs, Santander granted €950 million in microcredits in 2022, primarily in Brazil and Mexico.

The publication also highlighted Santander’s success in Latin America, naming it as the best bank in the region, and ‘Latin America's Best Bank for Wealth Management’. According to Euromoney, the bank “has the ability to operate locally with the depth of a domestic bank, while optimising the advantages of its global network”.

"Supporting SMEs and enabling greater financial inclusion are central to our purpose of helping people and businesses prosper. These awards are a testament to the success of the strategy we set back in 2015, and the hard work and dedication of our teams in Europe and the Americas in making it happen and delivering sustainable results. We are grateful to Euromoney for recognizing their efforts." - Ana Botín, Banco Santander executive chair

In addition, Santander was recognized as the best bank in Argentina, Chile, Mexico, Poland, Portugal and Uruguay. And as well as the global SME award, Santander was also named ‘Western Europe's Best Bank for SMEs’.

Related News

Ekmel Cilingir

Chairman of the Supervisory Board at European Merchant Bank

The FinTech industry is picking up speed, and is changing our understanding about financial services and their uses in many fields. see more

- 05:00 am

Acuiti today launches its Asset Management Expert Network, the latest in its series of networks of senior executives focused on the global derivatives markets.

Acuiti Expert Networks provide a virtual forum through which senior executives can gauge sentiment and benchmark approaches to common challenges.

Each quarter, members of the network have the opportunity to pose questions anonymously to their peers. These questions are then sent to the network and aggregated in a quarterly report, which provides an analysis of attitudes and approaches to the challenges that network is facing at that time.

The Asset Management Expert Network is comprised of senior derivatives-focused asset management executives at firms from across the globe.

The first quarterly report was released today and covers barriers to growth, headcount, approaches to key regulatory reforms facing the market today and how asset managers view the landscape for third-party technology provision.

The key findings of the inaugural report are:

- Asset management executives see the greatest opportunities in new trading strategies and investment in technology

- Cost bases are the main challenge that network members are dealing with

- Active account proposals in EMIR 3.0 are already having an effect on firms’ euro swap holdings, with over a third moving a portion of their books to an EU CCP

- Network members are divided on T+1 settlement, with some fearing it will cause operational complications

- Tokenization is seen as a promising collateral management tool, but many still perceive it as an immature solution

"After a challenging 2022 and first half of 2023, asset managers have continued to grapple with the unpredictable market conditions caused by rising interest rates,” says Ross Lancaster, head of research at Acuiti.

“These shifts have led to reviews of asset allocation and trading strategies, as well as an increased focus on risk and collateral management. As many asset managers look to change how they position in markets, there is also a need for investment to support the systems needed to put this into place as efficiently as possible.

“At the same time, firms are preparing for a new wave of regulatory change. European authorities are preparing EMIR 3.0 and those that trade in US markets are moving towards T+1 settlement, both of which present significant challenges to asset managers.

“In this report, we take a look at approaches to these challenges and also provide the first input for our sentiment index, a quarterly measure of how asset managers are feeling about their business prospects for the quarter ahead.”

To download the full report visit https://www.acuiti.io/q2-2023-asset-management-insight-report

Related News

- 05:00 am

The number of NatWest customers accessing Cogo’s carbon impact data through the bank’s app is now over half a million. Officially standing at 585,000 active users, this figure has increased from 334,500 in just four months.

The partnership between NatWest and Cogo - the first of its kind in the UK - officially launched in November 2021 to help customers learn about how their spending decisions impact the planet. The carbon footprint feature shows customers the carbon impact of their day-to-day spending decisions, and encourages them to choose the greener option, with tips and hints delivered through the app. They can also log their commitments and behaviour changes, to support motivation.

Emma Kisby, CEO of Cogo, EMEA says: "You can’t manage what you can’t measure, so in order for individuals to be able to play their part in tackling the climate crisis, they first have to be able to measure and understand what their personal carbon footprint is. We are seeing great momentum in the number of NatWest customers wanting to learn about the carbon impact that their spending decisions have.”

Wendy Redshaw, Chief Digital Innovation Officer, Retail, NatWest says: “Our customers are increasingly conscious around reducing the daily impact they make on carbon emissions. Through our partnership with Cogo we’re able to help them take control over their carbon footprint through accessing the relevant data to inform these decisions. Now we’ve passed half a million users, it’s clear that people are creating change – these are small steps day to day, but overall make a big impact in becoming more sustainable.”

Since launching its first banking partnership with NatWest, many banks have recognised the important role they have to play in helping to solve the climate crisis with Cogo now working with 16 banks globally.

Related News

- 04:00 am

Flywire, a global payments enablement and software company, today announced that it has partnered with Tencent Financial Technology, Tencent's fintech arm, to extend Weixin Pay (also known as WeChat Pay) as a payment option for Chinese students and families making education payments abroad. Through this direct partnership with Tencent, Flywire further streamlines the payment experience for students looking to make international tuition and other education-related payments from China.

Responding to increased demand for seamless, digital payment experiences

The partnership between Flywire and Tencent Financial Technology applies the same, seamless experience Chinese consumers are used to in their daily transactions to cross-border education payments. Weixin Pay is one of the popular digital wallets in China, with consumers deeply embedded into the Weixin ecosystem because it allows them to chat, browse, and make payments, all in one place. While Chinese students are eager to replicate the simplicity of these e-commerce transactions when making high-value payments, they’ve traditionally been faced with a lengthy and complex process when making tuition payments internationally due to restrictions and regulations imposed.

The partnership between Tencent Financial Technology and Flywire aims to rectify this gap and meet consumer demand for a seamless payment experience. Through Flywire, Chinese students can pay their education institution using Weixin Pay in their own currency (Renminbi). Payers can be assured that they will receive the added benefit of Flywire’s around-the-clock support in their local language. In turn, higher education institutions receive the exact amount owed, reconciled to the penny in their own currency.

“This partnership ensures that for Chinese students studying internationally at institutions that use Flywire, we essentially become their “pay” button, by offering localized and seamless payment capabilities, which benefit students, families and institutions alike," said Mohit Kansal, Senior Vice President of Global Payments and Payer Services at Flywire. “Flywire has long offered Weixin Pay as a payment method, but the direct connection with Tencent makes the payment experience more convenient and streamlined."

Partnership capitalizes on uptick of outbound Chinese students

Chinese students, next to those from India, represent the largest percentage of the international student population in the world. According to the latest research from the Institute of International Education (IIE) Open Doors report, China remained the top sending country of students to the United States, contributing more than $10 billion to the U.S. economy.

Flywire research also suggests that the demand to study abroad remains strong: 66% of Chinese students surveyed said they are motivated to study outside of their home country for the academic reputation of schools abroad and for new cultural experiences.

China’s recent border reopening reinforces more international student mobility from the region. According to the China Outbound Research Tourism Institute, Chinese outbound mobility is expected to recover to around two-thirds of its 2019 highs, with around 110 million border crossings expected from China. A 2023 report from New Oriental Vision Overseas Consulting Company suggests that in addition to studying in the U.S., Chinese students continue to broaden out to many other academic destinations, such as the United Kingdom, Canada, as well as a number of countries in the Asia-Pacific region.

Wenhui Yang, General Manager, Tencent Financial Technology Asia Pacific, said, "We are always looking for better ways to serve our users. Flywire’s existing footprint in China, impressive client roster and proven technology made this a natural partnership for us. As more Chinese students are eager to study abroad again, we’re confident that Flywire will enable our users to improve their international payment experience, and make paying for education as easy as sending a chat.”

Related News

- 03:00 am

Leading SME funding provider, Reward Finance Group has launched a dedicated Wellness Team to provide wellbeing, first aid, mental health and menopause support for staff across its five UK regional locations.

A healthy and supported workforce is the foundation for success, and the team is poised to offer emotional support to all colleagues in need, helping to nurture a thriving workplace together.

The Wellness Team consists of 30 employees, from across Leeds, Manchester, Birmingham London and Scotland. This includes 12 mental health first aiders, 10 menopause champions and eight first aiders.

Group managing director for Reward, Nick Smith, said: “The formation of the new Wellness Team underlines our commitment to fostering a safe, inclusive and supportive work environment for all employees, so that our workforce feels supported and valued in all aspects of their lives.

“Our Wellness Team is made up of volunteers who have been equipped with the knowledge and skills to address a range of physical and mental health concerns. The team members have undergone extensive training, enabling them to provide immediate assistance, guidance, and support to their colleagues in times of need.”

The mental health first aiders are equipped to offer emotional support and guidance to employees facing mental health challenges, offering a compassionate ear and helping individuals access professional support if required.

Reward’s menopause champions focus on understanding and addressing the unique physical and emotional needs of individuals going through menopause and will provide a safe and confidential space for discussions, offer guidance on managing symptoms and connect employees with relevant resources to help them navigate this transitional phase.

The first aiders have been trained to assess the situation, administer basic first aid and guide individuals toward appropriate medical care when necessary.