Published

- 09:00 am

SWIFT announces that it is to open its world-leading Know Your Customer platform, The KYC Registry, to corporates.

In a first step, from Q4 2019, all 2,000 SWIFT-connected corporate groups will be able to join The KYC Registry, and use it to upload, maintain and share their KYC information with their banks.

Enabling corporates to join The KYC Registry will be transformational both for multi-banked corporates and for their banks, who already benefit from access to the 5,100 bank strong registry and can see the huge advantage of adding corporates.

Major corporations use a range of banks in different jurisdictions around the world, with whom they need to exchange information to enable KYC checks. Data is held in different places and is often incomplete or out of date, making the process time consuming for both corporates and their banks.

The absence of uniformity, differing jurisdictional requirements and the lack of standardised data across the corporate KYC space increases these inefficiencies further.

The KYC Registry is an online portal for financial institutions to exchange institutional KYC Due Diligence information. The platform allows banks to share KYC data and documents with their correspondents in a secure, standardised and controlled way, as well to get access to their correspondents’ complete and validated KYC profiles, resulting in efficiency and cost savings in KYC processes.

The introduction of corporates will enable corporates to upload standard information to The KYC Registry as well as to exchange other KYC-relevant documents that are requested by their banks, thereby ensuring the highest level of usability of the platform. Banks will benefit by having access to corporates’ information through the same central repository they use for their correspondent KYC checks, thereby enabling efficient data sharing through a secure central utility, eliminating duplication and inefficiency.

Marie-Charlotte Henseval, Head of KYC Compliance Services, said: “Corporate treasurers cite KYC as one of the top three challenges they face in their bank relationships. We’re pleased to be extending what is already the largest KYC registry for banks in the world to corporate customers. This unique and well established utility already delivers huge benefits to banks, and its extension to corporates will extend them the same advantages, with a standard agreed by the community and a secure platform enabling efficient data sharing.”

Stephan Ziegler, Head of Bank Relations at Siemens Treasury, said: “As a global corporation, the efforts of Siemens to perform KYC-related tasks across the institution is a repetitive, lengthy and a cumbersome process. At Siemens Treasury we are constantly looking for ways to increase our efficiency. With SWIFT announcing KYC for Corporates, we are delighted to see a well-positioned player moving ahead to answer this need with the full strength of its banking and corporate community.”

John Colleemallay, Senior Director Group Treasury & Financing at Dassault Systèmes, said: “KYC for Corporates is a dream come true for all Treasurers, considering the heavy workload involved in providing the same documentation several times in multiple formats to our banking partners. We look forward to having a secured shared registry where we can more easily and rapidly complete the KYC processes.”

Daniel Ochsner, Member of Management, Würth Finance International B.V. and Chairman of SWIFT Corporate Group Switzerland, said: “We are very pleased to see that SWIFT has aligned its banking community to provide a simplified KYC experience to corporates. The success of The KYC registry for banks and the trust we put in SWIFT puts us at great ease when it comes to exchanging documents and information with our global bank partners”.

Related News

- 05:00 am

IX Reach, the leading provider of SDN cloud connectivity, remote peering and Ethernet services to more than 170 global locations is proud to announce it has upgraded its network Point of Presence (“PoP”) at the Scottsdale data centre of Iron Mountain Incorporated (NYSE: IRM), the global leader in storage and information management services. The changes enable IX Reach to offer its full suite of cloud and connectivity services to Iron Mountain’s Phoenix metro-connected campus.

IX Reach has been offering cloud and connectivity solutions at Iron Mountain’s Scottsdale data centre via cross connects since 2016. Strong customer demand and rapid sales growth underpinned IX Reach’s decision to install its own hardware in the Arizona data centre, bringing the location on-net as a fully-enabled IX Reach location. Iron Mountain Scottsdale is part of a three-data centre Iron Mountain connected campus in Phoenix that features more than one million square feet of colocation capacity and hundreds of customers and networks.

“At Iron Mountain, we are focused on delivering the best colocation experience possible for our 1,200-plus data center customers worldwide,” commented Rick Crutchley, vice president of Iron Mountain data centers, North America. “This includes providing efficient access to the clouds, carriers, and IT services our customers need to thrive in a multi-cloud world. Having IX Reach in our Scottsdale data center is an important part of this commitment as it delivers more network services options and increases the efficiency of customer hybrid IT implementations.”

“We are thrilled to have added the exciting and fast-growing city of Scottsdale as a fully on-net enabled location to our global network – not just because it gives our customers another option for connectivity, but it also further strengthens our relationship with Iron Mountain,” said Simon Vye, CEO at IX Reach. “Iron Mountain is one of the top global providers of data centres and colocation and has been protecting important assets for more than 225,000 customers since 1951. Our companies share a vision to foster long-term customer relationships through integrity, reliability and trust.”

The addition of Iron Mountain’s Scottsdale data centre means one of the largest data centre ecosystems in the mountain states has now been added to IX Reach’s growing global network. The PoP upgrades at Iron Mountain’s Scottsdale data centre allow the company’s Phoenix colocation customers unlimited and direct access to all IX Reach SDN Cloud connectivity, remote peering and transport connectivity services via a single cross connect.

The continued investment by IX Reach in its core infrastructure shows its dedication to meeting the global challenges of increased data use driven by the growth of video streaming, content delivery, IoT, big data and AI technology. The upgraded Scottsdale location is one of 170+ IX Reach network PoPs worldwide.

Related News

Kelly Read-Perish

Operations manager at Credit Kudos

Since January 2018, Open Banking has been driving dramatic change across the financial world, revolutionising everything from payment solutions and budgeting tools to lending app see more

- 01:00 am

- IDology provides GBG with a strong foothold for Identity Verification and Fraud Prevention in North America, a key growth region for the company.

- The acquisition will strengthen GBG's product portfolio and enhance its world-class customer experience, while delivering unbeatable regulatory compliance.

- A strong cultural alignment based on an established commercial partnership.

GBG, the UK-headquartered Identity Data Intelligence specialist, today announces that it has conditionally agreed to acquire the entire issued share capital of IDology, a US-based provider of identity verification and fraud prevention services, for $300m (£233m) in an all-cash transaction.

IDology is a fast-growing provider of identity verification services that helps remove friction both in onboarding customers and in the detection of fraud. Its market-leading US identity verification and fraud prevention services, led by its ExpectID product range, are the perfect strategic complement to GBG's identity verification solutions.

GBG can quickly validate and verify the identity and location of 4.4 bn people globally and accesses a breadth of data from over 200 global partners to establish trust between businesses and their customers. Having completed 11 acquisitions since 2011, GBG's $300m acquisition of IDology is its largest to date.

GBG has seen strong growth in the US market. Its existing US identity business has grown organically with customers across technology, payments and retail verticals. Meanwhile Loqate, its location intelligence solution, has offices in New York City and San Francisco and has seen high demand from household names like Abercrombie and Fitch, Oracle and Nordstrom. The acquisition will strengthen GBG's broader portfolio and enhance the business' product capability and customer reach.

Over the course of 2018, IDology delivered revenues of $38.2m at a CAGR of 16%, and EBITDA of $16.3 million. The company will retain its entire senior management team and the employee base of IDology will join GBG.

Today, IDology has established itself as the market leader in domestic identity verification and authentication which enables fraud prevention across multiple sectors. The acquisition will strengthen GBG's portfolio, enhancing the business' product capability and customer reach.

GBG and IDology have a history of working together in partnership and share a similar culture with a strong emphasis on people and talent. IDology's US customer base currently accounts for 99% of its revenue, which will provide GBG with geographic scale and help to position GBG as a global leader in electronic identification verification.

John Dancu, IDology's President and CEO, commented:

"For the past fifteen years, IDology has provided multi-layered identity verification. With the combination of IDology and GBG, we intend to innovate, delivering exceptional solutions for our customers, focusing on driving customer revenue and preventing fraud. With GBG's expertise in global data, we are all excited to expand our solutions and our trusted consortium network for customers across the globe."

The CEO of GBG, Chris Clark, said:

"I am delighted to announce the acquisition of IDology. With attractive organic growth, significant synergies and a strong cultural alignment, this is a high-quality addition to GBG. The combination of IDology and GBG enables us to meet growing customer appetite for an identity verification provider with global capabilities and scale in key markets.

"We are excited by the compelling strategic rationale behind this acquisition. It enables GBG to quickly expand even further into North America, a key growth territory for the business. We have already built an exciting domestic presence in the US with Loqate, our location proposition, and IDology now gives us an excellent platform for both identity verification and fraud prevention.

"The Board and I look forward to the future success that we anticipate that our combined business can deliver."

Today, the US Identity Verification market is valued at $1.5bn*, with a predicted CAGR to 2022 between 7 – 14%.[1] GBG's acquisition of IDology will provide the combined business with the critical mass to improve its customer offer, operational efficiency and deliver scale in a key target market.

Related News

- 04:00 am

Black Knight, Inc. (NYSE: BKI) announced today that KeyBank, one of the nation's largest bank-based financial services companies, has successfully implemented the Black Knight MSP servicing system. KeyBank, which has been using Black Knight's Empower loan origination system, as well as its Bankruptcy and Foreclosure and Invoicing solutions for several years, is now also using MSP to service its mortgage portfolio to help improve efficiency and risk management. Additionally, the bank is using components of the new Black Knight Actionable Intelligence Platform (AIP) to help the bank proactively monitor and manage its servicing portfolio through the use of strategic, proactive analytics.

"As a result of the Black Knight team's extensive servicing experience and skillful execution, the entire implementation process was planned and managed efficiently," said Amy Brady, CIO, KeyBank. "Black Knight's superior product innovation, as well as its ability to support our growing servicing operations and help enhance our compliance processes, were important factors in our decision to expand our current relationship with Black Knight."

The Black Knight AIP is a unified framework for delivering strategic, proactive and actionable analytics to the right people within an organization at the right time, so they know the right actions to initiate next. The AIP components used by KeyBank include Portfolio Insight Suite, which helps servicers proactively monitor and manage their operations through the use of key performance metrics, and Lien Alert, which provides servicers with instant notifications about key lien-related indicators. KeyBank will also use Black Knight McDash standard reports. McDash offers access to the deepest, broadest mortgage dataset in the market, including a majority of the active mortgage universe and historical data on 180 million first mortgage loans and more than 20 million home equity loans.

Because the company leverages multiple key offerings, KeyBank is now a Black Knight enterprise client. By gaining business process automation, workflow, rules, and integrated data throughout the loan process, Black Knight enterprise clients can help reduce risk, improve efficiency and drive financial performance.

MSP offers a single, comprehensive system used by financial institutions to service over 34 million active loans – more than any other in the mortgage industry. The scalable system, which helps clients manage all servicing processes – from payment processing to escrow administration, customer service, default management and more – can accommodate virtually any size portfolio, and includes award-winning client support services. MSP can also support home equity loans and lines of credit on the same platform.

"Taking advantage of multiple innovative Black Knight products will help KeyBank to benefit from reduced costs, increased operational efficiency and improved support for compliance initiatives," said Joe Nackashi, president of Black Knight's Servicing Technologies division. "KeyBank is a valued client, and we are proud to provide the premier technology that KeyBank uses to both originate and service its loans, as well as provide additional innovative capabilities to support KeyBank's growth and success."

Related News

- 02:00 am

ADCB has gone live in the United Arab Emirates with its personal finance management (PFM) application built on Strands' technology. The MoneyBuddy app helps ADCB customers understand and manage their finances in a smarter and more independent way.

Abu Dhabi Commercial Bank is introducing a new way of communicating with its clients, focusing on a transformative user experience and offering their users all the tools they need to get a 360º snapshot of their entire financial world.

Strands has a proven track of record of developing and delivering highly-customizable digital money management software to top-tier banks worldwide - and was selected by ADCB as their key FinTech partner for that journey.

More than half a million ADCB customers can already benefit from the MoneyBuddy PFM app functionalities, allowing them to:

- Track their spending, savings goals and budgets

- Predict how purchases will impact their overall financial health

- Understand their monthly cash flow so they're never caught unaware

Moreover, to speed up the customer onboarding process in MoneyBuddy, iOS users are able to log into the app through Face ID, a biometric facial recognition technology.

According to ADCB, customer feedback has been outstanding so far, with registrations currently doubling their initial target. MoneyBuddy has already achieved a rating of over 4.5 in app stores.

Strands' value-added solutions enable deeper and mutually beneficial long-term value between ADCB and its customers, helping them cement their commitment to relationship banking.

Related News

- 03:00 am

Solactive, the German index engineering firm, will collaborate with San Francisco-based AI company Truvalue Labs, intensifying efforts to meet a significant increase in client demand for ESG indices.

“We are looking for innovative ways to uncover insights from ESG data”, says Steffen Scheuble, CEO of Solactive. “Quality and timeliness in ESG data are high priorities for investors. As a company that puts substantial research into Machine Learning and Natural Language Processing, we are very confident that we have found an ally in Truvalue Labs, which also has Artificial Intelligence as its core competency.”

Truvalue Labs sources and analyzes information differently than other ESG data firms through its use of artificial intelligence and machine learning. The firm parses unstructured data from more than 100,000 sources compiling an independent perspective on company ESG performance instead of relying on company disclosures.

Hendrik Bartel, CEO and Co-founder of Truvalue Labs, states: “As more investors increasingly integrate ESG into their investment processes, it is our mission to provide signals that are timely and sourced from transparent data,” says Bartel. “With Solactive, we are pleased to find a partner that shares our values and vision with respect to AI and ESG. We look forward to working closely to bring new innovative indices to market.“

The first series of indices under development utilize Solactive’s Global Benchmark Series as the starting universe. From this universe, Solactive selects companies with high data volume and high “Insight Scores”, Truvalue Labs’ proprietary ESG rating. Backtests of the strategy have shown outperformance in different markets. The index design allows clients to individually form regional or domestic index combinations, providing full flexibility in the creation of custom equity strategies in index format.

Related News

- 07:00 am

Card expenditure continues to rise with customers increasingly expecting to be able to use their cards, even for low value payments

Convenience and speed drive increasing card usage for lower value payments

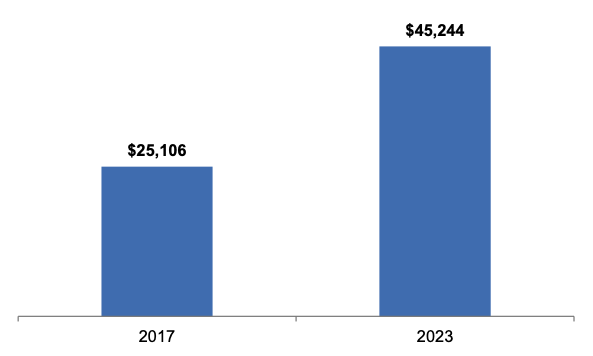

Payment cards were used for purchases with a value of $25.1 trillion worldwide in 2017, an increase of 13% on the year before, according to RBR in its recent Global Payment Cards Data and Forecasts to 2023research report. Although card expenditure is growing strongly, it is being outpaced by growth in the number of payments, as cards are increasingly being used for lower-value payments, often displacing cash in smaller retailers for goods such as drinks and snacks.

RBR forecasts global card expenditure will grow at an average of 10% per year between 2017 and 2023 to reach $45.2 trillion. The average value of a payment, however, will fall from $67 to $62 over the same period as the influence of contactless cards grows – the latter are typically used for the lowest-value payments, and particularly those which would previously have been made with cash. Both customers and merchants appreciate the convenience of contactless payments, partly because the need to enter a PIN is removed, but also because transactions are much quicker.

Chinese cards used less frequently, but for higher value purchases

According to RBR’s research, Asia-Pacific accounts for 50% of global card expenditure, which is much higher than its 28% share of the number of payments. The main reason for this is that in China, cards tend to be used for cash withdrawals rather than payments, and when they are used at POS, it is typically for high-value purchases such as property deposits and vehicles.

Average card payment value will fall as paying by card increasingly becomes the norm

RBR’s report shows that debit cards account for 55% of spending on cards worldwide, some way below their share of the number of payments. This is because debit cards are most commonly used for low-value purchases, whereas credit cards are usually used for more expensive items. As the influence of contactless grows, debit cards’ share of global card expenditure will continue to fall.

The value of card payments worldwide will doubtless continue to rise, but the average value of a payment will keep falling. Daniel Dawson, who led RBR’s research project, said: “Consumers worldwide are becoming more comfortable with using their cards for inexpensive goods, especially as contactless cards become commonplace. As they increasingly expect to be able to use contactless cards across the board, the average value of a payment will continue to fall”.

Related News

- 08:00 am

ACH Alert, an award-winning provider of electronic payments fraud prevention technology for financial institutions of all sizes, announced today its latest Payment Data Xchange (PDX) service module within its flagship Fraud Prevention HQ platform. Fraud Prevention HQ is the industry’s first exception decisioning portal that provides a fully integrated dashboard for financial institution customers to make their pay or no-pay decisions on suspicious payment activity across virtually every payment channel.

PDX is being introduced due to intense market demand for more automation and robust features for delivering translated EDI information (820 & 835) contained within incoming ACH files, NOC and ACH return information to business account holders. Dynamic configuration options within the new PDX module enable financial institutions to choose the EDI feature, the ACH return and NOC feature or both for themselves and their clients. Financial institutions simply enroll the account number for the EDI service or the originating company ID for the ACH return service.

Additionally, PDX will monitor incoming ACH transactions for enrolled accounts/company ID’s and alert account holders when incoming ACH transactions contain EDI information or when they have ACH returns or NOC’s. Information will be presented by settlement date to aid in the reconcilement process. Account holders can access the information online, export it in a variety of formats or have data delivered electronically to automate posting. PDX also offers an automated billing feature to allow financial institutions to bill clients via analysis or ACH debit.

“Our enterprise level platform can be easily accessed by account holders via single sign on through online banking,” said Deborah Peace, AAP, chief executive officer of ACH Alert. “As part of our commitment to serving the financial services industry, we are positioned to further compliment online banking systems by making valuable payment remittance information, such as ACH returns and NOC information, available to clients in a timely manner and an easy-to-use format.”

Related News

- 09:00 am

Tradeteq, the innovative AI-driven trade finance investment platform, has partnered with World of Open Account (WOA) to become Chair Partner of their “receivables as an investment class – funding and capital” Learning Lab.

WOA’s Learning Labs gather members of the WOA community to provide insight and knowledge into four areas of strategic importance to the open account ecosystem: People and Talent; Risk and Regulation; Products and Markets; Innovation and Development.

The “receivables as an investment class” Learning Lab will work to raise awareness of account receivables’ potential as an asset class. The recent application of technology to account receivables has allowed for their development into an investable asset class by bridging the information gap between investors and trading companies. As one of the lowest-risk and easiest-to-manage asset classes, such investments have become increasingly attractive to institutional investors – if they can overcome the information gaps that prevent credit scoring (exactly the service provided by Tradeteq).

“We are pleased to be partnering with WOA on their ‘receivables as an investment class’ Learning Lab,” says Christoph Gugelmann, CEO and co-founder of Tradeteq. “The potential for such assets is immense and, as part of the Learning Lab, we hope to bring attention to this highly-valuable area of trade finance by providing the necessary knowledge to community members.”

Aimed at anyone considering investing in receivables, the Lab will provide a centre for information as well as innovative insight on account receivables: producing highly relevant and timely articles, webinars, presentations, surveys and polls, as well as white papers and case studies, meetings and panel interviews.

“We are thrilled to have Tradeteq on board as a Chair Partner for our Learning Lab on receivables as an asset class,” says Erik Timmermans, co-founder of WOA. “Their expertise in this sector will be invaluable in steering the Lab’s activities and topics of interest, keeping on top of key developments and changes within the industry.”

While WOA facilitates the activities of each Learning Lab, they operate as independent, individual units led by a Chair Partner and members of the WOA Community Expert Groups who steer the direction and content of the Lab. The Learning Labs function at the heart of WOA’s “INSPIRE” activities, the aim of which is to provide community-led centres of knowledge and expertise – allowing members of the industry to make a difference in the areas that matter most for them.