Published

- 06:00 am

Avaloq, the leading cloud platform and service provider for banks, wealth managers and investment firms, has successfully closed the acquisition of Zurich-based Derivative Partners AG, the number one independent information and data provider for structured products and derivatives in Switzerland. The deal was first announced in July this year. Derivative Partners will continue to operate as an organizational entity, with all staff retained. Detailed financial terms are not being disclosed.

The acquisition puts Avaloq at the forefront of utilizing differentiating data for structured product and ETF markets on its platform. With Derivative Partners’ powerful analytical services, Avaloq is able to offer both established and new clients the independent valuation, trading and management of highly complex financial instruments at a time when their use by banks and wealth managers is becoming increasingly more relevant.

Derivative Partners provides solutions for structured products to more than 40 market participants including issuers, private banks, asset managers and exchanges with valuations of option-linked securities and complex financial products. Among other capabilities, the firm calculates regulatory figures and portfolio management ratios as well as third-party valuation models and provides quantitative support for investment banking and trading divisions.

Juerg Hunziker, Avaloq’s Group CEO, said: “We are delighted to have closed this significant acquisition, and I would like to thank the team at Derivative Partners for their utmost professionalism throughout the process. We are truly delighted to welcome them into the Avaloq Community, with our clients set to benefit from the firm’s extensive consulting capabilities and unparalleled know-how around structured products. The acquisition highlights Avaloq’s strong market confidence and underpins our vision of reinventing the financial experience in a fully digitized, always-on and data-driven world through powerful data analytics.”

Related News

- 07:00 am

Abacus Group, a leading provider of hosted IT solutions and services for alternative investment firms, is pleased to announce that four of its managers have been selected as finalists in the 5th Annual Markets Choice Awards: Women in Finance, presented by Markets Media Group.

The WIF program recognizes the most talented and accomplished women in multiple categories across the finance industry. Nominations are made by readers of MarketsMedia.com and TradersMagazine.com, and shortlists and winners are determined by the editorial staffs of the two platforms in conjunction with the WIF Advisory Board.

The four Abacus Group finalists are:

Angela Butler, Manager of Professional Services Operations (nominated in Rising Star, Service Providers and Excellence in Leadership categories). After Abacus Group’s acquisition of Proactive Technologies in early 2019, Angela was a key player in the integration of the two companies’ client services software systems, a complex, high-stakes and high-pressure project successfully completed in under six months. Angela demonstrated skilled leadership, dedicated ownership and substantial subject matter expertise. She is now responsible for workflow optimization across the company.

Sarah Cundiff, Director of Marketing and Communications (nominated for Excellence in Marketing and Communications). Sarah joined Abacus in 2017 as the company’s first Director of Marketing and Communications, responsible for spearheading the creation of a new dedicated MarComm Department. In 2019, among other initiatives, Sarah led the production of two marketing video series, including one focused on recruiting the finest talent in the industry and highlighting the stories of Abacus’ successful female employees in order to attract more women candidates. She also spearheaded the creation of an internal Women@Abacus networking program. Abacus’ growth since 2017 has been immense, and it is in large part because of Sarah’s ongoing efforts.

Meena Jeenarain, Director of Project Management (nominated in Fintech, Service Providers, and Excellence in Leadership categories). Since joining Abacus in 2014, Meena has successfully led the build-out of a dedicated and process-driven project management team. She created a playbook for how implementations should flow, establishing an organized, repeatable, transparent and highly successful process. She has recruited a talented team of project managers as well as developed internal talent. Earlier this year, Meena won the prestigious WatersTechnology Women in Technology & Data Award for “Support Person of the Year (Vendor).”

Cynthia Oliveras, Manager of Client Support Engineering (nominated in Rising Star, Service Providers and Crystal Ladder categories). Cynthia joined Abacus in 2014 and rapidly ascended through the ranks. She started as a Client Support Technician and was subsequently recruited to a lead production role on the Disaster Recovery team, operating a key component of business continuity. It was clear Cynthia was a high-level escalation resource the company could rely on, which led to her first management position as Manager of Hosted Application Support and most recently Manager of Client Support Engineering. Her technical knowledge coupled with her stellar customer service skills and relentless attention to detail and improvements makes Cynthia a highly valued engineer and effective mentor to her colleagues.

“We are delighted that these four talented Abacus Group managers have been named finalists for the Women in Finance awards,” said Chris Grandi, CEO of Abacus Group. “We see their dedication, leadership, and skills on display every day, and the external recognition of their accomplishments is richly deserved.”

Related News

- 08:00 am

Ledger, the global leader in security and infrastructure solutions for digital assets and blockchain applications, today obtained a crime insurance policy covering digital assets secured by the Ledger Vault platform.

This program follows a rigorous evaluation of Ledger Vault’s hardware and software security infrastructure as well as governance policies. Ledger Vault worked for the last year with leading broker and risk advisor Marsh and a lead underwriter of crypto-asset insurance, Arch Insurance (UK) Limited (Arch), to develop the custom program at the behest of Vault clients.

The Ledger Vault platform now has a customized crime insurance program insuring crypto assets for up to USD 150 million (subject to full policy terms and conditions) including against:

- Third-party theft of the master seed and private keys following a physical breach of a hardware security module in a secure data center;

- Secure transmissions of the master seed fragments as part of the client onboarding;

- Insider Ledger employee theft caused by collusion.

All the coins and tokens currently supported by the Vault platform are covered by the Ledger Vault policy. There is also a mechanism to add new coins/tokens to the policy coverage as may be necessary.

As a security technology platform Ledger Vault is not required to obtain digital asset insurance, unlike custodians, banks and exchanges. Despite this, Ledger understood the difficult process Vault clients would undergo to obtain insurance of this magnitude and proactively obtained insurance for the Vault platform at no additional cost for its clients. Vault clients are now alleviated from the majority of the burden of independently undergoing the insurance security evaluation process, and ultimately saving significant time and money to focus on their businesses.

Vault clients also have the opportunity to directly purchase their own primary coverage as needed on top of the Ledger Vault policy. With this feature Ledger Vault is the first digital asset security platform to enable seamless access to a customized crime insurance policy from the best in class underwriting.

Pascal Gauthier, Chief Executive Officer at Ledger, said: We consider insurance a crucial part of a comprehensive plan as digital assets gain a foothold in institutional portfolios. As a new class of assets, securing digital currencies has become a complex challenge for both institutions and insurers. Through our efforts with Marsh and Arch to curate this comprehensive crime insurance policy, we are playing a pivotal role in the movement to secure and insure all critical digital assets.”

Demetrios Skalkotos, Global Head of Ledger Vault, said: “The combination of Ledger Vault's secure hardware and software operating systems, along with our governance protocols, allowed Marsh and Arch to expand standard cold storage coverage to the Ledger Vault solution. The policy also covers the clients’ onboarding process, their personal security devices and the secure encrypted communication channel that is established when using the Vault platform. This unique policy is a true end-to-end solution that gives our customers the flexibility to both store and move funds without compromising on security and governance.”

Jennifer Hustwitt, Senior Vice President with Marsh’s global Digital Asset Risk Transfer Team, said: “As this asset class matures, we are focused on structuring insurance programs that align with how the underlying technology functions. This Ledger insurance program marks the next chapter in the burgeoning insurance market for digital asset risks.”

James Croome, Vice President of Specie at Arch, said: “We spent over 6 months working with the Ledger Vault team to develop a customized offering for their clients. Ledger took the time to educate us on every detail of the end-to-end security and governance that the Vault platform provides. This $150 million policy underscores just how impressed we are with the security technology platform they’ve built.”

Ledger has sold more than 1.5 million Nano devices globally and recently celebrated its five year anniversary. Vault, Ledger’s institutional offering with enhanced software security protocols, has more than 40 clients located across the APAC, EMEA and the Americas regions. Ledger Vault has a broad customer base that includes family offices, exchanges, trust and payment companies, and custodians, and clients such as Bitstamp, Uphold and Crypto.com.

Related News

- 05:00 am

Nomura Research Institute, Ltd. (NRI), a leading provider of consulting services and system solutions, announced today they will launch Shingan AD, a new service providing institutional investors with Japanese alternative data and data analysis on December 1st, 2019

The use of alternative data in investment decision-making is growing rapidly. Sourcing, cleansing, and preparing large amount of data for analysis presents a big challenge for institutional investors who are looking for untapped alpha.

NRI’s new offering, Shingan AD, allows institutional investors to easily access Japanese alternative data. A wide range of alternative data collected from Japanese companies and data vendors is available, as well as data processing and analysis services.

“Launching Shingan AD has been an exciting development for NRI, and we’re quite thrilled to see the already high demand for the Japanese alternative data from the global marketplace, particularly from North America,” said Shigeki Hayashi, Senior Corporate Managing Director of NRI.“ We’re proud of this new offering and are committed to helping fund managers and investors find untapped alpha in our market and support their data-driven investment initiatives.”

Shingan AD covers a wide range of data from various industries such as Consumer Transaction, PoS (Point of Sales), Mobile App, Healthcare and Sentiment Score data. Data presentation is customizable to the clients desired format, including raw, processed and/or in combination.

Data | Overview | Use case |

Consumer Transaction | Consumers’ purchase information on daily necessities collected from Japan’s largest consumer panel | · Earnings forecast for retailers · Economic trend analysis |

PoS | Point of sales data collected from Japan’s largest retailer panel | · Sales trend analysis for consume good manufacturers · Regional economy analysis · Consumer price index trend analysis |

Mobile App | Mobile usage data collected from Japan’s largest usage history monitoring source | · Retailers performance forecast as a tool for asset management and trading · Performance analysis on gaming app companies · Comparison between payment service providers |

Healthcare | Prescription drug sales data | · Pharmaceutical industry’s performance forecast as a tool for asset management and trading · Drug trend analysis |

Sentiment Scores | Score on corporate culture calculated based on employee reviews online | · Evaluation of corporate culture from employee’s viewpoints and application to asset management and investment / loan evaluation |

The data coverage is expected to increase in the future.

Related News

- 02:00 am

Caspian, the full-stack crypto trading and portfolio management platform for institutional investors and sophisticated traders, today announced it has partnered with Tagomi the leading global digital assets prime broker.

The two industry captains are set to shake up the crypto market with a new standard of crypto trading. The partnership will create the safest, most efficient and easy to access full end to end trading solution for institutional investors participating in crypto currency markets.

Launched in March 2018 Caspian was the first technology firm to provide a suite of institutional-grade trading solutions for crypto that include an integrated OEMS, PMS, algorithms and real-time reporting suite

Tagomi is at the forefront of digital asset prime brokerage providing trading, custody, margin, lending, shorting, staking and financing all from one account. The new partnership with Caspian will allow common clients to benefit from a new straight through process and seamless workflow when managing crypto portfolios and trading across many exchanges and other destinations.

Chris Jenkins, Managing Director, Caspian stated “We are really excited to partner with Tagomi, as we believe it will set a revolutionary new standard for crypto trading. At Caspian we have been focused on driving change, implementing better tools and ultimately building a more secure ecosystem that facilities institutional investors advancement into digital assets”

Marc Bhargava, Founder, Tagomi commented “Our partnership with an industry leader such as Caspian has been a great step forward for the industry. We are both focused on bringing institutional investors into the complex, fast-moving world of crypto assets. We see our integration with Caspian helping to further achieve our goal of bridging institutional capital into the space”

Caspian launched in March 2018 with its first-of-a-kind cryptocurrency investment platform that covers the entire lifecycle of a trade. Today, it provides a single interface into over 30 spot exchanges and seven derivatives exchanges from a single interface, a complete suite of sophisticated trading algorithms, real-time and historical PNL and exposure tracking and is known for its leading professional customer service.

About Caspian

Caspian is a full-stack crypto asset management platform tying together the biggest crypto exchanges and OTC desks in a single interface. The platform offers compliance, trading, algorithms, portfolio and risk management, and reporting. Led by an experienced team of developers Caspian is building an ecosystem that enables sophisticated traders to operate more efficiently and improve their performance.

Related News

Anthony Walton

CEO at Iliad Solutions

The payments industry is seeing a massive global surge in the implementation or modernisation of Immediate Payment systems. see more

Dr Bimal Roy Bhanu

CEO at AiXPRT

There are widespread misconceptions about Artificial Intelligence (AI), including its powers and what it can and can’t do. see more

- 04:00 am

Moorwand, a dedicated BIN sponsor that turns compliance into a competitive advantage, today announced that it is providing BIN sponsorship and card issuing services to Sunrate Partners Limited, a world-class foreign exchange and global payments provider.

Moorwand is providing Sunrate with a card programme which launched today. In addition, Moorwand is also acting as a BIN Sponsor, providing Sunrate with access to the Mastercard scheme for card processing, along with legal and regulatory guidance to achieve compliance in the best time possible.

While Moorwand has been involved in a number of issuing migrations, Sunrate is the first card programme it has implemented from conception to launch. The company is seeing strong growth from businesses looking to develop new card and wallet programmes, as well retailers following the debut of its European acquiring service for online merchants.

“We are very pleased to partner up with Moorwand,” said Paul Meng, Co-Founder at Sunrate Solutions Limited. “Together with Sunrate's well established client base, we expect to see great growth post product launch which will take both Sunrate and Moowand's global footprint to a whole new level."

“Moorwand’s legal and technical expertise makes it uniquely placed to identify developments before they appear, understand the impact of regulations before they are enforced, and anticipate the next waves of innovation before they break,” said Robert Courtneidge CEO of Moorwand. “This means that Moorwand can help fintechs like Sunrate rapidly orchestrate best-in-class payment propositions designed to capitalise on emergent market changes, whilst ensuring compliance. We expect the service to grow rapidly into a truly world-beating programme.”

“As our first end-to-end issuing customer, launching a card programme for Sunrate is major milestone for Moorwand as we continue our mission to help our clients turn compliance into competitive advantage.”

Related News

- 02:00 am

DataRobot, the leader in enterprise AI, has partnered with Kx to offer financial institutions and IoT-driven industries a comprehensive, scalable high-performance solution for applying AI to time series data. By integrating DataRobot’s Enterprise AI Platform with the Kx database platform kdb+—the world’s fastest in-memory time series database—the partnership, which was unveiled during the Kx Innovation Day at Aston Martin Red Bull Racing headquarters, allows consumers of market data to quickly generate actionable insights for agile, strategic business decisions.

“AI is rapidly reshaping all industries, but none more than financial institutions,” said Rob Hegarty, General Manager of Financial Markets and Fintech at DataRobot. “So much of the world’s market data is in kdb+ due to its powerful time series capabilities and performance. The integration with DataRobot—the world leaders in enterprise AI at scale—will accelerate ROI and separate financial markets institutions’ performance from their peers.”

In the AI-driven era, organizations everywhere need to develop strategies for implementing powerful machine learning models in order to stay competitive. This pressure is particularly acute in the securities industry, where financial institutions are constantly seeking ways to use cutting-edge technologies to accelerate research, find competitive advantage in trading, improve alpha generation, and manage risk. However, there are several hurdles when it comes to successfully deploying AI solutions. For instance:

- The sheer volume of financial market data, which makes searching for signals and developing predictive models extremely challenging and time-consuming;

- A reliance on manual, inefficient processes to build models for highly volatile and time-critical applications; and

- Fragmented, distributed data sources across tools, teams, and platforms, making it difficult to source and combine data for use in the development and deployment of AI.

By integrating kdb+ with DataRobot’s Enterprise AI Platform—which features an Automated Time Series solution that automates every step of the time-aware machine learning process—market participants can solve these challenges much more effectively and quickly. The integration results in a single system to easily prepare, build, deploy, monitor, and manage sophisticated machine learning models and AI applications across asset classes and use cases.

“Financial services and IoT industries, with their ever-growing ubiquity of data, are primed for AI, and DataRobot and Kx are leading the way,” said Mark Sykes, Group CTO First Derivatives, COO Kx. “The combination of the two time series technologies creates a single solution that accelerates market players’ ability to draw inferences and build time-aware machine learning models that can make extremely fast and accurate predictions. Firms deploying the DataRobot and Kx time series solutions together stand to gain immediate and unprecedented scale and speed over rival firms.”

Financial institutions and IoT users can combine the flexibility and power of the kdb+ database to build sophisticated data acquisition and integration strategies that integrate with DataRobot’s vast array of powerful time-aware machine learning algorithms, eliminating the barriers to build, scale, and integrate AI-driven workflows. As a result, the speed of iteration increases greatly and time-to-value for AI applications is reduced dramatically, allowing firms to be much more effective, productive, and agile. Such solutions can be built, deployed, monitored, and maintained across a wide range of mission-critical applications, including trading, risk management, middle and back-office operations, compliance, and surveillance.

“The technology integration and partnership of DataRobot and Kx is lowering the barrier between market data and value generation by providing organizations with a single, cohesive solution that unleashes AI-driven forecasting with previously unheard-of efficiency and effectiveness,” said Jay Schuren, General Manager of Time Series at DataRobot.

“The kdb+ time-series database is the smallest and fastest in the world, known across the financial industry for its speed, scalability and performance, and we couldn’t imagine a better partner to integrate with than DataRobot,” said Kx’s Sykes. “With the combined power of our two platforms, financial institutions worldwide are able to maintain their competitive edge in the AI era and innovate much more rapidly.”

Related News

- Product Reviews

- 14.11.2019 11:55 am

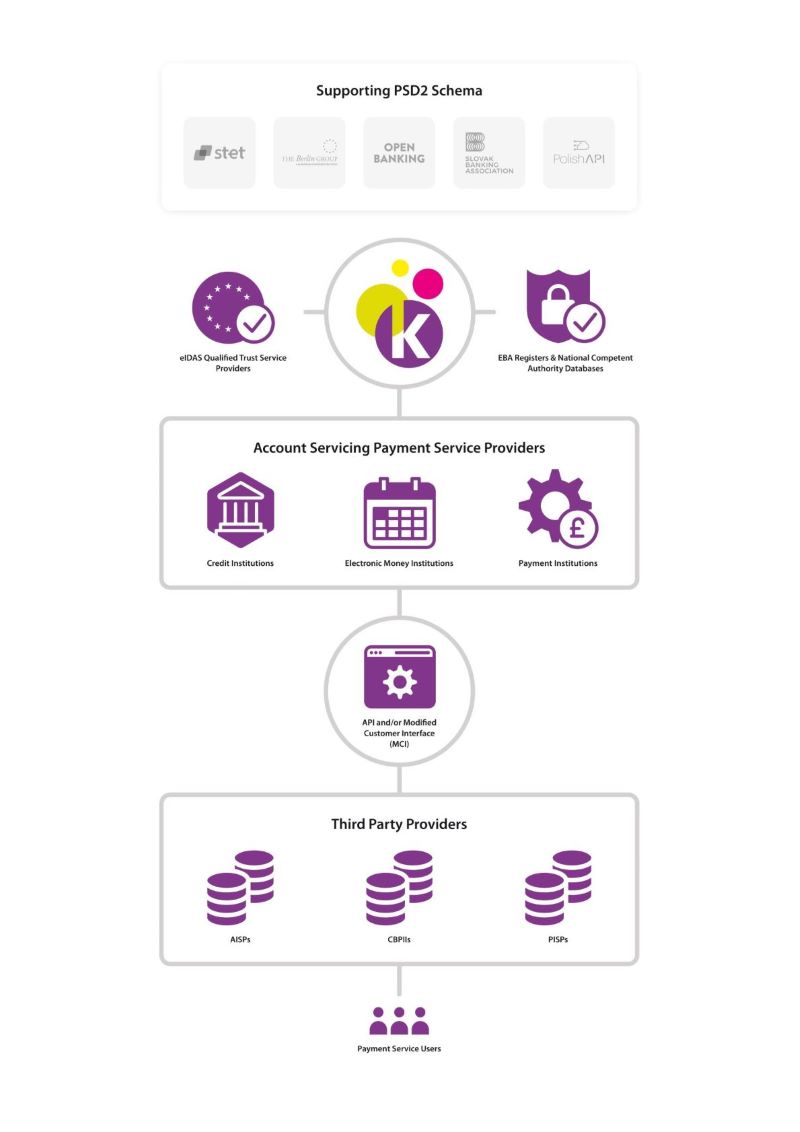

Konsentus is the leading online, machine readable, real-time service that provides ASPSPs (i.e. Credit Institutions encompassing Banks & Building Societies, Payment & Electronic Money Institutions etc.) with Third-Party Provider (TPP) Identity & Regulatory checking services required to enable them to comply with the Payment Services Directive 2 (PSD2) open banking, commonly referred to as “access to accounts”.

What is the solution?

Konsentus provides an online, real-time TPP identity and regulatory checking services for Financial Insitutions to comply with PSD2 access to accounts, via a SaaS based platform that delivers the following functionality in support of Open Banking:

TPP Identity Verification: Konsentus verifies a TPP’s identity, using their eIDAS certificates, in real-time via the relevant Qualified Trust Service Provider (QTSP). This gives the ASPSP confidence that the TPP connecting to its Open Banking API or MCI is a PSD2 regulated service provider (i.e. proven identity).

TPP Regulatory Checking: Upon verification of the identity of the TPP, Konsentus checks, in real-time, the regulated status of the TPP on a pan EEA basis and advises the ASPSP on the payment services the TPP is authorised to provide.

Token Issuance, Verification & Management Services: Certain PSD2 schema require ASPSPs to issue consent-based Access Tokens (OAuth2.0) to TPPs. Konsentus provides real-time issuance, checking & validation, and life cycle management of Access Tokens issued on behalf of the ASPSP.

Immutable audit log: Konsentus maintains an immutable audit log of all API calls providing the ASPSP with a system of record of all actions and activity that took place should it be required to assist in dispute management.

What does the solution do?

Konsentus provides an online, real-time single consolidated source of data on all regulated financial organisations across the EEA. The data is collected from the 31 National Competent Authorities, the Official Systems of Record, and is sourced directly from their 115 registers, which contain information on the following regulated organisations: Credit Institutions (i.e. Banks), Payment Institutions, Electronic Money Institutions, Prepaid Programme Providers, eWallet Providers

Konsentus also collects data from the European Banking Authority Credit Institutions Register and the Register of Payment and E-Money Institutions under PSD2, to complement the data collected from the National Competent Authorities.

What are the key features?

· Comprehensive solution - Checks both eIDAS and regulatory status, with full European Economic Area coverage, including passporting data

· Removal of complexity – RESTful APIs remove the significant cost of integrating to multiple regulatory and eIDAS databases

· Speed of implementation - dedicated SaaS solution that can be quickly and easily deployed

· Performance - deployed as a cloud based, micro services architecture to provide scalability, throughput and elasticity

· Reliability – resilient system design across multiple AWS availability zones provides maximum availability and fault tolerant service

Target audience?

Our target audience is all companies who need to comply with PSD2 Access to Accounts. The regulation defines this as any payment account being in the name of the account holder and used for the execution of payment transactions. So organisations in scope include: Credit Institutions (ie Banks), Payment Institutions, Electronic Money Institutions, Prepaid Programme Providers and E-Wallet Providers