Published

- 07:00 am

DekaBank now uses the iQbonds standard software from the IT developer icubic AG for swap trading. The securities trading bank of the German savings banks (Sparkassen) has thereby expanded their implementation of icubic solutions. This decision was based on their positive experience with the IT service provider’s applications in the past as well as pending regulatory requirements. The software implementation was fully completed in only about two weeks. With the implementation of iQbonds, DekaBank already fulfils upcoming regulatory requirements and benefits from significant advantages in electronic trading:

- MiFID II readiness

- Partial replacement of the existing trade order management solution

- No costs for mandatory updates

As per the 2014/65/EU guidelines concerning markets for financial instruments (MiFID II), swap trading – trading of financial derivatives which target an exchange of future cash flows – will be subject to new regulations as of 2018. However, this was not the only reason for the switch to iQbonds for swap trading explains Jens Lippoldt, Head of Sales and Business Development at icubic AG. “With this iQbonds expansion, the bank can now process swap trades on various markets almost completely electronically. This means that future MIFID II requirements are already fulfilled and the process optimisations will add value for both the bank and its clients.”

The mentioned process improvements also resulted from high performance interfaces from icubic that were implemented for swap trading after partially replacing an existing trade order management solution. Dietmar Jakal, C hairman of the Board at the IT service provider icubic, also provides a positive summary: “We were able to implement our application at DekaBank in only two weeks, thereby adhering to a challenging timetable without a problem. During installation and sometimes also for support, we utilised our particularly efficient remote access. The fact that DekaBank, one of the leading companies in the financial sector, is using iQbonds, emphasises the quality of our application.” The Chairman of the Board also stressed that DekaBank need not budget for any cost-intensive mandatory updates.

The iQbonds software is based on icubic’s standard solutions for efficient electronic trading. The application not only supports trading on classic bond markets, but can also be used with the required components and licenses as a powerful application for trading numerous other financial instruments – such as futures, ETFs, promissory notes, convertibles, repos or swaps. This offers users many advantages because the program combines different aspects – market-making, pricing and the connections to diverse information platforms, exchanges and other markets – into a complete solution. This results in a simplification of procedures, significant speed advantages as well as a lower error rate. The software also includes many useful features including auto hedging, multi-level pricing and comprehensive security mechanisms.

Related News

- 05:00 am

Bittium exhibits its secure and strong Bittium Tough Mobile smartphone and related products and solutions for authorities at the Critical Communications World exhibition in Hong Kong, May 16 - 18, 2017.

Bittium will take part in a panel discussion “Indrustry roasting – meeting user expectations (focus on broadband)”, where the panelists will discuss how to best fulfill authorities’ end user needs. The panel discussion will be held on Thursday, May 18, in the Critical Communications Live Theatre stream. Bittium’s panelist is Mr. Michael Long, Sales Director.

Bittium’s products and solutions:

- Bittium Tough Mobile™ is a secure and durable Android-based LTE smartphone combining the latest information security and commercial device technologies. Bittium Tough Mobile incorporates a hardware-based security platform, which enables strong device security as well as deep integration of both customers' own and third party software security solutions. This dedicated hardware is essential for building layered device and software security solutions. In addition, Bittium Tough Mobile’s features include for example a programmable Push-to-Talk button (PTT), glove-usable 5” full HD display, IP67 level water and dust protection, and MIL-STD-810G level shock resistance.

- Bittium Secure Suite™ is a device management and encryption software product that complements the Bittium Tough Mobile smartphone with a scalable set of new software services for remote management, remote attestation and securing the network connections of the device. Bittium Tough Mobile smartphone and Bittium Secure Suite form a unique, complete, reliable system for processing and transferring sensitive and classified material and securing critical communication.

Related News

- 04:00 am

Friday's cyberattack on tens of thousands of computers around the world revealed businesses' and other organizations' vulnerability to ransomware and extortion. Elliptic (www.elliptic.co) is a Bitcoin intelligence firm that can guide banks and corporations through the ransomware process and work with law enforcement to identify the attackers.

“Through our extensive Bitcoin ransomware work in the United States, United Kingdom, and Europe, we have put together a comprehensive plan for ransomware readiness,” says Dr. James Smith, Elliptic’s co-founder and CEO.

“Most ransomware attacks follow the same general pattern,” explains Elliptic co-founder and lead investigator Dr. Tom Robinson. “The victim is given a Bitcoin (or other cryptocurrency) payment address, and a deadline to make payment. Most people incorrectly assume there is nothing that can be done to identify the perpetrator after payment is made.”

Elliptic works with clients to deploy a four-step plan for ransomware readiness and response, including measures to identify the attacker.

1. Assess the risk

Not all ransomware is worth paying. Elliptic's team of experts may be able to decrypt the ransomware; or there may be indications that the attacker will not decrypt your machine even after payment. In the case of last week’s WannaCry attack, there is no evidence at the time of writing that the attacker will ever decrypt the compromised machines.

Based on its deep experience and extensive network in ransomware investigations, Elliptic provides clients with an expert recommendation on whether to proceed with the ransomware payment.

2. Obtain the Bitcoins

Ransomware operations usually demand payment quickly, sometimes in as little as 24 hours. It can be difficult for a company to secure large quantities of Bitcoins at short notice. “Most Bitcoin exchanges have Know Your Customer (KYC) policies that prohibit them from selling new clients a significant amount of Bitcoins," explains Dr. Robinson. "Often a company will have the cash ready to purchase Bitcoins, but the exchange cannot legally open an account and complete the transaction before the ransom is due.”

Elliptic helps its clients draw up a plan to rapidly access large volumes of Bitcoins and other cryptocurrencies in case of a ransomware attack. Elliptic can help clients obtain Bitcoins through its network of exchanges and liquidity providers.

3. Make the payment

Large Bitcoin payments can be confusing for companies that are not used to dealing in cryptocurrencies. “Constructing a large Bitcoin transaction is a technical process. You need to define the right transaction fee, verify the destination, and sign the transaction appropriately.”, explains Dr. Robinson. “Too low a fee and your transaction might never clear; send it to the wrong address and your Bitcoins are gone forever. It’s also important that the ransomer knows which of their victims is making the payment.”

Elliptic will prepare and execute your transaction, or we can also dispatch one of our experts to your location to perform the transaction on the premises.

4. Identify the attacker

Bitcoin transactions are difficult but not impossible to trace. Elliptic has developed advanced Bitcoin investigation software and employs a team of investigators with advanced degrees in computer science and decades of experience in the world’s top law enforcement agencies. Elliptic’s software and investigators have delivered actionable intelligence to identify ransomware and cyber-extortion attackers in the US, UK, and EU. “We are able to connect the dots between Bitcoin activity and real world actors,” says Dr. Smith. “We only provide our forensic investigation services in collaboration with law enforcement, and we have a very high success rate in delivering actionable intelligence on complex Bitcoin investigations.”

Dr. Robinson adds: “We actively trace proceeds of ransomware and cyber extortion, and we alert our Bitcoin exchange customers if they receive illegal funds. Our goal is to defeat ransomware by making it extremely difficult to launder the proceeds of these crimes.”

Related News

- 01:00 am

Gemalto, the world leader in digital security, is providing its Trusted Services Hub (TSH) to support Daimler AG's new smartphone-based 'digital vehicle key' for the Mercedes-Benz E-Class range. The premium car maker's innovative solution gives drivers the freedom to lock/unlock and start their vehicles using nothing more than an NFC smartphone. Gemalto's TSH enables seamless and secure over-the-air deployment of the digital keys to any type of phone that supports the solution.

With the key safely downloaded to a secure element* via Gemalto's TSH, drivers can lock/unlock their cars by simply placing the smartphone against the door handle. The engine can also be turned on with the phone in the charging tray of the dashboard and pressing the start button. Capable of operating even if the phone battery** is drained, the need to carry a conventional key is eliminated.

As an integral part of the 'Mercedes me connect' program, the digital vehicle key will connect seamlessly with services that meet the demands of modern mobility and digital lifestyles.

"Digitalization demands that companies harness their expertise to forge strong relationships with all stakeholders within the connected car ecosystem," said Christine Caviglioli, vice president New Mobility Solutions at Gemalto. "For Daimler AG, this aim is fully supported by our solutions, which enable it to offer customers innovative services through their preferred device, without compromising security."

*A Secure Element is a tamper resistant hardware platform, capable of securely hosting applications and storing confidential and cryptographic data. It can be found in a SIM provided by a Mobile Network Operator and/or an eSE (embedded Secure Element) built into phone handset by OEMs."

Related News

- 06:00 am

Unity Trust Bank, a Birmingham based commercial bank with a social conscience, is delighted to announce the appointment of Daryl Wilkinson as Director, Customer Propositions and Strategic Marketing.

Daryl brings first-hand experience of the SME sector having founded and led DWC Ltd, a specialist digital consulting, brand communications and software development company. He has previously held senior management positions at the Royal Bank of Scotland and Northern Rock Bank, contributing to the restructure and return of these institutions to the private sector.

“I love the brand promise and believe in its purpose: helping organisations that share our values to prosper and contribute to economic, community and social change” said Daryl. “I am excited by this new challenge and committed to helping the Bank to create a better society by delivering such a unique, authentic and enormously compelling proposition for socially-minded organisations.”

Commenting on the appointment, Margaret Willis, CEO of Unity Trust Bank, said: “I’m delighted to welcome Daryl to the Executive Team. His wealth of experience will be pivotal to further strengthening our brand profile and achieving our growth plans.”

Related News

- Product Reviews

- 15.05.2017 08:21 am

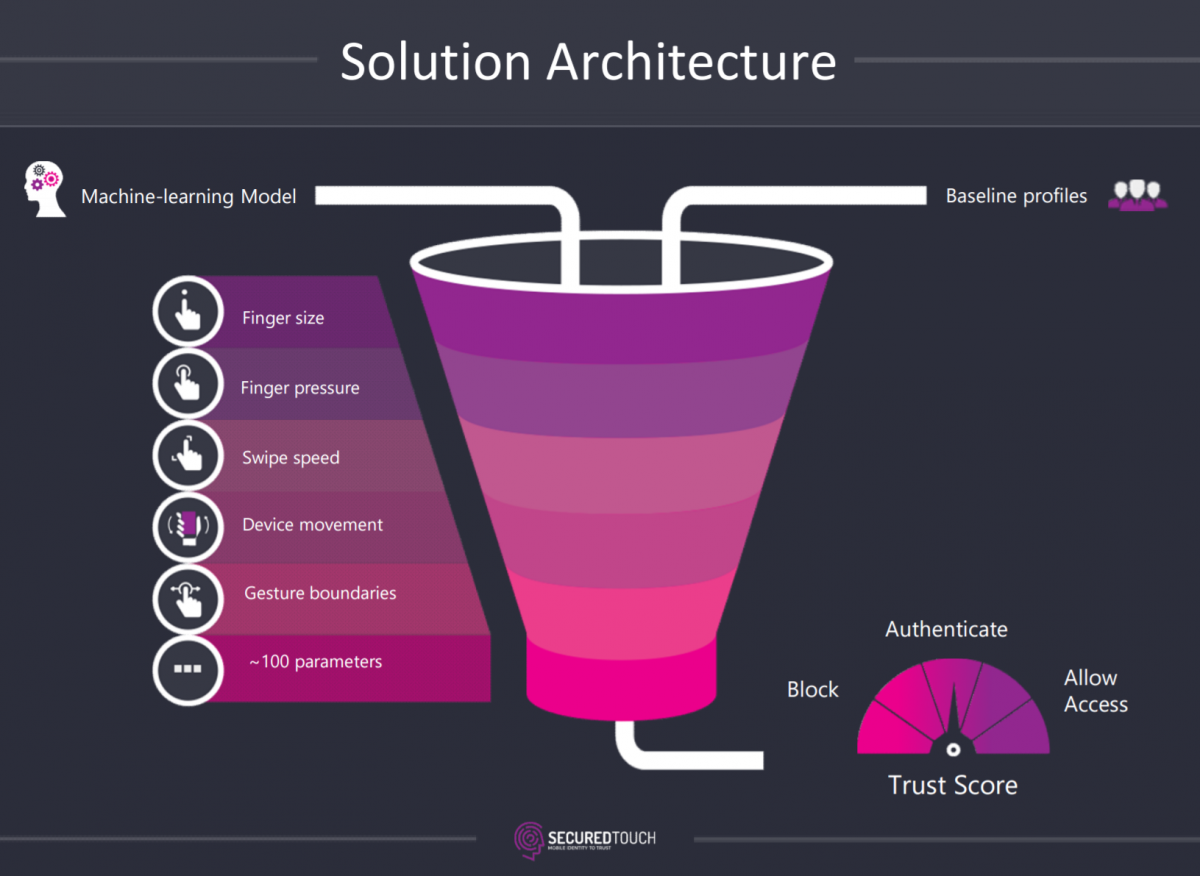

SecuredTouch is the first leading provider of behavioral biometrics for mobile services that offers digital-world authentication solutions to strengthen security and reduce fraud, at the same time allowing smooth digital experiences.

Idea Behind the Launch of Behavioral Biometrics

There has always been a big trade off between functionality, user-friendliness, and security. On one hand companies want to allow users the best functional experience and on the other hand, they want to avoid friction. In order to balance all these factors together, the company tried to think about the technique that could provide the best option. The solution was considered to be invisible to users, as well it had to be very strong in terms of functionality and security.

Moreover, as a financial organization that delivers or allows doing a lot of sensitive operations in the mobile channel, the user needs to feel very safe to do all the things, without being stopped at every place. So this is how SecuredTouch came up with behavioral biometrics, something that should be run at the background, just by leveraging the existing things that are already out there.

Behavioral Biometrics

Mobile behavioral biometrics refers to the stage when a user is analyzed by different physical interactions with several types of connected devices, in order to draw significance of identity of the user, who will specifically be deploying the device.

Furthermore, the way users interact with the mobile device is analyzed and measured by 100 different parameters. For instance, how big is the user’s finger that touches the device, how much of the pressure does the user’s finger put on the device, how fast you move your finger across the screen or how fast you scroll. As a result, about hundred parameters are collected, so later on they can be compared between the current behavior and the user’s profile that will come behind the scene. This way, we can make sure that this is a real user using a device just by looking at the behavior and see if there is a match.

Target Market

Currently, target market includes financial organizations that provide any kind of mobile service, or mobile application, where authentication or identification is a big issue. Mostly, these applications involve money transfers, or e-commerce applications, and every other application that involves authentication or knowing that this is a real user behind every transaction.

Integration Process

The integration is done to a specific mobile application. The process normally takes a few hours and consists of two parts. It is very easy and fast to integrate into the application and that is the application side. There is also integration on the back end, which takes approximately two or three days.

Real-life Example of Applying Behavioral Biometrics within Financial institutes

As an example, in Israel the company works with one of the credit card issuers, Leumi card. The company develops a mobile wallet, which can be downloaded by users and deals with all sorts of transactions. Behavioral biometrics was integrated into the mobile wallet platform, for both the IOS and Android. This collaboration allowed better user experience and simplified authentication process. Normally, every time customers want to transfer money, or want to look at the card bank and do something sensitive, they will act like putting a password or a pin code to proceed with further transaction. When it comes to transaction with a SecuredTouch, user behavior is continuously monitored. Then, when the user wants to do a transaction, the wallet calls to SecuredTouch and asks for a trust code, which is an out-code of the technology. It is kind of a confidence level and if the technology recognizes over 90%, the user does not need to enter a pin code and customers can proceed to the transaction, without being stopped on the way.

Challenges and Opportunities

The main challenge is to provide mobile users with the best of the user experience in all aspects. In terms of service, while staying very competitive, SecuredTouch is looking for the edge of making the services even better than it is now. There is a need to have security biometrics that complements one another, and choose the best one to make it more functional, user-friendly, and secure.

Other Product Reviews

- 05:00 am

Yandex.Checkout enabled companies to accept payments via marketing newsletters.

To create email newsletters with the payment-acceptance option, Yandex.Checkout partners can use SendPulse, which is an international online platform specializing in mass email, text message and push newsletters. The service helps companies around the world to send about 300 million newsletters in a month. There are more than 515,000 registered SendPulse accounts worldwide, 182,000 of which are from Russia.

«Yandex.Checkout payment button will help to increase sales conversion rate for those services who actively develop email marketing, - says Oksana Korobkina, Head of distribution development at Yandex.Checkout. - Some online stores and services are losing many customers, who follow the path from email to the website, but do not actually reach the payment stage. The reasons can vary: people tend to change their mind, get distracted, find the design inconvenient and so on. It is a known fact that the less the number of actions required from the user, the higher the probability of them buying something. Our solution is aimed to solve this problem: the user sees an interesting product or service in the newsletter, then immediately presses the button and pays in any convenient way».

Starting to accept payments from newsletters is easy - all one has to do is to conclude an agreement with Yandex.Checkout, the technical integration is not required. The service is available in both paid and free versions of SendPulse. Newsletters with a payment button can be sent to customers at any time from a computer or smartphone. The payment history can be found in company’s personal dashboard at Yandex.Checkout.

Email newsletters use Yandex Smart Checkout technology. It allows merchant sites to determine the preferred payment methods of a customer and present them with a faster, smarter payment process. Yandex.Checkout offers users a unique set of three payment methods, which are determined to be the most convenient for that user. To determine the most convenient payment methods for a person, the service analyzes various parameters, such as how the person had paid earlier, whether the order amount exceeds the one-time limit of the available payment methods, and the way customers usually pay in a particular store.

Related News

- 02:00 am

The Financial Conduct Authority (FCA) today entered into a co-operation agreement with the Securities and Futures Commission (SFC) in Hong Kong to foster collaboration in support of financial technology (Fintech) innovation.

Under the agreement, the FCA and SFC will co-operate on information sharing and referrals of innovative firms seeking to enter one another’s markets.

Christopher Woolard, Executive Director of Strategy and Competition at the FCA, said: “Co-operation agreements are absolutely vital in fostering an environment of Fintech innovation on a global scale. In the last few months alone we’ve signed agreements with colleagues in China, Japan, Canada and the Hong Kong Monetary Authority. Working with other regulators internationally, we want to build a common understanding of the principles of good innovation and we look forward to working closely with the SFC.”

Having signed a similar agreement with the Hong Kong Monetary Authority in December 2016, today’s announcement means that the FCA now has agreements with a number of key regulators in Hong Kong, which will be important given the breadth and speed in development of the Fintech sector.

“This agreement will help both regulators stay abreast of innovation in financial services while providing innovative Fintech firms seeking to develop and grow their businesses internationally with enhanced channels for communicating with regulators,” said Mr Ashley Alder, the SFC’s Chief Executive Officer.

The agreement follows the creation of the FCA’s Innovation Hub in 2014 and the SFC’s Fintech Contact Point in 2016.

Related News

- 03:00 am

The Malta Stock Exchange is to continue its use of Deutsche Börse trading technology. The two stock exchanges have extended their agreement retroactively from 1 January 2017, for another five years, until 31 December 2021.

In this context, the Malta Stock Exchange has also extended its trading hours. Daily trading in a number of products is now possible from 9.00 a.m. to 3.30 p.m.

“Deutsche Börse offers extremely reliable and high-performance trading technology. The partnership in place since 2012 has proven successful for the Malta Stock Exchange, which is why we decided to tackle future technological changes and challenges facing the financial sector jointly with Deutsche Börse again,” commented Simon Zammit, Malta Stock Exchange CEO.

“We are pleased that the Malta Stock Exchange has chosen Deutsche Börse's IT services and technology solutions. Trading participants will continue to benefit from our continually improved cash market technology as well as from a large international network of market participants,” commented Holger Wohlenberg, Managing Director of Deutsche Börse Market Data + Services.

The agreement ensures that the Malta Stock Exchange will continue to operate its cash market with highly efficient technology in the future. The two parties have thus agreed that all future modifications or updates to Deutsche Börse’s trading infrastructure will also be introduced on the Malta Stock Exchange.

A number of other stock exchanges in Europe and around the world also use Deutsche Börse's trading infrastructure. Cash market trading on the Vienna Stock Exchange has been based on the Xetra system since November 1999. The stock exchanges in Prague and Budapest have used the trading system since November 2012 and December 2013, respectively.

The Irish Stock Exchange, which introduced Xetra technology in 2000, extended its trading system agreement with Deutsche Börse last year, until 2021. The Bulgarian Stock Exchange has used Xetra technology since 2008. The Deutsche Börse Eurex Bonds platform also uses this technology. Moreover, the Shanghai Stock Exchange's New Generation Trading System was developed on the basis of Xetra.

Related News

- 05:00 am

The Royal Mint has timed its first entry into the platinum bullion market to coincide with London Platinum Week.

The first of a range of bullion platinum coins and bars will be launched on Monday 15 May via bullion trading platform royalmintbullion.com, and will be the first investment-grade platinum to be retailed by the 1,000 year-old organisation. A strategic partnership with The World Platinum Investment Council (WPIC) to deliver the physical platinum products was announced in December 2016.

Monday will see the launch of The Royal Mint’s 500g and Kilo platinum bars on the platform, which will be followed in the next few weeks by a 100g and 1oz platinum bar, and a 1oz ‘Queen’s Beasts Lion of England’ coin – the first platinum coin to be launched in the popular heraldic series.

Chris Howard, The Royal Mint’s Director of Bullion, said, “This is a new and exciting marketplace for us, and we look forward to working with the WPIC to expand the range of trusted Royal Mint Bullion products available to investors.

“The introduction of platinum to our portfolio is the next logical step for The Royal Mint and increases the choice available to our customers, supporting our ambition to be recognised as the home of the ‘complete bullion solution’.”

David Crawford, Program Manager at the World Platinum Investment Council, said: “The Royal Mint is one of the world’s oldest and foremost authorities and issuers of bullion coins and bars, and we are honoured to be working with them. The partnership is the latest in a series of strategic initiatives from the WPIC to stimulate further investor demand for physical platinum, and increase the number and type of platinum investment opportunities available worldwide.”

The Royal Mint - the world’s leading export mint, has been producing precious metal coinage since the 9th Century, and throughout this time has continued to strike coins in gold and silver. With the launch of bullion trading site royalmintbullion.com in 2014 The Royal Mint became the first mint to offer bullion coins and bars direct to individuals on a 24/7 basis, dispatched to the customer or stored on their behalf in The Royal Mint’s vault - The Vault™.