Published

- 02:00 am

Sponsorship and delegate registrations are open for IFINTEC Finance Technologies Conference and Exhibition that will be held on 09 - 10 April 2019 in Istanbul, Turkey. IFINTEC is a global conference which is one of the biggest and most important conferences in EMEA region with its focus on Retail Banking, Digital Banking, Core Banking, Payment Systems, Banking Technologies, Banking IT Solutions, Digital Transformation and Finance Technologies. With 900+ attendees, attendance from 15+ countries, 30+ speakers, 30+ speaking sessions, IFINTEC 2018 Conference was organized very successfully. An intensive participation is expected to the IFINTEC 2019 Conference from Turkey and many other countries.

The conference speeches will be either Turkish or English and simultaneous translation to Turkish or English will be available. There will be an exhibition area at where the sponsors will demonstrate their solutions to the visitors.

Retail Banking, Digital Banking, Core Banking, Payment Systems, Banking Technologies, Banking IT Solutions, Digital Transformation, Finance Technologies, Universal Banking, Lending Solutions, Secure Banking, Authentication Technologies for Banking, Branchless Banking, Mobile Banking, Internet Banking, Next Generation Banking, Artificial Intelligence Technologies for Banking, Mobile Payments, Branch Automation and Transformation, Business Process Outsourcing, Banking IT Services, Banking IT Infrastructure, IT Transformation, Risk Management, Credit Risk Management and Debt Management are key topics of the conference.

For more information about IFINTEC 2019 Conference, please visit event website www.ifintec.com or contact: info@ifintec.com

Related News

- 01:00 am

CoinField, Canada's most advanced Bitcoin and cryptocurrency exchange, has launched new offering for a global market: a complete system to start and run a digital asset exchange.

CoinField will offer its own platform model to other businesses globally, as an all-in-one White Label Licensing Package that is an exclusive blend of proprietary software, technical expertise, and project management skills, allowing new global partners to launch their own cryptocurrency exchanges within 90 days of initial setup. CoinField will present its solution on major global Blockchain conferences this year:

- Token 2049, March 13-14, Hong Kong

- Future Blockchain Summit April 2-3 Dubai, UAE

- Consensus 2019, May 13-15 New York, US

Marijana Prpic, VP of Business Development and Marketing says: "There are many White Label solutions offerings at the moment that seem to be more affordable or faster to implement. Our offer is for companies who are looking to build a sustainable cryptocurrency exchange business; they will want to use the best software solution with all business process elements included and built by experts who created our platform. The software is managed and fully hosted by us, so you can focus on building your business."

"Built by more than 19,000 man-hours of research, our Enterprise Matching Engine can process up to 75,000 orders per second and up to 1.5 million orders through its API. Cutting-edge Security and Advanced API will give creative freedom to each partner to build the perfect platform for their specific needs," says Reza Bashash, CoinField's CTO.

The solution offers a possibility of high-level UI/UX customization, mobile APP and access to CoinField's large liquidity pool at its own cryptocurrency exchange. Each new order book will also be connected to CoinField so that its cryptocurrency exchange is fully populated from Day One. Digital assets can be removed or added at any time.

In addition to the digital assets, the package will also enable access to CoinField's compliance, and finance teams to provide assistance for setting up worldwide bank accounts, 24/7 technical customer support, and AML/KYC solutions.

Related News

- 09:00 am

Eurofins Digital Testing, a global leader in end-to-end quality assurance (QA) and testing services, today announced that its Cyber Security division has launched a new General Data Protection Regulation (GDPR) testing service to assess data protection capabilities, and ensure CE devices and their associated businesses and processes are conforming to the GDPR.

GDPR is the legal framework for personal data protection and privacy for all individuals within the European Union, and applies to any company involved with the movement, processing or storage of personal data related to EU citizens, regardless where the company is located. Eurofins' GDPR testing service runs test data assessments to help worldwide companies meet the new security and privacy requirements, avoid substantial fines and penalties that can be imposed for non-compliance, and build consumer trust.

"With GDPR now in place, it is critical that companies adhere to the stringent data protection framework by running checks with test data to confirm compliancy," said Johan Craeybeckx, Business Line Director, Eurofins Digital Testing International. "Eurofins is proud to offer this new program to help our customers test their overall level and/or device readiness to comply with the GDPR to ensure protection and privacy for how consumers' personal data is used and managed."

GDPR and Cyber Security

Eurofins' GDPR conformance testing program helps companies safeguard and strengthen the rights of data subjects, and better enable them to take control of data in an increasingly digital society. Eurofins Digital Testing's Cyber Security division performs the comprehensive and wide-ranging GDPR conformance assessments that can be fully customised for individual requirements. The core elements tested include:

- Testing the communication to and from devices;

- Testing the vulnerability of products;

- Conformance to country-specific security requirements; and

- Analysis of product firmware to see whether it is possible to extract sensitive data.

Beyond the core testing areas, Eurofins also offers additional services, including:

- Remote host assessments and penetration testing;

- Local host assessments;

- Mobile app testing (iOS and Android);

- Code review, with a focus on embedded software;

- Checks according to Application Security Verification Standard and/or OWASP Top 10; and

- Hardware and embedded system testing from documentation review to coding errors and security loopholes.

Eurofins' also provides wide-range cyber security testing services beyond the GDPR domain. The Cyber Security Division of Eurofins Digital Testing serves the media and entertainment industry, and clients across the profit and non-profit sector, including: financial, utilities, healthcare, transportation, and others.

Eurofins Digital Testing helps companies worldwide reduce development, testing and deployment cycles to accelerate service delivery, and support a more continuous delivery environment. Through its suite of automated test tools, professional testing support services, staffing of onsite personnel, and training, Eurofins helps increase test coverage and consistency to provide service validation, insights into the end-user experience, and performance monitoring for quality assurance.

Related News

- 06:00 am

Wirecard, the global innovation leader for digital financial technology, and Tirol Werbung, the tourism organization of the Austrian state of Tyrol, are launching a new China Pay Initiative together with partners Innsbruck Tourism, Kitzbühel Tourism, the Kufsteinerland Tourism Association, Ötztal Tourism, the St. Anton Tourism Association and the Swarovski Kristallwelten. The initiative will enable a state-wide coverage of Wirecard's mobile payment solution, integrating the most popular Chinese mobile payment methods into numerous Tyrolean companies. Initially, 150 businesses in the region will be equipped with the solution.

According to a Nielsen study, around 91 percent of Chinese tourists would be willing to spend and buy more abroad if more merchants accepted Chinese mobile payment methods. With this initiative, Wirecard and Tirol Werbung are therefore addressing the preferences of this target group. The state of Tyrol wants to offer Alipay, among others, as a payment option in as many businesses as possible. Wirecard is responsible for the entire payment integration and processing operations.

A 2018 report found that total spending by Chinese tourists in Austria had increased by 28 percent over the previous year, making China the top spending country for tax-free purchases in the Alpine nation among non-European countries. With a share of 30 percent of all tax-free sales in Austria, China clearly ranks first, ahead of Russia (10 percent) and Switzerland (8 percent). While the average non-European tourist spent 508 euros, visitors from China spent an average of 616 euros per purchase.

Holger Gassler, Market Manager of Tirol Werbung, said, "We expect to gain a competitive advantage as the first Austrian province to introduce Chinese mobile payment methods on a large scale. Payment convenience plays a major role for this target group in particular and can make both the region and participating merchants more attractive to Chinese tourists. The introduction of Wirecard's digital payment platform is also one of the first projects within the scope of Tyrol's digitization campaign."

Roland Toch, Managing Director CEE at Wirecard, added, "Experience shows that accepting Alipay as a new payment method can lead to an increase in transaction volume with travelers from China of more than 350 percent within one year. We are proud to partner with Tirol Werbung to offer our digital payment solution to hundreds of companies and to continue the digitization of their payment processes. We look forward to expanding our partnership with Tyrol and other European regions in the future."

Related News

- 02:00 am

The Global Cyber Alliance (GCA) and Mastercard today released a new Cybersecurity Toolkit specifically designed for small and medium businesses. This free online resource is available worldwide and offers actionable guidance and tools with clear directions to combat the increasing volume of cyberattacks.

Some estimates indicate that 58 percent of cyberattacks are targeted against small businesses. These attacks include phishing, malware and ransomware – all of which can have devastating financial consequences. According to the Organisation for Economic Co-operation and Development (OECD):

- Small businesses account for 99 percent of businesses globally, including businesses in the US, EU, and the UK.

- Small businesses account for 70 percent of jobs, on average.

- Small businesses generate more than half of the value added by most economies.

Resourcing small businesses with tools to protect themselves from ever-evolving cyber risks not only strengthens their individual businesses but also supports the health of the entire commercial ecosystem, including governments and larger companies. Helping these small businesses be more secure by taking a few reasonable steps will significantly reduce risk for both the small business and its partners, no matter their size or resources.

The GCA Cybersecurity Toolkit arms small business owners with basic security controls and guidance, including:

- Operational tools that help them take inventory of their cyber-related assets, create and maintain strong passwords, use multi-factor authentication, perform backups of critical data, prevent phishing and viruses, and more

- How-to materials, such as template policies and forms, training videos, and other foundational documents they can customize for their organizations

- Recognized best practices from leading organizations in the industry including the Center for Internet Security Controls, the UK’s National Cyber Security Centre Cyber Essentials, the Australian Cyber Security Centre’s Essential Eight, and Mastercard

“What sets the Global Cyber Alliance Cybersecurity Toolkit apart is that it is an action kit,” said Philip Reitinger, president and CEO of Global Cyber Alliance. “Our focus is on producing a dynamic clearinghouse of operational tools that help small and medium businesses address risk and improve their cybersecurity posture, leveraging the deep expertise of our network of global partners, such as Mastercard, and the experiences of actual GCA toolkit users.”

As a Development Sponsor, Mastercard has shaped the priorities and early success of the GCA Cybersecurity Toolkit, helping to make it accessible to millions around the globe.

“Safety and security are core to our brand,” says Ron Green, chief security officer, Mastercard. “Every day, we are committed to developing new and better ways to keep payments safe – especially for small businesses, the lifeblood of any economy. By partnering with the Global Cyber Alliance, we’re helping entrepreneurs and business owners to better protect themselves. In that way, they can stay focused on what they do best: running and growing their business.”

The Global Cyber Alliance has partnered with several additional organizations to create the GCA Cybersecurity Toolkit, including the Center for Internet Security, the Cyber Readiness Institute, the City of London and the City of New York. The toolkit will also be regularly updated with input from users, industry experts, and public and private partners across the globe.

“I applaud the deployment of a cyber toolkit for small and medium businesses. This support is of critical importance to help smaller organizations effectively deal with increasingly complex and more frequent cyber threats,” said John Gilligan, president and CEO of the Center for Internet Security.

City of London Police Commissioner Ian Dyson said, “As the national lead force for fraud and a founding member of the Global Cyber Alliance, we are always pleased to see new initiatives that will assist businesses in improving their cyber security. Businesses lost £6.7 million as a result of social media and email accounts being compromised between April and September 2018. It’s therefore essential that we, as a force, continue to work closely with businesses as well as the organisations that serve to protect them.”

“When we launched the Global Cyber Alliance we set out to empower organizations of all sizes with the tools they need to prevent cybercrime. The Global Cyber Alliance’s free Cybersecurity Toolkit provides small- and medium-sized businesses with immediate, concrete steps to protect their companies and customers against crippling cyberattacks, and I thank each of the public and private partners who contributed their world-class expertise,” said Cyrus Vance, Jr., Manhattan District Attorney.

“NYCEDC is proud to partner with the Global Cyber Alliance on the Cybersecurity Toolkit to better educate small businesses about the risks of cyberattacks. Small businesses play a critical role in New York City’s economy and represent an underserved customer base for cyber education and technologies,” said Nicholas Lalla, project lead for Cyber NYC, at the New York City Economic Development Corporation (NYCEDC).

Cyber NYC is a $100 million public-private investment to build a vibrant and inclusive cybersecurity ecosystem. On November 1, 2018, the NYCEDC launched their Cybersecurity Moonshot Challenge, asking the industry to develop and deliver affordable and scalable cybersecurity solutions for small businesses. As part of their partnership with the Global Cyber Alliance, finalists will be considered for inclusion in the GCA Cybersecurity Toolkit. New York City will promote the free toolkit to New York City businesses through NYC Secure.

Managing Director of the Cyber Readiness Institute Kiersten Todt said, “The Cyber Readiness Institute is so pleased to support and collaborate with the Global Cyber Alliance on helping small businesses reduce their cyber risk. Our approaches are complementary, and our partnership highlights the importance of integrating the multiple cybersecurity efforts that exist to ensure efficiency and effectiveness for small businesses. I look forward to what our organizations will achieve together.”

The Global Cyber Alliance will expand the Cybersecurity Toolkit to help other sectors address the changing cyber threat landscape. Additional launches are planned this year with support from the District Attorney of New York, Craig Newmark Philanthropies, Corporation of London, Center for Internet Security and others.

Related News

Peter Shackleton

VP of Commercial at Upgrade Pack

Banking and customer retention in 2019 – why trust is no longer enough. see more

- 03:00 am

trueDigital Holdings, LLC, a global provider of financial infrastructure technologies and products for the digital economy, announced today it has appointed former Bridgewater Associates executive Thomas Kim as its Chief Executive Officer and a Member of its Board of Directors.

Kim brings an extensive track record of trading technology leadership at multiple major financial institutions and software providers to his role at trueDigital. He joins the company following seven years with Bridgewater Associates, where he most recently served as Chief Operating Officer of the Investment Engine Group. Earlier in his career he held positions as Managing Director at Lehman Brothers, responsible for the Townsend Analytics Electronic Trading franchise, and held executive-level roles at UNX and TradingScreen.

On the heels of trueDigital’s launch of Signature Bank’s blockchain-based digital payments platform – the first project of its kind to be approved by the New York State Department of Financial Services – Kim will be tasked with further expanding the company’s footprint across traditional financial institutions. Kim’s strategic initiatives will include growing the list of banking and custody partners for trueDigital’s payment, transfer and settlement platform, and the rollout of new institutional-grade digital asset derivatives.

“Thomas brings the expertise and the boldness to carry forward our vision of bringing blockchain-based financial technologies to life,” said Sunil Hirani, trueDigital’s Founder and Member of the Board of Directors. “His accomplishments at some of the world’s most technologically-driven and demanding institutions speak to his ability to think creatively and lead effectively. This will be instrumental as we double down on our ambitions to innovate, grow and scale.”

“With the recent successes at Signature Bank and with its CFTC-approved Bitcoin swaps, trueDigital is quickly building a reputation as a leader in the convergence of digital and traditional finance,” said Thomas Kim, CEO, trueDigital. “Transforming financial market infrastructure is an ambitious goal, yet the progress to date shows the potential of trueDigital’s technologies to modernize markets and bring digital assets forward. The team, the thinking and the technology at trueDigital are all attuned for significant growth, and I look forward to leading the way.”

Kim will take oversight of trueDigital’s existing business development initiatives, namely the upcoming launch of Bitcoin swaps trading in 2019. Following the CFTC’s approval of its physically deliverable Bitcoin swap – the first of its kind – in 2018, trueDigital has been steadily building institutional support for the product, successfully attracting multiple institutions to connect to its soon-to-open marketplace. trueDigital also recently hit a milestone with its Signature Bank partnership, with the real-time, token-based payment platform attracting a significant number of institutions within the first 30 days of operation.

"I very much look forward to working with Thomas Kim in his new role as CEO of trueDigital and believe that his depth of experience will help further this platform's vision of increasing efficiency, confidence, and transparency for institutional investors in the digital assets space. With Signet, trueDigital has staked out new fertile ground in the cryptospace and we look to Thomas to continue to drive that innovative spirit. Since ConsenSys established a partnership with trueDigital in March of 2018, we've seen increasing institutional investor interest in ether and other digital assets and look forward to continuing to develop the infrastructure necessary for broad adoption," said Joseph Lubin, Founder of ConsenSys.

Related News

- 01:00 am

Cloud-based data and API integration platform SPINR today announces its official launch as a catalyst for smaller fintechs, particularly startups and SMEs, to realise their full potential by unlocking the value in their data.

SPINR enables any organisation to control and maximise its data using a single, straightforward platform through which data can be brought together from any number of sources, so it can be viewed, transformed and shared across departments and between companies.

This democratisation of data through APIs also means that anyone within an organisation, regardless of technical ability, will be able to use data that was previously siloed or unattainable.

This makes the process of integrating, cleansing and sharing data simple, efficient and accessible to all, especially for SMEs and smaller businesses where this level of data management capability is often out of reach, due to its complexity and expense. Therefore, this new ability to maximise data affordably, could revolutionise the potential of hundreds of smaller-scale fintechs.

Although SPINR is a new venture, the development of the platform has been years in the making, and was formed out of cloud and digital transformation specialists Shaping Cloud. Following the launch of SPINR as a separate business, both companies will now sit within the newly formed Shaping Cloud Group.

Leading the charge at SPINR is its senior team, Carlos Oliveira, Tom Carter and Martino Corbelli, who have been appointed as CEO, CTO and Chief Product Officer respectively.

Carlos Oliveira is the founder of both Shaping Cloud and SPINR and Tom Carter joins him in becoming CTO of both companies. New to the Shaping Cloud Group, Martino Corbelli has been appointed as Chief Product Officer of SPINR, heading up their go-to-market strategy, using a broad knowledge of growth marketing honed at some of the UK’s most successful tech companies.

CEO and founder Carlos Oliveira said: “Our mission is to put the power of enterprise integration into the hands of every ambitious organisation. We believe in the power of data to drive the future innovations that will improve people’s lives. For any organisation to innovate, it must first set critical data free from application and departmental silos, that often keep it locked down and obstruct business agility.

“Building the next generation of digital platforms that will delight consumers, will only be possible through data services working in real-time, combined with the efficient creation, management and distribution of APIs. This drives better collaboration, so new products and services can be launched faster than ever and new customers onboarded in a fraction of the time.”

Related News

- 03:00 am

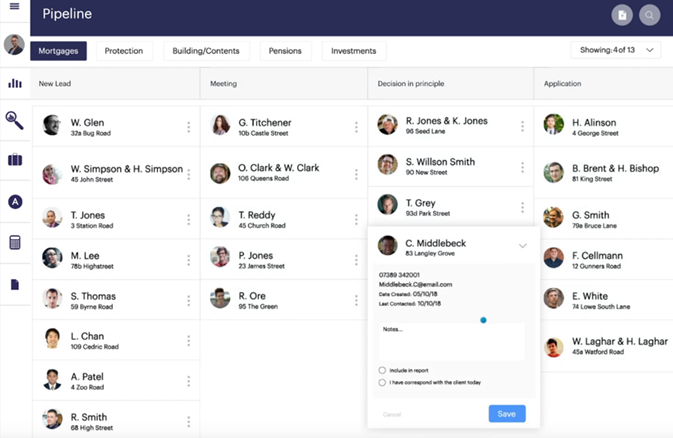

Smartr365, the end-to-end fintech mortgage platform, has today launched a new MortgageKanban feature. Developed after months of research and discussion with mortgage brokers, the MortgageKanban embodies Smartr365’s commitment to producing one of the fastest and most efficient ways of processing a mortgage application.

MortgageKanban is a scheduling and workflow management tool for brokers to manage mortgage applications from start to finish in a visual way. The new feature helps brokers to streamline their workflow and manage client cases all in one place.

Originally used in ‘lean’ manufacturing, Kanban is Japanese for ‘visual signal’ or ‘card’. Smartr365’s MortgageKanban breaks down the mortgage application process into a series of visual steps, represented by ‘cards’. The worktool gives a clear overview of all client cases, displayed by appropriate status or ‘swim lanes’. New leads, client meetings, DIPs, mortgage completions and payment of procuration fees are all displayed as cards within the system. Cards move from left to right across the board once each step is completed.

The MortgageKanban also has a filter option to allow brokers to focus on a specific part of the process. As each case progresses, MortgageKanban triggers certain automations, depending where the case is at in the process. For example, automated email notifications, client review meetings or generating re-mortgage opportunities to free up time for brokers to focus on advice.

Related News

- 03:00 am

Baker Hill, a leading provider of technology solutions for common loan origination, risk and relationship management, CECL compliance, and smart data analytics, was selected by TechPoint, the nonprofit, industry-led growth initiative for Indiana’s technology ecosystem, as a nominee for its 20th annual Mira Awards presented by Angie’s List and Salesforce.

Recognizing highly innovative and ground-breaking technology products, Baker Hill has been nominated for “New Tech Product of the Year” for its 2018 launch of its flagship product, Baker Hill NextGen®. With the most comprehensive combination of loan origination and risk management functionality in a single platform, Baker Hill NextGen® empowers financial institutions to work smarter and drive more profitable relationships.

“Today, most financial institutions use multiple, disjointed systems for loan origination and portfolio management, limiting their ability to compete effectively with the largest institutions,” said Niles Bay, CTO and COO of Baker Hill. “Banks and credit unions face more competitors today than ever before, contending with alternative lenders like Kabbage and OnDeck for market share. There is a need to supercharge profitability while shrinking risk and loss; however, most solutions today focus on one or the other, often forcing financial institutions to make tough choices about where to focus their investments and resources.”

As a direct response to this industry-wide challenge, Baker Hill built a system that addresses both loan origination (from online loan applications to complete lending process management) and portfolio risk management, making it possible for its clients to aggressively compete while driving profitability. Leveraging its three decades of feature-rich solutions, Baker Hill completely rebuilt its legacy products, transforming them into the onlyplatform of its kind with a modern, roles-based user interface that works across all devices.

Bay added, “While a product facelift may have delighted most of our clients, we leveraged our deep industry knowledge to truly innovate our multiple legacy systems, reimagining how they could come together in a single platform to meet the growing needs of the market and the increasing demands of customers for anytime, anywhere loan origination capabilities. Baker Hill completely redesigned its platform through a collaborative approach, conducting extensive studies and round-the-clock coding to create the most innovative system in lending history – Baker Hill NextGen®.”

Baker Hill NextGen® is committed to helping institutions stay ahead of regulatory changes. Most recently, the company dedicated significant resources to help banks and credit unions turn the upcoming Current Expected Credit Loss (CECL) requirements into a strategic advantage. This new standard has been referred to by bank regulators as “the biggest change ever to bank accounting” and is expected to have a massive impact on the financial industry. Not only will CECL change the way financial institutions conduct business – not just in lending, but across all departments – but it will also impact how institutions manage their capital.

“Since opening our doors nearly 35 years ago, Baker Hill continues to be one of the industry’s leading financial technology providers while creating local jobs and putting Indianapolis on the map as one of U.S.’s rising tech hubs,” said John M. Deignan, President and CEO of Baker Hill. “Today, Baker Hill and Baker Hill NextGen® have experienced unparalleled success. We’re thrilled to be recognized for our efforts and named a nominee for a Mira ‘New Tech Product of the Year’ award.”

“There is little doubt that tech will continue to be an area of significant growth for Indiana, as we see local tech companies growing, out-of-state companies opening offices here and large enterprises from other industries becoming increasingly tech enabled,” said Mike Langellier, CEO of TechPoint. “This is a special year, as we celebrate the 20th anniversary of the Mira Awards, and we look forward to recognizing the people, companies and places that are Indiana’s current and future success stories.”

Winners will be announced at a black-tie awards ceremony and gala on Saturday, April 13th at the JW Marriott — Indianapolis. The Mira Awards gala—the biggest tech awards event in the state—celebrates the people, products, companies and places chosen as “The Best of Tech in Indiana.”