Published

- 05:00 am

CoinEx is about to build a public chain CoinEx Chain for decentralized trading. The website was launched on March 22 and a CoinEx Chain-based decentralized trading platform CoinEx DEX will be online expected in Q4 this year.

In last August, CoinEx stood out among many exchanges with the launch of "Trade-driven Mining" (aka. Trans-fee mining), shortly surpassing Binance and BitMex, and became the world's largest trading exchange in terms of 24-hour volume; 6 months after the successful debut, the announcement of CoinEx Chain and DEX has once again triggered the discussion, unveiling CoinEx's ambition in the global market.

Last weekend, in a 90-minute live ask-me-anything (AMA) chat on Telegram, Haipo Yang, the founder of CoinEx, shared his vision of CoinEx Chain and CoinEx DEX:

"A brand new pattern of ecosystem, a new era of exchanges," Yang explained. "No more centralized drawbacks, users can control the private keys in their own hands, easily create a secured wallet, issue and manage their own tokens, and be freed of the fuss of prolonged listing procedures. Since all operations and account addresses are traceable and positions and transaction data are crystal clear, the only mission for the platform (CoinEx DEX) is to provide efficient and stable wallet and transaction services."

High performance, high transparency and low fees sum up CoinEx Chain according to its website (www.coinex.org). Aside from the basic features, three things caught users' eyes:

Users are in control of their own private keys

Supported by its strong R&D team, CoinEx exchange has been stably operating for over a year. CoinEx DEX too will continue with its proprietary high-speed matching engine to ensure secondly transaction confirmation and supported a processing capacity of up to 10,000 transactions per second. Comparably, only a few or dozens of transactions can be processed per second in BTC or ETH network.

CoinEx DEX empathized that it neither hosts or transfers user assets, nor saves users' private keys - and rather, it only provides efficient and stable wallet and transaction services.

Unlike most centralized exchange services where users have no access to their own private keys, CoinEx DEX allows traders to store assets in their own wallet throughout the transaction process, and they only need to verify signature with private key when placing or canceling an order. Trust becomes unnecessary here - users have unlimited access to and obtain ownership of their asset, even if the exchange is hacked.

Moreover, the POS consensus mechanism adopted ensures transaction confirmation within seconds; Placing/cancelling orders and trade matching are executed instantly and all user operations are recorded in sequence to rule out rollback possibilities.

Of course there will be downsides: Since CoinEx DEX neither hosts or transfers user assets, nor saves users' private keys, it can no longer assist users in retrieving their private keys. Though some diversity of functionality were sacrificed, CoinEx DEX will instead achieve higher performance.

Permissionless one-click token issuing

If the key points of CoinEx Chain are high performance and ease-of-use, the "Token Issuing" section is definitely the combination of both.

The token issuing module preinstalled in CoinEx Chain makes it more efficient and secure to issue your own tokens. Without any permission, users can issue tokens (Including but not limited to stablecoins) anytime, anywhere and create its trading pairs simultaneously, which frees users all the fuss of ICO, prolonged evaluation procedure of centralized exchange as well as high listing fees.

There are certain bars before issuing a token via the traditional smart contract. To start with, users need to know about the basics of coding, and depending on the smart contract in question, a set of steps must be followed to have the token ready to be issued. After this preparation, users still have to take into account an ICO, their project profile, and the listing procedure and fees by the targeted exchanges.

In a single click, users can easily issue and manage their own tokens after creating a secured wallet.

Completely open source code

As the open source of CoinEx, GitHub has already received popularity amongst developers, CoinEx Chain and DEX will also be open source for the community.

For the CoinEx R&D team, there is no boundary in the world of code and they would like to make contributions to make technology shared worldwide and various products available for users - That's how they help the blockchain industry move forward and become a better place.

CoinEx Chain - Born for financial liberalization

CoinEx Chain's a public chain built for the decentralized exchange and its vision is "Born for financial liberalization". Developed by a top R&D team of the industry, CoinEx Chain aims for high performance. The CoinEx team plans to support smart contracts with more diversified features via side chains and connect to mainstream public chains via cross chains in the future for a fully open and decentralized ecosystem and being a better public chain.

Presently, it is becoming increasingly difficult to differentiate an exchange from a public chain and the competition for exchange services has gradually evolved into a competition of ecosystems. CoinEx intends to stand out from the crowd in these changing times.

Related News

- 01:00 am

With the momentum that has lifted the banking sector's performance over the first half of the decade slowing in all major markets, banks must leverage digital technology to battle disruption and stem the threat of disintermediation brought on by fast-moving, newer entrants—or pay the price in staying power and profitability, according to a new report by Boston Consulting Group (BCG). The report, Global Risk 2019: Creating a More Digital, Resilient Bank, is being released today.

This ninth annual survey of the health and performance of the banking industry by BCG examines global and regional profitability levels and how institutions can raise them, explores ongoing regulatory trends and how banks can navigate them, and examines how core risk and treasury functions must adapt both their operating models and their roles in the wider banking organization to be more efficient and effective.

"As digitization opens the financial services ecosystem to new and niche players, we expect to see fewer full-stack banks," says Gerold Grasshoff, the global leader of BCG's risk management segment and a coauthor of the report. "As the banking value chain breaks up, banks will get the opportunity to reposition themselves. They will likely pursue a mix of strategies, such as becoming platform leaders, being specialist providers, and promoting infrastructure-as-a-service offerings. The cost basis will also change, and banks will need to be leaner and more efficient if they are to compete effectively against digitally mature peers and fintechs."

A Three-Speed World for Economic Profitability

According to the report, while banking remains profitable on an absolute basis, total economic profit (EP), which adjusts for risk and capital costs, softened again in 2017 (the last year for which year-end statistics are available). It was a second straight year of decline. Since reaching a global-average high of 16 basis points in 2015, EP has slumped, falling to just 8 basis points in 2017. With that slide, average banking performance is now on a par with that of 2013, when the banking industry started to regain its footing after the global recession.

In Europe, banks have remained mired in negative growth, hemmed in by low interest rates and nonperforming loans. By contrast, banks in North America have benefited from increasing interest rates, although rising costs edged total EP down for the second straight year. In Asia-Pacific, banks experienced the third consecutive year of declining EP. Overall, banking remains a three-speed world in which European banks continue to struggle, North American and Asia-Pacificbanks strive to stay the course, and the developing markets of South America and the Middle East and Africa continue to show high profitability. Yet systemic issues hound each region.

Setting the Regulatory Stage for the Future of Banking

The report says that, for regulators, instilling trust in the strength and resiliency of financial markets has become a dominant focus. Banks must improve the quality and efficiency of regulatory compliance to meet their ongoing financial-stability, prudent-operations, and resolution obligations. Achieving this will require finding leaner and smarter ways to manage the high volume of regulatory revisions, as well as experimenting with new technologies and partnerships to drive down the cost of know-your-customer documentation and to improve anti-money-laundering processes. Keen to protect financial markets from future shocks, regulators are trying to anticipate the ways that technology will reshape the banking ecosystem and, with it, their own role in establishing guidance and ensuring consistent standards. Moreover, since 2009, banks worldwide have paid $372 billion in penalties. Regulators assessed $27 billion in penalties on European and North American banks in 2018, an increase of $5 billion from the year before. Mortgage-related misconduct in the US, money laundering and interbank-offered-rate-related market manipulation across regions are among the factors sparking regulatory ire.

As Banks Digitize, So Must Risk and Treasury

The report says that banks' risk and treasury functions will change in profound ways over the coming years. Both functions face a broader mandate with a larger slate of risks to manage, a growing need for integrated steering to protect banks' interests, and an equally growing need to make the most strategic use of banks' balance sheet resources. Delivering on this mandate will require risk and treasury to operate faster and more incisively, backed by real-time data, predictive analytics, and end-to-end automation. Risk and treasury functions that commit to "going digital" in these ways will become not only more efficient operators but also more effective strategic partners in delivering value to banks.

Related News

- 05:00 am

A new study from the Capgemini Research Institute has found that just 10 percent of major automotive companies are implementing artificial intelligence1 (AI) projects at scale, with many falling short of an opportunity that could increase operating profit by up to 16 percent. The research also shows that fewer automotive companies are implementing AI than in 2017, despite the cost, quality and productivity advantages.

The "Accelerating Automotive's AI Transformation: How driving AI enterprise-wide can turbo-charge organizational value" study surveyed 500 executives from large automotive companies in eight countries, building on a comparable study from 2017, to establish recent trends in AI investment and deployment. The research highlighted the following potential reasons for the modest progress in relation to AI implementation:

- The roadblocks to technology transformation are still significant, such as legacy IT systems, accuracy and data concerns, and lack of skills.

- The hype and high expectations that initially came with AI may have turned into a more measured and pragmatic view as companies are confronted with the reality of implementation.

Key findings include:

Scaling of AI has seen a slow growth: Since 2017, the number of automotive companies that have successfully scaled AI implementation has increased only marginally (from seven percent to 10 percent). However, the increase in companies not using AI at all was more significant (from 26 percent to 39 percent). According to the report, just 26 percent of companies are now piloting AI projects (down from 41 percent in 2017). This is maybe due to companies finding it harder to realize a desired return on investment. The results also reveal a significant regional disparity, with 25 percent of U.S. firms delivering AI at scale, compared to nine percent in China.

Automotive organizations can drive significant reward from scaled AI: The modest progress in implementing AI projects at scale represents a major missed opportunity for the industry. Modelling in the report, based on one typical top 50 original equipment manufacturer (OEM), estimates that delivering AI at scale could achieve increases in operating profit ranging from five percent (or $232m) based on conservative estimates, to 16 percent (or $764m) in an optimistic scenario.

"With AI-empowered visual inspection we have sensibly reduced the ratio of false positives with respect to the previous systems," said Demetrio Aiello, head of the AI & Robotics Labs at Continental. "I am very confident that if we can deploy AI to its fullest potential it would have an impact on performance equivalent to almost doubling our capacity today."

AI is seen more as a job-creator than a job-replacer: The report showed that the industry has become more positive about AI's job-creation potential - 100 percent of executives say that AI is creating new job roles, up from 84 percent in 2017.

Where AI is being deployed, it is achieving results: The survey found a consistent story of AI delivering benefits across every automotive business function. On average, it delivered a 16 percent increase in productivity across Research and Development (R&D), operational efficiency improvements of 15 percent in the supply chain and 16 percent in manufacturing/operations, reduced direct costs of 14 percent in customer experience and 17 percent in IT, and reduced time to market by 15 percent in R&D and 13 percent in marketing/sales.

Additionally, a number of successful AI projects are identified and detailed in the research report. One example is Continental generating 5,000 miles of vehicle test data an hour through an AI-powered simulation, compared to 6,500 miles a month it was getting through physical test driving.

Others include:

- Volkswagen accurately modeling vehicle sales across 250 auto models in 120 countries using machine learning.2

- Mercedes-Benz testing an AI-recognition system for parcel delivery that can reduce vehicle loading time by 15 percent.3

Markus Winkler, Executive Vice President, Global Head of Automotive at Capgemini concludes, "These findings show that the progress of AI in the automotive industry has hit a speedbump. Some companies are enjoying considerable success, but others have struggled to focus on the most effective use cases, vehicle manufacturers need to start seeing AI not as a standalone opportunity, but as a strategic capability required to shape the future which they must organize investment, talent and governance around."

He continues, "As this research shows, AI can deliver a significant dividend for every automotive business, but only if it is implemented at scale. For AI to succeed, organizations will need to invest in the right skills, achieve the requisite quality of data, and have a management structure that provides both direction and executive support."

To deliver at scale, companies must invest, upskill and create infrastructure: The report also examined the behaviors of the companies in the survey who have had the most success implementing AI at scale ('Scale Champions'). It found they had typically,

- invested much more in AI (more than $200m a year for 86 percent of Champions),

- focused hiring and training efforts on AI skills (32 percent said hiring was relevant to their AI strategy, versus 14 percent of others; 25 percent said they proactively upskilled and re-skilled current employees, compared to eight percent of others); and

- created a clear governance structure to prioritize and promote AI, with measures including a central steering to govern AI investment, and a cross-functional team of tech, business and operations experts.

Research Methodology

The Capgemini Research Institute conducted a primary survey of 500 automotive executives from large automotive organizations in eight countries: China, France, Germany, India, Italy, Sweden, United Kingdom and the United States. The research team then conducted in-depth interviews with a number of industry experts and entrepreneurs.

The report can be downloaded here.

Related News

- 07:00 am

Bittium showcases a new version of the Bittium SafeMove® secure connectivity software at Digital Health Rewired on March 26 in London, United Kingdom. Digital Health Rewired is the new two-day conference and one-day exhibition in London Olympia connecting health IT leaders with the latest digital health innovations.

The new Bittium SafeMove® 11 version brings important new features to support cyber resilient field operations under disruptions and to optimize the mobile working experience. Administrators of mobile workforce are provided with additional tools for secure enterprise mobility management and for quickly discovering and remediating issues in mobile performance.

The New Features:

- One of the important updates is the new and efficient WAN optimization method that reduces the required bandwidth especially on the narrowband connections. This greatly improves the usability of applications for example in rural areas, where LTE coverage might be spotty or entirely missing. This benefits the mission and business critical users of SafeMove in public safety, community nursing, utilities and in other field services. By combining the new optimization method with the automatic context aware policy control, users will benefit from this and other SafeMove’s advanced features transparently, as the policy adjusts to the available link conditions. In addition, devices with SafeMove clients can automatically discover backup servers in case the primary server or data center becomes unavailable due to a cyber-attack or other disruptions.

- The Android user interface and look and feel have been completely re-designed to cater for end-users who depend on reliable and secure mobile communications. With the new Android user interface, SafeMove® users can now enjoy a consistent user experience across different mobile platforms.

- As usual, a number of workflow improvements have been introduced in SafeMove® Manager’s web-based secure mobility management console. For example, new device management parameters are now available for managing Android for Work containers and kiosk mode in single use devices through the SafeMove® Manager management console. In addition, SafeMove® Analytics and Zone features can now be integrated into the SafeMove® Manager user interface, making it a versatile operational tool for actionable mobile cyber security information.

- The update also comes with new version of SafeMove® Mobile Router Toolkit software stack for OEMs. SafeMove® Mobile Router Toolkit introduces additional SD-WAN capabilities to be integrated into multichannel routers with multiple bearers. Flexible prioritization and bonding of multiple bearers ensures uninterrupted connectivity in mission-critical applications increasingly used in public safety and other vehicular use cases.

Bittium SafeMove® 11 is immediately available to maintenance customers.

Products and solutions exhibited at the event are:

- Bittium SafeMove® Mobile VPN software enables the use of all IP based applications and networks by securing the connections between the mobile device and corporate services immediately upon device startup. As an example, with Bittium SafeMove®, home care workers can now have full access to the same systems and applications they would have on a hospital desktop, when mobile, enabling secure and real-time access to patient records at the point of care.

- Bittium SafeMove® Analytics is an advanced monitoring and reporting module that helps organizations to monitor network connectivity and performance to improve productivity and user experience. The Analytics tool continuously gathers connectivity data such as connectivity status, speed, throughput and bytes transferred, network type and Wi-Fi network information. In addition, the security features of the software can immediately report possible security deviations in the mobile devices used by employees. This makes it possible to react to cyber threats without delays, e.g. by blocking the device which reported the deviation from the corporate network during the investigation.

- Bittium SafeMove® Zone Health solution is designed to help healthcare organizations to efficiently monitor patients outside the hospital environment. It provides a two-way communication between the nurses and the patients, allowing patients to raise alert through the Zone app and nurses to request acknowledgement from patients after detected cardiac arrhythmia, for example.

Bittium’s products and solutions are exhibited at stand B24.

Related News

- 05:00 am

Traydstream, the entity for trade digitization and automation, celebrates the expansion of its offices in India. The offices have shifted to a new space in both, Calcutta and Mumbai, with a larger capacity. Traydstream has also recruited two bright graduates from IIM Calcutta who will be working in the Mumbai office starting 1st June 2019.

As the company expands its technology presence, has grown significantly in the last two years from an employee base of 20 to 75. The expansion will allow the company to cater to growing client demands in the region and support its growth for the next several years.

“The decision to expand our presence into India was a logical step in our business growth strategy,” said Jayan Menon, Country Head of India. “The area is rich with diverse talent from well-known prestigious colleges and universities, as well as high-tech companies. We have the opportunity to further expand staffing and capabilities in our software engineering, professional services and customer support departments, as well as increase our ability to service current and future markets.”

“Our growth is more than a story of surpassing revenue goals and signing new clients - it’s a testament to the hard-working employees at Traydstream and our commitment to offering top-notch services that outpace competitors,” says Varinder Dhaliwal, chief of staff. “I’m incredibly proud of the team this year, not only for the exceptional work they do, but also for the collaborative, fun and impactful culture we have built together. We look forward to reaching new heights in 2019.”

Related News

- 05:00 am

Digital payment solutions provider, MeaWallet, today announces the completion of its transition into a refinanced independent entity, following a management buyout enabled by a substantial capital injection from venture capital firm Idekapital Fund 1.

The refinancing enables MeaWallet to further develop its digital payment solutions for issuers, processors and payment-service-providers, and continue to provide uninterrupted service for its customers.

“The management buyout and backing of Idekapital has given us the freedom and resources to reposition the business for growth in 2019,” says Lars Sandtorv, CEO, MeaWallet. “Our digital payments platform is already known for its great user experience, ease of integration and powerful tokenization features. We are now focused on extending these points of difference through further development, which will benefit our existing customer base and also enable other European payments firms to capitalize on our feature-rich digital services quickly and easily.”

Idekapital strategically invests in rapidly growing Norwegian technology companies. The fund currently has a portfolio of ten companies, comprising Software-as-a-Service firms and other specialist tech businesses.

“Idekapital has observed with interest the ongoing changes within the payment industry and sees the products of MeaWallet as strategically positioned in this landscape. Therefore, we are enthusiastic to become a significant investor in this company,” says Managing Partner, Anders Brandt, Idekapital Fund 1.

MeaWallet develops globally recognized proprietary, platform-agnostic tokenization technologies for banks and card issuers. The company is a Mastercard Engage Platinum Partner, part of the Visa Token Service Ready Program and an American Express GNS partner for Amex Pay.

Related News

- 05:00 am

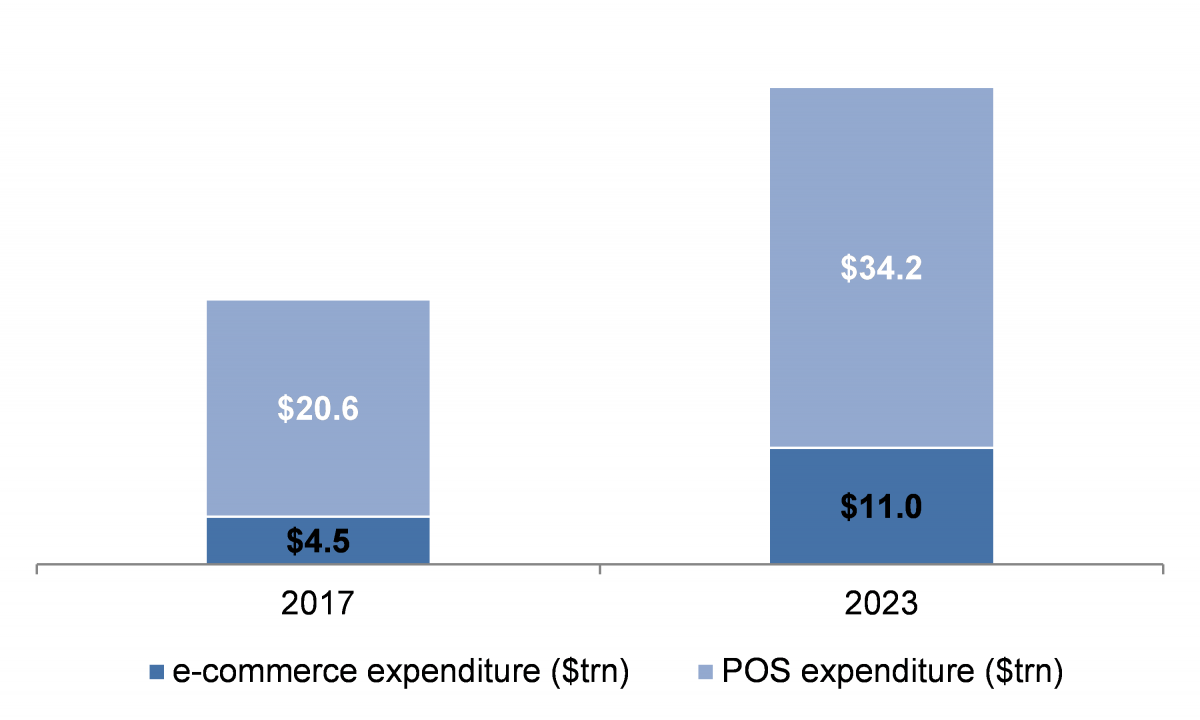

Online card expenditure growing at double digit rates and will continue to increase significantly faster than card spending at physical outlets to account for nearly a quarter of all card expenditure by 2023

Cardholders moving away from physical outlets in search of lower prices and convenience

Research from RBR analyses the role that payment cards are playing in the e-commerce sector and the impact growth in e-commerce is having on use of cards in traditional outlets. According to Global Payment Cards Data and Forecasts to 2023, e-commerce expenditure amounted to US$ 4.5 trillion in 2017, up 13% since 2016. The main drivers of this growth are increased convenience when compared to buying from bricks and mortar outlets and, in some cases, lower prices.

e-commerce and POS expenditure, 2017 and 2023 ($ trillion)

Source: Global Payment Cards Data and Forecasts to 2023 (RBR)

Ongoing migration to digital channels and increased smartphone penetration drive growth

RBR forecasts that e-commerce expenditure will increase to US$ 11 trillion in 2023. Daniel Dawson, who led RBR’s research project, said: “As consumers increasingly migrate from physical outlets to digital channels, smartphone ownership rises further and mobile payment apps become more and more sophisticated, e-commerce will see significant further growth”. In addition, new means of enhancing security will allay consumers’ concerns about the risk of fraud. By 2023, e-commerce is forecast to account for 24% of card expenditure, compared to 18% in 2017.

Consumers using e-commerce for less expensive purchases

RBR’s research highlights numerous factors which are driving growth in e-commerce, many of which vary between countries. For example, in the UK, retailer campaigns such as Black Friday and Cyber Monday have caused a migration away from the high street, while in Ukraine, which accounts for 10% of central and eastern Europe’s e‑commerce expenditure, customers are using online shopping as a way of reducing costs in a challenging economic environment.

Canada is an example of a country where the convenience of being able to order goods online rather than visit a physical merchant is particularly important, especially because a large number of people live in rural areas.

The arrival of companies like Uber in several markets has also boosted e-commerce, as have streaming services such as iTunes and Netflix. As these services typically attract lower purchase prices than larger items such as electronics and white goods, the growing influence of these companies means that e-commerce is being used for less expensive purchases than in the past.

Related News

- 04:00 am

CryptoCompare has announced its Digital Asset Summit 2019 along with an impressive roster of speakers - with Andreas M. Antonopoulos, a best-selling author, speaker, educator, and one of the world’s foremost bitcoin and open blockchain experts, delivering a keynote speech.

The conference is taking place in London on June 12th, and is welcoming a diverse crowd of industry participants from both the digital asset and finance industries, expecting more than 1,000 attendees.

The event bridges the gap between the cryptoasset ecosystem and traditional finance, affording participants a unique opportunity to hear from, network and form partnerships with many of those looking to grow and transform the industry.

Speakers and Attendees

The summit will include representatives from Nasdaq, UBS, VanEck, Bitmex, Coinbase and Global Digital Finance (GDF) and will feature talks on industry trends and how institutional investment in digital currencies is ramping up. An exclusive regulatory panel featuring speakers from the Bank of England, Financial Conduct Authority (FCA), and HM Treasury will provide insights into the upcoming regulatory developments in the UK.

Attendees will also have the opportunity to hear from speakers including Coinbase UK CEO Zeeshan Feroz, VanEck’s Gabor Gurbacs, Global Digital Finance’s Teana Baker-Taylor, with additional speakers being confirmed daily. The event will be MCed by “What Bitcoin Did” podcast host Peter McCormack.

The event will focus on key trends for the digital asset space in 2019 including regulation, institutional investment, stablecoins, security tokens, crypto derivatives, and custody options.

In addition to networking, partnership opportunities and expert talks, delegates will have the chance to meet Mr. Antonopoulos - author of the best-selling Mastering Bitcoin, The Internet of Money Series and Mastering Ethereum - for a book signing session.

Venue

The summit is taking place at 1 Old Billingsgate Walk, London EC3R 6DX, a unique location overlooking the Thames with unparalleled views of the historic Tower Bridge, The Shard and City Hall.

For more information

For the latest details and to book tickets go to https://summit.cryptocompare.com/. To find out about exhibitor and sponsorship opportunities, please email summit@cryptocompare.com.

Related News

- 04:00 am

SGG Group, the world’s 4th largest investor services group, today announced a new name, visual identity and corporate website. SGG Group has rebranded to become IQ-EQ.

IQ-EQ unites SGG, First Names Group, Augentius, Iyer Practice and Viacert under one single brand.

Mark Pesco, Group CEO, said, “Our new name brings together the rare combination of technical expertise with a deep understanding of the needs of our clients. To deliver for our clients depends not just on our ability to provide expert services, but equally on how well we know them and theirbusiness. We believe in personal relationships developed over time. As a brand IQ-EQ perfectly embodies this thinking and reflects who we are and what we bring to the sector. It also represents another hugely successful step on our journey and is something we’re all incredibly excited about.”

Serge Krancenblum, IQ-EQ’s Group Executive Chairman, added “Once more, IQ-EQ acts as a positive disruptor in our industry. Our new name unifies our brands under a unique and vibrant new identity. It bonds our staff under one promise: global technical expertise combined with a deep understanding of the needs of our clients. IQ-EQ stands out from the crowd and promises our clients and partners the right balance of intellectual and emotional intelligence working perfectly together."

Related News

- 01:00 am

Variscite, a leading global developer and manufacturer of System on Modules announced a significant partnership with Grossenbacher Systeme AG, a Swiss Electronic Engineering & Manufacturing Services (EEMS) specialist, focusing on industrial embedded systems such as control systems, display systems, and medical electronics. The goal of this partnership is to harness the advantages of the System on Module technology and to provide complete system support for companies who develop ARM-based devices; from the early concept stage, through custom hardware and software design, up to successful mass production.

Variscite is expanding its business activity in the DACH region (Germany, Austria and Switzerland) by establishing Variscite GmbH as its local subsidiary in Germany and upgrading its website and marketing assets to support the local needs. The partnership with Grossenbacher Systeme AG is an additional step in the overall course of the company in the DACH region.

Variscite develops and produces ARM-based System-on-Modules (SoMs) in various pin-compatible product lines, with a wide range of performance, feature-set and price levels. Variscite's broad SoM portfolio ranges from small-size, cost-effective solutions based on processors such as the NXP i.MX 6UL/6ULL, through mid-range modules based on NXP i.MX 6 and i.MX 7 and up to the newest powerful modules based on NXP's i.MX 8 multi-core processors with high-end multimedia features.

Grossenbacher Systeme AG's customers in the embedded solutions, controllers and display systems markets will benefit from accelerated hardware development of their own system around Variscite SoM solutions which will further shorten time-to-market and lower overall system development costs and risks, while benefit from local support for the entire process of system design and integration of their customized platform.

"We are pleased to take the partnership with Variscite to the next level, especially since we have already carried out many successful projects based on Variscite's products and brought them to mass production. In addition, we have a positive common history with Variscite GmbH management. Therefore, we believe in the potential of this partnership", says Oliver Roth, Managing Director of Grossenbacher Systeme AG.

Markus Steidl, Managing Director Sales and Marketing of Variscite GmbH, adds: "Along with the opening of our new Variscite GmbH subsidiary in Germany, the cooperation with Grossenbacher is yet another step in building our local presence and ecosystem in the DACH region, aiming to provide Variscite's customers the best system solution around our leading SoM products".