Published

Adam Zoucha

Managing Director EMEA at FloQast

The accounting profession, once considered to be a safe bet by the career professional, is now facing an escalating talent crisis. see more

- 06:00 am

Today, the leading web3 software technology company, Consensys, announces the completion of the public launch of its Layer 2 blockchain solution Linea. This milestone follows the Linea mainnet going live at EthCC in Paris. In the first month of Linea’s mainnet going live, the L2 blockchain saw a record level of on-chain activity with over 2.7 million transactions and $26M of tokens bridged, making it the fastest-growing zkEVM.

As part of the completion of the public launch, Linea has deployed its ERC20 token bridge with a canonical token list that will allow all Third Party Bridge Partners integrated on Linea to empower users across the globe to bridge ERC20 tokens to the Linea Network, unlocking a wave of DeFi applications. To mark this significant event, Linea has collaborated with MetaMask, Banxa, Circle, and Transak to create an offer for early users. For two weeks from August 17th to 31st, Linea users can benefit from a zero network fees and gateway fees rate to on-ramp to the network by using MetaMask’s Buy crypto aggregator to purchase USDC.e. USDC.e is USDC on Linea that has been bridged from Ethereum by Linea’s ERC20 token bridge. For more details, please refer to the terms and conditions.

One month in and Linea Mainnet has seen over 150 partners deploy dapps, more than 100k weekly active users, and more than 2.7M transactions. Linea is currently processing an average of 1.5 transactions per second, at 1/15th the cost of fees on Ethereum mainnet — A price that will continue to shrink as we reduce the rollup costs paid to Ethereum and pass on these cost savings to Linea users.

A public release unleashing new use cases

This release makes available on Linea the bluechip ERC20 tokens like stablecoins, liquid staking ETH and memecoins, and unlocks a constellation of new scalable dapps across Decentralized Finance (DeFi), gaming, and identity to decentralized social networks and NFTs. DeFi applications are choosing Linea for its fast finality, capital-efficient bridge, and inherited Ethereum security. NFTs, gaming, and social apps benefit from the zkEVMs EVM Equivalence, low gas fees, high throughput, and low latency.

With Linea now available on MetaMask and other wallets, everyone anywhere can now swap their favorite tokens (including stablecoins), lend and borrow assets, engage with more complex DeFi use cases, and also buy and sell NFTs, including in-game items. They can also leverage the power of Account Abstraction to pay fees with dollar-backed tokens.

To further stimulate innovations on Linea, Consensys launched the Ecosystem Investment Alliance (EIA), an investment syndicate of over 30+ leading venture capital firms to support builders through validated interest, dedicated capital, and a clear pipeline to the network. Builders are encouraged to apply to the EIA here! Finally, as part of the launch the linea team unveiled their first major NFT collection with an open mint for all Voyage participants. To date 27k participants have minted the Omega NFTs, and a total of 350k NFTs have been airdropped to participants who helped to shape and strengthen the network ahead of its mainnet launch—cementing its place as one of the largest collections in Ethereum history.

Declan Fox, Product Lead for Linea, expresses excitement about the alpha mainnet launch stating that: "The public release of Linea is a major milestone, but only the beginning of our continued commitment to collaborate with the broader Linea ecosystem and community, to build a mature rollup secured by Ethereum. The positive response from our launch partners highlights Linea's benefits: ultimate security, unparalleled efficiency, and seamless integration with popular Consensys products like MetaMask and Infura. This reinforces Linea as the top choice for users seeking a cutting-edge zk solution, delivering a frictionless and secure experience for all.”

Linea's Commitment to Security and Progressive Decentralization

Ensuring the security of mainnet alpha is a top concern and an ongoing endeavour. The team behind Linea has established an initial security council to respond to urgent issues, while the team actively pursues a progressive enhancement of the system's decentralization and trust minimization over time.

The roadmap can be broken down into five phases, which the team intends to deliver sequentially in collaboration with the broader Linea ecosystem and community. Each phase moves the Linea network closer to its target state of being a mature rollup secured by Ethereum.

By embracing the challenges of the blockchain trilemma and harnessing the power of zk technology, Linea pioneers a groundbreaking era of progressive decentralization. Through its phased approach, Linea paves the way for an inclusive, secure, and resilient blockchain ecosystem, empowering users and fostering trust in a decentralized future.

Related News

- 03:00 am

NCR Corporation, a leading enterprise technology provider, today announced that the U.S. Securities and Exchange Commission (SEC) has declared effective the Registration Statement on Form 10 filed by NCR Atleos. The Form 10 relates to NCR’s previously announced plan to split into two independent, publicly traded companies. NCR expects its separation into NCR Atleos and NCR Voyix to close in the fourth quarter of 2023. NCR’s board of directors first approved the plan to separate on September 15, 2022.

“NCR is well positioned to successfully separate into two market-leading companies, each with opportunities for long-term growth,” said Michael D. Hayford, NCR CEO. “Q2 was one of the strongest quarters in our history and NCR Atleos and NCR Voyix are ready to build on this momentum, create value for shareholders and make each a top destination for talent globally.”

NCR also announced designated members of the executive leadership teams for NCR Atleos, which will focus on banking services and ATMs, and NCR Voyix, which will focus on digital commerce.

NCR Atleos

The team for NCR Atleos, to be led by Tim Oliver as CEO-designate, is a strong mixture of current NCR executives and industry experts. The company will enable customers to meet global demand for ATM access while leveraging new ATM transaction types, including digital currency.

The executive leadership team designates include:

· Stuart Mackinnon, Chief Operating Officer

· Paul Campbell, Chief Financial Officer

· Dan Antilley, Executive Vice President, Chief Security & Cash Operations Officer

· Leonard Graves, Executive Vice President, Global Operations

· LaShawne Meriwether, Executive Vice President, Chief Human Resources Officer

· Carolyn Muise, Executive Vice President, Chief Customer Officer

· Diego Navarrete, Executive Vice President, Global Sales

· Jennifer Personette, Executive Vice President, Chief Marketing Officer

· Patty Watson, Executive Vice President, Chief Information & Technology Officer

“We have assembled a team of experienced professionals with diverse experiences and skill sets from inside and outside NCR. I have no doubt that this team will launch NCR Atleos toward a successful future as an independent company,” said Oliver. “We will bring the best technology and services to our global customers to help them reach their business and operational goals.”

NCR Voyix

The team for NCR Voyix, to be led by David Wilkinson as CEO-designate, will bring together NCR global retail, hospitality and digital banking executives with industry leaders to deliver best-in-class digital commerce solutions. The company will build on NCR’s platform-based model to drive innovation and boost operational efficiency for its customers.

The executive leadership team designates thus far include:

· Brian Webb-Walsh, Chief Financial Officer

· Ismail Amla, Executive Vice President, Professional Services and Strategy

· Jane Elliott, Executive Vice President, Chief Human Resources Officer

· Steve Fernandez, Executive Vice President, Chief Information Officer

· Frank Hauck, Executive Vice President and President, Digital Banking

· Eric Schoch, Executive Vice President and President, Retail

· George Sloan, Executive Vice President, Operations and Chief Procurement Officer

“We are building a strong leadership team that will enable NCR Voyix to continue to effectively transform, connect and run global retail, hospitality and digital banking technology platforms,” said Wilkinson. “NCR Voyix will maximize NCR’s software-led model to accelerate growth, drive innovation and exceed our customers’ needs today and in the future.”

Related News

- 08:00 am

Aleph, the leading global enabler of digital advertising connecting 22,000 advertisers in 130 primarily emerging countries with the world’s leading digital tech platforms such as TikTok, X (formerly Twitter), Snap, Spotify, Uber, Meta, Microsoft, Twitch, Google and over 35 more, is launching their global cross-border payments and credit underwriting unit, Aleph Payments.

The global digital advertising spend is expected to reach $766 billion by 2025 according to eMarketer. At the same time, global remittance and cross-border payments transaction value is estimated to grow from $37.15 trillion in 2020 to $39.99 trillion in 2026 according to Frost & Sullivan. Over the past 19 years, Aleph has been providing credit underwriting and cross-border payment offerings to advertisers and digital ad tech platforms building a robust capability. Aleph currently manages over $2bn worth of total cross-border credit and payments through its network across international markets, and it is a trusted operator for its partners and clients. Aleph’s proven reputation and expertise in primarily emerging markets provides the business with a solid foundation to roll out its payment service to new partners and clients.

Gaston Taratuta, Aleph’s CEO and Founder and EY’s 2022 Entrepreneur of the World explains: “We have built our company with the capability to adapt to the ever-changing needs of the digital industry.

We will expand our cross-border payment and credit underwriting capabilities into other subcategories within the digital advertising ecosystem such as SSP’s, DMP’s, DSP’s, ad-quality, viewability, ad-serving tech, apps, gaming, etc. We are local market experts who can solve the complexities so global ad tech companies can focus on their core businesses, and local advertisers can finance their ad tech needs.

We will also amplify our services to our current global partners such as Spotify, Uber, Meta, and new ones, expanding from our current services in digital advertising to allow cross-border payment of streaming, mobility, and digital services commerce, among other categories.

Finally, over 5,000 of Aleph's current digital-native advertisers, who are striving to connect with global consumers, could potentially become customers by leveraging the capabilities of Aleph Payments.”

Aleph will be presenting at DMEXCO in Cologne, DE September 20-21, 2023.

Related News

Sanjit Sarker

at Freelance Writer

Have you been thinking for a long time that you need good crypto AI software? see more

- 03:00 am

The Blockchain Economy Summit, recognized as the world's largest blockchain conference network, is set to redefine the future of finance by bringing together key players and experts from the crypto industry. The highly anticipated 8th edition of the summit will take place over two days in Dubai on October 4-5, 2023, in Le Meridien Dubai Hotel & Conference Center, attracting the world's top crypto companies, blockchain entrepreneurs and AI innovators.

Solidifying its position as a premier event in the blockchain and cryptocurrency space, the Blockchain Economy Summit has achieved remarkable success with previous editions held in London and Istanbul earlier this year. These highly acclaimed summits have further established the event's global reputation. Notably, OKX, the World's second-largest crypto exchange, proudly serves as the Exclusive Title sponsor for all of Blockchain Economy's 2023 Summits.

As Dubai rapidly emerges as a global crypto hub, the Blockchain Economy Dubai Summit will serve as the region's premier gathering, representing the world of blockchain, cryptocurrency and AI. With participants from over 85 countries, this prestigious event offers a comprehensive program focused on the future of financial technologies, providing extensive networking opportunities for attendees.

"We are thrilled to be back in Dubai, a city at the forefront of embracing blockchain technology," said Servi Aman, General Manager of the Blockchain Economy Summit. "Dubai's strategic vision and commitment to innovation perfectly align with our mission to shape the future of finance. This event will spark collaboration and exploration of groundbreaking ideas, driving the crypto industry forward."

The Blockchain Economy Dubai Summit will feature renowned speakers from various sectors of the tech industry. The first lineup of notable speakers joining the event this year includes:

Martin Hanzl - Head of New Technologies at EY Law

Lennix Lai - Global Chief Commercial Officer at OKX

Fred Sun - Head of Strategy at Tencent Cloud International

Matthew Sigel - Head of Digital Assets Research at VanEck

Michaël van de Poppe - Crypto Investor, Technical Analyst and CEO of MN Trading

Charles Cheng - Ph.D, Forbes China 60

Sam Blatteis - CEO of The MENA Catalysts

Alex Fazel - Chief Partnership Officer at SwissBorg

These influential speakers, along with many others, will share their expertise and insights, contributing to the vibrant discussions and knowledge exchange at the summit.

The summit will delve into the latest developments and trends within the blockchain, cryptocurrency and AI space, featuring industry leaders, engaging panel discussions, and opportunities for growth and investment. With top crypto companies and tech entrepreneurs converging in Dubai, the event will serve as an unparalleled platform for networking, knowledge sharing, and fostering strategic partnerships.

Dubai's dynamic ecosystem, progressive regulatory framework, and thriving crypto community provide the ideal backdrop for the Blockchain Economy Dubai Summit. The event aims to solidify Dubai's position as a global leader in blockchain innovation and accelerate its journey towards becoming a prominent crypto hub.

For more information about the Blockchain Economy Dubai Summit and to secure your participation, please visit the below links:

Tickets: https://beconomydubai.com/tickets

Sponsorships: https://beconomydubai.com/why-sponsor

Discounted Hotel Booking: https://beconomydubai.com/venue

Related News

- 09:00 am

Currency volatility could be significantly damaging the returns and investment potential of impact funds as well as other alternative investors deploying capital across Frontier Markets according to Ebury Institutional Solutions (EIS).

While impact funds are sitting on an estimated $73 billion of dry powder1 and there may be many exciting investment opportunities, there are also myriad risks and complicating factors throughout the investment journey.

FX risk has traditionally been a major barrier to entry, particularly given traditional banking providers provide minimal coverage of the less mature currency markets which are also characterised by wide swings and illiquid trading.

This can leave funds exposed to the spot market for the duration of their investment and create difficulties when looking to repatriate capital after exit.

The Ghanian Cedi, for example, experienced 113% volatility through 2022 with the Sterling ending the year up 48%, demonstrating the potential for losses when exiting an investment if left reliant on the spot market. Such a swing would cause a fund considerable uncertainty or significantly erode total returns, while the likelihood of such swings may deter any investment in the country.

While traditional providers may struggle to meet the needs of the impact investment sector, Ebury Institutional Solutions have seen growing demand from these funds leveraging Ebury's expertise and solutions that cover a wide range of exotic currencies.

Jack Sirett, Partner at Ebury commented, “We have seen rapidly growing demand from investment funds that invest in Frontier Markets for solutions to the problems they face around FX risk management and the currency volatility associated with traditionally illiquid markets.

“Impact funds are reliant on maximising the potential of the capital they deploy in these countries yet can struggle hedging capital flows with traditional banking providers. It is a serious obstacle to investing in Frontier Markets because it means they are left exposed to the spot market for a prolonged period of time.

“We urge impact funds and other alternative investors to explore their FX services to ensure they have appropriate hedging solutions in place. This can provide the catalyst needed to take advantage of the significant investment opportunities across Frontier Markets.”

Related News

- 04:00 am

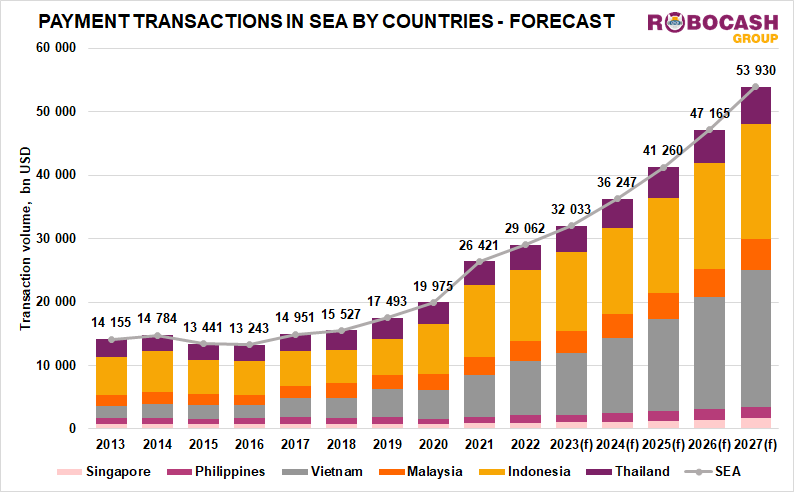

Analysts of the group explain: “One of the reasons for rapid growth in Southeast Asia’s payment transactions recently is the boost of digital technologies caused by the Covid-19 pandemic. From 2020 to 2022, the amount of payments in SEA increased by 45%. Secondly, there is strong support from the state. Each country in the region has its own national digitization programs, which include the digitization of payments. Thirdly, as of 2022, the total volume of private domestic and foreign investments in the fintech payment infrastructure of SEA amounted to about $60 billion. $26.5 billion of this amount was invested between 2021 and 2022.”

Related News

Gunja Gargeshwari

Chief Revenue Officer at Bright Data

Those three words Efficiency, reputation and future-proofing are the result of a great sustainability program for a business. see more

- 05:00 am

Nethone, the Know Your Users AI-powered fraud prevention company, has unveiled its proprietary solution that detects VPN and proxy connections, including residential proxies, even those used by skilled fraudsters to commit a wide range of online abuses in e-commerce and financial space.

Behavioural detection by Nethone serves as a powerful weapon against such threats, effectively identifying even the shadiest VPNs and proxies predominantly used for fraudulent activities such as account takeover (ATO), account opening fraud, and payment fraud.

Precise detection of proxies and VPNs offers key benefits for merchants and financial institutions:

Protect against large-scale payment fraud attacks

Prevent browser automation, including: web scraping, account creation fraud, price or inventory manipulation (e.g., "sneaker bots" that bid on rare items)

Detect and stop compliance breaches in industries that require strict regulations, like gambling or crypto, by making sure customers are not hiding their true location

The company’s own darknet research has identified that more than 80% of fraudster tactics involve the use of a VPN or proxy service to carry out successful online fraud attempts. By hiding their IP addresses and true geographic locations, fraudsters avoid detection and deceive unsuspecting victims. Particularly in ATO cases, fraudsters strive to hide any info that might give them away, and mimic the victim's behaviour once in control.

While many fraud prevention companies can detect proxy and VPN connections originating from well-known services, these detection methods often rely on easily traceable data from third-party providers. What sets Nethone apart is that they don't depend on outdated lists that may not include the latest VPNs and proxies being used by fraudsters. Instead, they actively identify suspicious behaviour and potential malicious actions in real-time.

Maciej Pitucha, Chief Data Officer comments: “Skilled fraudsters avoid well-known VPN services, opting for those popular among their community on the dark web. But we manage to stay one step ahead of them and detect all VPNs, therefore blocking fraudsters from causing damage while offering genuine users a frictionless experience.”

Nethone has a dedicated Fraud Intelligence team that is constantly searching for new fraud tactics on the Darkweb to learn who and what cybercriminals have on their radar, and what new ideas they apply to succeed. They gather intelligence and reverse-engineer fraudsters’ techniques to improve fraud recognition.

VPN and proxy detection is part of a large suite of risks detected by Nethone Guard - the company’s flagship fraud prevention product. Nethone offers a free trial for developers and fraud managers interested in seeing the product in action - a no-pressure way to see how it works and explore its benefits.