Published

- 07:00 am

Research conducted by digital cross-border payment provider InstaReM reveals that 44% of UK migrants are now sending less money ‘home’ as a result of Brexit chaos and a drop in value of sterling. This announcement comes after InstaReM took to the streets to speak with migrants in the UK about Brexit and the impact it’s having on their finances.

This is having a direct impact on the families they support, with almost half (48%) of the money they send home being used to fund basic necessities like food and healthcare. The findings also revealed that 45% of all money UK migrants send ‘home’ goes towards supporting their parents and elderly members of their family.

InstaReM’s research indicates that the Brexit decision has a significant negative impact on the spending power of UK migrants, of whom 36% now sacrifice a greater proportion of their income to continue to provide the same level of support they did for their families before the Brexit decision.

That’s why InstaReM is standing up for migrants in the UK and their families. The digital money provider will help protect migrants against the implementation of Article 50 with its Brexit50 offer which gives users a transfer bonus of £50 when remitting money from the UK to families abroad. This good-will gesture comes at a time where migrants in the UK are feeling frustrated with 33% of respondents stating they were ‘unsure’ about their ‘future in the UK’.

Hardik Shah, non-UK national, Pre-Sales Solution Architect:

“When I first heard the EU referendum result I knew it would have a big impact on the money I send home to my parents in India, who rely on me to buy the basics they need. Since the EU referendum decision, I’ve had to send more money home, which is putting a real strain on my household budget – and regardless of what Brexit deal the UK gets, there’s seems to be no sign of this strain stopping any time soon.”

Roya Rahnejat, Director at London fintech startup, Yobota:

“I don’t agree with Brexit, just from a business point of view. If you look at it economically, the decision just doesn’t make sense. In a way I feel like I’m being punished by a referendum that didn’t need to take place. My remittance values are being affected and this is making me think twice about sending money abroad, where previously I’ve never had an issue in doing so.”

Luke Santos, Teaching Assistant in South London:

“I regularly send money back to family members in South America for various occasions across the year and if the UK government leaves the EU, it would leave me no choice but to stop remitting as often, and maybe full stop.”

Prajit Nanu, CEO and Co-Founder of InstaReM said:

“Our research has shown that the effect of the Brexit decision goes much further than UK shores. Hardworking migrants in the UK are suffering and so are their families over an uncontrollable situation. That’s why InstaReM wants to stand with migrants in the UK and their families around the world and help them take control of their overseas money transfers.”

Related News

- 04:00 am

Today Instantor, the 3rd. fastest growing Swedish FinTech who makes tough calls easy within credit risk management presents “Credit Risk Management 2019 - How Do You Stack Up?”, a report based on a survey conducted by Instantor across Europe among top executives within leading financial organisations. The report reveals that two-thirds of these players are well underway to implementing machine learning (ML) and the majority benefits from its implementation within credit risk management.

A greater number of strict regulations have rapidly evolved in Europe in the last decade to protect the economy and the end-consumer. Consumers´ demands for fully digitised services, mobile-friendly interfaces and more convenient experiences have risen. Simultaneously, internal pressures to meet business targets while diminishing risk and compliance costs have increased too. These factors have urged financial institutions to come up with more efficient and innovative tools such as ML.

As part of the report, Instantor identifies other changes that financing organisations need to make to adapt to the current landscape: a shift to fully digitised and automated solutions; implement advanced analytics; partner with FinTechs; handle customer´s information with care to comply with regulations such as GDPR, and innovate services around data. Instantor recognises the opportunities being created by PSD2 that make it possible for financial institutions to gain new customers and tap into new data sources, such as transactional data.

“Credit Risk Management 2019 - How Do You Stack Up?” highlights significant benefits that can be drawn upon with the implementation of ML within financing, such as a boost in the bottom line and higher consumer satisfaction and retention. Instantor has identified an increase in the predictive power of the scoring models, a faster and more accurate loan acceptance process, and streamlined management as additional benefits that financing organisations can reap from ML implementation while gaining a definitive competitive advantage to stack up to competition.

The report covers the challenges in regards to ML implementation - finding that reasons for not implementing ML techniques are related to a lack of understanding and its potential impact on operations (44%), and not knowing how it could affect the company’s performance (22%). “With the release of this report, Instantor begins a series of seminars and webinars aiming to transfer knowledge to credit risk professionals as part of our mission to democratise the financing system,” comments Raiha Buchanan, CMO at Instantor.

“We are committed to empowering organisations with the technology and the knowledge they need to position themselves ahead of the curve. By better understanding the remarkable impact of ML utilisation for credit risk assessment, organisations will be able to take more at less risk.”, concludes Buchanan.

To download the full report please click here

Related News

- 02:00 am

Monobank, a cloud-based bank focused on consumer finance in the Nordics, showcased its new white label credit card app Mono Pay for Europe's finance and fintech industry in London.

More than 1,400 participants from over 300 of the largest financial institutions in Europe attend the Finovate conference. The companies that provide demos are hand-picked by Finovate, and only the most innovative solutions are presented, according to Finovate.

The fintech bank Monobank was on stage to showcase its new, innovative credit card and payment platform.

“We are very proud to have been selected by Finovate. Mono Pay is a white label credit card solution that we are now launching for partners across Europe. This is a unique opportunity to showcase Mono Pay to an audience of potential partners, banks, fintech companies and investors from all over Europe,” says Bent Gjendem, CEO of the Bank.

The Widerøe card is the first launch on this solution. Monobank has collaborated with Widerøe Flyveselskap, the largest regional airline in Norway, to launch a credit card specifically designed for Widerøe's customers.

Monobank is the only company from Norway to hold a demo this year, and the first Norwegian bank in Finovate's 12-year history.

In a demo, the companies are given seven minutes to show off their product. No PowerPoint presentation or video is allowed, only live demonstration of the product.

"Mono Pay has been referred to as a ‘game changer,’ and we are very pleased to have showcased the smart solutions our bank has made," says Gjendem.

Related News

- 01:00 am

This latest round brings Peltarion’s total funding to US$ 34 million to date, including previous investment from FAM, the holding company privately owned by the three largest Wallenberg foundations, and EQT Ventures.

Peltarion’s mission is to make AI technology useable and affordable for governments, not-profits and businesses alike. It believes that making AI operational will help to solve world problems - from food distribution to disease diagnostics - more quickly and at scale. The Peltarion Operational AI platform makes building and deploying AI products and services easier, faster and more affordable. Its API approach creates an enterprise-ready solution, lowering the bar of hard-to-find AI skills required to build AI products and services, while reducing the need for expensive infrastructure.

“AI is a technology that everyone should benefit from. Our mission is to make AI technology useable and affordable for all and this investment will help us to grow and scale in order to do more good in the world.” comments Luka Crnkovic-Friis, CEO and co-founder of Peltarion.

Peltarion has built strong momentum over the past twelve months, onboarding clients from a variety of different countries and focus areas - from the media industry through to finance and healthcare. Many of these solutions are already helping to make a difference in the world, particularly in relation to: cancer tumor segmentation, skin cancer detection, agriculture yield optimization, DNA prediction and energy.

In 2018, Peltarion founded the Swedish AI council, to establishing a continuous dialogue between Industry, Academia, Swedish Government and EU. The company has also built several technical and service partnership agreements with, including:

- Sopra Steria

- Bearingpoint

- Silo.AI

- Fourkind

- Neiron

- Avaus

Related News

- 02:00 am

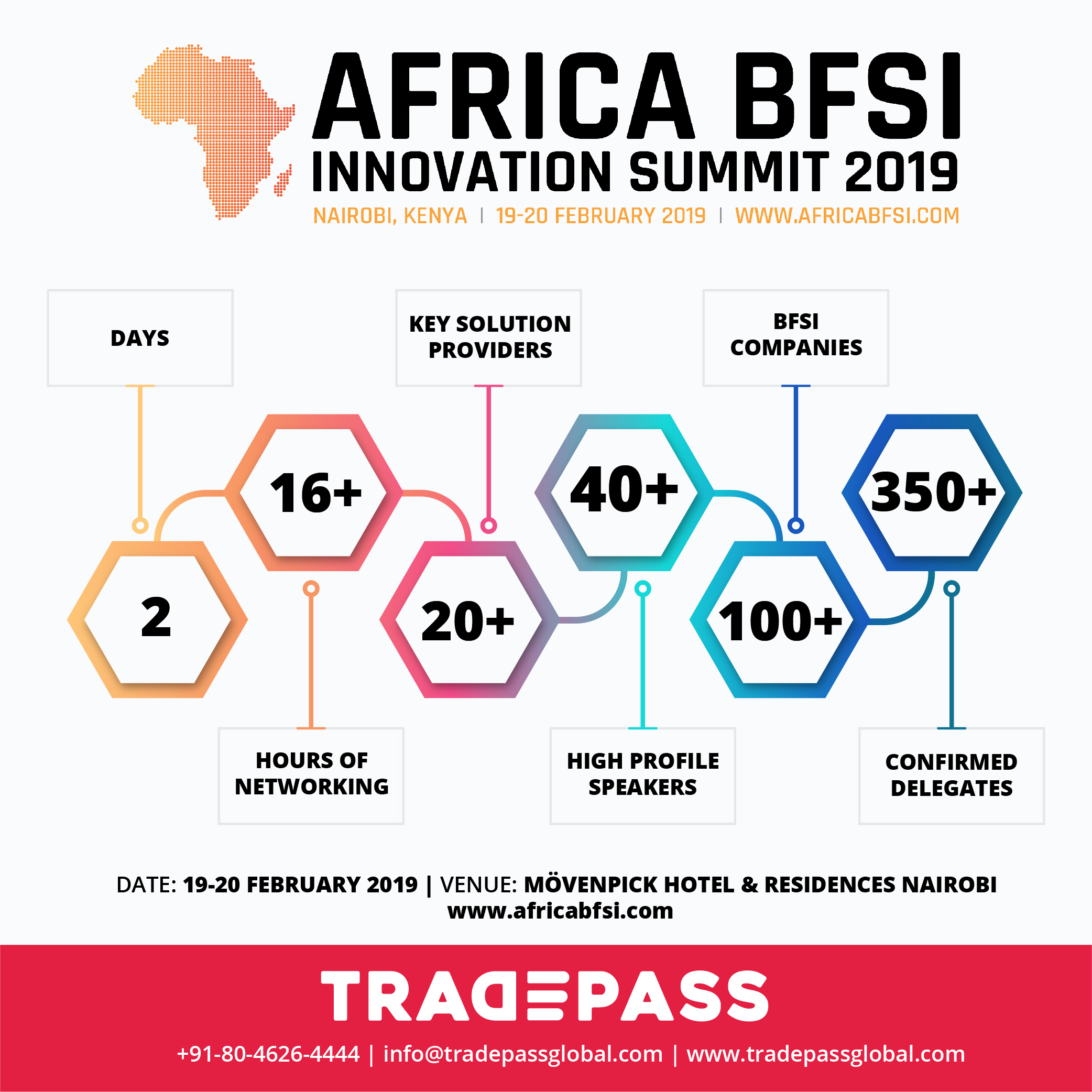

Over 300 BFSI industry professionals are scheduled to attend the Africa BFSI Innovation Summit 2019 on 19 - 20 February 2019 at the Mövenpick Hotel & Residences Nairobi, Kenya.

The two-day event will serve as a key meeting and networking platform for the top CIOs, CISOs, CTOs, Heads of IT, ICT, Risk, Compliance, Retail Banking, Customer Experience, Analytics etc. from Banks, Micro-Finance, Credit Unions & Insurance companies across East Africa.

“The event aligns with the needs of the BFSI industry and therefore relevant, resourceful persons will be available. The event is a platform to learn more about the specific digital transformation initiatives in the Banking and Insurance sectors”, said Stanley M. Chege, CIO, Madison Group Limited.

ABIS 2019 will bring together 20 innovative solution providers like Automation Anywhere, In2IT Technologies, Finastra, Openway, Seamfix, Craft Silicon, Arcon, Papersoft, Virmati, Smart Applications, Pio-Tech, Seacom, Intellect Design Area, Sybyl, Union Systems Global, Smartstream, NetGuardians, Forcepoint, Tagit and Atlancis to showcase the latest technologies and innovations for the BFSI sector. In addition to that, the terrific line-up of speakers includes experts like

• Eunice Kariuki, Director Partnerships, Innovation and Capacity Development, Kenya ICT Authority

· Steve Njenga, CIO, Barclays Bank

• Lawrence Mwai, Head, ICT Changes, National Bank of Kenya

• Michael Michie, CISO, M Oriental Bank

• George Njuguna, CIO, HFC Limited

• Thomas Gachie, COO, Resolution Insurance

• Dr. Tom Kahigu, Head IT, DIB Bank Kenya

• Judith Bogonko, Group Head of Customer Experience, APA Apollo Group

• Linda Were, Head of Customer Experience, Sanlam Insurance

• Aaron Niyonzima, CIO, AB Bank Rwanda

• Herbert Olowo, CIO, Stanbic Bank Uganda

• Bamidele Olalekan Oseni, Group Chief Risk Officer, I&M Bank Ltd

• Russell Akuom, Head of Digital Banking Experience, Cooperative Bank of Kenya

• Stanley Mwangi Chege, CIO, Madison Group Limited

• Reuben Kimani, CEO, Century DT Microfinance Limited

For the complete list of speakers, visit https://africabfsi.com/speaker.html

More than 300 representatives from 100+ top organizations from East Africa including I&M Bank, Barclays Bank, National Bank of Kenya, Commercial Bank of Africa, Kenya ICT Authority, Capital Markets Authority, Kenya Investment Authority, East Africa Chamber of Commerce, Standard Chartered, Ecobank, Equity Bank, KCB Group, Occidental Insurance, CIC Insurance, Heritage Insurance, SMEP Microfinance, Century Microfinance, Rafiki Microfinance, Musoni Microfinance and many more have confirmed their participation for the Summit. The event will bring face-to-face the top industry professionals in the country and the most innovative solution providers in the market to analyze solutions for a better and safer BFSI sector in Africa.

More information on the Africa BFSI Innovation Summit 2019 is now available at www.africabfsi.com. To get updates about the Summit, follow/subscribe to #ABIS2019 on social media.

Related News

- 07:00 am

More than 1200 well-known banking technology brands from 25 different countries will participate in the ATMIA Conference and Exhibition in Orlando (Florida, USA), which will be held on February 19-21. One of the most important events of this year has a global perspective and gives a great opportunity to share experience and knowledge forindustry representatives. Among the participants is the banking technology company BS/2, which will display the own developed solutions for face recognition and security ATMeye.iQ.

“The US market is interesting for us because of its competitive environment and great opportunities for business. We are not newcomers here. During our large-scale project, about 10,000 ATMeye.iQ licenses were sold to a major banking service provider in North America. I hope that participation in this event will be a real opportunity for us to unlock the potential and to lay the foundation for long-term and reliable partnerships in the future,” said Tomas Augucevičius, Deputy General Director of BS/2.

According to him, the company will display innovative face recognition (FRN.iQ), cash flow optimization (Cash Management.iQ) and security (ATMeye.iQ) solutions, as well as various banking hardware from the Diebold Nixdorf. Integrated hardware and software ATMeye.iQ solution, developed by BS/2, provides extra safety and security for self-service devices. It is recognized worldwide and secures 75 thousand self-service devices in different countries.

The company expects special interest of the banks representatives to the biometric identification solution FRN.iQ. A decade ago, face recognition was the subject of scientific research, but now it is a real technology, the newest trend covering the whole world.

“Not only exhibition, as an opportunity to showcase our solutions, is very important for us, but also the dialogue, that will allow us to compare our visions and expert forecasts. Today the business core is not the product, but the client. The customer experience is one of the hottest topics in most industries, therefore, the focus of this conference is particularly relevant,” said Tomas Augucevičius.

The 20th Anniversary ATMIA Conference “ATMs and Apps: the New World of Customer Experience” will host a series of workshops and seminars. Sessions and breakouts will cover cutting edge topics that are influencing the industry today. First, the experts will discuss the protection of ATMs from criminal attacks. Card fraud, cybercrime and physical attacks continue to undermine the security of the ATM channel, which leads not only to financial, but also reputational losses.

Another relevant topic is the exploring the benefits and opportunities for cardless ATMs. Thousands of ATMs in the U.S. are already taking advantage of this consumer-friendly technology of future. Today cardless ATMs have a big impact on the banking industry in Europe as well.

Special attention is given to the workshop on ITM/ATM servicing perspectives. According to organizers, discussions will focus on customer transactions experience, impact on ATM services for ITMs/ATMs, and mitigating the risk to the property, employees and customers.

Related News

Gerald Beuchelt

CISO at LogMeIn

Cyber-attacks are increasing at an alarming rate, and in 2018 we’ve witnessed breaches hit several trusted brands across various industries, including British Airways, Ticketmast see more

- 03:00 am

Spunta Project, a blockchain-based application for interbank reconciliations, has passed several tests and moves onto the pre-production phase. As of today, 18 banks, representing 78% of the Italian banking sector in terms of number of employees, are actively involved in the testing, selection and implementation of the new distributed technology.

The project, coordinated by ABI Lab, the banking research and innovation center promoted by the Italian Banking Association (ABI), together with technical partners NTT Data, Sia, and R3's Corda platform, aims to implement the blockchain in interbank processes. The objective is to provide data transparency and visibility, faster transaction execution and the possibility of performing checks and exchanges directly within the application.

Initial tests on the Distributed Ledger Technology (DLT) platform and on the transaction management have been carried out with the involvement of the banks. Some developmental updates are in the pipeline and will include the management of infra-group reconciliations, the creation of reliable reports for auditors, and the further refinement of the matching algorithm. The next steps will include technical testing of the platform's stability to verify its overall performance simulating the production phase for the entire Italian banking sector. To do this, a data simulator will generate transaction volumes over a period of 365 days. The simulation will be carried out in a geographically distributed environment and connected through a private network. In the meantime, additional function updates are being implemented thanks to the ongoing dialogue with the reconciliation experts of the pilot banks.

Interbank reconciliation

The scope of this project is interbank reconciliation, which verifies the correspondence of the activities of two different banks, e.g. transactions between two clients of two banks.

Why Spunta

Several reasons contributed to choose the Italian interbank reconciliation process as field of action. First, the reconciliation is an interbank process based on bilateral registers, has a low impact on the overall business, a low level of standardisation, and lacks advanced operating processes. Finally, the Italian Banking Association is the body that defines the operating procedures to be applied in the reconciliation process. The mutual accounts regulation is based on an interbank agreement created in 1978, revised in 1987 and further amended in the 90’s.

The benefits

The main benefits recognised by reconciliation experts include: the automatic check of mismatched transactions based on a shared algorithm; the standardisation of the process and of a single communications protocol; the visibility of transactions between the parties. The process involves the reconciliation of flows and transactions and the management of pending transactions. The activities relate to interbank dialogue.

Blockchain – Distributed Ledger Technology

With the blockchain, data is not stored on a single computer but is distributed over several nodes, i.e., on several machines that are interconnected. In this way, a vast database can be distributed, and transaction management is shared between several nodes on a network. Without having to rely on a single centralised entity, this new concept of distributed databases, Distributed Ledger Technology (DLT), changes the way we think and design the relationships and the exchange of value between the participants. The application of DLT technology can improve certain specific aspects of the current operations that can lead to discrepancies difficult to manage for the banks. Smart Contracts are another innovation in this area: a software programme that incorporates the rules of execution of an agreement to control the transfer of data and information. It uses a permissioned-type blockchain which is only open to banks participating in the experiment. It does this on a dedicated network like Sia and not on the open web.

Banks are paying close attention to this experiment. There is also interest from banks in other countries.

Spunta Project, energy efficient - data privacy

The use of a permissioned DLT helps to avoid the drawbacks sometimes associated with the blockchain. In the permissioned world there is no mining, the typical activity of crypto-currencies, intended to validate transactions at nodes. Therefore, high energy consumption is not expected. Data privacy is also assured. The exchange of information in the Spunta project occurs through private bilateral channels.

Related News

- 06:00 am

CQG, a leading global provider of high-performance solutions for trading, market data, technical analysis, and risk and account management, announced today a new partnership with JB Prime, an Australian financial services company offering access to securities and derivatives for wholesale and retail customers. Through the newly formed partnership, customers of JB Prime gain access to CQG’s multi-asset offering, including global equities, contracts for difference (CFDs), Foreign Exchange (FX), Commodities, and more, all on one platform.

With offices in Brisbane, Sydney and Melbourne, JB Prime offers full-service brokerage, managed discretionary accounts and self-directed trading opportunities across asset classes to institutional and individual clients across Australia, the UK, and Asia.

CQG’s Managing Director of APAC Leighton Andrew said: “It’s an important milestone for CQG to deliver a high-end, multi-asset offering, providing a seamless experience for global customers trading a diverse portfolio from a single account. The partnership with JB Prime gives customers new and broader trading opportunities.”

JB Prime CEO Daren Markisic said: “A professional multi-asset platform is what the marketplace has been demanding for over a decade. CQG offers, in addition to a robust front-end platform, market analysis and news, charting and order management across the futures and options space, on a global basis. Now, together with the technology developed by JB Prime, traders have access to trade Futures, Options, FX, CFDs and Equities globally, and all from the one account. That technology offering – coupled together with our 24-hour full-service operation which offers training and support, research and reports, as well as professional order management – places JB Prime as a premier broker to fill the needs of all traders across various asset classes.”

Related News

- 04:00 am

CloudMargin, creator of the world’s first and only collateral and margin management solution native to the cloud, announced today that PPM America, Inc. (PPM), a subsidiary of UK-based Prudential plc, has just gone live on its platform. The investment manager with $119.16 billion in assets as of Jan. 31, 2019 – including $9.31 billion managed by PPM Finance Inc., an affiliate that manages commercial mortgage loans and certain real estate investments – is now using CloudMargin for its entire collateral management margin workflow, collateral optimization and trade reconciliation with counterparties and futures commission merchants (FCMs).

CloudMargin CEO Steve Husk said: “We’ve been able to provide PPM with a one-stop solution for all things collateral, from calculating margin to meet Variation and Initial Margin requirements, to reconciling trade-level positions, to enabling the firm to automate its collateral processes, including sending payment instructions directly via SWIFT to its various custodians.”

The collateral workflows have been streamlined at PPM with the implementation of CloudMargin. With the tool, PPM is able to quickly onboard new counterparty relationships and add new accounts to existing relationships in short order. PPM noted the implementation and support staff have been great partners in helping achieve their goals.

Before selecting CloudMargin, Chicago-based PPM had engaged in a comprehensive search for an enterprise collateral management solution that would meet its stringent requirements for workflow, optimization and reconciliation for the wide range of instruments in its portfolio. The agreements and types of transactions the workflow accommodates include:

- ISDA collateral service agreements for bilateral over-the-counter (OTC) derivatives

- Cleared OTC transactions

- Exchange-traded futures and options

- Master Securities Forward Transaction Agreements (MSFTAs) for mortgage-backed securities and TBA (To-Be-Announced) mortgage-backed instruments

CloudMargin has established a global collateral hub, enabling clients to connect to a wide range of additional critical providers of related services across the collateral lifecycle. In addition to utilizing the gateway to SWIFT, PPM is also using the hub’s access to AcadiaSoft MarginSphere for margin call messaging, providing streamlined collateral payment processing.